Insurance Cover

In the world of financial planning and risk management, insurance cover stands as a vital tool to safeguard individuals, businesses, and assets from unforeseen events and financial losses. This comprehensive guide aims to explore the multifaceted nature of insurance, delving into its intricacies, benefits, and significance in our modern society. With a focus on providing expert insights and real-world examples, we will navigate through the various types of insurance, their mechanisms, and the strategic considerations involved in securing appropriate coverage.

Understanding the Essence of Insurance Cover

Insurance is a contract, represented by a policy, in which an individual or entity, known as the policyholder, receives financial protection or reimbursement against losses from an insurance company. The insurance company, in turn, collects premiums from the policyholder to provide this financial safeguard. This relationship forms the basis of a mutual agreement where the insurer assumes the risk of specific losses, offering a sense of security and peace of mind to the insured.

The concept of insurance is rooted in the principle of risk pooling, where a large number of individuals or entities contribute premiums to a common pool. This pool is then utilized to compensate those who suffer insured losses. By distributing the financial burden across a broad spectrum, insurance providers can offer protection against significant losses that may be catastrophic for individuals or businesses.

Types of Insurance Cover and Their Significance

Insurance is a versatile tool, offering protection in various aspects of life and business. Here’s an overview of some key types of insurance cover and their importance:

Life Insurance

Life insurance is a vital component of financial planning, especially for individuals with financial dependents. It provides a safety net for loved ones by offering a lump-sum payment, known as a death benefit, upon the policyholder’s death. This financial cushion can help cover funeral expenses, outstanding debts, and provide ongoing support for dependents, ensuring their financial security.

There are two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, often 10, 20, or 30 years, while permanent life insurance, including whole life and universal life, provides coverage for the insured's entire life.

Health Insurance

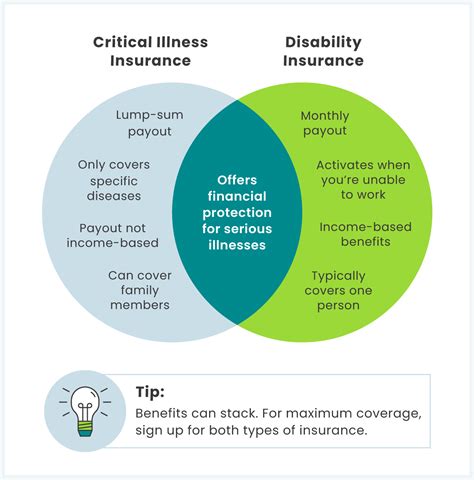

Health insurance is designed to protect individuals from the financial burden of medical expenses. It covers a wide range of healthcare services, from routine check-ups and preventive care to more significant treatments and surgeries. With rising healthcare costs, health insurance is an essential safeguard, ensuring access to quality medical care without the risk of financial strain.

Health insurance plans can vary widely, offering different levels of coverage and benefits. Some plans may focus on specific health needs, such as prescription drug coverage or mental health services, while others provide more comprehensive protection.

Property Insurance

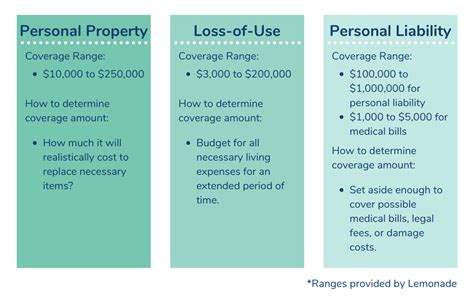

Property insurance is a broad category that includes various types of coverage to protect personal and business assets. This can include homeowners’ insurance, renters’ insurance, and business property insurance.

Homeowners' insurance provides coverage for a residence, its contents, and liability protection. It safeguards against losses from events like fires, storms, theft, and accidents. Renters' insurance, on the other hand, protects the personal property of tenants living in rental units.

Business property insurance is tailored to protect commercial properties and their contents. It can cover losses due to fires, natural disasters, vandalism, and other perils, ensuring that businesses can recover and continue operations in the face of unexpected events.

Auto Insurance

Auto insurance is a legal requirement in most jurisdictions and is essential for protecting drivers, passengers, and other road users. It provides coverage for a range of incidents, including accidents, theft, and damage to the insured vehicle.

Auto insurance policies typically include liability coverage, which protects the policyholder against claims arising from accidents they cause. It also offers collision coverage, which covers damages to the insured vehicle, and comprehensive coverage, which protects against non-collision incidents like theft or natural disasters.

Business Insurance

Business insurance is a critical component of risk management for any enterprise, large or small. It provides protection against a wide range of potential liabilities and perils that could threaten the financial stability and viability of a business.

Some common types of business insurance include general liability insurance, which covers injuries or damages caused to others on the business premises, professional liability insurance (or errors and omissions insurance) to protect against negligence claims, and workers' compensation insurance, which provides coverage for employees injured on the job.

Travel Insurance

Travel insurance is designed to protect travelers against unforeseen events that could disrupt their journey or cause financial loss. It can cover a range of incidents, including trip cancellations, medical emergencies, lost luggage, and travel delays.

With the unpredictability of travel, from unexpected health issues to natural disasters, travel insurance provides a safety net, ensuring that travelers can manage unforeseen circumstances without significant financial burden.

The Process of Obtaining Insurance Cover

Obtaining insurance cover involves a series of steps designed to assess risk and determine the appropriate level of protection. Here’s a simplified overview of the process:

Risk Assessment

Insurance companies evaluate the risk associated with providing coverage to a particular individual or entity. This involves analyzing various factors, such as age, health status, driving record, or the nature of the business, to determine the likelihood of a claim being made.

Policy Application

Once the risk assessment is complete, the potential policyholder fills out an application form, providing detailed information about their circumstances and the coverage they seek. This application is a critical step, as it forms the basis of the insurance contract.

