Insurance Commissioner

In the complex world of insurance, where policies, regulations, and consumer rights intertwine, the figure of an Insurance Commissioner emerges as a crucial guardian of the industry's integrity. With their expertise and regulatory powers, Insurance Commissioners play a pivotal role in shaping the landscape of insurance practices, ensuring fair and ethical conduct, and safeguarding the interests of both policyholders and insurers alike.

This article aims to provide an in-depth exploration of the Insurance Commissioner's role, shedding light on their responsibilities, impact, and the intricate web of regulations they navigate. From the day-to-day tasks that define their role to the far-reaching implications of their decisions, we will delve into the world of insurance regulation, offering a comprehensive understanding of this critical position.

The Insurance Commissioner: A Guardian of Trust and Transparency

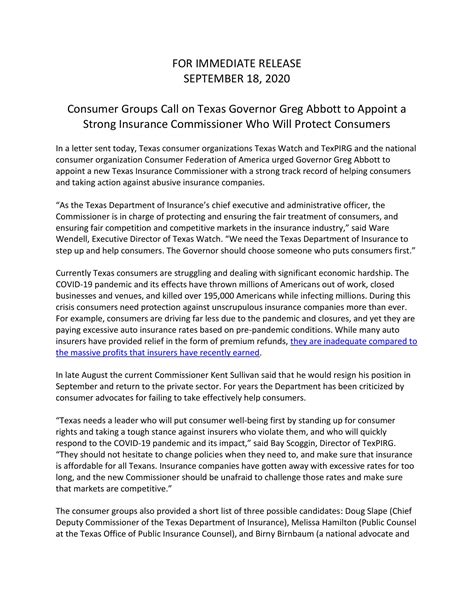

An Insurance Commissioner, often appointed by the state or regional government, serves as the chief regulator and overseer of the insurance industry within their jurisdiction. Their primary objective is to uphold the principles of fairness, transparency, and consumer protection, ensuring that insurance practices adhere to established laws and regulations.

With a keen eye for detail and a deep understanding of insurance intricacies, Commissioners are tasked with the formidable responsibility of overseeing a vast array of insurance products and services. From life and health insurance to property and casualty policies, their jurisdiction covers a diverse spectrum, demanding a comprehensive grasp of the unique challenges and complexities inherent to each.

The role of an Insurance Commissioner is not merely administrative; it carries significant weight in shaping the industry's ethical standards and consumer trust. Their decisions and regulatory actions can influence the very fabric of insurance practices, impacting not only the industry's stakeholders but also the millions of policyholders who rely on insurance for financial security and peace of mind.

Key Responsibilities and Functions of an Insurance Commissioner

- License and Regulate Insurance Entities: Commissioners oversee the licensing and regulation of insurance companies, agents, and brokers, ensuring they meet the necessary criteria for operation and conduct business ethically.

- Enforce Insurance Laws and Regulations: They are responsible for enforcing state or regional insurance laws, including those related to consumer protection, market conduct, and financial solvency.

- Monitor Insurance Market Conduct: Commissioners actively monitor the behavior and practices of insurance companies, investigating complaints and addressing issues such as unfair claim settlements or deceptive marketing practices.

- Oversee Insurance Company Solvency: A critical aspect of their role involves evaluating the financial stability of insurance companies, ensuring they can meet their obligations to policyholders and preventing potential insolvencies.

- Consumer Education and Advocacy: Insurance Commissioners often engage in public awareness campaigns, providing educational resources to help consumers understand their rights and make informed insurance decisions.

- Collaborate with Industry Stakeholders: They work closely with insurance companies, industry associations, and consumer advocacy groups to foster a collaborative environment, address concerns, and promote industry best practices.

The day-to-day work of an Insurance Commissioner involves a delicate balance of administrative tasks, policy analysis, and public engagement. They must stay abreast of evolving insurance trends, technological advancements, and changing consumer needs to effectively navigate the dynamic insurance landscape.

The Impact of Insurance Commissioner Decisions

The influence of an Insurance Commissioner extends far beyond the confines of their office. Their decisions and regulatory actions can have a profound impact on the insurance industry, shaping its future trajectory and the experiences of policyholders.

Regulatory Actions and Their Outcomes

When an Insurance Commissioner identifies violations or concerns, they have the authority to take regulatory actions. These actions can range from issuing fines and penalties to ordering corrective measures or even revoking licenses.

For instance, if an insurance company is found to engage in deceptive advertising practices, the Commissioner may issue a cease-and-desist order, requiring the company to immediately halt the misleading marketing. In more severe cases, repeated violations could lead to significant fines or the suspension of the company's license to operate within the Commissioner's jurisdiction.

These regulatory actions serve as a deterrent, encouraging insurance entities to adhere to ethical standards and protect consumer interests. They also provide a crucial layer of protection, ensuring that policyholders are not subjected to fraudulent or unfair practices.

