Home Insurance Car

Protecting your home and its contents is crucial, and when it comes to insuring your home and your car, it's essential to understand the coverage options available and how they can benefit you. Home insurance and car insurance are two vital aspects of financial protection, and in this comprehensive guide, we will delve into the world of home insurance, focusing specifically on the unique coverage provided for cars.

Understanding Home Insurance and its Comprehensive Approach

Home insurance policies are designed to offer a wide range of protections to homeowners and renters alike. These policies typically include coverage for the structure of the home, its contents, and personal liability. However, one of the often-overlooked benefits of home insurance is the comprehensive coverage it can provide for vehicles.

While car insurance is a separate policy, many home insurance providers offer packages that include auto insurance, providing a convenient and cost-effective solution for policyholders. This integrated approach to insurance coverage offers several advantages, particularly for those who own both a home and a car.

The Benefits of Bundling Home and Car Insurance

By bundling your home and car insurance policies, you can enjoy a range of benefits that enhance your overall insurance experience. Here are some key advantages:

- Discounts and Savings: Insurers often provide discounts when you bundle multiple policies. This means you can save money on your overall insurance premiums, making it a cost-effective choice.

- Convenience and Simplicity: Managing just one insurance provider and policy for both your home and car simplifies the insurance process. It streamlines billing, claims, and policy management, making it easier to keep track of your coverage.

- Comprehensive Coverage: Home insurance policies that include car coverage often offer a more comprehensive level of protection. This can include unique benefits such as coverage for damage caused by natural disasters, theft, or accidents involving your vehicle on your property.

- Customized Solutions: Bundling allows you to tailor your insurance to your specific needs. You can choose the coverage limits and deductibles that best suit your financial situation and the value of your assets.

How Home Insurance Provides Car Coverage

Home insurance policies that include car coverage typically provide a range of protections tailored to the unique needs of vehicle owners. Here’s a breakdown of the key coverages:

Comprehensive Car Coverage

This coverage provides protection for a wide range of incidents that are not typically covered by standard car insurance. It can include:

- Natural Disasters: Damage caused by events such as hurricanes, tornadoes, earthquakes, or floods.

- Theft and Vandalism: Coverage for theft of your vehicle or its parts, as well as damage caused by vandalism.

- Collision with Animals: Protection if your vehicle collides with an animal, such as a deer.

- Falling Objects: Damage caused by falling objects, such as tree branches.

- Fire and Explosions: Coverage for damage resulting from fire, including vehicle fires.

Liability Protection

Home insurance policies often include liability coverage for car-related incidents. This can provide protection if you are found legally responsible for causing damage to someone else’s property or bodily injury in an accident.

| Liability Coverage | Description |

|---|---|

| Property Damage Liability | Covers the cost of repairing or replacing another person's property that you damage in an accident. |

| Bodily Injury Liability | Provides compensation for medical expenses and lost wages of individuals injured in an accident for which you are at fault. |

Personal Property Coverage

Home insurance policies may also cover personal property, including items in your car. This can include coverage for:

- Electronic devices like laptops or phones left in your vehicle.

- Sports equipment or musical instruments stored in your car.

- Clothing and other personal items.

Emergency Roadside Assistance

Some home insurance policies offer emergency roadside assistance as an added benefit. This can include services like:

- Towing services in case of a breakdown.

- Flat tire changes.

- Jump-starting a dead battery.

- Fuel delivery if you run out of gas.

Choosing the Right Coverage for Your Needs

When selecting home insurance with car coverage, it’s essential to assess your specific needs and choose a policy that provides adequate protection. Consider the following factors:

Vehicle Value and Age

The value and age of your vehicle can influence the type and level of coverage you require. For newer, more valuable cars, comprehensive coverage is crucial to protect against a wide range of risks. On the other hand, older vehicles may require more targeted coverage to ensure you’re not overinsured.

Location and Risk Factors

Your geographical location and the associated risk factors can impact the type of coverage you need. If you live in an area prone to natural disasters or have a high risk of theft, comprehensive coverage becomes even more vital.

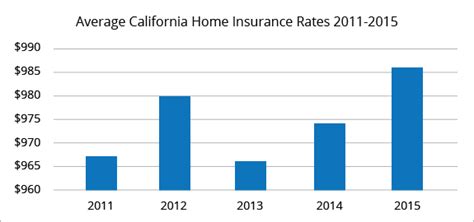

Deductibles and Premiums

Evaluate the deductibles and premiums associated with different coverage options. Choosing a higher deductible can lower your premiums, but it’s essential to select a deductible amount that you’re comfortable paying out of pocket in the event of a claim.

