Workers Insurance

Workers' insurance, also known as workers' compensation or work-related insurance, is an essential aspect of any organization's risk management strategy. It provides financial protection and support to employees who suffer work-related injuries, illnesses, or disabilities. In this comprehensive article, we will delve into the world of workers' insurance, exploring its significance, how it works, and its impact on employees and businesses alike.

Understanding Workers’ Insurance: A Comprehensive Overview

Workers’ insurance is a legal and contractual obligation for employers to ensure the well-being and financial security of their workforce. It is designed to offer a safety net for employees, covering various aspects of their work-related health and financial concerns. By implementing a robust workers’ insurance program, businesses can demonstrate their commitment to employee welfare and create a safer and more supportive work environment.

The origins of workers' insurance can be traced back to the early 20th century when industrial accidents and diseases were prevalent due to hazardous working conditions. Recognizing the need to protect workers and provide them with adequate compensation, governments and labor unions played a pivotal role in establishing workers' compensation laws. These laws aimed to create a balanced system that ensured employees received fair compensation without the need for lengthy and often costly legal battles.

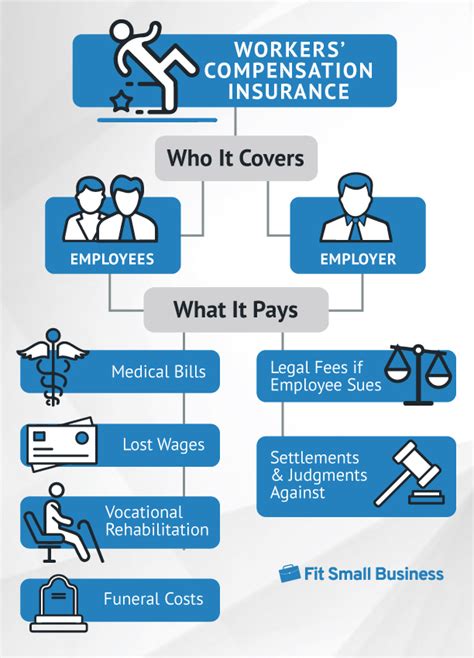

Key Components of Workers’ Insurance

Workers’ insurance encompasses a range of benefits and coverage options, tailored to meet the diverse needs of employees and the specific risks associated with different industries. Here are some crucial components of a comprehensive workers’ insurance program:

- Medical Benefits: This aspect covers the cost of medical treatment, hospitalization, and rehabilitation for work-related injuries or illnesses. It ensures that employees receive prompt and comprehensive medical care without incurring significant financial burdens.

- Wage Replacement: Workers' insurance provides temporary wage replacement benefits to employees who are unable to work due to their injuries. These benefits help sustain the financial stability of the employees and their families during their recovery period.

- Disability Coverage: In cases where an injury or illness results in a permanent disability, workers' insurance offers long-term or permanent disability benefits. These benefits aim to provide financial support to individuals who can no longer perform their regular job duties.

- Vocational Rehabilitation: Some workers' insurance programs include vocational rehabilitation services. These services assist employees in returning to work by providing training, job placement assistance, and adaptations to accommodate their new physical or mental capabilities.

- Survivor Benefits: In the unfortunate event of a work-related fatality, workers' insurance offers survivor benefits to the dependents of the deceased employee. These benefits help support the financial needs of the surviving family members.

The Impact on Employees

Workers’ insurance has a profound impact on the lives of employees, offering them a sense of security and peace of mind. Here’s how it benefits the workforce:

- Financial Stability: Workers' insurance ensures that employees receive financial support during challenging times, whether it's temporary wage replacement or long-term disability benefits. This stability allows them to focus on their recovery without worrying about their financial obligations.

- Prompt Medical Care: By covering medical expenses, workers' insurance encourages employees to seek immediate medical attention for work-related injuries or illnesses. This timely access to healthcare can significantly improve their chances of a full recovery.

- Protection Against Financial Burden: Without workers' insurance, employees might face substantial financial burdens, including medical bills and lost wages. This insurance provides a safety net, ensuring that employees are not left financially vulnerable due to work-related incidents.

- Legal Protection: Workers' insurance programs are designed to streamline the compensation process, reducing the need for employees to navigate complex legal procedures. This protection safeguards their rights and ensures they receive fair and timely compensation.

