Commercial Motor Vehicle Insurance

Commercial motor vehicle insurance is an essential aspect of the transportation industry, providing vital protection for businesses and their fleets. This comprehensive guide aims to delve into the intricacies of this insurance type, exploring its coverage, benefits, and the considerations businesses should make when selecting the right policy. With the ever-growing demand for transportation services, understanding commercial motor vehicle insurance is crucial for any business owner or manager operating vehicles for commercial purposes.

Understanding Commercial Motor Vehicle Insurance

Commercial motor vehicle insurance, often referred to as commercial auto insurance, is designed to cover a range of vehicles used for business operations. This includes trucks, vans, buses, and other commercial vehicles. Unlike personal auto insurance, which primarily covers individual vehicles and their drivers, commercial motor vehicle insurance caters to the unique needs of businesses, offering broader coverage and tailored policies.

Coverage Types

Commercial motor vehicle insurance offers a spectrum of coverage types to suit the diverse needs of businesses. These include:

- Liability Coverage: This protects the business from claims arising from accidents caused by the insured vehicle. It covers bodily injury and property damage claims, including legal fees and settlements.

- Physical Damage Coverage: Physical damage coverage ensures that the insured vehicles are protected against accidents, theft, and natural disasters. It includes collision coverage and comprehensive coverage, safeguarding the business’s assets.

- Medical Payments Coverage: In the event of an accident, medical payments coverage provides financial support for the medical expenses of the insured driver and passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the business and its drivers in the event of an accident with an uninsured or underinsured driver, ensuring they are not left financially vulnerable.

- Additional Coverages: Depending on the policy, additional coverages may be available, such as rental car reimbursement, roadside assistance, and cargo coverage for businesses transporting goods.

Benefits and Considerations

Commercial motor vehicle insurance offers several advantages to businesses. Firstly, it provides financial protection, ensuring that the business can continue operating even in the face of accidents or other incidents. Secondly, it helps businesses comply with legal requirements, as many states mandate commercial auto insurance for vehicles used for business purposes.

When selecting a commercial motor vehicle insurance policy, businesses should consider several factors. These include the type of vehicles insured, the nature of their operations, the coverage limits required, and any specific endorsements or additional coverages needed. It's essential to work with an insurance provider who understands the transportation industry and can tailor a policy to the business's unique needs.

| Coverage Type | Description |

|---|---|

| Liability | Protects against bodily injury and property damage claims, covering legal fees and settlements. |

| Physical Damage | Includes collision and comprehensive coverage, safeguarding vehicles from accidents, theft, and natural disasters. |

| Medical Payments | Provides financial support for medical expenses of insured drivers and passengers after an accident. |

| Uninsured/Underinsured Motorist | Protects against financial losses when involved in an accident with an uninsured or underinsured driver. |

Policy Selection and Tailoring

Selecting the right commercial motor vehicle insurance policy involves a careful evaluation of the business’s operations and risks. Here are some key considerations:

- Fleet Size: The number of vehicles in the fleet will influence the policy. Larger fleets may require more comprehensive coverage and additional endorsements.

- Vehicle Types: Different vehicle types have varying risks. Trucks, for instance, may have different coverage needs compared to passenger vans.

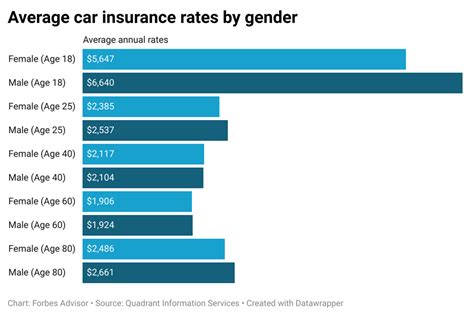

- Driver Profile: The driving record and experience of the drivers can impact the policy. A fleet with experienced drivers may qualify for better rates.

- Coverage Limits: Businesses should assess their risk tolerance and financial capabilities to determine appropriate coverage limits for liability and physical damage.