Customizing Your Policy

Many insurance providers allow you to customize your policy to fit your specific needs. You can opt for additional coverages, such as rental car coverage or enhanced liability protection, to ensure you have the right level of protection.

The Impact of Home Insurance on Car Ownership

Having comprehensive home insurance that includes car coverage can significantly impact your experience as a car owner. It provides peace of mind, knowing that your vehicle is protected against a wide range of risks, and it can also simplify the insurance process, making it more convenient and cost-effective.

Reduced Risk and Increased Peace of Mind

With comprehensive car coverage as part of your home insurance, you can rest assured that your vehicle is protected against various unforeseen events. Whether it’s damage from a natural disaster or a collision with an animal, you’ll have the financial support you need to repair or replace your car.

Streamlined Insurance Management

By bundling your home and car insurance, you’ll have a single point of contact for all your insurance needs. This simplifies the process of making claims, updating policies, and paying premiums. It also ensures that your coverage is consistent and tailored to your specific circumstances.

Potential Cost Savings

Bundling your insurance policies can lead to significant cost savings. Insurance providers often offer discounts when you combine multiple policies, and these savings can add up over time. Additionally, by having a single provider, you may be able to negotiate better rates or take advantage of loyalty programs.

Real-Life Examples and Case Studies

Let’s explore some real-life scenarios to illustrate the benefits of home insurance with car coverage:

Natural Disaster Coverage

Imagine you live in an area prone to hurricanes. Your home and car are both insured under a comprehensive policy. During a hurricane, your vehicle sustains significant damage from flying debris. With comprehensive car coverage, you can file a claim and have the repairs covered, ensuring your vehicle is back on the road quickly.

Theft and Vandalism Protection

Suppose you park your car on the street overnight, and unfortunately, it’s broken into and some personal items are stolen. With personal property coverage as part of your home insurance, you can receive compensation for the stolen items, helping to alleviate the financial burden of the loss.

Liability Protection in Action

In a worst-case scenario, if you cause an accident that results in property damage or bodily injury to others, your liability coverage can step in. It can provide the necessary funds to cover the costs associated with the accident, protecting your financial well-being.

Future Trends and Developments

The insurance industry is constantly evolving, and home insurance with car coverage is no exception. Here are some trends and developments to watch for in the future:

Increasing Focus on Personalized Coverage

Insurance providers are likely to continue offering more personalized coverage options. This means you’ll have the ability to choose the specific coverages you need, ensuring your policy is tailored to your unique circumstances and risks.

Technological Advancements

The use of technology in the insurance industry is on the rise. From digital claim processing to the use of telematics for auto insurance, technological advancements can enhance the efficiency and accuracy of insurance processes.

Sustainable and Eco-Friendly Options

With growing environmental awareness, insurance providers may start offering more sustainable and eco-friendly coverage options. This could include incentives for electric vehicles or coverage for green home improvements.

In Conclusion

Home insurance with car coverage is a powerful combination that offers comprehensive protection and peace of mind for vehicle owners. By understanding the benefits, customizing your policy to your needs, and staying informed about industry trends, you can ensure you have the right coverage to protect your home and car for years to come.

Can I add car insurance to my existing home insurance policy?

+Yes, many home insurance providers offer the option to add car insurance to an existing policy. This is often referred to as bundling and can provide significant savings and convenience.

What are the key benefits of bundling home and car insurance?

+Bundling home and car insurance offers discounts, convenience, and comprehensive coverage. You can save money on premiums, manage your policies with one provider, and enjoy unique benefits like natural disaster coverage for your vehicle.

How can I choose the right coverage limits for my car insurance?

+When choosing coverage limits, consider the value of your vehicle, your financial situation, and the risks you face. Higher limits provide more protection but also result in higher premiums. Assess your needs and choose limits that offer adequate coverage without overspending.

What should I do if I need to make a claim on my home insurance for car-related damage?

+If you need to make a claim for car-related damage under your home insurance policy, contact your insurance provider promptly. They will guide you through the claims process, which may involve providing documentation of the damage and any relevant reports.