How To Know If I Have Health Insurance

Health insurance is an essential aspect of modern healthcare systems, providing individuals with access to medical services and financial protection. With various types of health insurance plans available, understanding your coverage and rights is crucial. This comprehensive guide aims to help you navigate the process of determining if you have health insurance and utilizing it effectively.

Understanding Health Insurance Basics

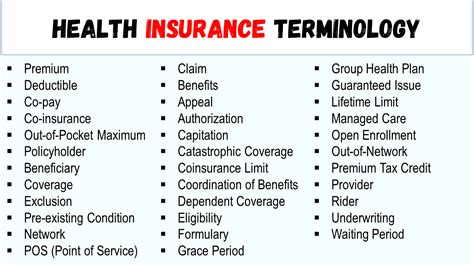

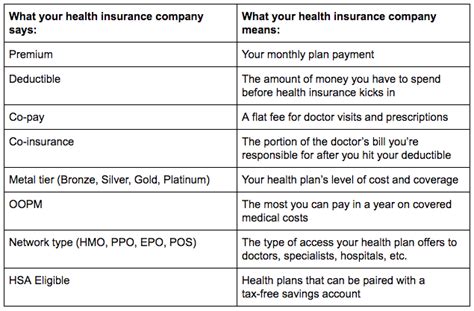

Health insurance is a contract between an individual (the policyholder) and an insurance company, where the insurer agrees to cover a portion or all of the policyholder’s medical expenses in exchange for regular premium payments. These policies can vary widely, offering different levels of coverage, deductibles, and out-of-pocket costs. Here’s an overview of the key components to help you grasp the basics:

- Premiums: Regular payments made to the insurance company to maintain coverage.

- Deductibles: The amount you must pay out of pocket before your insurance coverage begins.

- Copayments (Copays): Fixed amounts you pay for specific services, like doctor visits or prescription drugs.

- Coinsurance: The percentage of medical costs you pay after meeting your deductible.

- Out-of-Pocket Maximum: The most you'll pay for covered services in a year.

- Network Providers: Doctors, hospitals, and other healthcare professionals contracted with your insurance company.

- Coverage Limits: Maximum amounts your insurance will pay for specific services or treatments.

- Pre-existing Conditions: Health issues you had before obtaining insurance, which may affect your coverage.

Determining Your Health Insurance Status

Knowing if you have health insurance and understanding its specifics is a multi-step process. Here’s a comprehensive guide to help you navigate this journey:

Step 1: Check for Existing Policies

Start by searching for any physical or digital records of health insurance policies. Look through your documents, email inboxes, or online accounts associated with insurance providers. If you recently obtained insurance, you may have received a welcome kit or policy summary outlining your coverage details.

Step 2: Contact Your Employer

If you’re employed, your workplace may offer health insurance benefits. Contact your Human Resources (HR) department or benefits administrator to inquire about your coverage. They should provide you with details about your plan, including summary plan descriptions and eligibility requirements.

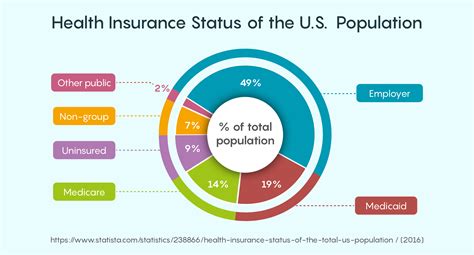

Step 3: Government-Sponsored Programs

Various government-sponsored health insurance programs are available, especially for those who meet specific income or demographic criteria. Examples include Medicaid, Medicare, and the Children’s Health Insurance Program (CHIP). Visit your state’s health insurance website or contact your local health department to explore these options.

Step 4: Marketplace Plans

If you don’t have employer-sponsored insurance or qualify for government programs, you can purchase health insurance through the Health Insurance Marketplace. Visit the official website for your country or region to browse plans and enroll during open enrollment periods. Remember that some plans may have waiting periods before coverage begins.

Step 5: Individual Policies

You can also purchase health insurance directly from insurance companies. Contact insurance providers or use online comparison tools to research and compare individual plans. Consider factors like premiums, deductibles, and coverage limits to find a plan that suits your needs and budget.

Verifying Your Coverage

Once you’ve identified a potential health insurance plan, it’s essential to verify your coverage and understand its specifics. Here are some key steps to take:

Review Your Policy Documents

Obtain and carefully read through your policy documents. These should include a summary of benefits and coverage, explaining what’s covered, any exclusions or limitations, and how to use your insurance. Pay attention to details like deductibles, copays, and network providers.

Contact Your Insurance Provider

If you have questions or need clarification, reach out to your insurance company’s customer service team. They can provide personalized assistance, answer questions about your coverage, and guide you through any necessary steps to utilize your insurance effectively.

Use Online Tools

Many insurance providers offer online portals or mobile apps where you can manage your policy, view benefits, and access digital copies of your insurance card. These tools can also help you find in-network providers and estimate costs for specific services.

