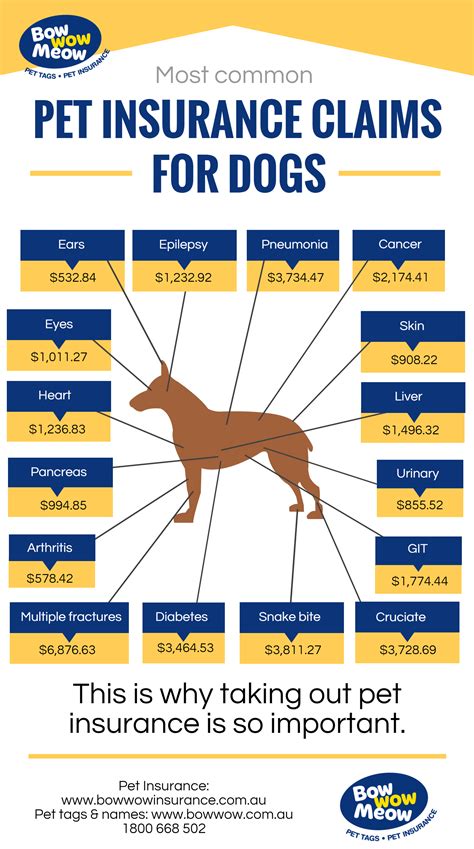

Average Pet Insurance Cost

Pet insurance has become an increasingly popular way for pet owners to protect their furry companions and manage the financial risks associated with veterinary care. As the costs of veterinary treatments continue to rise, understanding the average expenses related to pet insurance is essential for anyone considering this form of coverage. This article will delve into the various factors influencing the cost of pet insurance, provide real-world examples, and offer insights to help you make informed decisions about insuring your pet.

Understanding the Factors that Affect Pet Insurance Costs

The cost of pet insurance can vary significantly depending on several key factors. These include the type of coverage chosen, the age and breed of the pet, the geographical location, and the overall health of the animal. By examining these factors in detail, we can gain a clearer understanding of how insurance providers calculate premiums and what influences the final cost.

Type of Coverage

Pet insurance policies come in various forms, each with its own set of features and coverage limits. The most common types are accident-only, illness-only, and comprehensive plans that cover both accidents and illnesses. Accident-only policies are typically the most affordable, as they only cover injuries resulting from accidents, such as broken bones or wounds. Illness-only plans, on the other hand, provide coverage for non-accident-related health issues, including chronic conditions like diabetes or kidney disease. Comprehensive plans offer the most extensive coverage, protecting pets against both accidents and illnesses.

Within each type of policy, there are additional variables that can impact the cost. These include the annual limit (the maximum amount the insurer will pay out per year), the reimbursement rate (the percentage of eligible expenses the insurer covers), and the deductible (the amount the pet owner must pay out of pocket before the insurance kicks in). Policies with higher annual limits, more generous reimbursement rates, and lower deductibles generally come with higher premiums.

Age and Breed of the Pet

The age and breed of a pet are significant factors in determining insurance costs. Younger pets are generally healthier and pose a lower risk to insurers, resulting in lower premiums. As pets age, their risk of developing health issues increases, leading to higher insurance costs. For example, a 2-year-old Labrador Retriever might have an average monthly premium of 30, while a 10-year-old Labrador of the same breed could see premiums rise to 50 or more.

Certain breeds are also predisposed to specific health conditions, which can affect insurance costs. For instance, brachycephalic breeds like Bulldogs and Pugs are known to have respiratory issues, which can lead to higher veterinary bills and, consequently, higher insurance premiums. Similarly, large breeds like Great Danes and Saint Bernards are prone to joint problems, which can also drive up insurance costs.

Geographical Location

The cost of living and the availability of veterinary services in a given area can influence pet insurance premiums. In regions with a higher cost of living, veterinary fees tend to be higher, which can result in increased insurance costs. Additionally, areas with a higher concentration of veterinary specialists may also see higher insurance premiums, as these specialists often charge more for their services.

Health of the Pet

The overall health of a pet is a critical factor in determining insurance costs. Pets with pre-existing conditions or a history of illness may be considered a higher risk by insurers, leading to increased premiums or even policy exclusions for certain conditions. It’s important to note that while pet insurance can cover ongoing conditions, most policies have a waiting period (often around 14 days) before they will cover claims related to pre-existing conditions.

Furthermore, pets that have already undergone significant veterinary treatment may be considered a higher risk. For instance, a dog that has recently had surgery for a torn ACL might face higher insurance premiums or even difficulty finding a provider willing to insure them. In such cases, pet owners may need to shop around and compare policies to find the best coverage for their pet's specific needs.

Real-World Examples of Pet Insurance Costs

To provide a clearer picture of the average costs associated with pet insurance, let’s examine some real-world examples based on data from leading insurance providers.

