Cost Of Wegovy With Insurance

Wegovy, also known as semaglutide, is a prescription medication that has gained significant attention in the field of weight management and diabetes treatment. As an analog of the human glucagon-like peptide-1 (GLP-1) hormone, Wegovy works by regulating appetite and blood sugar levels, leading to potential weight loss and improved glycemic control. However, one of the primary concerns for individuals considering Wegovy is the cost, especially when it comes to insurance coverage and out-of-pocket expenses.

Understanding the Cost of Wegovy

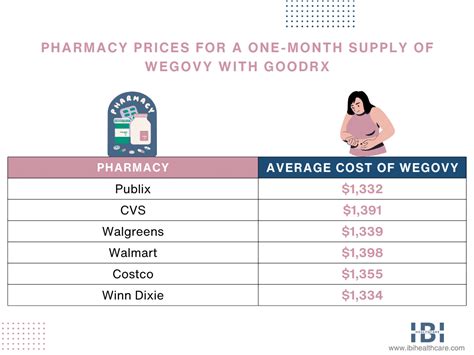

The cost of Wegovy can vary significantly depending on several factors, including the dosage, the pharmacy or retailer where it is purchased, and, most importantly, the individual’s insurance coverage. Wegovy is typically available in two dosages: 2.4 mg, which is used for weight management, and 0.5-1.0 mg for diabetes treatment. The price per dose can range from 80 to 150, with the higher dose being more expensive. It is essential to note that these prices represent the cost without insurance coverage.

Dosage and Frequency

Wegovy is administered once weekly via subcutaneous injection. The recommended starting dose for weight management is 2.4 mg, and the dose may be adjusted by a healthcare professional based on the individual’s response and tolerance. For diabetes treatment, the starting dose is typically lower, ranging from 0.25 mg to 0.5 mg, with potential dose increases over time.

| Dosage | Cost per Dose |

|---|---|

| 2.4 mg (Weight Management) | $80 - $150 |

| 0.5-1.0 mg (Diabetes Treatment) | $80 - $120 |

Insurance Coverage for Wegovy

The good news is that many insurance plans cover Wegovy for both weight management and diabetes treatment. However, the extent of coverage can vary greatly. Some insurance providers may cover the medication at a lower cost-sharing level, such as a small co-pay or co-insurance rate, while others may require a higher out-of-pocket expense, or even a prior authorization process to approve the prescription.

Navigating Insurance Coverage

When considering Wegovy, it is crucial to understand your insurance coverage and the potential out-of-pocket costs. Here are some steps to navigate insurance coverage for Wegovy:

- Check Your Insurance Benefits: Contact your insurance provider to understand your prescription drug coverage. Ask about any specific restrictions, prior authorization requirements, or preferred pharmacies for Wegovy.

- Review Your Formulary: Every insurance plan has a list of covered medications, known as a formulary. Ensure that Wegovy is included in your plan's formulary and at what tier it is classified. Higher tiers may result in higher out-of-pocket costs.

- Explore Discount Programs: Some pharmaceutical companies offer patient assistance programs or co-pay cards that can reduce the cost of Wegovy. These programs may provide significant savings, especially for those with high out-of-pocket expenses.

- Consider Mail-Order Pharmacies: Many insurance plans offer lower costs or additional benefits when using mail-order pharmacies for specialty medications like Wegovy. These pharmacies often provide discounts and convenient home delivery options.

- Negotiate with Your Doctor: Discuss your financial concerns with your healthcare provider. They may be able to work with you and your insurance company to find a suitable treatment plan, including exploring alternative medications or adjusting the dosage to optimize coverage and affordability.

Real-World Examples of Insurance Coverage for Wegovy

To illustrate the variability in insurance coverage for Wegovy, let’s examine a few real-world scenarios:

Scenario 1: Commercial Insurance

John, a 45-year-old individual with commercial insurance, was prescribed Wegovy for weight management. His insurance plan had a preferred pharmacy program, and by using one of the approved pharmacies, he was able to obtain Wegovy for a co-pay of 40 per dose. With a weekly injection, his out-of-pocket cost for Wegovy was 160 per month.

Scenario 2: Medicare Part D

Emily, a 68-year-old with Medicare Part D coverage, was prescribed Wegovy for diabetes treatment. Her Medicare plan had a standard deductible of 445 for specialty medications. After meeting the deductible, Emily's co-insurance rate for Wegovy was 25%, resulting in an out-of-pocket cost of 20 per dose. With a monthly prescription, her total out-of-pocket expense for Wegovy was $80.

Scenario 3: Medicaid

David, a 32-year-old with Medicaid coverage, was prescribed Wegovy for weight management. His Medicaid plan covered Wegovy at a 100% rate, meaning he had no out-of-pocket expense for the medication. This scenario demonstrates the potential for significant cost savings when insurance coverage is comprehensive.

Financial Assistance Programs for Wegovy

For individuals facing financial barriers to accessing Wegovy, several financial assistance programs are available. These programs aim to make the medication more affordable for those in need.

NovoCare® Support Program

Novo Nordisk, the manufacturer of Wegovy, offers the NovoCare® Support Program. This program provides co-pay assistance, free product samples, and other support services for eligible individuals. The program can reduce the out-of-pocket cost of Wegovy, making it more accessible for those with financial constraints.

Patient Assistance Programs

Various patient assistance programs are available through independent organizations and charities. These programs provide free or low-cost medications to individuals who meet specific income and eligibility criteria. By applying to these programs, individuals may receive significant discounts or even free access to Wegovy.

Generic Alternatives and Future Cost Reductions

While Wegovy is currently a brand-name medication, the potential for generic alternatives in the future may significantly reduce its cost. Generic medications are typically much more affordable than their brand-name counterparts, as they do not incur the same research and development costs. As the patent for Wegovy expires, generic versions are likely to become available, making the medication more accessible and cost-effective for a wider range of individuals.

Conclusion: Making Informed Decisions About Wegovy

Understanding the cost of Wegovy with insurance coverage is a crucial step in making informed decisions about your healthcare. By navigating insurance benefits, exploring financial assistance programs, and staying informed about potential generic alternatives, individuals can make choices that align with their financial circumstances and healthcare needs. Remember, it is always essential to consult with healthcare professionals and insurance providers to ensure you have accurate and up-to-date information regarding the cost and coverage of Wegovy.

Frequently Asked Questions

Can I use Wegovy if I don’t have insurance coverage?

+Yes, it is possible to use Wegovy without insurance coverage. However, the out-of-pocket cost can be significant, ranging from 80 to 150 per dose. Uninsured individuals may benefit from exploring financial assistance programs or waiting for the potential release of generic alternatives in the future.

Are there any restrictions on insurance coverage for Wegovy?

+Insurance coverage for Wegovy can vary depending on the insurance provider and the individual’s plan. Some plans may require prior authorization, have specific dosage restrictions, or have higher cost-sharing rates for certain dosages. It’s essential to review your insurance benefits and consult with your healthcare provider to understand any potential restrictions.

How can I reduce the cost of Wegovy with insurance coverage?

+There are several strategies to reduce the cost of Wegovy with insurance coverage. These include using preferred pharmacies, exploring co-pay cards or discount programs, and considering mail-order pharmacies. Additionally, negotiating with your healthcare provider and insurance company can sometimes lead to more affordable treatment options.