Life Insurance No Exam Needed

In today's fast-paced world, life insurance is a crucial aspect of financial planning, offering security and peace of mind to individuals and their families. However, traditional life insurance policies often require extensive medical exams and lengthy application processes, which can be time-consuming and daunting for many. Fortunately, the industry has evolved, introducing no-exam life insurance policies that provide an efficient and convenient alternative.

This article delves into the world of life insurance without the need for medical exams, exploring its benefits, coverage options, and suitability for various demographics. We will uncover the advantages of this innovative approach, dispel common misconceptions, and guide you through the process of obtaining life insurance coverage without the traditional hurdles.

Understanding No-Exam Life Insurance: A Modern Approach

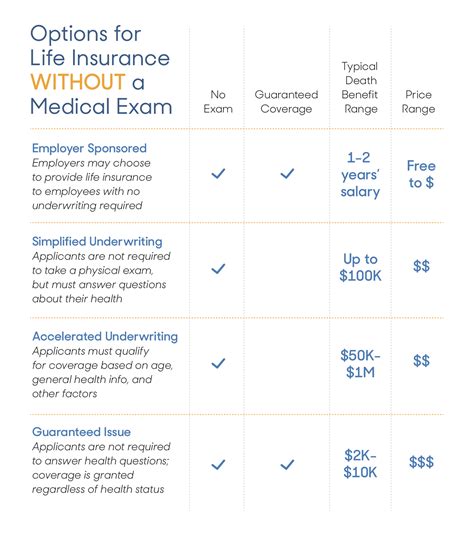

No-exam life insurance, as the name suggests, is a type of policy that does not require applicants to undergo a medical examination. Instead, these policies rely on a streamlined application process that focuses on gathering essential health and lifestyle information through a series of health-related questions. This modern approach to life insurance aims to simplify the often complex and invasive traditional application process, making coverage more accessible and convenient for a wider range of individuals.

The concept of no-exam life insurance gained traction as a response to the changing needs and preferences of modern consumers. With busy lifestyles and a desire for instant gratification, the traditional medical exam and extensive paperwork involved in traditional policies can be a significant barrier to entry. No-exam policies offer a solution, providing an efficient and straightforward way to secure life insurance coverage without compromising on quality or reliability.

The Advantages of No-Exam Policies

The benefits of no-exam life insurance policies are numerous and cater to a diverse range of individuals. Firstly, the most significant advantage is the speed of approval. Without the need for a medical exam, applicants can often receive their policy in a matter of days, compared to the weeks or even months required for traditional policies. This rapid turnaround time ensures that individuals can quickly secure the coverage they need, especially in times of urgent financial planning.

Additionally, no-exam policies offer convenience and privacy. The application process can be completed online or over the phone, eliminating the need for in-person meetings or time-consuming medical appointments. This not only saves time but also provides a discreet and private way to obtain life insurance, which is particularly appealing to those who value their personal information and time.

Another advantage is the flexibility in coverage options. No-exam policies are available in various types, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, often with the option to renew, while permanent life insurance offers lifelong coverage. This flexibility allows individuals to choose a policy that aligns with their unique needs and financial goals.

| Policy Type | Description |

|---|---|

| Term Life Insurance | Coverage for a specified term, often renewable. Suitable for short-term financial needs. |

| Permanent Life Insurance | Provides lifelong coverage, including a cash value component. Ideal for long-term financial planning. |

Who Can Benefit from No-Exam Life Insurance?

No-exam life insurance policies are suitable for a wide range of individuals, making them an inclusive and accessible option. Here are some demographics that can particularly benefit from this innovative approach:

- Busy Professionals: Individuals with demanding careers or hectic schedules often find the traditional application process a hindrance. No-exam policies offer a quick and efficient solution, allowing them to secure coverage without disrupting their busy lives.

- Young Adults: Many young adults starting their careers or building their financial stability may find the cost and complexity of traditional policies off-putting. No-exam policies provide an affordable and straightforward entry point into life insurance, helping them establish financial security early on.

- Health-Conscious Individuals: Those who maintain a healthy lifestyle and have no major health concerns may prefer the simplicity of no-exam policies. These policies often provide coverage at competitive rates, recognizing the value of a healthy lifestyle.

