How Much Does Automobile Insurance Cost

Automobile insurance is a crucial aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. The cost of insurance, however, can vary significantly depending on numerous factors. Understanding these variables is essential for any vehicle owner, as it allows for informed decisions and the potential to save on insurance premiums.

Factors Influencing Automobile Insurance Costs

The cost of automobile insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. These factors can be broadly categorized into three groups: individual factors, vehicle factors, and geographic factors.

Individual Factors

Individual characteristics play a significant role in determining insurance costs. Age is a key factor, with younger drivers often facing higher premiums due to their lack of driving experience and higher risk profile. Gender also influences premiums, with males historically paying more due to statistical data suggesting higher accident rates. Driving history is another critical factor; those with a clean driving record, free from accidents or traffic violations, typically enjoy lower insurance costs.

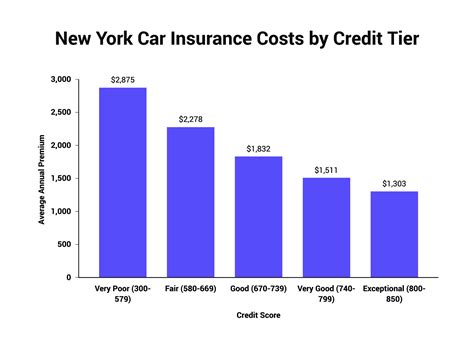

Furthermore, credit history can impact insurance premiums. Many insurance companies use credit-based insurance scores to assess an individual's risk, with better credit scores often resulting in lower premiums. Marital status also comes into play, with married individuals often benefiting from lower rates due to statistical associations between marital status and reduced risk.

Vehicle Factors

The type of vehicle you drive can significantly influence your insurance costs. Vehicle make and model are key considerations, with some vehicles being more expensive to insure due to higher repair costs, higher theft rates, or a history of being involved in more accidents. Vehicle age is another factor, with older vehicles generally being cheaper to insure as they typically have lower replacement and repair costs.

The vehicle's usage also matters. Those who use their vehicles for personal use only often pay less compared to those who use their vehicles for business purposes or as part of their profession. Vehicle safety features can also influence premiums, with vehicles equipped with advanced safety technologies often qualifying for discounts.

Geographic Factors

The area in which you live and drive can significantly impact your insurance costs. Location is a critical factor, with urban areas often facing higher premiums due to increased traffic congestion, higher accident rates, and higher rates of vehicle theft. Conversely, rural areas may offer lower premiums due to reduced traffic and lower crime rates.

The state in which you reside also matters, as each state has its own set of laws and regulations governing automobile insurance. These laws can influence the cost of insurance, with some states having higher average premiums due to more stringent requirements or higher rates of insurance fraud.

Average Automobile Insurance Costs

The average cost of automobile insurance in the United States varies significantly depending on the factors mentioned above. According to the Insurance Information Institute, the average spent on automobile insurance in 2022 was 1,674 per year, or about 140 per month. However, this is just an average, and actual costs can be significantly higher or lower depending on individual circumstances.

To provide a more detailed understanding, here's a table showcasing average automobile insurance costs based on different vehicle types:

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,500 |

| SUV | $1,650 |

| Sports Car | $2,200 |

| Pickup Truck | $1,450 |

Please note that these averages are just estimates and actual costs can vary greatly. It's essential to obtain quotes from multiple insurance providers to get a clear understanding of the costs specific to your situation.

Strategies to Lower Automobile Insurance Costs

While the cost of automobile insurance is influenced by various factors, there are strategies that can help reduce your premiums. Here are some tips to consider:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates. You might find significant variations in premiums, and shopping around can help you identify the most cost-effective option.

- Bundling Policies: Many insurance companies offer discounts when you bundle multiple policies, such as automobile and home insurance, under the same provider.

- Increase Deductibles: Opting for a higher deductible can reduce your premium. However, it's essential to ensure you can afford the higher deductible in the event of a claim.

- Safe Driving: Maintaining a clean driving record can lead to significant savings. Many insurance companies offer safe driver discounts, and avoiding accidents and traffic violations is key to qualifying for these discounts.

- Vehicle Safety Features: Vehicles equipped with advanced safety features often qualify for insurance discounts. These features can include anti-lock brakes, air bags, and collision avoidance systems.

- Membership Discounts: Certain memberships, such as AAA, often provide discounts on automobile insurance.

Future Trends in Automobile Insurance

The automobile insurance industry is constantly evolving, influenced by technological advancements, changing regulatory landscapes, and shifting consumer behaviors. Here are some key trends that are likely to shape the future of automobile insurance:

- Telematics and Usage-Based Insurance: Telematics technology allows insurance companies to monitor driving behavior in real-time, offering the potential for more personalized and dynamic insurance premiums. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining traction, offering policyholders the opportunity to pay premiums based on their actual driving habits and miles traveled.

- Artificial Intelligence and Machine Learning: AI and machine learning are being increasingly utilized in the insurance industry to improve underwriting accuracy, detect fraud, and personalize insurance offerings. These technologies can help insurance companies better assess risk and price insurance policies more competitively.

- Digital Transformation: The digital revolution is transforming the insurance industry, with more companies offering digital-first experiences. This includes online quoting, policy management, and claims processing, providing policyholders with greater convenience and efficiency.

- Connected Car Technology: With the increasing integration of advanced connectivity features in vehicles, insurance companies are exploring opportunities to leverage this data for more precise risk assessment and personalized insurance offerings.

Frequently Asked Questions

How often should I review my automobile insurance policy?

+

It’s recommended to review your automobile insurance policy at least once a year. This allows you to ensure your coverage is still adequate, make any necessary updates, and explore potential cost savings.

Can I get automobile insurance if I have a poor driving record or credit history?

+

Yes, but it may be more challenging and costly. Insurance companies typically offer higher premiums for individuals with poor driving records or credit histories. However, shopping around and being transparent about your situation can help you find a suitable policy.

What are some common discounts offered by automobile insurance providers?

+

Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and vehicle safety feature discounts. It’s worth inquiring with your insurance provider about the discounts they offer and ensuring you’re taking advantage of any applicable discounts.