Auto Liability Insurance Definition

Auto liability insurance, a fundamental component of the insurance landscape, plays a crucial role in protecting individuals and businesses from financial burdens resulting from automobile-related incidents. This type of insurance provides coverage for bodily injury and property damage liabilities arising from the use of a vehicle, offering a vital safety net for drivers and their passengers. With a comprehensive understanding of auto liability insurance, one can navigate the complexities of the automotive world with confidence, ensuring that they are adequately prepared for unforeseen circumstances.

The Fundamentals of Auto Liability Insurance

Auto liability insurance is a mandatory coverage in most states, serving as a legal and financial safeguard for drivers. It is designed to provide compensation for damages caused by the policyholder to third parties in an automobile accident. This includes medical expenses, lost wages, and pain and suffering resulting from bodily injuries, as well as repair or replacement costs for damaged property.

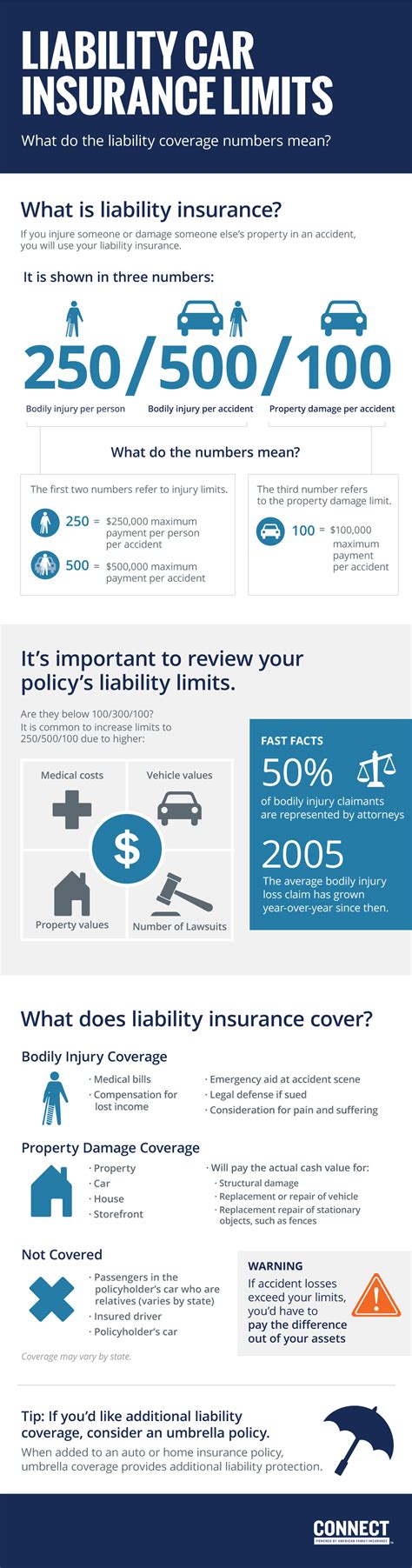

The coverage offered by auto liability insurance can be categorized into two main types: bodily injury liability and property damage liability. Bodily injury liability covers medical treatment, rehabilitation, and other related expenses incurred by individuals injured in an accident. It also extends to lost wages and other financial losses resulting from the injury. Property damage liability, on the other hand, covers the cost of repairing or replacing vehicles, structures, and other property damaged in an accident.

Key Components of Auto Liability Insurance

- Bodily Injury Liability Limits: This specifies the maximum amount the insurer will pay for bodily injury claims per person and per accident. For instance, a policy with a limit of 100,000/300,000 means the insurer will pay up to 100,000 for each person injured and a total of 300,000 for all injuries sustained in the accident.

- Property Damage Liability Limits: Similar to bodily injury liability, this indicates the maximum amount the insurer will pay for property damage claims per accident. A typical limit is $50,000, which covers the cost of repairing or replacing damaged property up to that amount.

