Insurance Agency Jobs Near Me

The insurance industry is a vital part of our financial ecosystem, offering security and protection to individuals, families, and businesses. It's a diverse sector with numerous career paths and opportunities. If you're interested in exploring insurance agency jobs near you, this comprehensive guide will provide you with valuable insights and information to help you navigate the industry and find the right role.

Understanding the Insurance Industry

The insurance industry is broad and complex, encompassing various types of insurance, from life and health insurance to property and casualty insurance, and even specialty lines like marine or aviation insurance. Each segment has its own unique set of products, regulations, and customer profiles, offering a range of career options.

Insurance agencies are typically independent businesses that sell insurance products on behalf of insurance companies. They play a crucial role in the industry by providing personalized advice and tailored solutions to their clients. Working in an insurance agency can offer a rewarding career path, allowing you to help people protect their most valuable assets and plan for their future.

Types of Insurance Agency Jobs

Insurance agencies offer a variety of roles, each with its own set of responsibilities and skill requirements. Here’s a breakdown of some common insurance agency jobs you might encounter:

Insurance Agents and Brokers

Insurance agents and brokers are the primary client-facing roles in an agency. They are responsible for selling insurance policies to individuals and businesses. This role requires excellent communication and interpersonal skills, as agents need to build trust and understand their clients’ needs to provide suitable insurance solutions.

Agents can specialize in specific types of insurance, such as auto insurance, homeowners' insurance, or commercial insurance. They may also focus on particular client groups, like high-net-worth individuals or small businesses.

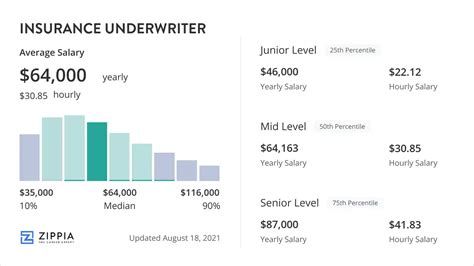

Underwriters

Underwriters are crucial to the insurance process as they assess the risk associated with each potential client. They review applications for insurance coverage, evaluate the risk profile of the applicant, and determine the terms and conditions of the policy, including the premium amount. This role requires strong analytical skills and a deep understanding of insurance risk assessment.

Claims Adjusters and Examiners

When policyholders experience a loss or damage, they file a claim with their insurance company. Claims adjusters and examiners are responsible for investigating these claims, evaluating the extent of the loss, and determining the amount to be paid out. This role involves detailed work, strong organizational skills, and a good understanding of insurance policies.

Insurance Sales Managers

Insurance sales managers oversee a team of insurance agents and brokers, providing leadership, training, and support to help them achieve sales targets. They are responsible for developing sales strategies, motivating their team, and ensuring compliance with industry regulations. This role demands strong leadership and management skills, as well as a deep understanding of the insurance sales process.

Insurance Administrators and Clerical Staff

Insurance agencies also employ administrative and clerical staff to handle the day-to-day operations of the business. This includes maintaining client records, processing insurance applications, issuing policies, and managing correspondence. While these roles may not involve direct client interaction, they are essential to the smooth running of the agency.

Education and Training Requirements

The education and training requirements for insurance agency jobs can vary depending on the role and the state or country in which you’re located. Here’s an overview of some common requirements:

Insurance Agents and Brokers

Insurance agents and brokers typically need to obtain a license to sell insurance products. The licensing process usually involves completing pre-licensing education, passing an exam, and meeting certain ethical standards. The education requirement can range from a high school diploma to a college degree, depending on the type of insurance and the state’s regulations.

Many insurance agencies also provide on-the-job training to new agents, covering product knowledge, sales techniques, and customer service skills. Additionally, continuing education is often required to maintain your license and stay up-to-date with industry changes.

Underwriters

Underwriters typically need a bachelor’s degree in a relevant field, such as finance, economics, or business. Some may also pursue a master’s degree in risk management or a related field. Prior work experience in the insurance industry, especially in an underwriting role, can be beneficial.

