Homewoners Insurance

Homeowner's insurance is a vital protection for one of the most significant investments most people make: their homes. This policy safeguards homeowners from financial losses due to various unforeseen events, providing peace of mind and ensuring they can rebuild and recover from potential disasters. With the right coverage, homeowners can navigate the unexpected with confidence.

Understanding Homeowner’s Insurance: A Comprehensive Overview

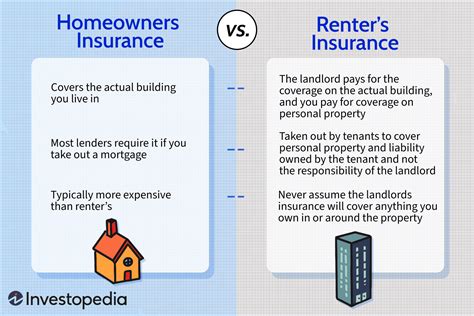

Homeowner’s insurance is a contract between an insurance provider and a homeowner, designed to protect against financial losses arising from damages to a home or its contents. It covers a range of incidents, from natural disasters to burglaries and even liability claims. This type of insurance is not a one-size-fits-all solution; policies can be tailored to individual needs, offering different levels of coverage and deductibles.

The cost of homeowner's insurance can vary significantly, influenced by factors such as the location, age, and type of home, as well as the level of coverage chosen. For instance, a homeowner in an area prone to natural disasters like hurricanes or earthquakes may expect to pay a higher premium due to the increased risk.

Key Components of Homeowner’s Insurance Policies

A standard homeowner’s insurance policy typically includes coverage for the dwelling, personal property, liability, and additional living expenses. The dwelling coverage refers to the structure of the home itself, including any attached structures like garages. Personal property coverage protects the homeowner’s belongings inside the home, such as furniture, electronics, and clothing. Liability coverage safeguards the homeowner against legal claims and lawsuits for bodily injury or property damage that occurs on the insured property. Lastly, additional living expenses cover the cost of temporary housing and other expenses if the home becomes uninhabitable due to a covered event.

It's important to note that standard policies often have limitations and exclusions. For example, certain natural disasters like floods or earthquakes may require separate policies or endorsements. Additionally, high-value items like jewelry, art, or collectibles may need to be scheduled separately to ensure adequate coverage.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home and attached structures. |

| Personal Property Coverage | Covers belongings inside the home, offering replacement or repair costs. |

| Liability Coverage | Provides legal defense and pays for damages if the homeowner is sued. |

| Additional Living Expenses | Covers costs incurred if the home becomes uninhabitable due to a covered event. |

Choosing the Right Homeowner’s Insurance: Factors and Considerations

Selecting the right homeowner’s insurance involves a careful evaluation of various factors. One of the primary considerations is the replacement cost of the home and its contents. This refers to the amount it would cost to rebuild the home and replace its contents if they were completely destroyed. It’s important to ensure that the coverage limit is sufficient to cover these costs, taking into account any changes in the market value of the home and its contents over time.

Another critical factor is the deductible. A deductible is the amount the homeowner must pay out of pocket before the insurance company starts covering the costs. Choosing a higher deductible can lead to lower premiums, but it's essential to consider whether this would be a feasible financial burden in the event of a claim.

Assessing Coverage Options

Homeowner’s insurance policies offer various coverage options, and it’s vital to understand the differences to make an informed decision. The two primary types of coverage are replacement cost coverage and actual cash value coverage. Replacement cost coverage pays the full cost to rebuild the home and replace its contents, without deducting for depreciation. This type of coverage is often recommended as it ensures the homeowner can fully restore their home without being penalized for the age of their belongings.

In contrast, actual cash value coverage pays the replacement cost minus depreciation. This means the insurance company will consider the age and condition of the home and its contents when determining the payout. While this type of coverage typically has lower premiums, it may not provide sufficient funds to fully rebuild and replace everything.

Additionally, homeowners should consider endorsements or riders, which are additions to the policy that provide extra coverage for specific items or situations. For example, a homeowner might want to add a rider for high-value items like jewelry or fine art to ensure they are fully covered in the event of a loss.

The Claims Process: Navigating Homeowner’s Insurance Claims

When a homeowner experiences a loss that is covered by their policy, they initiate the claims process. This involves notifying the insurance company of the incident and providing details about the damage. The insurance company will then assign an adjuster to investigate the claim, assess the extent of the damage, and determine the payout amount.

Step-by-Step Guide to Filing a Claim

- Report the Claim: Immediately after an incident, contact your insurance company to report the claim. Provide as much detail as possible about the event and the damage incurred.

- Document the Damage: Take photographs or videos of the damage, both of the home and its contents. This documentation can be crucial in supporting your claim.

- Secure the Property: Take reasonable steps to prevent further damage. For example, if a storm has caused a tree branch to fall on your roof, you should have it removed promptly to prevent water damage.

- Cooperate with the Adjuster: The insurance company will assign an adjuster to investigate your claim. Cooperate fully with the adjuster’s requests for information and access to the property.

- Receive the Payout: Once the adjuster has assessed the damage and determined the payout amount, you will receive a check or other form of payment to cover the agreed-upon costs.

It's important to note that the claims process can vary depending on the type and severity of the loss, as well as the insurance company's policies. Some claims may be straightforward and quickly resolved, while others may require more extensive investigation and negotiation.

What is the average cost of homeowner’s insurance?

+The average cost of homeowner’s insurance can vary significantly depending on factors like location, the age and type of the home, and the level of coverage chosen. On average, homeowners can expect to pay between 1,000 and 2,000 annually for their policy. However, this range can extend significantly higher or lower based on individual circumstances.

Are there any discounts available for homeowner’s insurance?

+Yes, many insurance companies offer discounts for homeowner’s insurance policies. These can include multi-policy discounts (for bundling home and auto insurance), loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features like fire alarms or security systems. Additionally, some companies offer discounts for homeowners who are claim-free for a certain period.

How often should I review my homeowner’s insurance policy?

+It’s recommended to review your homeowner’s insurance policy annually, or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and that you’re not paying for coverage you no longer need. Regular reviews also allow you to take advantage of any new discounts or coverage options that may become available.