- Medical Payments Coverage: While not a liability coverage, this option can be added to the policy to cover the medical expenses of the policyholder and their passengers, regardless of fault. It provides a quick and easy way to pay for medical treatment without waiting for a liability claim to be settled.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and other costs for injuries sustained by third parties. |

| Property Damage Liability | Pays for the repair or replacement of vehicles and other property damaged in an accident. |

| Medical Payments Coverage | Optional coverage for medical expenses of the policyholder and passengers, regardless of fault. |

Understanding Policy Limits and Deductibles

Policy limits refer to the maximum amount an insurer will pay for covered losses. In the context of auto liability insurance, these limits are typically defined by state laws or chosen by the policyholder during policy acquisition. It’s important to note that selecting higher policy limits can provide more extensive coverage but may also result in higher premiums.

Deductibles, on the other hand, are the amount the policyholder must pay out of pocket before the insurer covers the rest of the claim. For instance, if a policy has a $500 deductible and the insured is involved in an accident resulting in $3,000 in damages, they will pay the first $500, and the insurer will cover the remaining $2,500. Choosing a higher deductible can lower premiums, but it also means the policyholder will have to pay more in the event of a claim.

Factors Affecting Auto Liability Insurance Rates

- State Laws: Each state has its own minimum liability insurance requirements, which can significantly impact the cost of auto liability insurance.

- Driver’s Record: A history of accidents or traffic violations can lead to higher premiums, as these factors are considered a higher risk by insurers.

- Type of Vehicle: The make, model, and age of the vehicle can influence insurance rates. For instance, sports cars or luxury vehicles often come with higher insurance premiums due to their higher repair costs.

- Credit Score: Surprisingly, many insurers use credit scores as a factor in determining insurance rates. A higher credit score can lead to lower premiums, while a lower score may result in higher costs.

The Importance of Adequate Coverage

Having adequate auto liability insurance is crucial to protect yourself and your assets in the event of an accident. If the damages exceed your policy limits, you may be held personally responsible for the remaining amount. This could result in significant financial strain, or even the need to sell assets to cover the costs.

Consider a scenario where you cause an accident that results in severe injuries to multiple people and extensive property damage. If your policy limits are not sufficient to cover these costs, you could be sued for the remaining amount. This is why it's important to carefully review your policy limits and consider increasing them if necessary, especially if you have significant assets to protect.

Tips for Choosing the Right Auto Liability Insurance

- Understand your state’s minimum liability requirements, but consider purchasing more than the minimum to ensure adequate coverage.

- Compare quotes from multiple insurers to find the best coverage at the most competitive price.

- Review your policy annually and adjust your coverage as your needs and circumstances change.

- Consider adding optional coverages like uninsured/underinsured motorist coverage to further protect yourself and your passengers.

Conclusion

Auto liability insurance is a vital component of any driver’s insurance portfolio, offering financial protection and peace of mind in the event of an accident. By understanding the fundamentals of auto liability insurance, including policy limits, deductibles, and the factors that influence rates, you can make informed decisions to ensure you have the coverage you need. Remember, adequate auto liability insurance is not just a legal requirement, but a necessary safeguard for your financial well-being.

What happens if I cause an accident but don’t have enough liability insurance to cover the damages?

+

If you cause an accident and your liability insurance limits are insufficient to cover the damages, you may be held personally responsible for the remaining amount. This could lead to financial strain or even legal action against you.

Are there any circumstances where auto liability insurance won’t cover an accident?

+

Yes, auto liability insurance typically excludes coverage for intentional acts, racing, and damages caused by normal wear and tear. It’s important to review your policy’s exclusions to understand what is and isn’t covered.

How often should I review my auto liability insurance coverage?

+

It’s recommended to review your auto liability insurance coverage at least once a year, or whenever your personal or vehicle circumstances change significantly. This ensures that your coverage remains adequate and up-to-date with your needs.