Seek Professional Advice

If you’re still unsure about your coverage or have complex healthcare needs, consider consulting a healthcare advocate or financial advisor. These professionals can help you navigate the complexities of health insurance and ensure you’re making informed decisions about your healthcare.

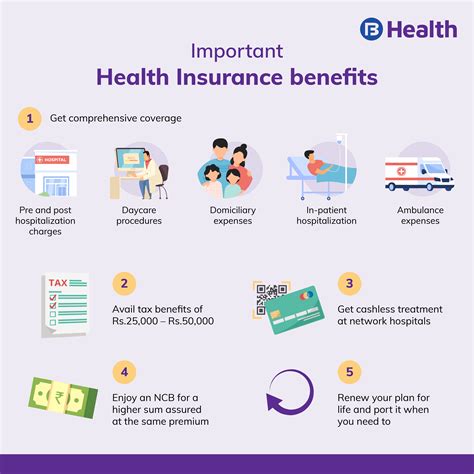

Utilizing Your Health Insurance

Once you’ve confirmed your health insurance coverage, it’s essential to understand how to use it effectively. Here are some key tips to navigate the healthcare system with your insurance:

Choose In-Network Providers

Using in-network providers is generally more cost-effective, as they have negotiated rates with your insurance company. Check your insurance directory or online tools to find doctors, hospitals, and other healthcare professionals within your network.

Understand Referral and Prior Authorization Requirements

Some insurance plans require referrals from your primary care physician to see specialists or receive certain treatments. Additionally, prior authorization may be necessary for specific services or medications. Familiarize yourself with these requirements to avoid unexpected costs or denials.

Review Explanation of Benefits (EOBs)

After receiving medical services, your insurance company will send you an EOB, detailing what was billed, what was covered, and any remaining costs. Review these carefully to ensure accuracy and identify any discrepancies. If you have questions, contact your insurance provider or healthcare provider.

Manage Your Costs

Health insurance can help manage healthcare costs, but it’s important to be mindful of expenses. Track your deductibles, copays, and out-of-pocket maximums to stay within your budget. Consider using health savings accounts (HSAs) or flexible spending accounts (FSAs) to save on taxes and cover healthcare expenses.

Stay Informed

Health insurance policies and healthcare regulations can change, so stay updated on any modifications to your coverage. Regularly review your policy documents, attend employer-sponsored benefits workshops, and subscribe to relevant newsletters or alerts to stay informed.

Common Challenges and Solutions

Navigating health insurance can come with its fair share of challenges. Here are some common issues and strategies to overcome them:

Denials and Appeals

If a claim is denied, don’t panic. Insurance companies can make mistakes or misinterpret policies. Contact your insurance provider to understand the reason for the denial and explore your appeal options. Gather supporting documentation and seek guidance from healthcare advocates or legal professionals if needed.

High Costs

Health insurance can sometimes come with high premiums, deductibles, or out-of-pocket costs. To manage these expenses, consider negotiating with healthcare providers for discounts, especially for cash payments. Additionally, explore options like high-deductible health plans (HDHPs) paired with HSAs, which offer tax advantages and can help cover expenses.

Finding the Right Provider

Locating in-network providers that meet your specific healthcare needs can be challenging. Utilize online tools and insurance directories to search for providers by specialty, location, and insurance acceptance. Read reviews and consider seeking recommendations from friends or healthcare professionals to find the right fit.

Future Implications and Tips

Health insurance is an evolving landscape, and staying informed is crucial. Here are some insights and tips for the future:

- Stay updated on healthcare reforms and policy changes that may impact your coverage.

- Review and compare health insurance plans annually during open enrollment periods to ensure you have the best coverage for your needs.

- Consider short-term health insurance plans if you're between jobs or need temporary coverage.

- If you're self-employed, explore small business health insurance options or consider forming a limited liability company (LLC) to access group health insurance rates.

- Stay organized by keeping all your health insurance documents, receipts, and EOBs in one place for easy reference.

Remember, health insurance is a powerful tool to protect your financial and physical well-being. By understanding your coverage, asking questions, and staying informed, you can navigate the healthcare system with confidence and make the most of your health insurance benefits.

What should I do if I lose my health insurance card?

+If you misplace your health insurance card, contact your insurance provider immediately. They can provide you with a replacement card or offer other options for verification, such as a digital copy or a temporary reference number.

How do I know if a healthcare provider is in my insurance network?

+You can verify if a healthcare provider is in your insurance network by checking your insurance company’s website or mobile app. Most insurance providers offer search tools where you can look up providers by name, specialty, or location. Additionally, you can contact your insurance company’s customer service team for assistance.

What happens if I need emergency medical care outside my network?

+In emergency situations, you can seek treatment at any hospital or facility, regardless of whether they are in your insurance network. However, it’s important to notify your insurance company as soon as possible to ensure that any necessary approvals or authorizations are obtained. After receiving emergency care, contact your insurance provider to understand your coverage and potential out-of-pocket costs.