Best Marketplace Insurance

When it comes to finding the best insurance options, marketplace insurance plans offer a convenient and affordable solution for many individuals and families. With the rise of online platforms and a growing demand for accessible healthcare, marketplace insurance has become a popular choice. In this comprehensive guide, we will explore the world of marketplace insurance, delve into its benefits, and help you navigate the process of selecting the right plan for your needs.

Understanding Marketplace Insurance

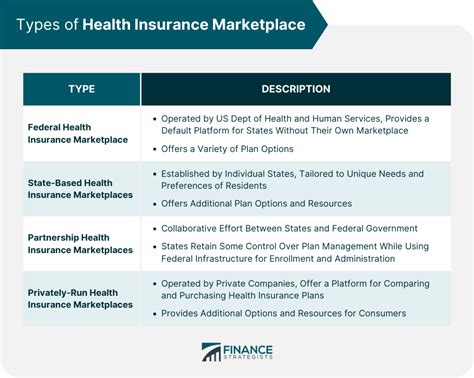

Marketplace insurance, also known as the Health Insurance Marketplace or simply the Health Insurance Exchange, is a platform that allows individuals and small businesses to compare and purchase health insurance plans. It was established as part of the Affordable Care Act (ACA) to provide a centralized and transparent marketplace for insurance coverage.

The primary goal of marketplace insurance is to make health insurance more accessible and affordable, especially for those who might not have employer-sponsored coverage or face challenges in obtaining insurance due to pre-existing conditions or financial constraints.

The Advantages of Marketplace Insurance

Marketplace insurance offers a range of benefits that make it an attractive option for many consumers:

1. Cost-Effectiveness

One of the key advantages is the potential for cost savings. Marketplace insurance plans often come with subsidies and tax credits, especially for individuals and families with lower incomes. These financial aids can significantly reduce the cost of monthly premiums, making healthcare more affordable.

Additionally, marketplace plans are required to provide essential health benefits, ensuring that enrollees receive comprehensive coverage without excessive out-of-pocket expenses. This helps individuals avoid unexpected medical bills and provides peace of mind.

2. Wide Selection of Plans

Marketplace insurance platforms offer a diverse range of plans from multiple insurance providers. This variety allows individuals to compare different options based on their specific needs, preferences, and budget. Whether you prioritize low premiums, comprehensive coverage, or a particular network of healthcare providers, the marketplace provides choices.

3. Simplified Enrollment Process

Navigating the world of health insurance can be daunting, but marketplace insurance aims to simplify the enrollment process. Online platforms provide clear and concise information, making it easier for consumers to understand their options. The application process is designed to be user-friendly, and individuals can often receive instant eligibility determinations and quotes.

4. Protection for Pre-Existing Conditions

Prior to the ACA, individuals with pre-existing conditions often faced challenges in obtaining affordable insurance. Marketplace insurance plans are required to cover pre-existing conditions without discrimination, ensuring that everyone has access to essential healthcare services.

5. Annual Open Enrollment Period

Marketplace insurance operates on an annual open enrollment period, typically lasting several months. During this time, individuals can enroll in a new plan, switch plans, or make changes to their existing coverage. This provides an opportunity to review and adjust insurance options based on changing needs or new plan offerings.

How to Choose the Best Marketplace Insurance Plan

Selecting the best marketplace insurance plan requires careful consideration of your unique circumstances. Here are some key factors to guide your decision-making process:

1. Assess Your Healthcare Needs

Begin by evaluating your current and potential future healthcare needs. Consider factors such as your age, any existing medical conditions, and the frequency of healthcare services you anticipate requiring. Understanding your needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

2. Compare Premiums and Deductibles

Premiums and deductibles are crucial aspects of any insurance plan. Compare the monthly premiums and annual deductibles offered by different plans. While lower premiums might be tempting, consider the overall cost, including deductibles and out-of-pocket maximums. A higher premium plan with a lower deductible might be a better fit if you anticipate frequent healthcare utilization.

3. Evaluate Coverage Details

Dig into the fine print of each plan's coverage details. Pay attention to the scope of coverage, including primary care, specialist visits, prescription drugs, mental health services, and any specific procedures or treatments you might require. Ensure that the plan covers your preferred healthcare providers and facilities.