- Families with Young Children: Parents with young children often prioritize their family's well-being and financial security. No-exam policies offer a convenient way to obtain life insurance, ensuring their family is protected in case of unforeseen circumstances.

- Senior Citizens: As individuals age, the traditional medical exam can become more challenging. No-exam policies provide an alternative for seniors, allowing them to obtain coverage without the physical strain of a medical exam.

The Application Process: A Step-by-Step Guide

Applying for no-exam life insurance is a straightforward process designed to be user-friendly and efficient. Here’s a step-by-step guide to help you navigate the application journey:

Step 1: Choose a Reputable Provider

Begin by researching and selecting a reputable insurance provider that offers no-exam policies. Look for companies with a strong track record, positive customer reviews, and a range of policy options to suit your needs. Ensure the provider is licensed and regulated to offer life insurance in your state or region.

Step 2: Understand Your Coverage Needs

Before applying, take the time to assess your life insurance needs. Consider your financial obligations, such as mortgage payments, outstanding debts, and your family’s future financial goals. Determine the amount of coverage you require and the type of policy (term or permanent) that best aligns with your circumstances.

Step 3: Gather Essential Information

The no-exam application process relies on accurate health and lifestyle information. Prepare by gathering the following details:

- Personal information: Your full name, date of birth, address, and contact details.

- Health history: Any pre-existing medical conditions, hospitalizations, or surgeries you have had.

- Lifestyle factors: Smoking status, alcohol consumption, and any high-risk activities or hobbies you participate in.

- Financial information: Your annual income and any existing life insurance policies you hold.

Step 4: Complete the Application

Visit the insurance provider’s website or contact their customer service team to initiate the application process. You will be guided through a series of health-related questions designed to assess your eligibility for coverage. Provide honest and accurate answers to ensure a smooth application journey.

Step 5: Review and Sign the Policy

Once your application is approved, you will receive a policy document outlining the terms and conditions of your coverage. Take the time to carefully review the policy, ensuring it meets your expectations and covers your specific needs. If you have any questions or concerns, reach out to the insurance provider for clarification.

Step 6: Make Your Premium Payment

After reviewing and accepting the policy, you will be required to make your initial premium payment. This payment solidifies your coverage and ensures you are protected from the chosen policy start date.

Misconceptions and Frequently Asked Questions

Is No-Exam Life Insurance as Reliable as Traditional Policies?

+

Absolutely! No-exam life insurance policies are just as reliable as traditional policies. The no-exam approach simply streamlines the application process, making it more convenient and efficient. The insurance provider still assesses your health and lifestyle factors through a series of detailed questions, ensuring that the coverage provided is suitable and adequate for your needs.

Are There Any Age Restrictions for No-Exam Policies?

+

While age restrictions may vary between insurance providers, no-exam policies are generally available to a wide age range. Some providers offer coverage for individuals as young as 18 years old, while others may have an upper age limit, typically around 70-75 years. It’s essential to check with the specific provider to understand their age requirements.

Can I Increase My Coverage Amount Later?

+

Yes, many no-exam life insurance policies allow for coverage increases over time. This is particularly beneficial if your financial obligations or family circumstances change. However, the process for increasing coverage may vary, so it’s advisable to review your policy’s terms and conditions or consult with your insurance provider to understand the specific requirements.

What Happens if My Health Status Changes After Getting the Policy?

+

If your health status changes significantly after obtaining your no-exam life insurance policy, it’s crucial to inform your insurance provider. They will guide you through the necessary steps, which may include a review of your policy and potentially an adjustment in your premium or coverage. Honesty is vital to maintain the integrity of your coverage.

Conclusion: Empowering Financial Security

No-exam life insurance policies have revolutionized the industry, offering a modern and accessible approach to financial protection. By eliminating the need for medical exams, these policies provide a convenient and efficient way for individuals to secure the coverage they need. Whether you’re a busy professional, a young adult starting your financial journey, or a senior citizen seeking peace of mind, no-exam life insurance policies cater to a diverse range of demographics.

As you embark on your journey towards financial security, remember that life insurance is an essential component of a well-rounded financial plan. With the insights and guidance provided in this article, you can navigate the world of no-exam life insurance with confidence, ensuring your loved ones are protected and your future is secure.