Medical Insurance Broker

The world of medical insurance is complex and ever-evolving, and navigating it can be a daunting task for individuals and businesses alike. This is where medical insurance brokers step in, playing a crucial role in the healthcare industry. These professionals act as intermediaries, connecting individuals and organizations with the most suitable insurance plans to meet their unique healthcare needs. With their extensive knowledge of the healthcare system and insurance market, brokers ensure that their clients receive the best coverage at the most competitive rates.

The Role of a Medical Insurance Broker

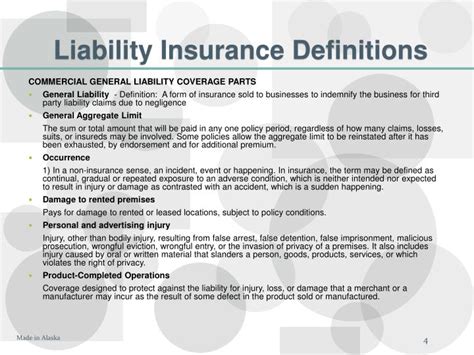

A medical insurance broker is a trusted advisor who specializes in understanding the intricate details of healthcare insurance. They work closely with their clients to assess their specific healthcare requirements, whether it’s for an individual, a family, or an entire business workforce. By evaluating the client’s needs, the broker can tailor-make insurance plans that offer the right balance of coverage and affordability.

Brokers act as a bridge between insurance companies and their clients, providing an impartial perspective on various insurance options. They keep themselves updated with the latest healthcare regulations, market trends, and insurance product offerings. This ensures that their clients are not only aware of the best insurance plans available but also the potential risks and benefits associated with each.

Furthermore, medical insurance brokers provide ongoing support to their clients. This includes helping with claim processes, resolving any insurance-related issues, and keeping their clients informed about any changes in the healthcare landscape that might impact their coverage. Their role extends beyond mere sales; they are committed to building long-term relationships with their clients, ensuring they have the right protection for their health needs at every stage of life.

Key Responsibilities of a Medical Insurance Broker

- Client Assessment: Brokers conduct comprehensive assessments of their clients’ healthcare needs, considering factors like age, medical history, family composition, and lifestyle.

- Plan Comparison: They research and compare a wide range of insurance plans, evaluating benefits, coverage limits, and cost to find the best fit for their clients.

- Policy Negotiation: Brokers often negotiate with insurance companies to secure the best possible terms and rates for their clients, ensuring value for money.

- Policy Management: Beyond policy selection, brokers assist with policy implementation, ensuring all necessary paperwork is completed accurately and on time.

- Claim Assistance: When clients need to make a claim, brokers guide them through the process, advocating on their behalf to ensure a smooth and fair resolution.

- Ongoing Support: Medical insurance brokers provide ongoing support and guidance, staying updated with their clients’ changing needs and keeping them informed about market changes.

The Benefits of Working with a Medical Insurance Broker

Engaging the services of a medical insurance broker offers a multitude of advantages. Firstly, brokers bring a wealth of industry knowledge and expertise, ensuring their clients receive the most suitable insurance coverage. They can explain complex insurance terms and benefits in simple language, making it easier for clients to understand their options.

Brokers also save their clients valuable time and effort. Instead of researching and comparing countless insurance plans, brokers do the legwork, presenting their clients with a curated selection of plans tailored to their needs. This personalized approach ensures clients receive the coverage they need without the stress of navigating the complex insurance landscape alone.

Furthermore, medical insurance brokers provide an objective perspective, free from the biases that might influence direct interactions with insurance companies. They act in their clients' best interests, advocating for the most advantageous policies and terms. With a broker's assistance, clients can feel confident they are making informed decisions about their healthcare coverage.

Key Advantages of Using a Medical Insurance Broker

- Expertise: Brokers possess in-depth knowledge of the healthcare insurance industry, enabling them to offer tailored advice and solutions.

- Time-Saving: Clients avoid the tedious task of comparing countless insurance plans, as brokers present a curated selection of options.

- Impartial Advice: Brokers provide unbiased recommendations, prioritizing their clients’ best interests over any insurance company’s agenda.