How Workers’ Insurance Benefits Businesses

While workers’ insurance primarily focuses on employee welfare, it also offers significant advantages to businesses. Here’s how a well-implemented workers’ insurance program can benefit organizations:

Risk Management and Liability Protection

Workers’ insurance serves as a crucial risk management tool for businesses. By providing coverage for work-related injuries and illnesses, it helps mitigate the financial risks associated with workplace accidents. Here’s how it contributes to risk management:

- Financial Stability: Workers' insurance protects businesses from the financial impact of workplace injuries. It covers medical expenses, wage replacement, and other associated costs, ensuring that the business can continue its operations without significant financial disruptions.

- Reduced Legal Exposure: With workers' insurance in place, businesses can minimize their legal liability. The insurance program provides a structured framework for compensating injured employees, reducing the likelihood of costly and time-consuming lawsuits.

- Improved Risk Assessment: Businesses can analyze their insurance data to identify potential hazards and implement preventive measures. By understanding the common causes of workplace injuries, they can enhance safety protocols and reduce the frequency of accidents.

- Enhanced Employee Morale: A robust workers' insurance program demonstrates the organization's commitment to employee welfare. This can boost employee morale, improve retention rates, and foster a positive work environment, leading to increased productivity.

Cost-Effectiveness and Long-Term Savings

Investing in workers’ insurance can result in significant cost savings for businesses in the long run. Here’s how it contributes to cost-effectiveness:

- Reduced Medical Costs: Workers' insurance covers the cost of medical treatment for work-related injuries, which can be expensive. By providing prompt medical care, the insurance program helps prevent injuries from becoming more severe and costly to treat.

- Wage Replacement Savings: Temporary wage replacement benefits ensure that injured employees receive a portion of their wages while recovering. This helps businesses avoid the higher costs associated with hiring and training temporary replacements.

- Disability Management: Workers' insurance includes disability coverage, which can be more cost-effective than long-term disability plans offered by individual employees. It provides a comprehensive solution for managing and supporting employees with long-term disabilities.

- Worker Retention: By offering a comprehensive workers' insurance program, businesses can attract and retain top talent. This can lead to reduced recruitment and training costs, as well as improved employee loyalty and satisfaction.

Real-World Examples: Workers’ Insurance in Action

To better understand the impact and effectiveness of workers’ insurance, let’s explore some real-world examples of how it has benefited both employees and businesses:

Case Study 1: Construction Industry

The construction industry is known for its inherent risks, including falls, equipment-related accidents, and exposure to hazardous materials. Workers’ insurance plays a critical role in protecting construction workers. In a recent case, a construction worker sustained severe injuries after a fall from a ladder. The workers’ insurance program covered the cost of his medical treatment, including specialized surgery and rehabilitation. Additionally, the insurance provided temporary wage replacement, ensuring the worker’s financial stability during his recovery. This real-world example demonstrates how workers’ insurance provides a safety net for employees facing challenging circumstances.

Case Study 2: Healthcare Sector

Healthcare professionals, such as nurses and doctors, often face physical and emotional demands in their work. Workers’ insurance is crucial in this sector to address both physical injuries and occupational stress. In a case involving a nurse who developed severe carpal tunnel syndrome due to repetitive tasks, workers’ insurance covered the cost of her medical treatment and provided temporary wage replacement while she underwent surgery and rehabilitation. The insurance program also offered vocational rehabilitation services to help the nurse transition back to work with adapted equipment and techniques. This case highlights how workers’ insurance supports employees in various sectors, addressing their unique occupational challenges.

Case Study 3: Manufacturing Industry

The manufacturing industry involves the use of heavy machinery and potential exposure to hazardous substances. Workers’ insurance is vital in protecting employees from the risks associated with this industry. In a manufacturing plant, an employee suffered a serious injury when a machine malfunctioned. The workers’ insurance program covered the cost of his emergency medical treatment, hospitalization, and subsequent rehabilitation. Additionally, the insurance provided long-term disability benefits, ensuring the employee received financial support while he was unable to return to work due to his permanent disability. This example showcases how workers’ insurance provides comprehensive coverage, including support for employees facing long-term disabilities.

