Insurance Quotes Home And Auto

The world of insurance is vast and often complex, offering various coverage options to protect our homes and vehicles. Navigating the insurance landscape can be daunting, especially when seeking the best quotes for home and auto policies. This comprehensive guide aims to demystify the process, providing an expert's perspective on securing the most advantageous insurance quotes for your specific needs.

Understanding Insurance Quotes: Home and Auto

Insurance quotes serve as the cornerstone of your policy, offering an estimate of the premium you'll pay for the coverage you require. For homeowners and vehicle owners, understanding the factors influencing these quotes is crucial. Whether you're a first-time buyer or seeking a better deal, this section provides an in-depth look at the intricacies of home and auto insurance quotes.

Factors Influencing Home Insurance Quotes

Home insurance quotes are determined by a multitude of factors, each playing a role in the final premium. Here's an overview of the key considerations:

- Location: The geographical location of your home significantly impacts your insurance quote. Factors like crime rates, weather patterns, and proximity to natural disaster-prone areas can all influence the cost of your policy.

- Home Value and Size: The value and size of your home are major considerations. A larger home with higher-value contents will typically result in a higher insurance premium.

- Age of the Home: Older homes may require more maintenance and are susceptible to different risks, which can affect the insurance quote.

- Construction Materials: The materials used in your home's construction can impact its resilience to various risks. For instance, a home with brick or stone exterior may be more resistant to fire and wind damage, potentially lowering insurance costs.

- Safety Features: Presence of security systems, fire alarms, and other safety measures can reduce the risk of theft or damage, leading to lower insurance premiums.

- Previous Claims: Your insurance history is a key factor. Multiple claims in the past may result in higher premiums, as they indicate a higher risk to the insurer.

- Deductibles: Choosing a higher deductible can lower your insurance premium, as it reduces the financial burden on the insurer in the event of a claim.

- Coverage Options: The extent of your coverage, including additional riders for specific risks like flood or earthquake, will impact the overall quote.

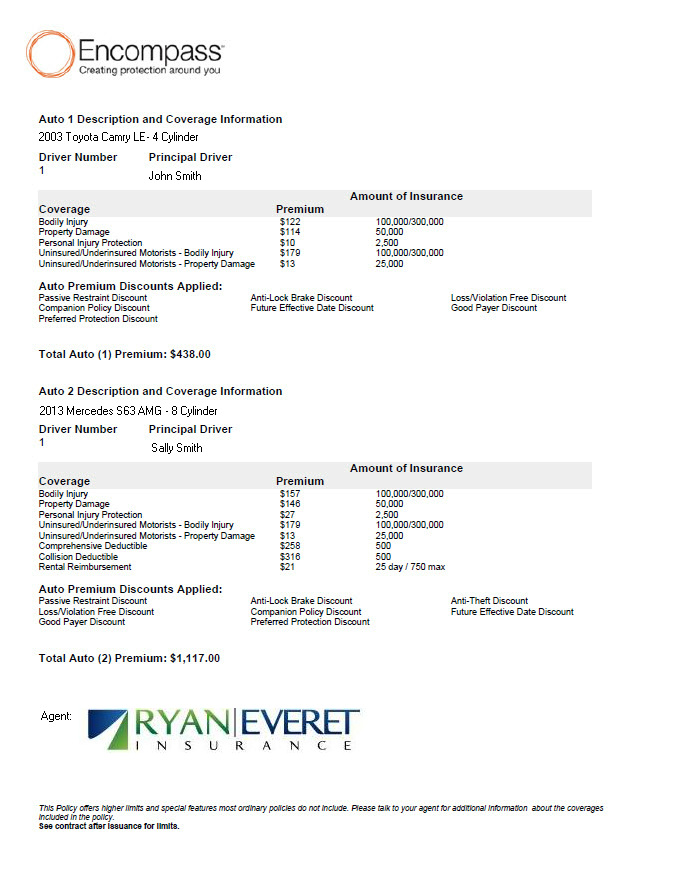

Auto Insurance Quotes: What to Consider

Auto insurance quotes are equally intricate, influenced by a range of factors specific to vehicle ownership. Here's a breakdown:

- Vehicle Type and Value: The make, model, and value of your vehicle play a significant role. More expensive vehicles generally attract higher insurance premiums.

- Driver Profile: Your age, gender, and driving record are crucial. Younger drivers, especially males, often face higher premiums due to their perceived higher risk.

- Location: Similar to home insurance, the location where your vehicle is garaged can impact your premium. Areas with higher crime rates or frequent accidents may result in higher insurance costs.

- Coverage Level: The level of coverage you choose, including liability, collision, and comprehensive coverage, will influence your quote. Higher coverage limits typically mean higher premiums.

