Cgl Insurance Coverage

CGL insurance, or Commercial General Liability insurance, is a vital component of any business's risk management strategy. It provides comprehensive protection against a wide range of liability claims that a business may face in its day-to-day operations. With an ever-changing legal landscape and an increasing awareness of potential risks, understanding CGL insurance and its coverage is essential for business owners and stakeholders.

Understanding CGL Insurance Coverage

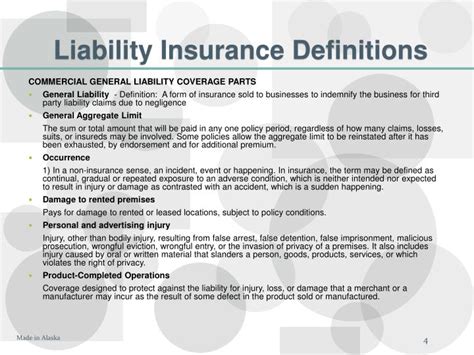

CGL insurance is designed to protect businesses from third-party liability claims, which can arise from various incidents or circumstances. These claims often involve bodily injury, property damage, personal injury, or advertising-related issues. The coverage offered by CGL insurance is extensive and can be tailored to meet the unique needs of different industries and businesses.

One of the key aspects of CGL insurance is its broad coverage. It typically includes protection for bodily injury, such as medical expenses and pain and suffering, resulting from accidents on the business premises or due to the business's operations. Property damage coverage extends to damage caused by the business to others' property, including buildings, structures, and personal belongings.

Personal injury claims, which encompass libel, slander, defamation, and invasion of privacy, are also covered by CGL insurance. This coverage is particularly crucial for businesses that engage in advertising or marketing activities, as it safeguards them against potential legal repercussions.

Additionally, CGL insurance provides defense costs coverage. This means that if a business is sued, the insurance policy will cover the legal fees and expenses incurred during the defense process, regardless of the outcome of the lawsuit. This aspect of CGL insurance is especially beneficial, as legal battles can be costly and time-consuming.

Key Coverage Areas

CGL insurance offers protection in several critical areas, ensuring businesses are prepared for a wide array of potential risks. Here are some of the key coverage areas:

- Premises Liability: This coverage applies to accidents or injuries that occur on the business's premises, whether it's a slip and fall incident or an injury caused by a defective product.

- Products and Completed Operations Liability: CGL insurance protects businesses from claims arising from their products or completed work. If a product causes harm or a project results in property damage, this coverage comes into play.

- Advertising and Personal Injury Liability: With the rise of online businesses and digital marketing, this coverage is increasingly important. It safeguards businesses from claims related to copyright infringement, defamation, or false advertising.

- Medical Payments Coverage: In certain situations, CGL insurance may provide medical payments coverage, which can help cover the medical expenses of individuals injured on the business premises, regardless of fault.

- Damage to Rented Premises: For businesses that rent or lease spaces, this coverage can be a lifesaver. It protects against claims for damage to the rented premises, ensuring the business is not held solely responsible.

It's important to note that while CGL insurance provides broad coverage, there are certain exclusions and limitations. For instance, professional liability or errors and omissions are typically not covered by CGL insurance and require separate policies. Additionally, pollution-related incidents and certain intentional acts may also be excluded.

Benefits and Real-World Examples

The benefits of CGL insurance are multifaceted and can be a literal lifesaver for businesses facing unforeseen circumstances. Let’s explore some real-world examples of how CGL insurance has come to the rescue:

Slip and Fall Incidents

Imagine a customer slipping on a freshly mopped floor at a retail store. The customer sustains injuries and sues the store for negligence. In this scenario, CGL insurance steps in to cover the medical expenses, legal fees, and potential compensation owed to the injured party. Without CGL insurance, the store could face significant financial burdens.

Product Liability Claims

A manufacturing company produces toys with a potential defect that could cause harm to children. Despite their best efforts, a child is injured while playing with the toy. The parents file a lawsuit, claiming product liability. CGL insurance protects the manufacturing company by covering the legal defense and any compensation awarded to the injured child.

Advertising-Related Issues

A marketing agency creates an ad campaign for a client, but the ad is accused of plagiarizing another company’s work. The aggrieved company files a lawsuit, alleging copyright infringement. The marketing agency’s CGL insurance policy covers the legal costs and any settlement or judgment resulting from the lawsuit.

Property Damage Claims

A contractor is hired to renovate a building. During the renovation, an accident occurs, causing significant damage to the building’s roof. The building owner files a claim against the contractor. CGL insurance protects the contractor, covering the costs of repairing the roof and any legal fees associated with the claim.

