Geico Insurance Policy

When it comes to choosing an insurance provider, having a comprehensive understanding of the policy options and coverage is crucial. This article delves into the specifics of GEICO's insurance policies, exploring the various aspects that make it a popular choice for many individuals and businesses. From its comprehensive coverage to its innovative features and customer-centric approach, GEICO offers a range of benefits that are worth exploring.

Comprehensive Coverage Options with GEICO

GEICO, known for its catchy advertising campaigns, provides much more than just clever slogans. It offers a wide array of insurance policies tailored to meet diverse needs. Whether you’re seeking auto insurance, homeowners insurance, renters insurance, or even life insurance, GEICO has you covered.

Auto Insurance: A Comprehensive Approach

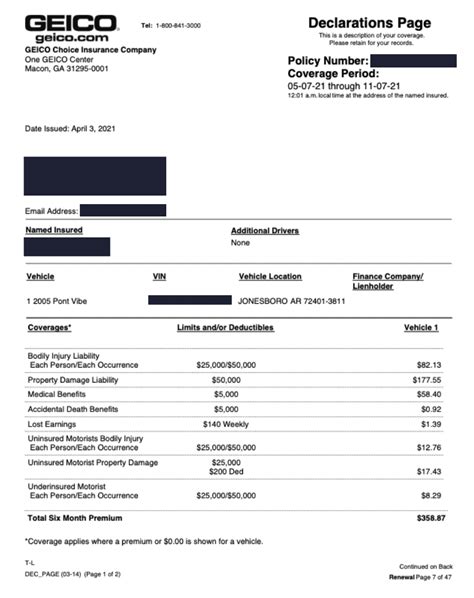

GEICO’s auto insurance policies are designed to offer extensive coverage while remaining affordable. The company provides standard coverage options such as liability, collision, and comprehensive insurance. Additionally, GEICO offers a range of optional add-ons to customize your policy according to your specific needs.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage liabilities to others. |

| Collision Coverage | Covers damages to your vehicle in case of an accident. |

| Comprehensive Coverage | Covers non-accident related damages like theft, vandalism, and natural disasters. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages resulting from an accident. |

| Uninsured/Underinsured Motorist Coverage | Protects you if an at-fault driver doesn't have enough insurance coverage. |

With GEICO, you can also benefit from various discounts. These include discounts for safe driving, multi-policy discounts, military discounts, and even discounts for having certain safety features in your vehicle. Additionally, GEICO offers unique programs like its Accident Forgiveness feature, which prevents your rates from increasing after your first at-fault accident.

Homeowners and Renters Insurance: Protecting Your Belongings

For homeowners, GEICO offers a range of coverage options to protect your home and its contents. This includes coverage for the structure of your home, personal belongings, liability protection, and additional living expenses in case you need to relocate temporarily due to a covered loss.

Renters insurance, often overlooked, is another vital coverage provided by GEICO. It safeguards your personal belongings against damage or theft and provides liability protection in case someone is injured in your rental unit. With GEICO's renters insurance, you can customize your coverage to suit your specific needs and budget.

Life Insurance: Planning for the Future

GEICO also offers life insurance policies to help secure your family’s financial future. Their term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is an affordable option for those seeking financial protection for their loved ones.

Additionally, GEICO offers permanent life insurance, which provides coverage for your entire life and includes a cash value component that grows over time. This type of policy offers more flexibility and can be a valuable tool for estate planning and wealth accumulation.

Innovative Features and Customer-Centric Approach

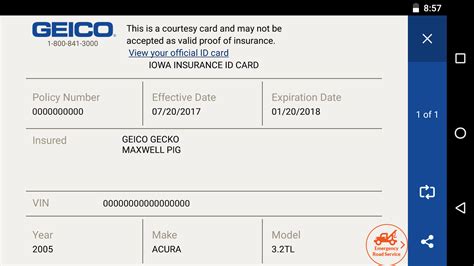

GEICO sets itself apart by continually innovating its services and prioritizing customer satisfaction. One of its standout features is the GEICO Mobile App, which allows policyholders to manage their insurance needs conveniently from their smartphones. The app provides easy access to policy details, allows for quick claims filing, and offers a range of helpful tools, including a digital ID card and accident support.

Furthermore, GEICO's 24/7 customer service is renowned for its efficiency and friendliness. Policyholders can reach a representative at any time via phone, email, or live chat, ensuring that their queries and concerns are addressed promptly.

Digital Convenience and Claim Support

In today’s digital age, GEICO understands the importance of offering convenient online services. Their website provides a user-friendly interface where customers can easily navigate to find information, manage their policies, and even get instant quotes. The online platform also offers a range of educational resources to help customers understand their insurance options better.

When it comes to claims, GEICO aims to make the process as smooth as possible. Policyholders can file claims online, over the phone, or using the mobile app. GEICO's dedicated claims team works diligently to process claims quickly and efficiently, ensuring that customers receive the support they need during challenging times.

Community Involvement and Corporate Responsibility

Beyond its insurance offerings, GEICO actively contributes to the communities it serves. The company supports various charitable initiatives and is committed to environmental sustainability. GEICO’s corporate social responsibility efforts include partnering with organizations that promote education, health, and safety, as well as initiatives focused on reducing its environmental impact.

The Bottom Line: Why Choose GEICO Insurance Policies

GEICO’s insurance policies offer a compelling combination of comprehensive coverage, competitive pricing, and innovative features. With its range of insurance options, discounts, and customer-centric approach, GEICO provides a compelling value proposition for individuals and businesses seeking reliable insurance coverage.

Whether you're a first-time insurance buyer or looking to switch providers, exploring GEICO's policies is certainly worth considering. Their commitment to customer satisfaction and continuous innovation ensures that policyholders receive the best possible experience and value for their insurance needs.

What are the key benefits of GEICO’s auto insurance policies?

+GEICO’s auto insurance policies offer a comprehensive range of coverage options, including liability, collision, and comprehensive insurance. They also provide a variety of add-ons to customize your policy. Additionally, GEICO offers competitive pricing and a range of discounts, making it an affordable choice for many drivers.

How does GEICO’s homeowners insurance protect my property?

+GEICO’s homeowners insurance provides coverage for the structure of your home, personal belongings, and additional living expenses in case of a covered loss. It also includes liability protection, ensuring you’re covered in case someone is injured on your property.

What are the different types of life insurance offered by GEICO?

+GEICO offers both term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage with a cash value component.

How can I access my GEICO policy information and file claims?

+GEICO policyholders can access their policy information and file claims through the GEICO Mobile App, their website, or by contacting GEICO’s 24⁄7 customer service. The app and online platform offer convenient tools for managing policies and filing claims quickly.

What sets GEICO apart from other insurance providers?

+GEICO stands out for its comprehensive coverage options, competitive pricing, and innovative features like the GEICO Mobile App. Additionally, their commitment to customer satisfaction and continuous improvement ensures a positive experience for policyholders.