Renters Insurance What Does It Cover

Renters Insurance: Understanding the Coverage and Protecting Your Peace of Mind

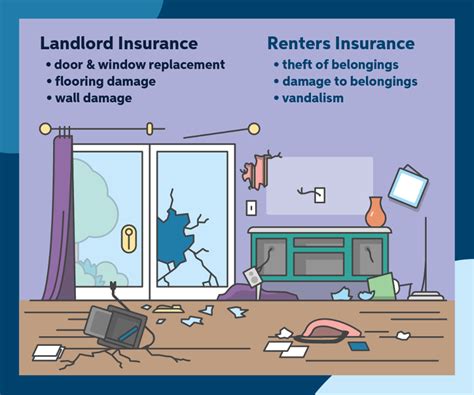

In the world of rental properties, where tenants often bring their personal belongings and create a home away from home, understanding renters insurance is crucial. This type of insurance provides a safety net for individuals who rent their living spaces, offering protection against unforeseen events that could lead to financial burdens. Let's delve into the specifics of renters insurance, exploring what it covers, why it's essential, and how it can safeguard your possessions and peace of mind.

The Comprehensive Coverage of Renters Insurance

Renters insurance is a comprehensive policy designed to cover a wide range of scenarios that may affect tenants. It typically includes the following key components:

Personal Property Protection

One of the primary purposes of renters insurance is to safeguard your personal belongings. This coverage ensures that if your possessions are damaged, destroyed, or stolen due to a covered event, you will receive financial compensation to replace or repair them. From furniture and appliances to clothing and electronics, renters insurance provides peace of mind knowing your valuables are protected.

| Covered Items | Protection Details |

|---|---|

| Furniture | Covers damage or loss from fires, theft, and natural disasters. |

| Electronics | Provides coverage for theft, power surges, and accidental damage. |

| Clothing | Reimburses you for clothing losses due to covered incidents. |

| Jewelry and Collectibles | May require additional coverage or riders for high-value items. |

Liability Protection

Renters insurance also extends to liability coverage, which is a critical aspect for tenants. This coverage protects you from financial responsibility in the event that someone is injured on your rental property or if your actions inadvertently cause damage to others' property.

For instance, if a guest trips and falls in your rental unit, resulting in injuries, your renters insurance can provide coverage for their medical expenses and any legal costs you may incur. Similarly, if your pet causes damage to the rental property or harms someone, liability coverage can step in to mitigate the financial impact.

Additional Living Expenses

In certain situations, such as a fire or severe storm that renders your rental unit uninhabitable, renters insurance can cover the additional costs of temporary housing and meals. This coverage ensures that you have a place to stay and can maintain a semblance of normalcy during the restoration process.

Medical Payments to Others

This coverage applies when someone sustains minor injuries on your rental property. It provides for the medical expenses of the injured party, regardless of fault. This can be particularly beneficial in preventing small incidents from escalating into legal disputes.

Real-Life Scenarios: When Renters Insurance Steps In

Consider the following examples where renters insurance can make a significant difference:

Scenario 1: Natural Disaster

Imagine a tenant, Sarah, whose rental unit is flooded during a severe storm. Her furniture, electronics, and personal items are ruined. With renters insurance, Sarah can file a claim and receive compensation to replace her damaged belongings, helping her get back on her feet faster.

Scenario 2: Theft

John, a tenant, discovers that his apartment has been broken into, and several valuable items, including his laptop and jewelry, are missing. Renters insurance steps in to reimburse him for the stolen items, reducing the financial impact of the theft.

Scenario 3: Liability Concern

Emily, a tenant, accidentally starts a fire in her kitchen while cooking. The fire spreads, causing damage to her unit and the neighboring apartment. Her renters insurance policy's liability coverage kicks in, covering the repairs and any legal costs associated with the incident.

Customizing Your Renters Insurance Policy

Renters insurance policies can be tailored to meet your specific needs. Here are some ways to customize your coverage:

- Adjust Coverage Limits: Increase or decrease the coverage limits for your personal property to match the actual value of your belongings.

- Add Riders for High-Value Items: If you have valuable possessions like jewelry, artwork, or musical instruments, you can add riders to your policy to ensure they are adequately covered.

- Choose Deductibles: Select a deductible amount that aligns with your budget and risk tolerance. A higher deductible may result in lower premiums.

- Optional Coverage: Consider adding optional coverages like identity theft protection or rental unit improvements and betterments coverage.

The Benefits of Renters Insurance: Peace of Mind and Financial Security

Renters insurance offers a range of advantages that contribute to a tenant's overall well-being and financial security:

- Peace of Mind: Knowing that your possessions and personal liability are protected gives you the freedom to enjoy your rental home without constant worry.

- Financial Protection: In the event of a covered loss, renters insurance provides financial assistance to replace or repair your belongings, preventing a sudden financial strain.

- Legal Defense: Liability coverage ensures that you have legal representation if a claim is made against you, offering peace of mind in potentially stressful situations.

- Additional Support: The additional living expenses coverage provides a safety net during unexpected displacements, ensuring you can maintain your standard of living.

Choosing the Right Renters Insurance Policy

When selecting a renters insurance policy, it's essential to consider the following factors:

- Coverage Options: Ensure the policy covers your specific needs, including personal property, liability, and additional living expenses.

- Reputable Insurer: Choose an insurance provider with a strong reputation and a history of prompt claim settlements.

- Policy Limits and Deductibles: Review the coverage limits and deductibles to ensure they align with the value of your possessions and your financial situation.

- Discounts and Bundles: Look for opportunities to save, such as multi-policy discounts or bundle deals with other insurance types.

- Claims Process: Inquire about the insurer's claims process and customer service reputation to ensure a smooth experience when filing a claim.

Conclusion: Empowering Tenants with Knowledge and Protection

Renters insurance is an essential tool for tenants, providing a safety net against unforeseen events and offering peace of mind. By understanding the comprehensive coverage it offers, from protecting personal belongings to liability and additional living expenses, tenants can make informed decisions to safeguard their possessions and financial well-being. With the right policy in place, renters can navigate the challenges of rental living with confidence and security.

How much does renters insurance typically cost?

+The cost of renters insurance varies depending on several factors, including the coverage limits, deductibles, and location. On average, renters insurance policies range from 15 to 30 per month, making it an affordable option for most tenants. However, it’s important to shop around and compare quotes to find the best coverage at the most competitive price.

Does renters insurance cover my roommate’s belongings as well?

+Renters insurance policies typically cover the personal property of all individuals listed on the lease or rental agreement. So, if your roommate is officially recognized as a tenant, their belongings should be covered under your policy. However, it’s always a good idea to verify this with your insurance provider and ensure that your roommate’s possessions are adequately insured.

What if I own high-value items like expensive artwork or jewelry? Are they covered by renters insurance?

+Renters insurance policies often have limits on coverage for high-value items. While basic policies may provide some coverage, it might not be sufficient for valuable possessions. To ensure these items are adequately protected, you can add riders or endorsements to your policy, which will increase your coverage limits specifically for these high-value items. This way, you can have peace of mind knowing your valuable belongings are insured.