Get A Insurance Quote

Securing an insurance quote is a crucial step in safeguarding your financial well-being and protecting what matters most. Whether you're looking to insure your home, your car, your health, or your business, obtaining accurate and competitive quotes is essential for making informed decisions. In this comprehensive guide, we'll explore the process of getting an insurance quote, covering everything from the initial search to comparing policies and making the final choice. By understanding the ins and outs of insurance quotes, you can navigate the market with confidence and find coverage that suits your unique needs.

Understanding the Insurance Quote Process

The journey to obtaining an insurance quote begins with a simple yet vital step: defining your coverage needs. This involves assessing your specific requirements and understanding the risks you want to mitigate. Whether it’s protecting your home from natural disasters, ensuring your car against accidents, or safeguarding your health and finances, the first step is recognizing the scope of your insurance needs.

Once you've identified your coverage goals, the next phase is to research and compare insurance providers. This is a critical step, as different insurers offer varying levels of coverage, customer service, and price points. By taking the time to explore multiple options, you can ensure you're not only getting the best deal but also accessing the right type of coverage for your situation.

The Initial Insurance Quote Request

Requesting an insurance quote is typically a straightforward process, often starting with a simple online form. This form will ask for basic information about you and your insurance needs. For instance, if you’re seeking car insurance, the form might inquire about your driving history, the make and model of your vehicle, and the primary purpose of your driving (e.g., commuting, business, pleasure). For home insurance, details about your home’s location, size, and construction materials are often required. Health insurance quotes may involve questions about your age, location, and pre-existing medical conditions.

Upon submitting this initial request, you'll typically receive a range of quotes from different insurers. These quotes provide a snapshot of the coverage and costs associated with each policy. It's important to remember that these initial quotes are not set in stone; they are often flexible and can be adjusted based on further discussion with the insurer.

Comparing Insurance Quotes

Comparing insurance quotes is a critical step in the insurance-shopping process. It allows you to evaluate different policies, understand their unique features, and make an informed decision about your coverage. Here’s a closer look at how to effectively compare insurance quotes.

Understanding Coverage Details

When comparing insurance quotes, it’s essential to go beyond the headline price and delve into the specifics of each policy’s coverage. Different insurers may offer varying levels of coverage for similar risks. For instance, two home insurance policies might have different deductibles, coverage limits, and exclusions. One policy might provide broader coverage for water damage, while another might offer more comprehensive liability protection.

| Policy Type | Coverage Highlight |

|---|---|

| Home Insurance | Broad water damage coverage, including protection against floods and burst pipes. |

| Auto Insurance | Enhanced rental car coverage, providing reimbursement for higher-end rental vehicles. |

| Health Insurance | Comprehensive dental and vision coverage, including orthodontic and vision correction procedures. |

Assessing Policy Limits and Deductibles

Policy limits and deductibles are key components of any insurance policy. The policy limits represent the maximum amount the insurer will pay out for a covered loss, while deductibles are the portion of a claim that you, the policyholder, are responsible for paying. When comparing quotes, it’s crucial to consider both of these factors.

Higher policy limits generally provide more comprehensive coverage, but they also come with a higher premium. Similarly, while lower deductibles can be more appealing, as they mean you pay less out of pocket in the event of a claim, they often result in a higher premium.

| Policy Type | Policy Limit | Deductible |

|---|---|---|

| Home Insurance | $500,000 | $1,000 |

| Auto Insurance | $100,000 per person, $300,000 per accident | $500 |

| Health Insurance | Lifetime maximum: $2 million | $2,000 individual, $4,000 family |

Evaluating Additional Benefits and Perks

Beyond the core coverage, many insurance policies offer additional benefits and perks that can enhance your overall experience. These might include access to a 24⁄7 customer service hotline, roadside assistance for auto policies, or wellness programs and discounts for health insurance plans.

When comparing quotes, take the time to explore these additional features. They can often be the deciding factor between two similar policies, especially if they align with your specific needs and preferences.

The Impact of Personal Factors on Insurance Quotes

Insurance quotes are highly personalized, taking into account a variety of factors that are unique to your situation. These factors can significantly influence the cost and coverage of your insurance policy. Here’s a closer look at some of the key personal factors that impact insurance quotes.

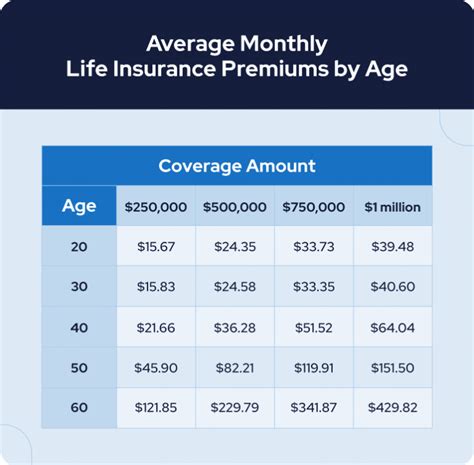

Age and Insurance Premiums

Age is a significant factor in determining insurance premiums, especially for auto and health insurance. Generally, younger individuals are considered higher-risk, leading to higher premiums. This is because younger drivers and individuals may have less experience, leading to a higher likelihood of accidents or health issues. Conversely, older individuals often benefit from lower premiums due to their established driving records and lower overall health risks.

| Age Range | Average Auto Insurance Premium |

|---|---|

| 16-24 years | $2,500 annually |

| 25-34 years | $1,800 annually |

| 35-44 years | $1,500 annually |

| 45-54 years | $1,200 annually |

| 55+ years | $1,000 annually |

Location and Insurance Rates

Your geographical location plays a significant role in determining your insurance rates. This is because different areas have varying levels of risk associated with them. For instance, areas prone to natural disasters like hurricanes or earthquakes will generally have higher insurance rates for home and auto policies. Similarly, densely populated urban areas with higher crime rates may also result in increased insurance costs.

