Auto Insurance For Texas

Welcome to the comprehensive guide on auto insurance in Texas! This article aims to provide you with an in-depth analysis of the unique aspects of car insurance in the Lone Star State, covering everything from the specific laws and regulations to the unique coverage options and potential savings. Whether you're a seasoned driver or new to the roads of Texas, understanding the intricacies of auto insurance is crucial to making informed decisions and ensuring you have the right coverage for your needs.

Understanding Texas Auto Insurance Requirements

Texas has specific laws and regulations surrounding auto insurance to ensure drivers are adequately protected and financially responsible in the event of an accident. These requirements are designed to safeguard both the insured driver and other parties involved. Let’s delve into the essential aspects of Texas auto insurance regulations.

Minimum Liability Coverage

In Texas, drivers are legally required to carry liability insurance as their primary coverage. This type of insurance protects you financially if you’re found at fault in an accident. The minimum liability limits in Texas are as follows:

- Bodily Injury Liability: 30,000 per person / 60,000 per accident

- Property Damage Liability: $25,000 per accident

While these are the minimum limits mandated by law, it’s essential to consider your individual needs and financial situation. In some cases, increasing your liability limits can provide additional protection and peace of mind.

Proof of Insurance

Texas takes insurance verification seriously. When you register your vehicle or renew your registration, you must provide proof of insurance. This proof can be in the form of an insurance card or a valid insurance policy document. Failing to maintain continuous insurance coverage can result in legal penalties, including fines and the suspension of your vehicle registration.

Financial Responsibility Law

The Financial Responsibility Law in Texas requires drivers to demonstrate their ability to pay for damages caused in an accident. This can be achieved through various means, including maintaining the minimum liability insurance coverage or providing a cash deposit to the Texas Department of Transportation.

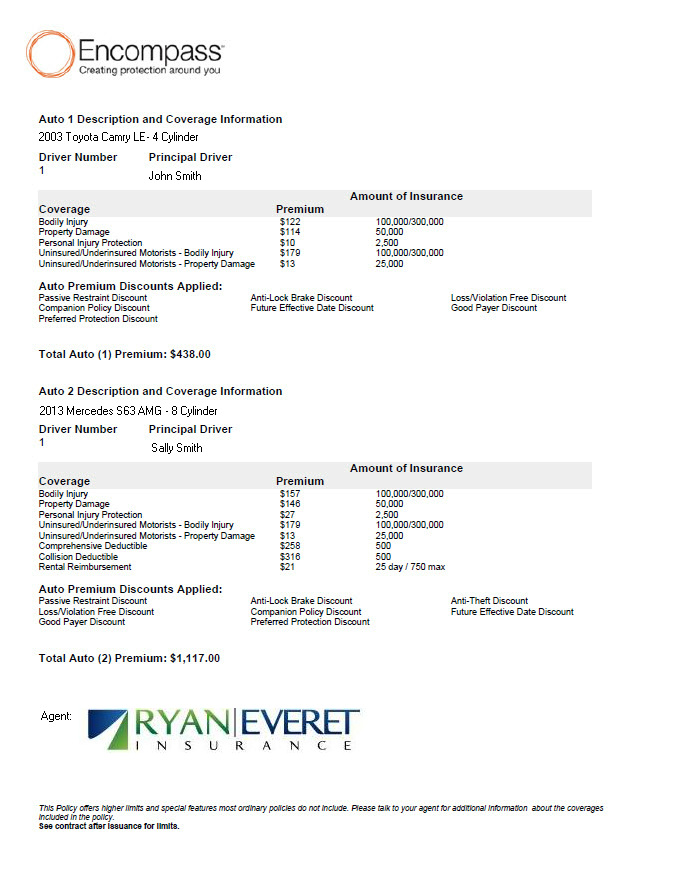

Uninsured/Underinsured Motorist Coverage

Texas also encourages drivers to consider Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage. These optional coverages protect you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. While not mandatory, these coverages can provide valuable protection and are often recommended.

Tailored Coverage Options for Texas Drivers

Beyond the legal requirements, Texas drivers have access to a wide range of coverage options to tailor their auto insurance policies to their specific needs. Here’s a closer look at some of the key coverage choices available.

Comprehensive and Collision Coverage

While not mandatory, comprehensive and collision coverage are essential for protecting your vehicle from damages unrelated to accidents. Comprehensive coverage covers losses due to events like theft, vandalism, weather damage, and natural disasters. Collision coverage, on the other hand, protects against damages caused by collisions with other vehicles or objects.

These coverages are particularly valuable for newer vehicles or those with high resale value, as they provide financial protection in the event of non-accident-related incidents.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers damages from theft, vandalism, weather, and natural disasters. |

| Collision | Protects against damages from collisions with other vehicles or objects. |

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is another optional coverage available in Texas. PIP provides medical coverage for you and your passengers, regardless of who is at fault in an accident. This coverage can be especially beneficial for those who want comprehensive medical coverage without relying solely on health insurance.

Medical Payments Coverage (MedPay)

Medical Payments Coverage (MedPay) is an alternative to PIP, offering similar benefits. MedPay covers medical expenses for you and your passengers, including co-pays, deductibles, and other out-of-pocket costs. It provides quick and straightforward access to medical coverage after an accident.

