Benefits Of Term Life Insurance

Unveiling the Advantages: Why Term Life Insurance is a Smart Choice

In the realm of financial planning and insurance, term life insurance stands out as a fundamental tool for safeguarding your loved ones' future. This type of insurance, often overlooked, offers a range of benefits that can provide peace of mind and substantial support during life's unpredictable moments.

Term life insurance is a simple yet powerful contract between an individual and an insurance company. It promises to pay out a specified amount, known as the death benefit, to the policyholder's beneficiaries upon their death, as long as the policy is active. This straightforward approach makes it an appealing and accessible option for many individuals and families.

Let's delve into the key advantages of term life insurance and explore why it should be a consideration for anyone looking to secure their financial future.

Affordable Protection for Your Loved Ones

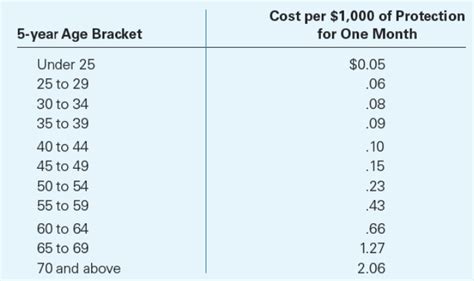

One of the most significant advantages of term life insurance is its affordability. Unlike permanent life insurance policies that offer coverage for the entirety of one's life, term life insurance provides coverage for a specific period, often ranging from 10 to 30 years. This temporary nature allows for significantly lower premiums, making it an attractive option for those on a budget.

For instance, a 35-year-old non-smoker can expect to pay around $200 to $300 annually for a $500,000 term life insurance policy. This cost is significantly lower compared to permanent life insurance, which can often cost several times more for the same coverage amount. The affordability of term life insurance means that individuals from various income brackets can access the protection they need without straining their finances.

Consider the case of Sarah, a single mother with two young children. With a term life insurance policy, she can ensure that her children's future is financially secure, even if an unexpected event were to occur. The peace of mind that comes with knowing her children's education, housing, and other needs will be taken care of is invaluable.

