Insurance For Car Cheapest

Welcome to an insightful exploration of the world of car insurance, specifically tailored to those seeking the most cost-effective coverage options. In today's fast-paced and competitive insurance market, understanding the factors that influence policy costs and the strategies to secure the best deals is crucial. This comprehensive guide will navigate you through the intricacies of car insurance, ensuring you make informed decisions and unlock the most affordable premiums available.

Unraveling the Complexity: Factors Influencing Car Insurance Costs

The cost of car insurance is a multifaceted equation, influenced by a myriad of variables. From your personal details to the specific make and model of your vehicle, each factor plays a pivotal role in determining the premium you’ll pay. Let’s delve into these aspects to gain a clearer understanding.

Demographics and Personal Factors

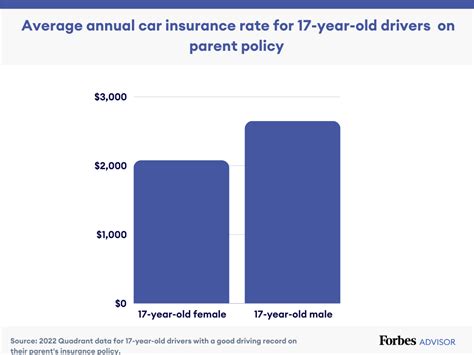

Your age, gender, marital status, and even your occupation can significantly impact your insurance rates. Insurance providers often classify individuals based on these demographic factors, with certain profiles associated with higher risks. For instance, young drivers, particularly males, are statistically more prone to accidents, leading to higher premiums. Similarly, individuals with certain occupations, such as delivery drivers or sales representatives, who spend more time on the road, may also face increased costs.

Moreover, your driving history and credit score are key considerations. A clean driving record, free from accidents or traffic violations, can be a significant advantage, often resulting in substantial savings. On the other hand, a history of accidents or traffic citations may lead to higher premiums or even difficulty in securing coverage. Your credit score also plays a role, with many insurers using it as an indicator of financial responsibility, affecting your premium rates.

Vehicle Details and Usage

The type of vehicle you drive and how you use it are essential factors in insurance pricing. The make, model, and year of your car are key considerations. Sports cars or luxury vehicles, for example, often attract higher premiums due to their higher repair costs and increased risk of theft. Conversely, sedans or family cars may be more affordable to insure.

The purpose for which you use your vehicle also matters. If you primarily use your car for pleasure or commuting to work, your insurance costs may be lower. However, if you frequently use your vehicle for business purposes or as part of a ridesharing service, your premiums could increase, as these activities generally involve more miles driven and higher risks.

Location and Coverage

Your geographic location plays a significant role in determining insurance costs. Factors such as local crime rates, weather conditions, and the density of traffic can all impact your premium. Areas with higher rates of car theft or frequent natural disasters may see increased insurance costs. Similarly, densely populated urban areas with heavy traffic often result in higher premiums due to the increased risk of accidents.

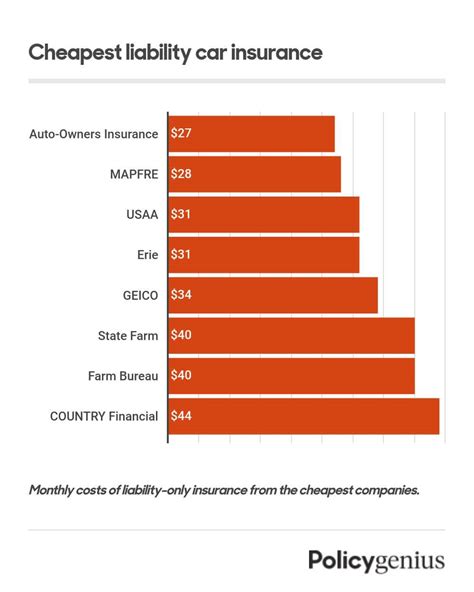

The level of coverage you choose is another critical factor. Comprehensive and collision coverage, while offering broader protection, can significantly increase your premium. On the other hand, liability-only coverage, while more affordable, provides limited protection. It's essential to strike a balance between the coverage you need and the premium you can afford.