Underwriting

Underwriters review the application and the associated risk assessment to decide whether to offer coverage. They may request additional information or conduct further investigations to make an informed decision. Underwriting is a crucial phase, as it ensures that the insurance company can manage the risk effectively.

Premium Determination

Based on the underwriting process, the insurance company determines the premium amount. Premiums are the regular payments made by the policyholder to maintain their insurance coverage. The premium amount is influenced by the level of risk, the coverage limits, and other factors specific to the policy.

Policy Issuance

If the application is approved, the insurance company issues a policy, which is a legal contract outlining the terms and conditions of the coverage. The policy details the rights and responsibilities of both the insurer and the insured, including the coverage limits, exclusions, and any additional riders or endorsements.

Maximizing the Benefits of Insurance Cover

While insurance cover is a powerful tool for managing risk, it’s essential to approach it strategically to ensure the most effective protection. Here are some key considerations to maximize the benefits of insurance:

Understanding Your Needs

The first step in obtaining appropriate insurance coverage is understanding your unique needs. This involves assessing your financial situation, identifying potential risks, and determining the level of protection required. For instance, a young professional with no dependents may prioritize health and auto insurance, while a business owner may need a more comprehensive business insurance package.

Comparing Providers and Policies

The insurance market is highly competitive, offering a wide range of providers and policies. It’s essential to compare different options to find the best fit for your needs. Consider factors such as coverage limits, deductibles, premium costs, and the reputation and financial stability of the insurance company.

Customizing Your Coverage

Many insurance policies offer customization through riders or endorsements. These additions to the base policy can enhance coverage in specific areas, providing more tailored protection. For example, a homeowner may choose to add flood insurance as a rider to their policy if they live in a high-risk area.

Regular Policy Review

Insurance needs can change over time, whether due to life events, changes in personal circumstances, or evolving business needs. It’s crucial to review your insurance coverage regularly to ensure it remains adequate and up-to-date. This may involve adjusting coverage limits, adding new policies, or making other necessary changes.

Claim Management

In the event of an insured loss, understanding the claim process is vital. Insurance companies have specific procedures for filing and managing claims. It’s essential to follow these processes carefully and provide all the necessary documentation to ensure a smooth and timely resolution.

The Future of Insurance Cover

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here are some key trends and developments shaping the future of insurance cover:

Digital Transformation

The digital age has brought significant changes to the insurance landscape. Insurance companies are increasingly leveraging technology to streamline processes, improve customer experience, and offer more efficient and accessible services. From online policy applications and digital claims management to the use of artificial intelligence for risk assessment, the industry is embracing digital transformation.

Personalized Insurance

With the availability of vast data and advanced analytics, insurance providers are moving towards more personalized insurance offerings. By analyzing individual risk factors and behavior, insurers can offer tailored coverage and pricing, providing a more customized experience for policyholders.

Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on predefined parameters, such as weather conditions or natural disasters. This type of insurance offers a more objective and efficient claim process, as payouts are triggered based on the occurrence of a specific event, rather than the assessment of damages.

Usage-Based Insurance

In certain sectors, such as auto insurance, usage-based insurance is gaining traction. This model bases premiums on actual usage patterns, rather than traditional factors like age and driving record. By installing monitoring devices in vehicles, insurers can assess driving behavior and offer more accurate and fair pricing.

Insurtech Partnerships

Insurtech, or insurance technology startups, are disrupting the traditional insurance landscape with innovative solutions. Established insurance companies are increasingly partnering with these startups to leverage their expertise in areas like digital distribution, data analytics, and AI-powered risk assessment, driving innovation and improving efficiency.

Environmental and Social Considerations

As societal awareness and environmental concerns grow, insurance providers are adapting their offerings to address these issues. This includes the development of green insurance products that promote sustainable practices and the integration of social responsibility into insurance policies, such as offering discounts for eco-friendly initiatives.

Conclusion: A Strategic Approach to Insurance Cover

Insurance cover is a fundamental tool for managing risk and ensuring financial security in an uncertain world. By understanding the various types of insurance, the process of obtaining coverage, and the strategic considerations involved, individuals and businesses can make informed decisions to protect their assets and future. As the insurance industry continues to evolve, staying informed about the latest trends and innovations will be crucial for navigating the changing landscape effectively.

How do insurance companies determine premiums?

+Insurance companies use a combination of factors to determine premiums, including the level of risk associated with the policyholder, the coverage limits, and the policy type. Risk assessment involves analyzing data such as age, health status, driving record, or business operations to estimate the likelihood of a claim. Premiums are then calculated based on this assessment, with higher-risk policyholders typically paying more.

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specified period, often 10, 20, or 30 years, and is typically more affordable than permanent life insurance. Permanent life insurance, including whole life and universal life, offers coverage for the insured’s entire life and also includes a savings or investment component. Permanent life insurance policies accumulate cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility.

How can I reduce my insurance premiums?

+There are several strategies to reduce insurance premiums. For health insurance, maintaining a healthy lifestyle and opting for high-deductible plans can lead to lower premiums. In auto insurance, safe driving practices and taking defensive driving courses can result in premium discounts. For homeowners’ insurance, implementing safety measures like smoke detectors and burglar alarms can reduce premiums. Additionally, bundling multiple policies with the same insurer can often lead to significant savings.

What is the process for filing an insurance claim?

+The process for filing an insurance claim can vary depending on the type of insurance and the specific insurer. However, there are some general steps. First, you must notify your insurer about the incident and provide them with all relevant details. You will then need to complete a claim form, providing documentation to support your claim, such as photos, receipts, or medical reports. The insurer will review your claim and, if approved, will process the payment according to the terms of your policy.