Example 1: Young, Healthy Pet

Let’s consider the case of a 2-year-old, mixed-breed dog named Max. Max is a healthy, active dog with no known health issues. His owner opts for a comprehensive pet insurance plan with an annual limit of 10,000, an 80% reimbursement rate, and a 250 deductible. Based on this plan, Max’s average monthly premium is expected to be around $35.

| Plan Feature | Cost |

|---|---|

| Annual Limit | $10,000 |

| Reimbursement Rate | 80% |

| Deductible | $250 |

| Average Monthly Premium | $35 |

Example 2: Older Pet with Pre-existing Condition

Now, let’s look at the case of a 10-year-old, purebred Labrador Retriever named Bella. Bella has a history of hip dysplasia, a common condition in her breed. Her owner opts for an illness-only plan with an annual limit of 5,000, a 70% reimbursement rate, and a 300 deductible. Given Bella’s age and pre-existing condition, her average monthly premium is expected to be around $65.

| Plan Feature | Cost |

|---|---|

| Annual Limit | $5,000 |

| Reimbursement Rate | 70% |

| Deductible | $300 |

| Average Monthly Premium | $65 |

Example 3: Comprehensive Plan for a High-Risk Breed

Consider the situation of a 3-year-old French Bulldog named Charlie. French Bulldogs are considered a high-risk breed due to their predisposition to respiratory issues. Charlie’s owner opts for a comprehensive plan with an annual limit of 15,000, a 90% reimbursement rate, and a 200 deductible. Given Charlie’s breed and the extensive coverage chosen, his average monthly premium is expected to be around $70.

| Plan Feature | Cost |

|---|---|

| Annual Limit | $15,000 |

| Reimbursement Rate | 90% |

| Deductible | $200 |

| Average Monthly Premium | $70 |

Tips for Choosing the Right Pet Insurance Policy

When selecting a pet insurance policy, there are several key considerations to keep in mind. Here are some expert tips to help you make an informed decision:

- Assess Your Pet's Risk Factors: Evaluate your pet's age, breed, and overall health. Consider any pre-existing conditions or potential genetic predispositions to certain health issues. This will help you understand the level of coverage your pet may require.

- Compare Different Plans: Don't settle for the first policy you find. Compare multiple plans from different providers to find the best coverage at the most competitive price. Look at the annual limits, reimbursement rates, deductibles, and any additional benefits or exclusions.

- Understand the Waiting Periods: Most policies have waiting periods for certain conditions, especially pre-existing ones. Ensure you're aware of these waiting periods to avoid any surprises when you need to make a claim.

- Read the Fine Print: Carefully review the policy's terms and conditions. Pay attention to any exclusions, limitations, or specific clauses that may affect your coverage. Make sure you understand what's covered and what's not.

- Consider Additional Benefits: Some policies offer additional benefits like routine care coverage, wellness exams, or even alternative therapies. While these may increase the premium, they can provide significant value for certain pet owners.

- Check for Discounts: Look for providers that offer discounts for multiple pets, loyalty programs, or automatic payment options. These small savings can add up over time.

Performance Analysis and Future Implications

The pet insurance market has been experiencing significant growth in recent years, with more pet owners recognizing the value of this coverage. As the industry continues to mature, we can expect to see further innovations and improvements in the policies offered. Insurance providers are likely to continue developing more comprehensive plans, potentially offering additional benefits such as coverage for alternative therapies or even mental health issues in pets.

Additionally, as veterinary medicine advances and new treatments become available, pet insurance providers may need to adapt their policies to include coverage for these emerging treatments. This could lead to more specialized plans tailored to specific breeds or health conditions. On the other hand, the increasing cost of veterinary care may also drive up insurance premiums, making it crucial for pet owners to carefully consider their coverage options.

Conclusion

Understanding the average cost of pet insurance is a crucial step in making informed decisions about protecting your pet’s health and well-being. By considering the various factors that influence insurance costs and comparing different policies, pet owners can find the best coverage for their beloved companions. Remember, the cost of insurance is a small price to pay for the peace of mind that comes with knowing your pet is protected against unexpected health issues.

How do I choose the right pet insurance provider?

+When selecting a pet insurance provider, it’s essential to research and compare multiple options. Consider factors such as the range of coverage, reputation, customer service, and any additional benefits or discounts offered. Reading reviews and seeking recommendations from other pet owners can also be helpful.

Can I get pet insurance for an older pet?

+Yes, many providers offer insurance for older pets, but the cost may be higher due to the increased risk of health issues. However, it’s always worth checking, as some providers may have policies specifically designed for senior pets.

What happens if I switch insurance providers?

+Switching insurance providers may result in a new waiting period for certain conditions, especially pre-existing ones. It’s important to carefully review the terms and conditions of your new policy to understand any potential limitations or exclusions.