- Negotiation Power: Brokers can negotiate better rates and terms with insurance companies, securing the best value for their clients.

- Claim Support: In the event of a claim, brokers offer invaluable assistance, guiding their clients through the process and ensuring a fair outcome.

The Process of Choosing and Working with a Medical Insurance Broker

Selecting the right medical insurance broker is a critical decision that can significantly impact your healthcare coverage and experience. Here’s a step-by-step guide to help you choose a broker and maximize the benefits of their services.

Step 1: Research and Qualifications

Start by researching potential brokers. Look for professionals who are licensed and accredited by reputable industry bodies. Ensure they have the necessary qualifications and expertise to handle your specific insurance needs. Check their website, reviews, and testimonials to get an idea of their reputation and the quality of their services.

Step 2: Initial Consultation

Schedule an initial consultation with the broker. This is an opportunity to discuss your healthcare needs and goals. Be prepared to provide detailed information about your health history, family composition, and any specific coverage requirements. The broker should listen attentively and ask relevant questions to understand your situation thoroughly.

Step 3: Plan Comparison and Proposal

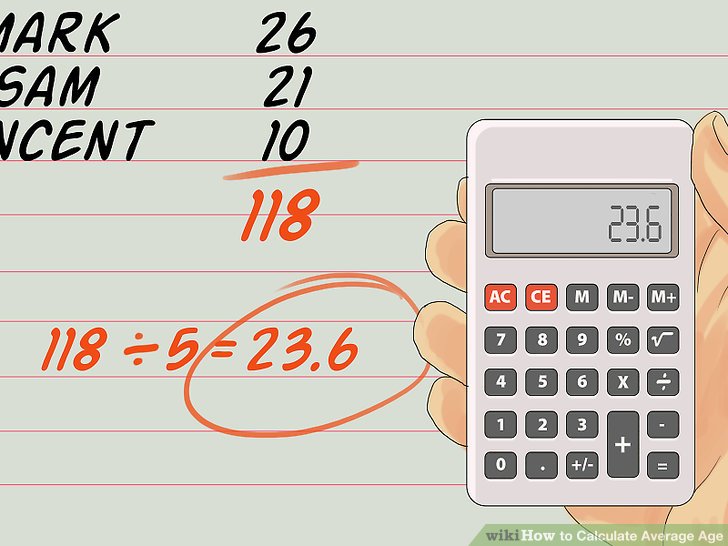

After the consultation, the broker will research and compare various insurance plans based on your needs. They should present you with a detailed proposal, outlining the benefits, coverage limits, and costs of each plan. Ensure they explain the key differences between the plans and how they align with your goals.

Step 4: Policy Selection and Implementation

Once you’ve chosen a plan, the broker will guide you through the policy selection and implementation process. They should assist with all necessary paperwork, ensuring accuracy and completeness. They should also provide clear instructions on any actions you need to take, such as paying premiums or providing additional documentation.

Step 5: Ongoing Support and Claim Assistance

The relationship with your broker doesn’t end with policy implementation. They should provide ongoing support, keeping you informed about any changes in the healthcare landscape that might impact your coverage. Additionally, they should be readily available to assist with any claim-related issues, guiding you through the process and advocating for your rights.

FAQs

How do medical insurance brokers get paid?

+Medical insurance brokers typically earn a commission from the insurance companies when a policy is sold. This commission is built into the insurance premium and is a standard practice in the industry. Brokers also may charge a fee for their services, especially for complex cases or specialized services.

Can a medical insurance broker help with international health insurance plans?

+Yes, many medical insurance brokers specialize in international health insurance plans. They can assist individuals and businesses with global mobility needs, offering tailored advice and solutions for expatriates, international students, and those traveling or working abroad. These brokers have expertise in navigating the complexities of international healthcare systems and insurance regulations.

How often should I review my medical insurance plan with my broker?

+It’s recommended to review your medical insurance plan annually or whenever your personal or professional circumstances change significantly. This could include getting married, having a child, changing jobs, or experiencing a major health event. Regular reviews ensure your coverage remains up-to-date and aligned with your evolving needs.