- Usage and Mileage: The purpose of your vehicle and the number of miles driven annually can affect your insurance quote. Commercial use or high mileage may result in higher premiums.

- Safety Features: Vehicles equipped with advanced safety features like lane departure warnings or automatic braking systems may qualify for lower insurance rates.

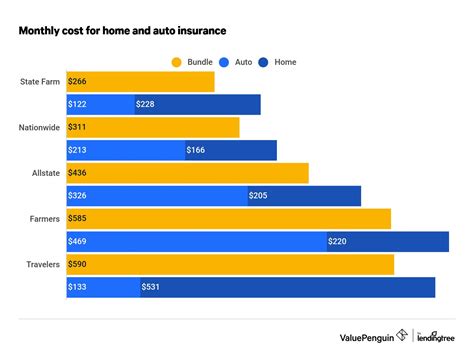

- Discounts: Taking advantage of discounts for safe driving, multiple policies, or bundling home and auto insurance can significantly reduce your premium.

- Previous Claims: Similar to home insurance, a history of frequent claims can lead to higher auto insurance premiums.

Obtaining Competitive Insurance Quotes

Securing competitive insurance quotes requires a strategic approach. Here are some expert tips to help you navigate the process effectively:

Comparing Quotes: A Step-by-Step Guide

Comparing insurance quotes is a crucial step to ensure you're getting the best deal. Follow these steps for an effective comparison:

- Identify Your Needs: Start by assessing your specific insurance needs. Determine the coverage limits, deductibles, and additional riders you require. This ensures you're comparing quotes for similar policies.

- Research Insurers: Familiarize yourself with a range of insurance providers. Check their financial stability, customer satisfaction ratings, and the breadth of their coverage options.

- Obtain Quotes: Request quotes from multiple insurers. Many providers offer online quote tools, making the process convenient. Ensure you provide consistent information for accurate comparisons.

- Review Coverage Details: Don't just compare premiums. Review the fine print to understand the coverage limits, exclusions, and any unique benefits or discounts offered by each insurer.

- Consider Long-Term Costs: While a lower premium may be appealing, consider the long-term costs. Some insurers may offer lower initial rates but increase premiums significantly over time.

- Ask About Discounts: Inquire about available discounts. Many insurers offer multi-policy discounts, safe driver discounts, or loyalty rewards that can significantly reduce your premium.

Tips for Negotiating Better Insurance Quotes

Negotiating your insurance quote can be a delicate process, but it's not uncommon. Here are some strategies to help you secure a better deal:

- Bundle Policies: Consider bundling your home and auto insurance policies with the same provider. Many insurers offer significant discounts for customers who choose this option.

- Increase Deductibles: Opting for higher deductibles can reduce your premium. However, ensure you can afford the higher deductible in the event of a claim.

- Review Coverage Levels: Evaluate your coverage needs annually. As your circumstances change, you may no longer require certain coverage limits, allowing you to reduce your premium.

- Take Advantage of Loyalty Rewards: If you've been with the same insurer for several years, inquire about loyalty discounts or rewards. Many insurers offer reduced rates to long-term customers.

- Improve Your Risk Profile: Taking steps to reduce your risk profile, such as installing security systems or completing defensive driving courses, can make you a more attractive customer to insurers, potentially leading to lower premiums.

Maximizing Your Insurance Coverage

While securing a competitive insurance quote is important, it's equally crucial to ensure you have adequate coverage. This section explores strategies to ensure your home and auto insurance policies provide the protection you need.

Ensuring Adequate Home Insurance Coverage

Adequate home insurance coverage is essential to protect your investment. Here's how to ensure your policy meets your needs:

- Assess Your Coverage Limits: Review your policy annually to ensure your coverage limits align with the current value of your home and its contents. This is especially important if you've made significant renovations or acquired valuable possessions.

- Consider Additional Riders: Depending on your location and specific risks, additional riders may be necessary. For instance, if you live in a flood-prone area, consider adding flood insurance to your policy.

- Review Exclusions: Understand what's excluded from your policy. Common exclusions include damage from earthquakes, floods, and pests. If these risks are relevant to your location, consider adding coverage for them.

- Keep Records and Receipts: Maintain a record of your possessions, including photos and receipts. This documentation can be invaluable in the event of a claim, helping to prove the value of your possessions.

- Regularly Update Your Policy: As your home and its contents change, your insurance policy should reflect these changes. Ensure you inform your insurer of any significant updates to avoid gaps in coverage.

Auto Insurance: Covering All Bases

Auto insurance is a legal requirement in most states, but it's important to ensure you have the right coverage to protect yourself financially. Here's a guide to maximizing your auto insurance coverage:

- Understand Your State's Minimum Requirements: Every state has different minimum coverage requirements. Ensure you meet these requirements at a minimum, but consider if you need additional coverage beyond the state-mandated limits.

