How Much Would Home Insurance Cost

Understanding the cost of home insurance is crucial for homeowners as it provides financial protection against various risks and unforeseen circumstances. The price of home insurance can vary significantly depending on several factors, including the location, size, and type of your home, as well as the level of coverage you require. In this comprehensive guide, we will delve into the key aspects that influence home insurance costs and provide you with valuable insights to make an informed decision.

Factors Influencing Home Insurance Premiums

When determining the cost of home insurance, insurance providers consider a multitude of factors to assess the potential risks associated with your property. Here are some of the key elements that can impact your insurance premiums:

Location and Regional Factors

The geographical location of your home plays a significant role in determining insurance costs. Areas prone to natural disasters such as hurricanes, earthquakes, or floods typically have higher insurance premiums due to the increased risk. Additionally, crime rates, proximity to fire stations, and local building codes can also affect the cost of insurance.

| Region | Average Annual Premium |

|---|---|

| Urban Areas | $1,500 - $2,500 |

| Suburban Areas | $1,200 - $1,800 |

| Rural Areas | $1,000 - $1,500 |

It's essential to note that while these averages provide a general idea, actual insurance costs can vary widely based on specific regional factors and the individual circumstances of your home.

Home Size and Construction

The size and construction of your home are vital considerations when calculating insurance premiums. Larger homes generally require higher coverage limits, resulting in increased costs. Moreover, the construction materials and design of your home can impact its resilience against natural disasters and other risks. For instance, a home built with reinforced concrete may be more resistant to hurricanes than one constructed with wood framing.

| Home Size | Average Annual Premium |

|---|---|

| Small (Under 1,500 sq. ft.) | $800 - $1,200 |

| Medium (1,500 - 3,000 sq. ft.) | $1,200 - $1,800 |

| Large (Over 3,000 sq. ft.) | $1,800 - $3,000 |

Keep in mind that these averages are estimates, and the actual cost can vary based on the specific construction and features of your home.

Coverage Limits and Deductibles

The level of coverage you choose for your home insurance policy is a significant factor in determining your premiums. Higher coverage limits provide more financial protection but can result in increased costs. Additionally, selecting a higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lower your premiums. It’s crucial to find a balance between adequate coverage and affordable premiums.

| Coverage Limit | Average Annual Premium |

|---|---|

| $100,000 | $800 - $1,200 |

| $200,000 | $1,200 - $1,800 |

| $300,000 | $1,800 - $2,500 |

Personal Factors and Discounts

Insurance providers also consider personal factors when calculating premiums. Your age, occupation, and credit score can influence the cost of your insurance. Additionally, certain discounts may be available, such as loyalty discounts for long-term customers, multi-policy discounts for bundling home and auto insurance, or safety discounts for installing security systems or fire prevention measures.

Obtaining Accurate Home Insurance Quotes

To get an accurate estimate of your home insurance costs, it’s essential to provide detailed and accurate information to insurance providers. Here are some steps to help you obtain precise quotes:

Gather Information About Your Home

Before requesting quotes, gather essential details about your home, including its size, construction materials, age, and any recent renovations or upgrades. This information will help insurance providers assess the risks associated with your property accurately.

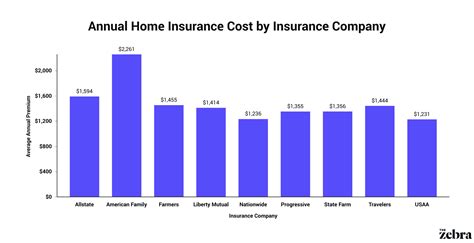

Compare Multiple Insurance Providers

Don’t settle for the first insurance quote you receive. Compare quotes from several reputable insurance providers to ensure you’re getting the best value for your money. Online insurance comparison tools can be valuable resources for this purpose.

Consider Bundle Discounts

If you have multiple insurance needs, such as auto and home insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts for customers who bundle their insurance needs, resulting in potential savings on your home insurance premiums.

Understanding the Coverage Provided by Home Insurance

Home insurance policies typically cover a range of risks and perils, providing financial protection for your home and its contents. Here’s an overview of the key coverage components you can expect from a standard home insurance policy:

Dwelling Coverage

This coverage protects the physical structure of your home, including the walls, roof, and permanent fixtures. It provides financial assistance in case of damage or destruction caused by covered perils, such as fire, windstorms, hail, or vandalism.

Personal Property Coverage

Personal property coverage safeguards the contents of your home, such as furniture, electronics, clothing, and personal belongings. It reimburses you for the cost of repairing or replacing damaged or stolen items, up to the limits specified in your policy.

Liability Coverage

Liability coverage protects you against financial losses resulting from accidents or injuries that occur on your property and for which you are legally responsible. It provides coverage for medical expenses, legal defense costs, and damages awarded to the injured party.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered peril, additional living expenses coverage reimburses you for the costs incurred while temporarily living elsewhere. This coverage typically includes expenses such as hotel stays, meals, and other necessary costs during the restoration period.

Optional Coverages

Depending on your specific needs and the risks associated with your location, you may opt for additional coverage beyond the standard policy. Optional coverages can include flood insurance, earthquake insurance, or coverage for high-value items like jewelry or artwork.

Tips for Managing Home Insurance Costs

While the cost of home insurance can vary significantly, there are several strategies you can employ to manage and potentially reduce your insurance premiums:

Maintain a Good Credit Score

Insurance providers often consider your credit score when determining your insurance premiums. Maintaining a good credit score can positively impact your insurance costs. Regularly review your credit report and take steps to improve your creditworthiness.

Improve Your Home’s Security

Installing security systems, such as burglar alarms, smoke detectors, and fire sprinklers, can reduce the risk of theft and fire-related incidents. Insurance providers often offer discounts for homes with enhanced security features, so consider investing in these measures to potentially lower your insurance premiums.

Review Your Policy Annually

It’s essential to review your home insurance policy annually to ensure it aligns with your current needs and circumstances. Life changes, such as renovations, additions, or changes in personal property value, may require adjustments to your coverage limits. Regularly reviewing your policy ensures you have adequate coverage without paying for unnecessary premiums.

Consider Higher Deductibles

As mentioned earlier, selecting a higher deductible can lead to lower insurance premiums. However, it’s crucial to choose a deductible amount that you can comfortably afford in case of an emergency. Assess your financial situation and select a deductible that provides a balance between affordability and adequate coverage.

Explore Discounts and Loyalty Programs

Insurance providers often offer discounts and loyalty programs to attract and retain customers. Explore the various discounts available, such as multi-policy discounts, safety discounts, or loyalty discounts for long-term customers. By taking advantage of these programs, you may be able to reduce your insurance costs significantly.

How often should I review my home insurance policy?

+It's recommended to review your home insurance policy annually to ensure it aligns with your current needs and circumstances. Life changes and renovations may require adjustments to your coverage limits.

Can I get home insurance if I have a poor credit score?

+While a poor credit score may impact your insurance premiums, it doesn't necessarily mean you can't get home insurance. Insurance providers consider multiple factors, and some may offer specialized policies for individuals with lower credit scores.

What is the average cost of home insurance in the United States?

+The average cost of home insurance in the United States varies depending on factors such as location, home size, and coverage limits. On average, homeowners can expect to pay between $1,000 and $2,000 annually for home insurance.

Understanding the factors that influence home insurance costs is crucial for making informed decisions about your financial protection. By considering your location, home size, coverage limits, and personal factors, you can obtain accurate quotes and manage your insurance costs effectively. Remember to regularly review your policy, explore discounts, and maintain a good credit score to ensure you have adequate coverage at a reasonable price.