Flexible Coverage to Meet Your Needs

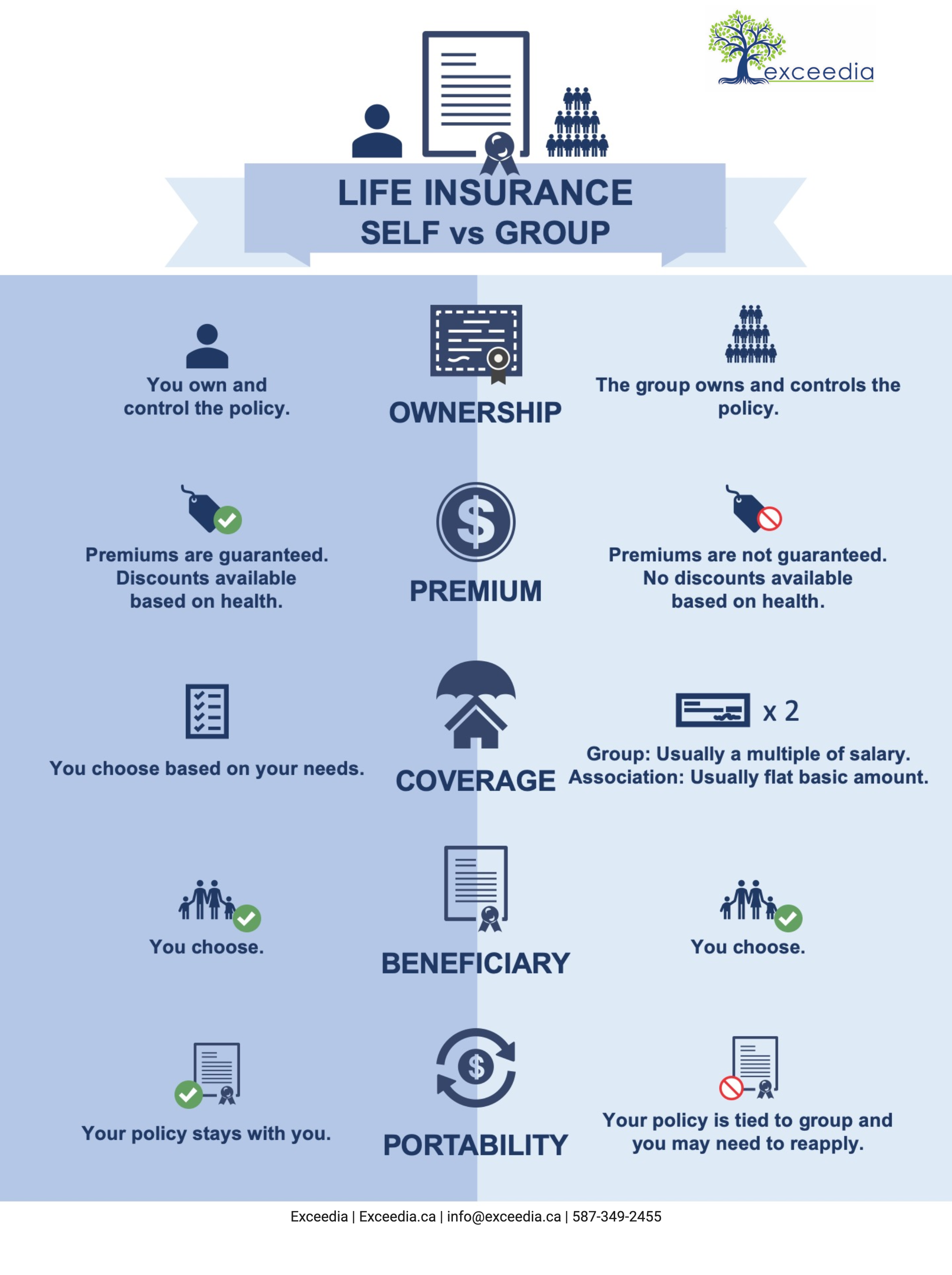

Term life insurance offers a high degree of flexibility, allowing individuals to tailor their coverage to their specific needs. Policyholders can choose the coverage amount, the term length, and even add optional riders to enhance their policy.

The coverage amount, often referred to as the death benefit, is the sum that the insurance company pays out to the beneficiary upon the policyholder's death. This amount can be adjusted to reflect the individual's financial responsibilities, such as mortgage payments, outstanding debts, or the cost of raising children. By choosing a coverage amount that aligns with their financial obligations, policyholders can ensure their loved ones are not left with a financial burden.

Term length, on the other hand, determines the duration of the policy. Common term lengths include 10, 15, 20, and 30 years. Policyholders can select a term that coincides with a specific financial goal or milestone. For example, a couple planning to pay off their mortgage within 15 years might opt for a 15-year term life insurance policy to ensure their financial obligations are met in the event of an untimely death.

Additionally, term life insurance policies often offer optional riders that can enhance coverage. These riders can include accelerated death benefit for terminal illness, waiver of premium in case of disability, or even a conversion option that allows the policyholder to convert their term policy into a permanent life insurance policy without a medical exam.

Peace of Mind and Financial Security

Term life insurance provides a vital sense of security and peace of mind. It ensures that, should the unexpected happen, your loved ones will have the financial means to maintain their standard of living and meet their financial obligations. The death benefit can cover a wide range of expenses, including funeral costs, outstanding debts, and ongoing living expenses.

For families, this security is especially crucial. The death benefit can provide financial stability, ensuring that children's education, daily expenses, and other long-term goals are not compromised. It can also help to cover any immediate financial needs, such as paying off a mortgage or other significant debts, reducing the burden on the surviving family members.

Moreover, term life insurance can be a valuable tool for estate planning. It can provide the liquidity needed to settle estate taxes and other expenses, ensuring that the assets you leave behind are not depleted to cover these costs. This way, your loved ones can inherit the full value of your estate, as intended.

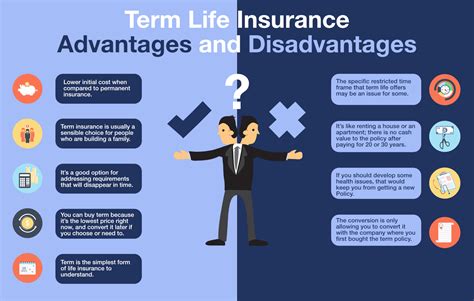

Understanding the Advantages of Term Life Insurance

Term life insurance is a straightforward and cost-effective way to secure your family's financial future. Its affordability, flexibility, and the peace of mind it provides make it an essential component of any comprehensive financial plan. By choosing the right coverage amount and term length, you can ensure that your loved ones are protected and their future is secure.

While term life insurance might not be suitable for everyone, its benefits are undeniable. It is an accessible and effective way to manage financial risk and ensure that your loved ones are taken care of, no matter what life throws their way. As you consider your financial planning options, term life insurance should be at the forefront of your considerations.

Key Takeaways

- Term life insurance offers affordable protection for a specified period.

- Flexible coverage options allow individuals to tailor policies to their needs.

- It provides peace of mind and financial security for loved ones.

- The death benefit can cover various expenses, including funeral costs and debts.

- Term life insurance is an essential component of comprehensive financial planning.

How much does term life insurance typically cost?

+The cost of term life insurance varies based on factors like age, health, and the coverage amount. On average, a 30-year-old non-smoker can expect to pay around 200 to 300 annually for a $500,000 policy. However, rates can be significantly lower or higher depending on individual circumstances.

What is the difference between term life and permanent life insurance?

+Term life insurance provides coverage for a specified period, typically 10 to 30 years. It offers a death benefit if the policyholder dies during the term. Permanent life insurance, on the other hand, provides coverage for the policyholder’s entire life and also accumulates cash value over time, which can be borrowed against or withdrawn.

Can I renew my term life insurance policy when the term ends?

+Yes, most term life insurance policies offer the option to renew at the end of the term. However, the premiums will likely increase with age, and you may need to undergo another medical exam to qualify for the renewal.