Shaping Insurance Industry Practices

Insurance Commissioners play a pivotal role in influencing the overall culture and practices of the insurance industry. Their regulatory framework and oversight can encourage innovation while maintaining a focus on consumer protection.

By implementing proactive measures and promoting best practices, Commissioners can foster an environment where insurance companies prioritize ethical conduct and transparency. This, in turn, can lead to increased consumer confidence and trust in the industry, driving long-term growth and sustainability.

Consumer Empowerment and Protection

At the heart of an Insurance Commissioner's role is the protection of consumers. Through their regulatory actions and public engagement initiatives, Commissioners empower policyholders to make informed decisions and understand their rights.

For example, Commissioners may establish consumer complaint processes, providing a direct channel for policyholders to report issues or concerns. By investigating these complaints, Commissioners can address individual grievances and identify systemic issues, taking appropriate actions to rectify them.

Additionally, Insurance Commissioners often collaborate with consumer advocacy groups and community organizations to educate the public about insurance basics, such as understanding policy terms, recognizing potential scams, and navigating the claims process. This proactive approach ensures that consumers are well-equipped to navigate the insurance landscape and protect their financial interests.

The Evolving Landscape of Insurance Regulation

The world of insurance is dynamic, with emerging technologies, changing consumer behaviors, and evolving regulatory challenges. Insurance Commissioners must adapt to these changes, staying at the forefront of industry developments to effectively fulfill their regulatory duties.

Technological Advancements and Insurance Innovation

The insurance industry is experiencing a technological revolution, with digital platforms, artificial intelligence, and data analytics transforming traditional practices. Insurance Commissioners must navigate this digital transformation, ensuring that technological advancements benefit consumers without compromising ethical standards.

For instance, the rise of insurtech startups and online insurance platforms has introduced new business models and distribution channels. Commissioners must evaluate these innovations, assessing their impact on consumer protection and market conduct. They must also address potential risks, such as data privacy concerns or algorithmic bias, to ensure a fair and transparent digital insurance ecosystem.

Addressing Emerging Risks and Consumer Needs

Insurance Commissioners are tasked with anticipating and addressing emerging risks and evolving consumer needs. This involves staying abreast of changing demographics, societal trends, and environmental factors that can impact insurance practices.

For example, with the increasing prevalence of natural disasters and climate change, Commissioners may focus on promoting resilience and sustainability within the insurance industry. This could involve encouraging the development of innovative insurance products to address climate-related risks or implementing measures to protect policyholders in disaster-prone areas.

Additionally, Commissioners must consider the unique needs of an aging population, addressing issues related to long-term care insurance, retirement planning, and health coverage for seniors. By adapting regulatory frameworks to these changing demographics, Commissioners can ensure that insurance practices remain relevant and responsive to the diverse needs of society.

Collaborative Efforts and Industry Partnerships

In today's interconnected world, collaboration and partnerships are essential for effective insurance regulation. Insurance Commissioners recognize the value of working closely with industry stakeholders, including insurance companies, brokers, and consumer advocacy groups.

By fostering open communication and collaborative initiatives, Commissioners can leverage the expertise and insights of industry professionals. This collaborative approach allows for the development of practical solutions, addressing complex regulatory challenges and promoting industry-wide best practices.

For instance, Insurance Commissioners may engage in joint initiatives with insurance companies to enhance data security measures, addressing the growing threat of cyberattacks and data breaches. By sharing best practices and implementing industry-wide standards, Commissioners can ensure a robust defense against cyber threats, protecting both insurance companies and policyholders.

The Future of Insurance Regulation: A Vision for Change

As we look ahead, the role of an Insurance Commissioner is poised for evolution, adapting to the rapid changes and emerging challenges of the insurance industry. With a focus on innovation, consumer empowerment, and sustainable practices, Commissioners can drive transformative change, shaping a future where insurance serves as a reliable pillar of financial security and peace of mind.

Embracing Digital Transformation

The digital revolution is here to stay, and Insurance Commissioners must embrace the opportunities it presents while mitigating potential risks. By leveraging technology, Commissioners can enhance regulatory efficiency, streamline processes, and improve consumer engagement.

For instance, digital platforms can facilitate the submission and tracking of consumer complaints, providing Commissioners with real-time insights into emerging issues. Additionally, digital tools can enable more efficient license management, allowing Commissioners to quickly verify the credentials of insurance entities and agents.

Furthermore, Commissioners can explore the potential of blockchain technology, ensuring secure and transparent transactions within the insurance ecosystem. By embracing these digital advancements, Commissioners can future-proof the insurance industry, fostering an environment of trust and innovation.