The Future of Workers’ Insurance: Innovations and Trends

As the landscape of work evolves, so too must workers’ insurance adapt to meet the changing needs of employees and businesses. Here are some emerging trends and innovations shaping the future of workers’ insurance:

Technology Integration

The integration of technology is revolutionizing the workers’ insurance industry. Here’s how it’s making a difference:

- Digital Claims Processing: Many insurance providers are adopting digital platforms for streamlined claims processing. Employees can now submit claims and track their progress online, reducing paperwork and accelerating the compensation process.

- Wearable Devices and Telemedicine: The use of wearable devices and telemedicine services is on the rise. These technologies enable remote monitoring of employee health and provide convenient access to medical consultations, enhancing the efficiency of workers' insurance programs.

- Data Analytics: Advanced data analytics tools are being utilized to identify patterns and trends in workplace injuries. By analyzing this data, insurance providers can develop more targeted risk management strategies and offer customized insurance solutions.

Emphasis on Prevention and Wellness

There is a growing recognition that prevention and wellness initiatives can significantly reduce the incidence of workplace injuries and illnesses. Here’s how workers’ insurance is embracing this focus:

- Ergonomic Assessments: Insurance providers are partnering with occupational health experts to conduct ergonomic assessments in workplaces. These assessments identify potential hazards and recommend improvements to reduce the risk of injuries, particularly those related to repetitive strain and poor ergonomics.

- Wellness Programs: Many insurance programs now include wellness initiatives, such as fitness incentives, stress management workshops, and nutritional guidance. By promoting overall employee wellness, these programs aim to prevent work-related illnesses and improve productivity.

- Mental Health Support: Recognizing the importance of mental health in the workplace, some workers' insurance programs are expanding their coverage to include mental health services. This support can help employees manage stress, anxiety, and other mental health challenges, ultimately improving their overall well-being.

Customized Insurance Solutions

One size does not fit all when it comes to workers’ insurance. Insurance providers are increasingly offering customized solutions to meet the unique needs of different industries and businesses. Here’s how they’re tailoring their offerings:

- Industry-Specific Coverage: Insurance providers are developing insurance packages that address the specific risks associated with different industries. For example, construction insurance may include coverage for falls and equipment-related accidents, while healthcare insurance may focus on occupational stress and musculoskeletal injuries.

- Small Business Support: Recognizing the challenges faced by small businesses, some insurance providers are offering specialized programs with flexible payment options and tailored coverage. This support ensures that small businesses can access the benefits of workers' insurance without straining their financial resources.

- Risk Assessment and Mitigation: Insurance providers are collaborating with businesses to conduct comprehensive risk assessments. By identifying potential hazards and implementing preventive measures, businesses can reduce the likelihood of workplace incidents and create a safer work environment.

Conclusion: Empowering Employees and Businesses Alike

Workers’ insurance is a vital component of a responsible and supportive workplace. By offering financial protection and support to employees, it empowers them to focus on their recovery and well-being without the added stress of financial burdens. Simultaneously, businesses benefit from a robust workers’ insurance program through risk management, cost savings, and enhanced employee morale.

As we've explored in this article, workers' insurance is not merely a legal obligation but a powerful tool for creating a safer, healthier, and more productive work environment. With ongoing innovations and a focus on prevention and wellness, workers' insurance continues to evolve, ensuring that employees and businesses can thrive together.

How do I choose the right workers’ insurance for my business?

+When selecting workers’ insurance, consider factors such as industry-specific risks, coverage options, and the reputation of the insurance provider. Research and compare different policies, and consult with industry experts or insurance brokers who can guide you toward the best fit for your business.

What are some common challenges faced by employees when claiming workers’ insurance benefits?

+Common challenges include delays in processing claims, misunderstandings about coverage, and difficulties accessing medical treatment or rehabilitation services. It’s important for employees to stay informed about their rights and seek assistance from their employer or insurance provider if they encounter any issues.

How can businesses improve their workers’ insurance programs?

+Businesses can enhance their workers’ insurance programs by regularly reviewing and updating coverage to align with changing workplace risks. Implementing proactive safety measures, providing employee education on insurance benefits, and fostering a culture of open communication about workplace health and safety can also contribute to a more effective program.