Cheap Ny Auto Insurance

When it comes to finding cheap car insurance in New York, it's essential to understand the unique challenges and factors that influence auto insurance rates in this bustling state. With a dense population, heavy traffic, and a diverse range of drivers, navigating the world of auto insurance can be complex. However, with the right knowledge and strategies, it is possible to secure affordable coverage without compromising on essential protections. In this comprehensive guide, we will delve into the intricacies of cheap New York auto insurance, exploring the key factors that impact rates, offering expert tips, and providing valuable insights to help you make informed decisions.

Understanding the Cost of Auto Insurance in New York

New York, often referred to as the “Big Apple,” presents a unique set of circumstances that contribute to higher-than-average auto insurance rates. The state’s dense urban areas, like New York City, are notorious for heavy traffic congestion, increasing the risk of accidents and claims. Additionally, the diverse population and varying driving behaviors across different regions can significantly impact insurance costs.

Factors Influencing Auto Insurance Rates

Several key factors play a pivotal role in determining auto insurance premiums in New York. These include:

- Location: Urban areas often have higher rates due to increased traffic and accident risks. For instance, Manhattan and Brooklyn are known for their costly insurance premiums.

- Traffic and Accident Rates: Areas with heavy traffic and a high volume of accidents tend to see higher insurance costs. New York’s busy highways and major thoroughfares contribute to this.

- Population Density: The more densely populated an area, the higher the likelihood of accidents and claims. New York’s densely populated boroughs are prime examples.

- Driving Behavior: Different regions may have varying driving cultures, impacting insurance rates. Aggressive driving, for instance, can lead to more accidents and higher costs.

- Vehicle Usage: The purpose of your vehicle, such as daily commuting or occasional pleasure driving, can influence rates. More frequent usage may result in higher premiums.

- Driver Demographics: Insurance companies consider factors like age, gender, and driving experience when determining rates. Younger drivers, for example, often face higher premiums.

Understanding these factors is crucial as they provide a foundation for crafting strategies to reduce your auto insurance costs.

Strategies for Affordable Auto Insurance in New York

Securing affordable auto insurance in New York requires a thoughtful approach. Here are some expert strategies to help you save on your premiums:

1. Shop Around and Compare Quotes

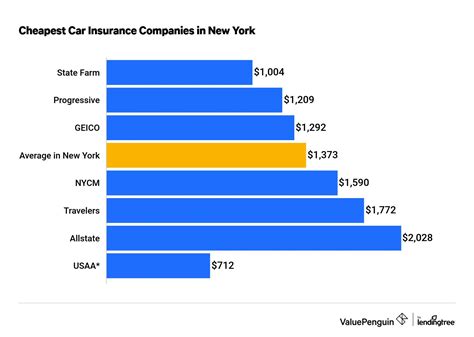

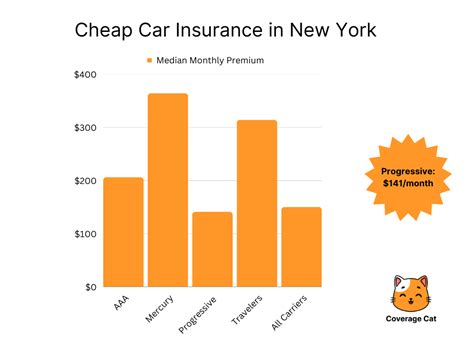

Don’t settle for the first insurance quote you receive. Shopping around and comparing rates from multiple providers is essential. Each insurance company uses its own formula to calculate premiums, so quotes can vary significantly. By comparing at least three to five quotes, you can identify the most competitive rates for your specific circumstances.

Online insurance comparison tools can be incredibly useful for this task. These platforms allow you to enter your information once and receive multiple quotes from different providers, making the process efficient and convenient.

| Insurance Provider | Average Premium |

|---|---|

| Provider A | $1,200 annually |

| Provider B | $1,500 annually |

| Provider C | $1,350 annually |

In this example, Provider A offers the most competitive rate. However, it's essential to consider other factors, such as coverage limits, customer service, and claims handling, when making your final decision.

2. Bundle Your Insurance Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with the same provider. Insurance companies often offer significant discounts when you combine multiple policies, as it reduces their administrative costs and increases customer loyalty.

For instance, let's say you currently have auto insurance with Provider X at $1,200 annually and home insurance with Provider Y at $800 annually. By bundling these policies with Provider X, you might be eligible for a discount of 10-15% on both policies, resulting in significant savings.

3. Choose a Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your monthly premiums. However, it’s important to choose a deductible that you can afford in the event of an accident or claim.

For example, if you currently have a $500 deductible and are comfortable with a higher amount, increasing it to $1,000 could lead to a 10-20% reduction in your monthly premiums. This strategy works best for responsible drivers who rarely file claims.

4. Maintain a Clean Driving Record

Insurance companies reward safe driving with lower premiums. A clean driving record, free of accidents and violations, is a key factor in obtaining affordable insurance. Even a single speeding ticket or minor accident can increase your rates significantly.