- Deductibles: Higher deductibles can lower premiums, but businesses must consider their ability to cover these expenses in the event of a claim.

- Additional Coverages: Depending on the business’s operations, additional coverages like cargo insurance or rental car reimbursement may be necessary.

Working with Insurance Providers

Partnering with reputable insurance providers is crucial for obtaining comprehensive commercial motor vehicle insurance. These providers should have experience in the transportation industry and a track record of providing tailored policies. They can offer expert advice on coverage types, policy limits, and any regulatory requirements.

It's also beneficial to compare quotes from multiple providers to ensure the best value for the business's needs. Online comparison tools and broker services can simplify this process, providing a range of options and helping businesses make informed decisions.

Risk Management and Safety Practices

Commercial motor vehicle insurance is not a standalone solution for managing risks. Businesses should also implement robust safety practices and risk management strategies. These include:

- Driver Training: Investing in comprehensive driver training programs can reduce accidents and claims, leading to lower insurance premiums.

- Vehicle Maintenance: Regular maintenance and inspections ensure vehicles are in good condition, reducing the likelihood of breakdowns and accidents.

- Safe Driving Policies: Establishing and enforcing safe driving policies, such as speed limits and phone usage restrictions, can minimize accidents.

- Telematics and GPS Tracking: Utilizing telematics and GPS tracking technologies can provide real-time data on driver behavior, helping identify areas for improvement and reducing risks.

- Claim Management: Efficient claim management practices, including prompt reporting and documentation, can help mitigate the impact of claims on insurance rates.

The Impact of Technology

Advancements in technology have significantly influenced commercial motor vehicle insurance. Telematics, for instance, allows insurers to monitor driving behavior and offer usage-based insurance policies. This can provide businesses with more accurate premiums based on their driving patterns.

Additionally, technology has improved risk assessment and claims management. Insurers can now leverage data analytics and machine learning to identify potential risks and streamline the claims process, ensuring faster and more efficient resolution of incidents.

Future Trends and Industry Developments

The commercial motor vehicle insurance industry is evolving, and several trends are shaping its future. These include:

- Automated Vehicles: As autonomous vehicles become more prevalent, insurance policies will need to adapt to cover the unique risks associated with this technology.

- Electric Vehicles: The rise of electric vehicles in commercial fleets will require insurers to understand the specific risks and maintenance needs of these vehicles.

- Data-Driven Insurance: With the increasing availability of data, insurers are moving towards more data-driven policies, offering personalized premiums based on individual fleet performance.

- Digitalization: The insurance industry is digitalizing, with online platforms and mobile apps making it easier for businesses to manage their policies and claims.

- Collaboration and Partnerships: Insurers are forming partnerships with technology companies and transportation service providers to offer more comprehensive and tailored coverage.

Staying informed about these developments is crucial for businesses to ensure they have the right insurance coverage as the industry evolves.

What is the difference between commercial motor vehicle insurance and personal auto insurance?

+Commercial motor vehicle insurance is designed to cover vehicles used for business purposes, providing broader coverage and tailored policies. Personal auto insurance, on the other hand, is intended for individual vehicles and their drivers, offering more limited coverage.

How can businesses lower their commercial motor vehicle insurance premiums?

+Businesses can lower their premiums by implementing safety practices, maintaining a clean driving record, and considering higher deductibles. Additionally, comparing quotes from multiple providers and negotiating coverage limits can help reduce costs.

What factors influence commercial motor vehicle insurance rates?

+Rates are influenced by factors such as the type of vehicles insured, the nature of business operations, driver profiles, coverage limits, and the number of claims made. Insurers also consider the business’s credit score and loss history.

How often should businesses review their commercial motor vehicle insurance policies?

+Businesses should review their policies annually to ensure they remain adequately covered. Changes in fleet size, vehicle types, or business operations may require adjustments to the policy.

What is the process for filing a claim under commercial motor vehicle insurance?

+The claim process typically involves notifying the insurer promptly after an incident, providing details of the accident, and submitting any required documentation. The insurer will then assess the claim and determine coverage and payment.