Roadside Assistance and Rental Car Reimbursement

Texas drivers can also opt for roadside assistance coverage, which provides emergency services like towing, flat tire repair, and battery jump-starts. Additionally, rental car reimbursement coverage can be added to your policy to cover the cost of a rental vehicle while your car is being repaired after an insured incident.

Navigating Auto Insurance Savings in Texas

Finding the right auto insurance policy in Texas is not just about understanding the coverage options; it’s also about discovering ways to save. Here are some strategies to help you get the best value for your insurance dollar.

Discounts and Savings Opportunities

Insurance providers in Texas offer a variety of discounts to help you lower your premiums. Some common discounts include:

- Multi-Policy Discounts: Bundle your auto insurance with other policies, such as homeowners or renters insurance, to save on both.

- Safe Driver Discounts: Maintain a clean driving record to qualify for discounts based on your driving history.

- Good Student Discounts: If you’re a student or have a student driver in your household, maintaining good grades can lead to insurance discounts.

- Loyalty Discounts: Many insurance companies reward long-term customers with loyalty discounts.

Comparing Quotes and Coverage

One of the best ways to ensure you’re getting the most competitive rates is to compare quotes from multiple insurance providers. Online quote comparison tools can make this process easier and faster. However, it’s crucial to compare not only the prices but also the coverage options and policy details to ensure you’re getting the right coverage for your needs.

Understanding Deductibles

Deductibles are an essential aspect of auto insurance policies. When choosing your policy, consider the impact of different deductible amounts on your premiums. Higher deductibles typically result in lower premiums, but it’s essential to select a deductible amount that you’re comfortable paying out of pocket in the event of a claim.

Texas-Specific Auto Insurance Considerations

In addition to the general coverage options and savings strategies, Texas drivers should be aware of a few unique considerations when it comes to auto insurance.

Natural Disaster Coverage

Texas is prone to various natural disasters, including hurricanes, tornadoes, and floods. It’s crucial to ensure that your auto insurance policy provides adequate coverage for damages caused by these events. Comprehensive coverage typically includes protection against weather-related incidents, but it’s always wise to review your policy and understand your specific coverage limits.

Uninsured Motorist Rates

Texas has a relatively high rate of uninsured drivers on the roads. This underscores the importance of considering Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage to protect yourself financially if you’re involved in an accident with an uninsured or underinsured driver.

Teen Driver Discounts and Safety Programs

If you have teen drivers in your household, it’s worth exploring discounts and safety programs specifically designed for young drivers. Many insurance companies offer discounts for teens who complete driver’s education courses or maintain good grades. Additionally, consider enrolling your teen in a graduated driver licensing (GDL) program, which can provide valuable experience and potentially lower insurance costs.

The Future of Auto Insurance in Texas

The auto insurance landscape in Texas is evolving, and several trends and developments are shaping the industry. Here’s a glimpse into the future of auto insurance in the Lone Star State.

Telematics and Usage-Based Insurance

Telematics and Usage-Based Insurance (UBI) are gaining traction in Texas. These innovative programs use technology to monitor driving behavior and offer personalized insurance rates based on real-time data. Drivers who practice safe driving habits can potentially benefit from lower premiums through these programs.

Increasing Focus on Digital Insurance

The digital transformation is revolutionizing the insurance industry, and Texas is no exception. Insurance providers are investing in digital platforms and mobile apps to enhance the customer experience. From policy management to claims filing, many aspects of auto insurance are becoming more accessible and efficient through digital channels.

Enhanced Fraud Detection and Prevention

Insurance fraud is a significant concern in Texas, and insurers are continuously improving their fraud detection and prevention measures. Advanced analytics and data-driven approaches are being employed to identify suspicious claims and ensure fair pricing for policyholders.

Conclusion: Your Guide to Auto Insurance in Texas

Navigating auto insurance in Texas requires a thorough understanding of the state’s unique regulations, coverage options, and potential savings opportunities. By familiarizing yourself with the requirements, exploring tailored coverage choices, and staying informed about the latest trends, you can make confident decisions about your auto insurance coverage.

Remember, your auto insurance policy should provide the protection you need while fitting within your budget. Regularly review your policy, compare quotes, and stay updated on the evolving landscape of auto insurance in Texas to ensure you’re always getting the best value for your insurance needs.

What are the penalties for driving without insurance in Texas?

+Driving without insurance in Texas can result in fines ranging from 175 to 350, depending on the circumstances. Additionally, your vehicle registration may be suspended, and you may be required to provide proof of insurance to reinstate it. In some cases, repeat offenders may face more severe penalties, including license suspension.

Can I get auto insurance without a driver’s license in Texas?

+While having a valid driver’s license is not a legal requirement for purchasing auto insurance in Texas, insurance companies typically require proof of a valid license to provide coverage. However, there may be exceptions for certain situations, such as purchasing insurance for a vehicle that is not regularly driven or for specific commercial purposes.

How often should I review my auto insurance policy in Texas?

+It’s recommended to review your auto insurance policy annually, or whenever there are significant changes in your life or driving circumstances. This includes events like purchasing a new vehicle, moving to a different area, getting married, or adding a young driver to your policy. Regular reviews ensure that your coverage remains adequate and aligned with your needs.