Insurance companies often provide training programs for new underwriters, covering risk assessment techniques, insurance regulations, and the use of underwriting software.

Claims Adjusters and Examiners

Claims adjusters and examiners may need a bachelor’s degree in a field like business, finance, or insurance. However, some positions may only require a high school diploma with relevant work experience. Many insurance companies provide on-the-job training to teach new hires about their claims processes, evaluation techniques, and industry regulations.

Insurance Sales Managers

Insurance sales managers often have a bachelor’s degree in business, marketing, or a related field. Prior experience in insurance sales is usually required, and some companies may prefer candidates with a master’s degree in business administration or a related discipline. Leadership and management skills are crucial for this role, and many companies offer training programs to help sales managers develop these skills further.

Career Growth and Opportunities

The insurance industry offers a wealth of opportunities for career growth and advancement. Here are some potential paths you can explore:

Specialization

You can specialize in a particular type of insurance, such as life insurance, health insurance, or property and casualty insurance. Specialization allows you to become an expert in your field, offering more complex and tailored solutions to your clients. It can also lead to higher earning potential and greater job satisfaction.

Management Roles

As you gain experience and demonstrate your leadership skills, you may have the opportunity to move into management roles. Insurance sales managers, for instance, can advance to become agency owners or even regional managers, overseeing multiple agencies.

Advanced Positions

With advanced education and experience, you can pursue roles like actuaries, who use statistical analysis to assess risk and determine insurance rates, or risk managers, who help organizations identify and manage risks.

Transferable Skills

The skills you develop in the insurance industry, such as risk assessment, sales, and customer service, are highly transferable to other sectors. This can open up opportunities for career changes if you decide to explore other industries later in your career.

Conclusion

The insurance industry offers a wide range of rewarding career paths, each with its own set of challenges and opportunities. Whether you’re interested in sales, risk assessment, or administration, there’s a role that can suit your skills and interests. With the right education, training, and dedication, you can build a successful and fulfilling career in the insurance industry.

Frequently Asked Questions

What are the average salaries for insurance agency jobs?

+Salaries in the insurance industry can vary significantly based on factors like job role, experience, and geographic location. On average, insurance agents and brokers can expect to earn between 40,000 and 100,000 annually, with potential for higher earnings through commissions. Underwriters typically earn around 60,000 to 120,000 per year, while claims adjusters and examiners can make between 45,000 and 80,000 annually. Insurance sales managers often have higher salaries, ranging from 70,000 to 150,000 or more, depending on their level of responsibility and performance.

What are the working hours like in insurance agency jobs?

+Working hours can vary depending on the role and the agency. Insurance agents and brokers often have flexible hours, allowing them to schedule client meetings and make sales calls at times that suit their clients. However, they may also need to work evenings and weekends to accommodate client needs. Underwriters and claims adjusters typically work regular business hours, although they may need to be on call during evenings or weekends in case of emergencies. Insurance sales managers often have more demanding schedules, working longer hours to oversee their team’s performance and meet sales targets.

What are the career advancement opportunities in the insurance industry?

+The insurance industry offers numerous opportunities for career advancement. Experienced insurance agents can become managers, overseeing a team of agents and brokers. They can also specialize in specific insurance lines, catering to high-net-worth individuals or businesses. Underwriters can advance to senior underwriting roles or become risk managers. Claims adjusters can move into supervisory or management positions, overseeing a team of adjusters. Insurance sales managers can advance to regional or national management roles, or even become agency owners.

What are the key skills needed for a career in insurance?

+A successful career in insurance requires a range of skills. For agents and brokers, strong communication and interpersonal skills are essential to build trust with clients and understand their needs. Analytical skills are crucial for underwriters to assess risk accurately. Claims adjusters need to be detail-oriented and organized to handle claims efficiently. Insurance sales managers require leadership and management skills to motivate and guide their team. Additionally, all insurance professionals need a good understanding of insurance products, regulations, and ethical standards.