Federal Deposit Insurance Coverage

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that plays a crucial role in maintaining the stability and public confidence in the nation's banking system. One of its key functions is to provide insurance coverage for depositors, ensuring that their hard-earned money is protected even in the event of a bank failure.

In this comprehensive article, we will delve into the world of Federal Deposit Insurance Coverage, exploring its history, the benefits it offers, how it works, and the impact it has on individuals and the financial industry as a whole. By understanding this vital system, you will gain valuable insights into the safety net that underpins the American banking system.

A Historical Perspective: The Birth of FDIC

The Federal Deposit Insurance Corporation was established in the aftermath of the Great Depression, a period marked by widespread bank failures and financial instability. The primary aim was to restore confidence in the banking system and protect depositors from potential losses. On June 16, 1933, President Franklin D. Roosevelt signed the Banking Act, which established the FDIC and marked a significant milestone in the nation’s financial history.

The early years of the FDIC were focused on stabilizing the banking industry and implementing its insurance program. Initially, the FDIC insured deposits up to $2,500, providing a much-needed safety net for depositors during a time of economic uncertainty. Over the years, the deposit insurance limit has been increased multiple times, reflecting the changing economic landscape and the FDIC's commitment to adapting to the needs of depositors.

The Benefits of Federal Deposit Insurance

Federal Deposit Insurance Coverage offers a range of benefits that have a significant impact on both individuals and the financial system as a whole. Here are some key advantages:

Protection for Depositors

The most obvious benefit is the protection it provides to depositors. FDIC insurance ensures that individuals’ savings are secure, even if their bank were to fail. This peace of mind encourages people to save and invest their money, knowing that their funds are guaranteed up to the insurance limit.

Stability and Confidence

FDIC insurance plays a pivotal role in maintaining stability and confidence in the banking system. By providing a safety net, it reduces the likelihood of bank runs and panic withdrawals, which can destabilize financial institutions. This, in turn, fosters a more stable and reliable banking environment, benefiting both depositors and financial institutions.

Encouraging Savings and Economic Growth

The presence of FDIC insurance encourages individuals to save and invest their money, knowing that their deposits are secure. This promotes economic growth as savings can be channeled into productive investments, supporting businesses and driving economic development. The increased financial stability also encourages long-term planning and investment, contributing to a robust and resilient economy.

Protection for Small Businesses

Small businesses often rely heavily on local banks for their financial needs. FDIC insurance provides a vital safety net for these businesses, ensuring that their operational funds and savings are protected. This stability is crucial for the survival and growth of small enterprises, which are the backbone of many local economies.

How Federal Deposit Insurance Works

Understanding the mechanics of Federal Deposit Insurance Coverage is essential to appreciate its impact and effectiveness. Here’s a step-by-step breakdown of how it works:

FDIC Membership and Insurance Coverage

FDIC insurance is available to all banks and savings associations that are members of the FDIC. These institutions pay premiums to the FDIC, which in turn provides insurance coverage for their depositors. Not all financial institutions are FDIC members; credit unions, for instance, are insured by the National Credit Union Administration (NCUA), which provides similar insurance coverage.

Deposit Insurance Limits

The FDIC insures deposits in various account categories, including checking, savings, and certain types of certificates of deposit (CDs). The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. This means that an individual with different types of accounts at the same bank can have their funds insured up to this limit.

Complex Ownership Structures

The FDIC offers enhanced insurance coverage for certain complex ownership structures. For example, if an individual has multiple joint accounts with different co-owners, the insurance coverage can be higher. Additionally, certain retirement accounts and trust accounts may also have higher insurance limits.

Insurance Coverage for Business Accounts

FDIC insurance extends to business accounts as well. Sole proprietorships, partnerships, and corporations can have their business funds insured up to the standard insurance limit. However, it’s important to note that the insurance coverage applies separately for each business entity, ensuring that multiple businesses owned by the same individual are protected.

Identifying Insured Banks

Identifying FDIC-insured banks is crucial for depositors. The FDIC logo, often displayed at bank branches and on official websites, is a visual indicator of insurance coverage. Additionally, the FDIC provides a BankFind tool that allows individuals to verify if a bank is FDIC-insured. This transparency helps depositors make informed decisions about where to keep their money.

Bank Failure and Resolution

In the event of a bank failure, the FDIC steps in to resolve the situation. It works to quickly reopen the bank or transfer its assets and liabilities to another insured bank. During this process, the FDIC ensures that depositors have access to their insured funds as soon as possible. The FDIC’s prompt action minimizes disruption and protects depositors from losses.