4. Consider Network Options

Network options play a significant role in the accessibility and affordability of healthcare services. Some plans offer a narrower network of providers, which can result in lower costs but may limit your choice of doctors and hospitals. On the other hand, broader networks provide more flexibility but might come with higher premiums.

5. Explore Additional Benefits

Marketplace insurance plans often include additional benefits beyond standard healthcare coverage. These can include dental and vision care, wellness programs, and discounts on certain services. Evaluate these benefits to determine if they align with your overall healthcare goals and priorities.

6. Calculate Subsidies and Tax Credits

Marketplace insurance plans offer subsidies and tax credits based on income and family size. Use the online tools provided by the marketplace to estimate your potential savings. These financial aids can make a significant difference in the overall cost of your insurance plan.

7. Seek Professional Advice

If you're unsure about which plan to choose, consider seeking advice from insurance brokers or healthcare professionals. They can provide valuable insights and guidance based on your specific circumstances, ensuring that you make an informed decision.

Marketplace Insurance Performance and Satisfaction

Marketplace insurance has gained popularity over the years, and consumer satisfaction has been a key indicator of its success. Surveys and studies have shown that individuals enrolled in marketplace plans generally report positive experiences, particularly regarding the accessibility and affordability of healthcare.

The marketplace platform itself has evolved to provide a user-friendly interface, making it easier for consumers to navigate and compare plans. Additionally, the implementation of the ACA has led to improved healthcare outcomes, as more individuals have gained access to essential medical services.

| Key Performance Indicator | Marketplace Insurance Statistics |

|---|---|

| Number of Enrollees | Over 11.4 million Americans were enrolled in marketplace plans as of 2021. |

| Premium Growth | Marketplace premiums have increased at a slower rate compared to employer-sponsored plans. |

| Consumer Satisfaction | 85% of marketplace enrollees reported being satisfied with their insurance coverage in a recent survey. |

Future Implications and Innovations

The landscape of marketplace insurance is continually evolving, and several key developments are shaping its future:

1. Expanded Coverage Options

Efforts are underway to expand the range of coverage options available on the marketplace. This includes exploring new types of plans, such as short-term health insurance and association health plans, to provide more flexibility and choice for consumers.

2. Improved Technology Integration

Marketplace platforms are embracing technological advancements to enhance the user experience. This includes the integration of artificial intelligence and machine learning to personalize plan recommendations and streamline the enrollment process.

3. Focus on Preventive Care

There is a growing emphasis on preventive care and wellness initiatives within marketplace insurance plans. By encouraging individuals to prioritize their health and engage in preventive measures, these plans aim to reduce long-term healthcare costs and improve overall well-being.

4. Enhanced Consumer Education

Recognizing the importance of informed decision-making, marketplace platforms are investing in educational resources and tools. This includes providing clear explanations of plan features, coverage details, and cost-sharing structures to help consumers choose the right plan for their needs.

5. Collaborative Efforts with Healthcare Providers

Marketplace insurance providers are collaborating with healthcare organizations to improve the coordination of care. By establishing partnerships, they aim to streamline administrative processes, reduce costs, and enhance the overall patient experience.

Frequently Asked Questions

How do I know if I’m eligible for marketplace insurance subsidies?

+Eligibility for marketplace insurance subsidies is based on your household income and family size. Generally, individuals and families with incomes up to 400% of the federal poverty level may qualify for premium tax credits. Use the online subsidy calculator provided by the marketplace to estimate your eligibility.

Can I enroll in marketplace insurance outside of the open enrollment period?

+In most cases, enrollment in marketplace insurance is restricted to the annual open enrollment period. However, there are certain qualifying life events, such as losing your job or getting married, that may allow you to enroll outside of this period. These are known as Special Enrollment Periods.

What happens if I miss the open enrollment deadline?

+If you miss the open enrollment deadline, you may still be able to obtain insurance through the marketplace, but your options may be limited. You can purchase a short-term health insurance plan or explore other non-marketplace options. It’s important to note that missing the deadline may result in a lack of coverage for the upcoming year.

Can I keep my current doctor with marketplace insurance?

+Whether you can keep your current doctor depends on the network of providers associated with your chosen marketplace plan. Some plans have a restricted network, while others offer a broader range of choices. Review the plan’s provider directory to ensure that your preferred healthcare providers are included.