To keep your record clean, practice defensive driving, obey traffic laws, and avoid distractions while behind the wheel. Regularly review your driving habits and make adjustments to become a safer, more conscientious driver.

5. Explore Discounts and Rewards Programs

Insurance companies offer a variety of discounts and rewards programs to attract and retain customers. These can include discounts for:

- Safe driving records

- Multi-vehicle policies

- Good student status (for young drivers)

- Anti-theft devices installed in your vehicle

- Completing defensive driving courses

Ask your insurance provider about the discounts they offer and how you can qualify. Additionally, some insurance companies have rewards programs that provide cash back, gift cards, or other incentives for maintaining a good driving record and avoiding claims.

6. Consider Usage-Based Insurance (UBI)

Usage-Based Insurance, also known as Pay-As-You-Drive or Pay-How-You-Drive insurance, is an innovative approach to auto insurance that uses telematics technology to monitor your driving behavior. With UBI, your insurance premium is based on how, when, and where you drive.

UBI programs typically involve installing a small device in your vehicle or using a smartphone app to track your driving habits. The data collected includes speed, acceleration, braking, mileage, and time of day driven. Safe driving behaviors, such as avoiding sudden braking and maintaining a steady speed, can lead to significant discounts on your insurance premium.

While UBI may not be suitable for everyone, it can be an excellent option for responsible drivers who want to save money on their insurance. However, it's important to note that UBI may not be available in all states or with all insurance providers.

The Future of Affordable Auto Insurance in New York

The auto insurance landscape is constantly evolving, and New York is no exception. As technology advances, we can expect to see further innovations in the industry, offering new opportunities for drivers to save on their insurance premiums.

Emerging Technologies and Trends

Several emerging technologies and trends are shaping the future of auto insurance:

- Autonomous Vehicles: Self-driving cars are expected to significantly reduce accidents, leading to lower insurance costs over time. As these vehicles become more prevalent, insurance companies will need to adapt their policies and pricing structures.

- Connected Cars: With the increasing connectivity of vehicles, insurance companies can gather more detailed data on driving behavior. This data can be used to offer personalized insurance rates based on individual driving habits, potentially benefiting safe drivers.

- Advanced Driver Assistance Systems (ADAS): Features like lane departure warnings, automatic emergency braking, and adaptive cruise control are becoming more common in modern vehicles. These safety systems can reduce accident risks, leading to potential insurance discounts.

- Telematics and Data Analytics: Insurance companies are utilizing advanced data analytics to identify patterns and trends in driving behavior. This allows them to offer more accurate and personalized insurance rates, rewarding safe drivers with lower premiums.

The Role of Government and Regulation

Government regulations and initiatives also play a significant role in shaping the auto insurance industry. In New York, efforts are underway to address issues like fraud and ensure a fair and competitive insurance market.

For instance, the New York State Department of Financial Services has implemented measures to combat insurance fraud, which can drive up premiums for honest drivers. Additionally, the state is exploring ways to improve the insurance shopping experience, making it easier for consumers to compare rates and understand their coverage options.

Consumer Empowerment and Education

Empowering consumers with knowledge and tools is crucial for fostering a competitive and affordable insurance market. By understanding their rights, shopping around, and making informed choices, New York drivers can take control of their insurance costs.

Insurance companies are also investing in educational resources and tools to help consumers understand their coverage options and make more informed decisions. This includes online calculators, interactive tools, and comprehensive guides to demystify the insurance process.

Conclusion: Navigating the Road Ahead

Securing cheap car insurance in New York is a journey that requires knowledge, strategy, and a willingness to explore various options. By understanding the unique factors that influence rates in the state and implementing the expert strategies outlined in this guide, you can navigate the complex world of auto insurance with confidence.

Remember, the key to success lies in staying informed, comparing quotes, and taking advantage of the discounts and programs available to you. With the right approach, you can find affordable auto insurance coverage that meets your needs and budget without compromising on essential protections.

So, embark on your journey towards cheap New York auto insurance with confidence, knowing that you have the tools and knowledge to make informed decisions and secure the best rates for your circumstances.

What is the average cost of auto insurance in New York?

+The average cost of auto insurance in New York varies depending on several factors, including location, driving record, and the coverage chosen. As of 2022, the average annual premium for a liability-only policy in New York is around 1,100, while a full-coverage policy averages around 2,200.

Are there any state-specific discounts available for New York drivers?

+Yes, New York offers various state-specific discounts to its drivers. These include discounts for safe driving, completing approved driver education courses, and having anti-theft devices installed in your vehicle. It’s important to inquire with your insurance provider about these discounts and how to qualify.

Can I get cheap auto insurance if I have a poor driving record?

+Having a poor driving record, such as multiple accidents or violations, can significantly increase your insurance premiums. However, it’s still possible to find affordable coverage by shopping around and comparing quotes from different providers. Additionally, consider exploring usage-based insurance programs, which may offer lower rates based on your individual driving behavior.