Real-World Impact: Case Studies

To illustrate the practical impact of Federal Deposit Insurance Coverage, let’s explore a few real-world case studies:

The Impact on Individual Depositors

Consider the story of John, a retired teacher who had saved diligently throughout his career. When his bank failed, John was initially worried about the safety of his retirement funds. However, thanks to FDIC insurance, he received full protection for his savings, up to the insurance limit. This reassurance allowed John to continue his retirement plans without financial worries.

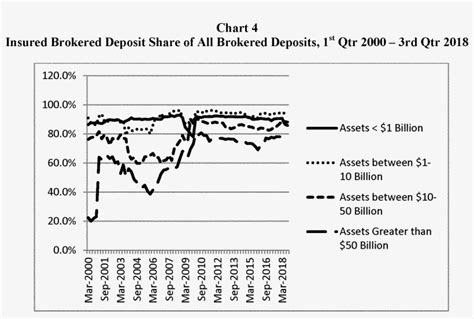

Stabilizing the Financial Industry

In 2008, during the global financial crisis, the FDIC’s role became even more crucial. As several large banks faced difficulties, the FDIC’s insurance coverage helped maintain stability and prevent a widespread panic. Depositors knew their funds were protected, which prevented a run on banks and contributed to the overall stability of the financial system during a challenging economic period.

Protecting Small Businesses

Imagine a local bakery, owned by a husband-and-wife team, that relies on its bank for operating funds and business loans. When their bank faced financial troubles, the FDIC stepped in to ensure that the bakery’s accounts were protected. This stability allowed the bakery to continue its operations and serve its community, contributing to local economic resilience.

Future Implications and Innovations

As the financial landscape evolves, the FDIC continues to adapt and innovate to meet the changing needs of depositors and the banking industry. Here are some key future implications and potential innovations:

Digital Transformation

With the rise of digital banking and online financial services, the FDIC is exploring ways to enhance its insurance coverage for these platforms. Ensuring that depositors’ funds are protected in the digital realm is a priority, and the FDIC is working towards developing robust systems to address this evolving challenge.

Enhanced Consumer Education

The FDIC recognizes the importance of financial literacy and consumer education. It aims to empower depositors with the knowledge they need to make informed decisions about their savings and investments. By providing clear and accessible information, the FDIC can help individuals understand their rights and the protection offered by FDIC insurance.

Addressing Cybersecurity Threats

In an era of increasing cyber threats, the FDIC is focused on strengthening the cybersecurity measures of insured institutions. By working closely with banks and financial institutions, the FDIC aims to minimize the risk of cyberattacks and protect depositors’ funds from digital threats.

Exploring New Ownership Structures

The FDIC is also exploring ways to provide enhanced insurance coverage for emerging ownership structures, such as fintech partnerships and innovative financial models. By adapting to these new structures, the FDIC can ensure that depositors’ funds remain protected even in the most cutting-edge financial environments.

Conclusion

Federal Deposit Insurance Coverage is a cornerstone of the American banking system, providing a vital safety net for depositors and contributing to the overall stability of the financial industry. Through its historical evolution, the FDIC has proven its resilience and adaptability, ensuring that depositors’ funds are protected even in times of economic uncertainty.

As we move forward, the FDIC's ongoing commitment to innovation and consumer protection will continue to shape the banking landscape. By staying informed about FDIC insurance and its benefits, individuals can make confident decisions about their financial future, knowing that their savings are secure.

What happens if a bank fails, and I have deposits above the insurance limit?

+If a bank fails and your deposits exceed the insurance limit, the FDIC works to sell the bank’s assets and pay out as much of the uninsured deposits as possible. However, it’s important to note that uninsured deposits may be at risk and may not be fully recovered.

Are all banks insured by the FDIC?

+Not all banks are FDIC-insured. Credit unions, for instance, are insured by the National Credit Union Administration (NCUA). It’s crucial to verify if your bank is FDIC-insured by checking for the FDIC logo or using the FDIC’s BankFind tool.

How often does the FDIC update its insurance limits?

+The FDIC reviews and updates its insurance limits periodically to reflect changes in the economic environment and the needs of depositors. The last significant increase in the insurance limit was in 2010, when it was raised from 100,000 to the current 250,000.

Can I have multiple accounts with different ownership structures at the same bank to increase my insurance coverage?

+Yes, you can have multiple accounts with different ownership structures at the same bank to increase your insurance coverage. Each account ownership category has its own insurance limit, so you can maximize your protection by utilizing different account types.