Promoting Consumer-Centric Innovation

The future of insurance regulation should prioritize consumer-centric innovation, encouraging insurance companies to develop products and services that meet the evolving needs of policyholders. Commissioners can play a pivotal role in fostering this innovation by providing a supportive regulatory environment and incentivizing industry initiatives.

For example, Commissioners may establish innovation hubs or incubators, providing a platform for insurtech startups and established companies to collaborate and develop cutting-edge solutions. These initiatives can focus on areas such as personalized insurance products, digital health platforms, or sustainable insurance models, driving the industry towards a more consumer-centric future.

Addressing Environmental and Social Challenges

In a world facing environmental and social challenges, Insurance Commissioners have a unique opportunity to promote sustainable practices within the insurance industry. By incentivizing green initiatives and encouraging the development of climate-resilient insurance products, Commissioners can drive positive change.

For instance, Commissioners may introduce regulatory frameworks that reward insurance companies for implementing environmentally friendly practices or offer incentives for policyholders who adopt sustainable lifestyles. These initiatives can not only mitigate the impact of climate change but also foster a culture of social responsibility within the insurance industry.

Additionally, Commissioners can address social issues by promoting inclusive insurance practices, ensuring that vulnerable populations have access to affordable and comprehensive coverage. By collaborating with community organizations and advocacy groups, Commissioners can work towards a more equitable and socially conscious insurance landscape.

Strengthening Regulatory Collaboration and Oversight

As the insurance industry becomes increasingly interconnected, with global markets and cross-border transactions, the need for enhanced regulatory collaboration and oversight becomes evident. Insurance Commissioners can play a leading role in establishing international regulatory standards and fostering cross-border cooperation.

By participating in international regulatory bodies and collaborating with counterparts from other jurisdictions, Commissioners can harmonize insurance regulations, ensuring consistent consumer protection and market integrity. This collaborative approach can streamline cross-border insurance transactions, making it easier for insurance companies to operate globally while maintaining high standards of conduct.

Furthermore, Commissioners can work towards establishing a unified framework for addressing emerging risks, such as cyber threats or pandemic-related disruptions. By sharing best practices and lessons learned, Commissioners can strengthen the resilience of the insurance industry, protecting policyholders and maintaining market stability.

Conclusion: A Commitment to Integrity and Consumer Protection

The role of an Insurance Commissioner is multifaceted and crucial to the health and integrity of the insurance industry. Through their regulatory powers and commitment to consumer protection, Commissioners ensure that insurance practices are fair, transparent, and aligned with the best interests of policyholders.

As we have explored, Insurance Commissioners navigate a complex landscape, addressing emerging risks, technological advancements, and evolving consumer needs. Their impact extends beyond regulatory actions, shaping the culture and practices of the insurance industry while empowering consumers to make informed decisions.

Looking to the future, Insurance Commissioners are poised to lead transformative change, embracing digital innovation, promoting consumer-centric practices, and addressing environmental and social challenges. By adapting to the evolving insurance landscape and fostering collaboration, Commissioners can drive the industry towards a more sustainable, ethical, and consumer-focused future.

In conclusion, the role of an Insurance Commissioner is not merely administrative; it is a guardian of trust and transparency, a champion of consumer rights, and a catalyst for positive change within the insurance industry. With their expertise and dedication, Commissioners ensure that insurance remains a reliable pillar of financial security and peace of mind for individuals, families, and businesses alike.

What is the primary role of an Insurance Commissioner?

+An Insurance Commissioner serves as the chief regulator of the insurance industry within their jurisdiction. Their primary role is to uphold fairness, transparency, and consumer protection, ensuring that insurance practices adhere to established laws and regulations.

How do Insurance Commissioners regulate insurance entities?

+Insurance Commissioners oversee the licensing and regulation of insurance companies, agents, and brokers. They enforce insurance laws, monitor market conduct, and evaluate the financial stability of insurance companies to ensure they meet regulatory standards.

What impact do Insurance Commissioner decisions have on the insurance industry?

+Insurance Commissioner decisions can have far-reaching effects, influencing insurance industry practices, shaping consumer trust, and driving innovation. Their regulatory actions, consumer advocacy initiatives, and proactive measures set the tone for ethical conduct and transparency.

How do Insurance Commissioners address emerging risks and consumer needs?

+Insurance Commissioners stay abreast of changing demographics, societal trends, and environmental factors. They adapt regulatory frameworks to address emerging risks, such as climate change, and promote sustainable practices. Additionally, they prioritize consumer education and protection, empowering policyholders to make informed decisions.

What is the future vision for Insurance Commissioners?

+The future vision for Insurance Commissioners involves embracing digital transformation, promoting consumer-centric innovation, addressing environmental and social challenges, and strengthening regulatory collaboration. By adapting to emerging trends and fostering collaboration, Commissioners can drive positive change and ensure a sustainable future for the insurance industry.