Strategies for Securing the Cheapest Car Insurance

Navigating the complex world of car insurance can be daunting, but with the right strategies, securing the cheapest insurance is well within reach. Here are some expert tips to guide you toward the most affordable coverage.

Compare Quotes from Multiple Insurers

One of the most effective ways to find the cheapest car insurance is by comparing quotes from multiple providers. Insurance companies use different methods to calculate premiums, and rates can vary significantly between them. By obtaining quotes from at least three to five insurers, you can identify the most competitive rates and choose the policy that best suits your needs and budget.

Leverage Discounts and Bundles

Insurance providers often offer a variety of discounts to attract customers and reward safe driving practices. These can include discounts for safe driving records, loyalty rewards for long-term customers, or even multi-policy discounts if you bundle your car insurance with other types of coverage, such as homeowners or renters insurance. Be sure to inquire about all available discounts and take advantage of those that apply to you.

Adjust Your Coverage Levels

While it’s essential to have adequate coverage, over-insuring your vehicle can lead to unnecessary expenses. Review your coverage limits and consider whether you truly need the highest levels of coverage in all areas. For instance, if you have an older vehicle with a low market value, comprehensive and collision coverage may not be as necessary as liability coverage, which protects you against claims made by others in the event of an accident.

Additionally, consider increasing your deductible. A higher deductible means you'll pay more out-of-pocket if you need to file a claim, but it can significantly reduce your premium. Just ensure that you can afford the higher deductible in the event of a claim.

Improve Your Driving Record

Your driving history is a significant factor in determining your insurance premium. Maintaining a clean driving record, free from accidents and traffic violations, can lead to substantial savings. If you’ve had accidents or violations in the past, consider taking defensive driving courses. These courses can help improve your driving skills and may even result in a reduced premium, as some insurers offer discounts for completing such courses.

Shop Around Regularly

Insurance rates are not set in stone and can change over time. It’s a good practice to review your insurance policy annually and compare it with other providers’ rates. This is especially important if you’ve made significant changes to your vehicle or your driving habits, as these changes can affect your premium. Regularly shopping around ensures you’re always getting the best deal and can help you identify any new discounts or promotions that might apply to you.

The Impact of Credit Score on Car Insurance Costs

Your credit score is an often-overlooked factor that can significantly influence your car insurance costs. Many insurance companies use credit-based insurance scores to assess the risk of insuring a particular individual. These scores are derived from your credit report and are designed to predict the likelihood of you filing an insurance claim.

Individuals with higher credit scores are often viewed as more financially responsible and are associated with a lower risk of filing claims. As a result, they may be eligible for lower insurance premiums. Conversely, those with lower credit scores may face higher premiums, as they are seen as a higher risk. Improving your credit score can, therefore, lead to significant savings on your car insurance.

| Factor | Impact on Insurance Costs |

|---|---|

| Demographics (Age, Gender, Marital Status, Occupation) | Significant impact, with certain profiles associated with higher risks and costs. |

| Driving History and Credit Score | Clean driving records and higher credit scores often lead to lower premiums. |

| Vehicle Type and Usage | Sports cars or luxury vehicles, and frequent business use, may attract higher premiums. |

| Location and Coverage | Urban areas and comprehensive coverage often result in higher costs. |

FAQ

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever you experience significant changes in your life or driving habits. This ensures you’re always getting the best value and coverage for your needs.

Can I get car insurance without a credit check?

+While some insurers may offer insurance without a credit check, it’s important to note that your credit score is a significant factor in determining your premium. By improving your credit score, you can often secure better rates.

What are some common discounts offered by car insurance providers?

+Common discounts include safe driver discounts, multi-policy discounts, loyalty rewards, and discounts for completing defensive driving courses. It’s worth shopping around and inquiring about all available discounts to ensure you’re taking advantage of every opportunity to save.