Geico Insurance Call

In today's fast-paced world, insurance is an essential aspect of financial planning and protection. Among the many insurance providers, GEICO stands out as a well-known and trusted name. This article delves into the experience of calling GEICO Insurance, offering insights into what you can expect and how to navigate this important aspect of your insurance journey.

Navigating the GEICO Insurance Call: A Comprehensive Guide

Making a call to your insurance provider can be a daunting task, especially when it comes to something as crucial as auto insurance. GEICO, known for its catchy slogans and efficient services, aims to make the process as seamless as possible. Let's explore the key aspects of a GEICO insurance call, providing you with the knowledge to navigate it with confidence.

The Initial Contact: Expectations and Preparation

When you dial the GEICO customer service number, you'll be greeted by a friendly automated system. This system is designed to direct your call efficiently, whether you're a new customer seeking a quote or an existing policyholder needing assistance. It's important to have your policy number or the details of your vehicle ready to ensure a smooth process.

For new customers, the call will typically involve a series of questions to understand your insurance needs. This includes details about your vehicle, driving history, and any additional coverages you might require. The representative will guide you through the process, ensuring you receive a personalized quote tailored to your situation.

| Policy Type | Coverage Options |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Medical Payments, Uninsured/Underinsured Motorist |

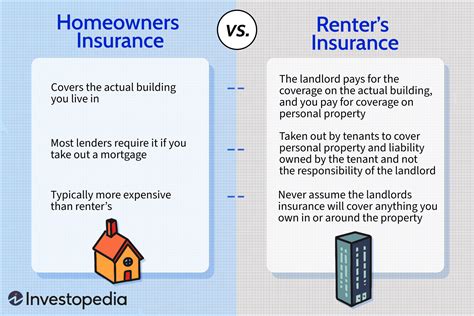

| Homeowners Insurance | Dwelling, Personal Property, Liability, Additional Living Expenses |

| Renters Insurance | Personal Property, Liability, Additional Living Expenses |

If you're an existing customer, the call might involve updating your policy, reporting a claim, or simply seeking clarification on a billing issue. GEICO's representatives are trained to handle a wide range of inquiries, ensuring that your needs are met efficiently.

The Benefits of Calling GEICO

GEICO offers a comprehensive suite of insurance products, covering not just auto insurance but also homeowners, renters, and more. Calling GEICO provides an opportunity to discuss these options and understand the full range of coverages available to you. The representatives are knowledgeable and can guide you in making informed decisions about your insurance portfolio.

One of the key advantages of calling GEICO is the personalized attention you receive. Unlike online quotes, which can be generic, a call allows you to discuss your unique circumstances and receive tailored advice. This ensures that you're not only getting the right coverage but also the best value for your money.

Claim Management: A Smooth Process

In the event of an accident or other insured event, the claim management process is a critical aspect of your insurance experience. GEICO has streamlined this process, ensuring that policyholders can report claims efficiently and receive timely updates.

When calling to report a claim, GEICO representatives will guide you through the necessary steps. This includes verifying your policy details, assessing the extent of the damage, and providing guidance on the next steps. GEICO's claim management system is designed to be transparent, ensuring that policyholders are kept informed throughout the process.

For more complex claims, GEICO offers dedicated claim specialists who can provide expert guidance and support. This ensures that your claim is handled with the utmost care and that you receive the compensation you're entitled to.

GEICO's Digital Services: Enhancing the Call Experience

GEICO understands the importance of digital convenience and has developed a robust online and mobile platform. These digital services complement the call experience, providing policyholders with additional tools to manage their insurance needs.

The GEICO mobile app, for instance, allows users to access their policy details, pay bills, and even report claims from the convenience of their smartphones. This digital integration ensures that policyholders can handle many routine tasks without the need for a call, reserving phone support for more complex inquiries or issues.

| Digital Service | Description |

|---|---|

| Mobile App | Access policy details, pay bills, and report claims on the go. |

| Online Portal | Manage policies, view billing history, and access educational resources. |

| Email and Text Alerts | Stay informed about policy changes, billing reminders, and claim updates. |

The online portal, accessible via the GEICO website, offers a similar suite of services. Here, policyholders can manage their policies, view billing history, and even access educational resources to better understand their insurance coverage. These digital tools enhance the overall customer experience, providing policyholders with control and convenience.

Future Outlook: GEICO's Commitment to Innovation

As the insurance industry evolves, GEICO remains committed to innovation. The company continuously invests in technology to enhance its services, ensuring that policyholders benefit from the latest advancements.

One area of focus is AI integration. GEICO is exploring ways to use AI to streamline processes, enhance customer service, and improve claim management. This includes developing AI-powered chatbots and virtual assistants to provide instant support and guidance to policyholders.

Additionally, GEICO is exploring the potential of blockchain technology to enhance security and efficiency in insurance transactions. This technology has the potential to revolutionize how policies are managed, claims are processed, and data is shared, offering greater transparency and security for policyholders.

Conclusion: A Trusted Partner for Your Insurance Needs

Calling GEICO Insurance is a vital step in managing your insurance portfolio. The company's commitment to customer service, coupled with its innovative approach to insurance, ensures that policyholders receive the support and guidance they need. Whether it's a simple inquiry or a complex claim, GEICO is dedicated to providing a seamless and efficient experience.

By understanding the expectations and benefits of a GEICO insurance call, you can approach the process with confidence. Remember, GEICO's representatives are there to assist, guide, and ensure that you receive the coverage and support you deserve.

What documents should I have ready when calling GEICO for a quote?

+When calling GEICO for a quote, it’s helpful to have the following information ready: your vehicle’s make, model, and year; your driver’s license number; and any previous insurance information, including policy number and expiration date. If you’re seeking additional coverages, such as renters or homeowners insurance, have details about your residence, including its value and any recent improvements.

How can I report a claim to GEICO over the phone?

+To report a claim to GEICO over the phone, simply dial their customer service number and follow the prompts to speak with a representative. Have your policy number and details of the incident ready. The representative will guide you through the process, which typically involves verifying your policy, assessing the damage, and providing guidance on the next steps.

What are some of the benefits of using GEICO’s digital services alongside phone support?

+GEICO’s digital services, such as the mobile app and online portal, offer a range of benefits when used alongside phone support. These include the ability to manage your policy details, pay bills, and access educational resources at your convenience. Additionally, these digital tools can provide instant support for routine tasks, freeing up phone lines for more complex inquiries.