These real-world examples highlight the critical role CGL insurance plays in mitigating financial risks and providing businesses with the peace of mind to focus on their core operations.

CGL Insurance and Risk Management

CGL insurance is an integral part of a comprehensive risk management strategy. By understanding the potential risks and liabilities associated with their business, owners can tailor their CGL insurance coverage to meet their specific needs. Here are some key considerations when it comes to CGL insurance and risk management:

Assessing Risk

Every business operates in a unique environment with its own set of risks. Conducting a thorough risk assessment is crucial. This involves identifying potential hazards, evaluating the likelihood of incidents, and estimating the potential financial impact. By understanding these risks, businesses can make informed decisions about their CGL insurance coverage.

Policy Customization

CGL insurance policies are not one-size-fits-all. Businesses should work closely with insurance providers to customize their policies based on their specific needs. This may involve adjusting coverage limits, adding endorsements or riders to address unique risks, or even considering specialized insurance policies to supplement CGL coverage.

Loss Prevention and Control Measures

CGL insurance is designed to provide financial protection, but it’s equally important to implement loss prevention and control measures to reduce the likelihood of incidents. This can include safety training for employees, regular maintenance of equipment and premises, and implementing best practices to minimize the risk of accidents, injuries, and property damage.

Regular Policy Review

The business landscape is dynamic, and so are the risks associated with it. It’s essential to regularly review and update CGL insurance policies to ensure they remain aligned with the business’s evolving needs. This may involve adjusting coverage limits, adding new coverage options, or addressing changes in regulations or industry standards.

Collaborating with Insurance Professionals

Navigating the world of insurance can be complex. Collaborating with experienced insurance brokers or agents can provide valuable insights and guidance. These professionals can help businesses understand the intricacies of CGL insurance, identify potential gaps in coverage, and ensure that the business is adequately protected.

Future Trends and Considerations

As the business landscape continues to evolve, so too do the risks and challenges faced by organizations. Here are some future trends and considerations that businesses should keep in mind when it comes to CGL insurance:

Emerging Risks

With the rapid advancement of technology and the increasing reliance on digital platforms, new risks are emerging. Cyberattacks, data breaches, and privacy concerns are becoming more prevalent. While CGL insurance may provide some coverage for these risks, businesses should consider specialized cyber insurance policies to address these emerging threats comprehensively.

Changing Regulatory Landscape

Regulatory changes can have a significant impact on businesses and their insurance needs. Keeping up with evolving regulations, especially in industries with strict compliance requirements, is crucial. Businesses should regularly review their CGL insurance policies to ensure they align with any new legal obligations or industry standards.

Sustainability and Environmental Considerations

As sustainability and environmental responsibility become increasingly important, businesses are facing new challenges. Environmental liability, including pollution-related incidents, is a growing concern. While CGL insurance may exclude certain pollution-related claims, businesses should explore options for environmental liability insurance to address these specific risks.

Changing Consumer Behavior

Consumer expectations and behavior are constantly evolving. With the rise of social media and online reviews, businesses must be vigilant about their public image and reputation. CGL insurance can provide coverage for certain reputation-related incidents, but businesses should also focus on proactive reputation management strategies.

Collaboration and Risk Sharing

In an increasingly interconnected business world, collaboration and risk sharing are becoming more common. Whether it’s through joint ventures, partnerships, or supply chain relationships, businesses should consider how their CGL insurance coverage aligns with these collaborations. Working closely with insurance providers can help ensure that all parties involved are adequately protected.

What is the difference between CGL insurance and other liability insurance policies?

+CGL insurance, or Commercial General Liability insurance, provides broad coverage for third-party liability claims, including bodily injury, property damage, personal injury, and advertising-related issues. It is designed to protect businesses from a wide range of potential risks. Other liability insurance policies, such as professional liability or errors and omissions insurance, focus on specific risks associated with professional services and may not cover the same breadth of incidents as CGL insurance.

Are there any exclusions or limitations to CGL insurance coverage?

+Yes, CGL insurance typically has certain exclusions and limitations. These may include professional liability claims, pollution-related incidents, and intentional acts. It’s important to review the policy documents carefully to understand the specific exclusions and limitations applicable to your CGL insurance policy.

How can businesses customize their CGL insurance coverage?

+Businesses can customize their CGL insurance coverage by working closely with insurance providers. This may involve adjusting coverage limits, adding endorsements or riders to address unique risks, or even considering specialized insurance policies to supplement CGL coverage. By understanding their specific risks and collaborating with insurance professionals, businesses can tailor their CGL insurance to meet their unique needs.