Insurance Quote Home

Home insurance is an essential aspect of protecting one's financial interests and safeguarding the roof over your head. It provides coverage for a wide range of potential risks and offers peace of mind to homeowners. When it comes to obtaining an insurance quote for your home, there are several key factors to consider, and the process can vary depending on your specific needs and the insurance provider. In this comprehensive guide, we will delve into the world of home insurance, exploring the critical aspects that influence your quote, the steps to obtain an accurate estimate, and the various coverage options available to tailor your policy to your unique circumstances.

Understanding the Factors That Impact Your Home Insurance Quote

Numerous elements contribute to the calculation of your home insurance quote. These factors can significantly influence the overall cost of your policy and are assessed by insurance companies to determine the level of risk associated with insuring your home. Here are some of the primary considerations that impact your quote:

Location and Geographical Factors

The geographical location of your home plays a pivotal role in determining your insurance quote. Different regions face varying levels of risk, such as natural disasters, crime rates, and proximity to emergency services. For instance, areas prone to hurricanes, floods, or earthquakes will typically have higher insurance premiums. Additionally, the local crime rate and the availability of emergency response teams can also impact your quote.

| Region | Risk Factors | Impact on Quote |

|---|---|---|

| Hurricane-prone coastal areas | High risk of wind damage and flooding | Increased premiums |

| Mountainous regions | Potential for wildfires and landslides | Elevated rates |

| Urban centers | Higher crime rates and risk of vandalism | Slightly higher premiums |

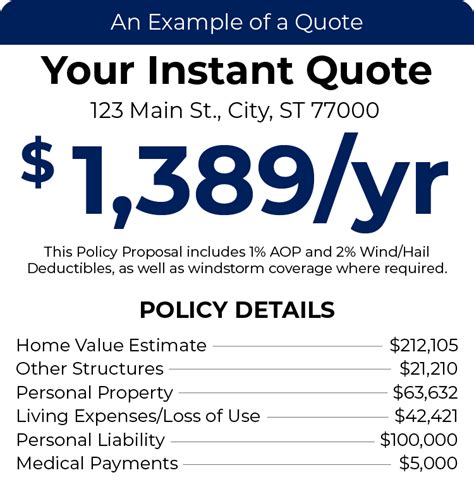

Home Value and Replacement Cost

The value of your home and its replacement cost are crucial considerations when determining your insurance quote. Insurance companies will assess the cost of rebuilding your home to its pre-loss condition, taking into account factors such as the size, construction materials, and any unique features. A higher home value or a more expensive replacement cost will generally result in a higher insurance premium.

Coverage Limits and Deductibles

The coverage limits you choose for your home insurance policy will directly affect your quote. Higher coverage limits provide more extensive protection but will also result in a higher premium. Additionally, the deductible you select, which is the amount you agree to pay out of pocket before your insurance coverage kicks in, can significantly impact your quote. A higher deductible typically leads to a lower premium, as you are assuming more financial responsibility in the event of a claim.

Age and Condition of the Home

The age and condition of your home are important factors in assessing the risk associated with insuring it. Older homes may require more frequent maintenance and repairs, which can increase the likelihood of claims. Additionally, older homes may not adhere to modern building codes, potentially affecting their structural integrity and increasing the risk of damage. Insurance companies often offer discounts for newer homes or those that have undergone recent renovations to improve their safety features.

Claim History and Credit Score

Your insurance claim history and credit score can impact your home insurance quote. A history of frequent claims may indicate a higher risk to the insurance company, leading to increased premiums. Similarly, a poor credit score can also result in a higher quote, as it may be seen as an indicator of financial instability and a potential increased risk of filing claims.

Steps to Obtain an Accurate Home Insurance Quote

To ensure you receive an accurate and competitive home insurance quote, it’s essential to follow a structured process. Here are the key steps to guide you through the quote-obtaining journey:

Assess Your Coverage Needs

Before seeking a quote, take the time to evaluate your specific coverage needs. Consider the replacement cost of your home, the value of your personal belongings, and any additional coverage requirements such as liability protection or coverage for high-value items. Understanding your needs will help you tailor your insurance policy accordingly and ensure you’re not overpaying for unnecessary coverage.

Gather Relevant Information

Compile all the necessary information to provide an accurate quote. This includes details about your home, such as its age, size, construction materials, and any recent renovations. Additionally, have your current insurance policy (if you have one) handy to compare coverage and premiums. If you’re unsure about any specific details, consult with a professional to ensure you have all the required information.

Compare Multiple Quotes

Obtain quotes from several insurance providers to compare coverage and premiums. While it’s important to consider the cost of the policy, don’t solely base your decision on price. Evaluate the coverage limits, deductibles, and any additional benefits or discounts offered by each provider. A comprehensive comparison will help you identify the best value for your money and ensure you’re adequately protected.

Consider Bundling Options

Many insurance companies offer discounts when you bundle multiple policies together, such as home and auto insurance. Bundling can result in significant savings, so it’s worth exploring this option if you’re in the market for other types of insurance coverage. Discuss bundling opportunities with your insurance provider to determine if it’s a suitable choice for your financial situation.

Review and Understand the Policy

Once you’ve obtained quotes and selected a provider, carefully review the policy documentation. Ensure you understand the coverage limits, deductibles, and any exclusions or limitations. Don’t hesitate to reach out to your insurance agent or provider with any questions or concerns. A clear understanding of your policy will help you make informed decisions and ensure you’re adequately protected in the event of a claim.