- Consider Your Risk Profile: Assess your personal risk profile. If you frequently drive in high-risk areas or have a history of accidents, you may benefit from higher liability limits to protect your financial interests.

- Add Collision and Comprehensive Coverage: While these coverages typically come at an additional cost, they provide protection against a range of risks, including damage from accidents, theft, and natural disasters.

- Review Your Deductibles: Higher deductibles can reduce your premium, but ensure you can afford the deductible in the event of a claim. Consider your financial situation and choose a deductible that aligns with your comfort level.

- Consider Gap Insurance: If you're leasing or financing your vehicle, gap insurance can provide coverage for the difference between your vehicle's actual value and the amount you still owe on your lease or loan.

The Future of Insurance: Technological Advancements

The insurance industry is evolving rapidly, with technological advancements playing a pivotal role. Here's a glimpse into the future of insurance and how it may impact your insurance experience.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance (UBI) are transforming the auto insurance landscape. These technologies allow insurers to gather real-time data on driving behavior, offering personalized premiums based on actual usage.

- Telematics Devices: These devices, often installed in vehicles, track driving behavior, including speed, acceleration, and braking patterns. Insurers use this data to assess risk and offer personalized premiums.

- Usage-Based Insurance Programs: UBI programs reward safe driving with lower premiums. Participants typically receive a discount for enrolling and can further reduce their premium by maintaining safe driving habits.

- Benefits for Drivers: UBI can lead to significant savings for safe drivers. It also encourages safer driving habits, potentially reducing accidents and making roads safer for everyone.

Artificial Intelligence and Personalized Insurance

Artificial Intelligence (AI) is revolutionizing the insurance industry, offering personalized insurance products and services. AI-powered algorithms can analyze vast amounts of data to provide tailored insurance solutions.

- AI in Underwriting: AI algorithms can assess risk more accurately, allowing insurers to offer personalized premiums based on an individual's unique circumstances.

- Chatbots and Virtual Assistants: AI-powered chatbots and virtual assistants are enhancing customer service, providing instant support and answers to common insurance queries.

- Predictive Analytics: AI can predict future risks and trends, helping insurers develop more effective risk management strategies and offering customers more accurate coverage options.

The Impact of Blockchain Technology

Blockchain technology is poised to transform the insurance industry, offering enhanced security, transparency, and efficiency.

- Secure and Transparent Claims Process: Blockchain's distributed ledger technology can streamline the claims process, making it more secure and transparent. It allows for real-time tracking of claims, reducing fraud and improving customer satisfaction.

- Smart Contracts: Blockchain-based smart contracts can automate insurance processes, including policy issuance, premium payments, and claim settlements. This automation reduces administrative costs and enhances efficiency.

- Improved Data Management: Blockchain's immutable ledger can improve data management in the insurance industry. It ensures accurate and tamper-proof record-keeping, enhancing trust and security.

FAQs

What is the average cost of home insurance in the US?

+The average cost of home insurance in the US varies significantly depending on factors like location, home value, and coverage limits. According to recent data, the national average for annual home insurance premiums is approximately $1,300. However, premiums can range from a few hundred dollars to several thousand dollars, based on individual circumstances.

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review my insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's recommended to review your insurance policies annually or whenever there's a significant change in your life, such as a move to a new location, a home renovation, or a new vehicle purchase. Regular reviews ensure your coverage remains adequate and that you're taking advantage of any applicable discounts.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate my insurance premium?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, negotiating your insurance premium is possible. You can discuss your options with your insurer, explore discounts, and review your coverage limits to see if there's room for adjustment. Bundling multiple policies or increasing your deductibles are common ways to reduce your premium.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What factors determine my auto insurance premium?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Auto insurance premiums are influenced by various factors, including your driving record, the make and model of your vehicle, your age and gender, the location where your vehicle is garaged, and the level of coverage you choose. Insurers also consider your credit score and claims history.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I save money on my home insurance premium?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To save money on your home insurance premium, consider increasing your deductible, reviewing your coverage limits to ensure they align with your needs, and taking advantage of available discounts. Installing security systems or making your home more disaster-resistant can also lead to premium reductions.</p>

</div>

</div>

</div>

In conclusion, navigating the world of insurance quotes for your home and auto can be complex, but with the right knowledge and strategies, you can secure competitive rates and adequate coverage. By understanding the factors influencing your quotes, comparing policies effectively, and maximizing your coverage, you can protect your assets while keeping costs manageable. Additionally, keeping an eye on the latest technological advancements in the insurance industry can provide insights into future trends and potential savings opportunities.