Credit Score and Insurance Costs

Your credit score is another factor that can influence your insurance costs, particularly for auto and home insurance. Many insurers use credit-based insurance scores to help predict the likelihood of an insurance claim. Individuals with higher credit scores are often seen as lower-risk, leading to more favorable insurance rates. Conversely, those with lower credit scores may face higher premiums.

The Future of Insurance Quotes

The insurance industry is continuously evolving, and the process of obtaining insurance quotes is no exception. With advancements in technology and changing consumer preferences, the future of insurance quotes looks set to become even more streamlined, personalized, and data-driven.

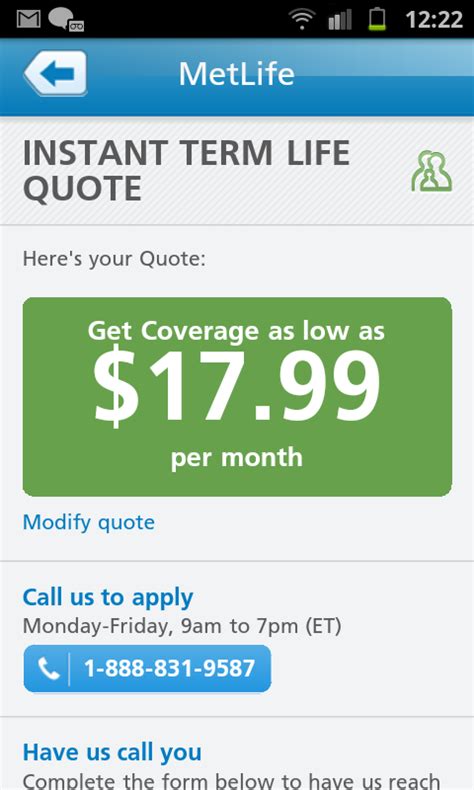

The Rise of Digital Insurance Quotes

The digital revolution has already had a significant impact on the insurance industry, and this trend is set to continue. With the increasing popularity of online insurance marketplaces and comparison websites, consumers now have more options than ever to research and compare insurance quotes from the comfort of their homes.

These digital platforms not only provide a convenient way to shop for insurance but also offer a wealth of information and resources to help consumers make informed decisions. From detailed policy explanations to real-time quotes and customer reviews, these platforms are empowering consumers to take control of their insurance needs.

Personalized Insurance Quotes

The future of insurance quotes also lies in personalization. With the advancement of data analytics and artificial intelligence, insurers are now able to offer highly personalized quotes that take into account an individual’s unique circumstances and needs. This level of personalization ensures that consumers receive insurance coverage that is tailored to their specific risks and requirements.

For instance, using data analytics, insurers can now offer dynamic pricing models that adjust premiums based on an individual's changing circumstances. This could include factors such as changes in driving behavior, health conditions, or home improvements that reduce the risk of insurance claims.

The Role of Telematics in Auto Insurance

In the realm of auto insurance, the future of insurance quotes is closely tied to the use of telematics. Telematics involves the use of technology to monitor and record driving behavior, which can then be used to offer more accurate and personalized insurance quotes. By installing a small device in the vehicle or using a smartphone app, insurers can collect data on driving habits, such as speed, distance traveled, and even the time of day the vehicle is driven.

This data-driven approach to insurance quotes has the potential to benefit both insurers and consumers. For insurers, it provides a more accurate assessment of risk, leading to more efficient underwriting and pricing. For consumers, it offers the opportunity to lower their insurance premiums by demonstrating safe driving habits. Additionally, telematics data can be used to offer real-time feedback and incentives to encourage safer driving behaviors.

FAQs

What information do I need to provide to get an insurance quote?

+The specific information required will depend on the type of insurance you’re seeking. For auto insurance, you’ll typically need to provide details about your vehicle, your driving history, and your personal information. Home insurance quotes may require information about your home’s location, size, construction materials, and any additional features or improvements. Health insurance quotes often involve questions about your age, location, and pre-existing medical conditions.

How do I know if an insurance quote is competitive?

+To determine if an insurance quote is competitive, it’s essential to compare it with quotes from other insurers. You can use online comparison tools or contact multiple insurers directly to request quotes. Additionally, consider factors beyond just the price, such as the coverage details, policy limits, deductibles, and any additional benefits or perks offered by the insurer.

Can I negotiate my insurance quote?

+While insurance quotes are generally not negotiable in the traditional sense, there are strategies you can employ to potentially lower your insurance costs. For instance, you can consider increasing your deductibles, which can lead to lower premiums. Additionally, some insurers offer discounts for bundling multiple policies (e.g., home and auto insurance) or for certain safety features or improvements (like a home security system or defensive driving courses). It’s worth discussing these options with your insurer to see if you can reduce your insurance costs.

What should I do if I’m not satisfied with my insurance quote?

+If you’re not satisfied with your insurance quote, it’s important to take a step back and reassess your coverage needs. Consider whether you’ve accurately conveyed your risks and requirements to the insurer. You may also want to explore quotes from other insurers to see if you can find a better deal. Additionally, don’t hesitate to reach out to your insurer to discuss your concerns and see if they can offer any additional discounts or adjust your coverage to better meet your needs.

How often should I review my insurance quotes and coverage?

+It’s a good practice to review your insurance quotes and coverage annually or whenever your circumstances change significantly. Life events such as getting married, buying a new home, or starting a family can all impact your insurance needs. Regularly reviewing your coverage ensures that you’re adequately protected and that you’re not overpaying for insurance.