Exploring Home Insurance Coverage Options

Home insurance policies offer a range of coverage options to cater to different needs and circumstances. Understanding these options is crucial to selecting the right policy for your home. Here’s an overview of some common coverage types and their benefits:

Dwelling Coverage

Dwelling coverage is the foundation of your home insurance policy, providing protection for the physical structure of your home. It covers the cost of repairing or rebuilding your home in the event of damage caused by covered perils, such as fire, windstorms, hail, or vandalism. This coverage ensures that you can restore your home to its pre-loss condition without incurring significant financial burden.

Personal Property Coverage

Personal property coverage protects the contents of your home, including furniture, electronics, clothing, and other personal belongings. In the event of a covered loss, this coverage will reimburse you for the cost of replacing or repairing your belongings up to the policy limits. It’s essential to assess the value of your personal property to ensure you have adequate coverage to protect your investments.

Liability Coverage

Liability coverage provides protection against claims and lawsuits arising from accidents or injuries that occur on your property. It covers legal expenses, medical payments, and potential settlements or judgments. This coverage is crucial to safeguard your financial well-being in the event of an unforeseen incident that results in bodily injury or property damage to others.

Additional Living Expenses Coverage

Additional living expenses coverage kicks in when your home becomes uninhabitable due to a covered loss, such as a fire or severe storm damage. This coverage reimburses you for the additional costs incurred while you’re temporarily displaced, including hotel stays, meals, and other necessary expenses until you can return to your home.

Optional Coverage Endorsements

Insurance providers often offer optional coverage endorsements to enhance your policy and provide protection for specific scenarios. These endorsements may include coverage for high-value items like jewelry or fine art, coverage for natural disasters such as earthquakes or floods (which are typically excluded from standard policies), or coverage for unique circumstances like identity theft protection. Discuss these options with your insurance agent to determine if any are relevant to your situation.

The Future of Home Insurance: Technological Advancements and Trends

The home insurance industry is evolving, and technological advancements are shaping the way policies are underwritten and claims are processed. Here are some emerging trends and technologies that are transforming the home insurance landscape:

Telematics and Smart Home Technology

The integration of telematics and smart home technology is revolutionizing home insurance. Telematics devices can monitor and analyze data related to your home’s energy usage, security systems, and water usage patterns. This data can be used to assess risk more accurately and offer personalized insurance rates based on your specific home’s characteristics and usage patterns. Additionally, smart home technology can enhance security and provide early detection of potential hazards, reducing the risk of claims.

Data Analytics and Artificial Intelligence

Insurance companies are leveraging data analytics and artificial intelligence (AI) to improve their underwriting processes and claim management. By analyzing vast amounts of data, insurers can identify patterns, assess risk more efficiently, and offer more precise pricing. AI-powered chatbots and virtual assistants are also being utilized to enhance customer service, providing quick and accurate responses to policyholder inquiries.

Risk Mitigation and Prevention

Insurance companies are increasingly focusing on risk mitigation and prevention to reduce the frequency and severity of claims. This includes offering incentives and discounts for homeowners who implement safety measures, such as installing smoke detectors, upgrading to fire-resistant roofing materials, or implementing smart home security systems. By encouraging proactive risk management, insurers can lower their exposure to claims and offer more competitive premiums to policyholders.

Pay-As-You-Go and Usage-Based Insurance

Pay-as-you-go and usage-based insurance models are gaining traction in the home insurance industry. These innovative approaches allow homeowners to pay for insurance based on their actual usage or the level of risk they present. For instance, usage-based insurance may consider factors like the number of occupants in the home, the frequency of home maintenance, or the use of specific safety features. By offering flexible pricing models, insurers can attract a wider range of customers and provide more tailored coverage options.

Climate Change and Catastrophe Modeling

As climate change continues to impact weather patterns and increase the frequency and severity of natural disasters, insurance companies are investing in catastrophe modeling to better understand and manage these risks. Advanced modeling techniques help insurers assess the potential impact of natural disasters on specific regions and adjust their pricing and coverage accordingly. This enables them to provide more accurate quotes and offer comprehensive protection to homeowners in high-risk areas.

Conclusion: Navigating the Home Insurance Landscape

Obtaining a home insurance quote involves considering various factors that influence the cost and coverage of your policy. By understanding the key elements that impact your quote, following a structured process to obtain accurate estimates, and exploring the diverse coverage options available, you can make informed decisions and secure the right protection for your home. Additionally, staying abreast of the latest technological advancements and industry trends will help you navigate the evolving home insurance landscape and ensure you’re adequately prepared for the future.

What is the average cost of home insurance?

+

The average cost of home insurance varies widely depending on factors such as location, home value, coverage limits, and claim history. According to industry data, the national average premium for homeowners insurance in the United States is approximately $1,300 per year. However, it’s important to note that rates can range from a few hundred dollars to several thousand dollars annually, so obtaining multiple quotes is essential to find the most competitive rates for your specific circumstances.

How often should I review and update my home insurance policy?

+

It’s recommended to review your home insurance policy annually, or whenever significant changes occur in your home or personal circumstances. Regular reviews ensure that your coverage remains up-to-date and adequate to meet your changing needs. For instance, if you’ve made renovations, added high-value items, or experienced a change in your financial situation, it’s crucial to reassess your policy to ensure you’re appropriately protected.

Can I save money on my home insurance by increasing my deductible?

+

Yes, increasing your deductible can result in significant savings on your home insurance premium. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it also lowers the risk to the insurance company, leading to reduced premiums. However, it’s important to choose a deductible amount that you’re comfortable paying, as it should be a realistic amount that you can afford in the event of a covered loss.