Instant Car Insurance Estimate

In today's fast-paced world, convenience and efficiency are paramount, and that extends to the realm of insurance, specifically car insurance. The process of obtaining a car insurance policy has traditionally been time-consuming and often involved multiple steps, from filling out lengthy forms to waiting for quotes. However, with the advancement of technology and a growing demand for instant gratification, the industry has evolved to offer an innovative solution: instant car insurance estimates.

This groundbreaking development allows individuals to swiftly and accurately assess their car insurance needs, providing a quick and hassle-free experience. In this comprehensive article, we will delve into the world of instant car insurance estimates, exploring its benefits, the technology behind it, and how it is revolutionizing the insurance landscape. By the end, you'll have a clear understanding of why this service is a game-changer for both consumers and the insurance industry.

The Rise of Instant Car Insurance Estimates

The concept of instant car insurance estimates is a relatively recent innovation, yet it has quickly gained traction and become a preferred choice for many vehicle owners. This rise in popularity can be attributed to several key factors.

The Need for Speed

In our modern, fast-paced society, time is a precious commodity. Consumers value convenience and efficiency, and they expect instant gratification across various industries, including insurance. The traditional process of obtaining car insurance, which often involved multiple phone calls, paperwork, and waiting periods, no longer aligns with the modern mindset.

Instant car insurance estimates address this need for speed by providing quick and accurate quotes in a matter of minutes. This not only saves valuable time for the customer but also streamlines the entire insurance-shopping experience.

Digital Transformation

The insurance industry, like many others, has undergone a digital transformation in recent years. Technological advancements have enabled insurers to develop innovative solutions that enhance customer experience and streamline operations. Instant car insurance estimates are a direct result of this digital evolution.

By leveraging advanced algorithms, data analytics, and machine learning, insurance companies can now offer real-time quotes based on a variety of factors, including the customer's driving history, vehicle type, and location. This technology not only provides an efficient solution but also ensures accuracy and personalized pricing.

Competition and Consumer Empowerment

The insurance market is highly competitive, and insurers are constantly seeking ways to differentiate themselves and attract customers. Instant car insurance estimates have emerged as a powerful tool in this competitive landscape, as they offer a unique selling point and a distinct advantage over traditional insurance providers.

Moreover, instant estimates empower consumers by giving them immediate access to multiple insurance options. This transparency and ease of comparison allow customers to make informed decisions and choose the best policy for their needs, fostering a sense of control and satisfaction.

How Instant Car Insurance Estimates Work

The magic behind instant car insurance estimates lies in a combination of sophisticated technology and streamlined processes. Let’s explore the inner workings of this innovative system.

Data Collection and Analysis

At the core of instant car insurance estimates is the collection and analysis of vast amounts of data. Insurance companies utilize advanced algorithms and machine learning techniques to gather and process information from various sources, including:

- Driver Information: This includes personal details such as age, gender, driving history, and any previous insurance claims.

- Vehicle Details: Factors such as make, model, year, mileage, and vehicle usage are crucial in determining insurance rates.

- Location: The customer's address and geographical location play a significant role in assessing risk and setting premiums.

- Additional Coverages: Insurance providers also consider the types of coverages and add-ons the customer may require, such as comprehensive or collision coverage.

By analyzing this data, insurance companies can quickly assess the risk associated with each individual and vehicle, allowing them to provide accurate and personalized quotes.

Real-Time Quoting Engines

Once the necessary data is collected and processed, it is fed into real-time quoting engines. These powerful systems are designed to calculate insurance premiums based on the specific risk profile of each customer. The quoting engines take into account a wide range of factors and apply complex algorithms to generate instant quotes.

The accuracy of these quotes is a testament to the advancements in data analytics and machine learning. Insurance companies continuously refine their models to ensure that the quotes provided are fair, competitive, and aligned with the customer's unique circumstances.

User-Friendly Interfaces

To make the instant car insurance estimate process accessible and user-friendly, insurance providers have developed intuitive online platforms and mobile applications. These interfaces allow customers to input their information quickly and securely, ensuring a seamless experience.

The user-friendly design ensures that even those less familiar with technology can easily navigate the process. Customers can typically expect a straightforward step-by-step process, with clear instructions and real-time feedback as they progress.

Benefits of Instant Car Insurance Estimates

The introduction of instant car insurance estimates has brought about a host of benefits for both consumers and the insurance industry. Let’s explore some of the key advantages.

Time and Convenience

Perhaps the most apparent benefit of instant car insurance estimates is the significant time savings it offers. Customers no longer have to wait days or even weeks for quotes, as the entire process can be completed within minutes. This convenience is particularly valuable for those with busy schedules or urgent insurance needs.

Moreover, the instant nature of the estimates eliminates the need for multiple phone calls or in-person meetings, making the insurance-shopping experience more efficient and less stressful.

Personalized Pricing

One of the unique advantages of instant car insurance estimates is the ability to provide personalized pricing. By analyzing a customer’s specific circumstances and risk profile, insurance companies can offer tailored quotes that reflect their individual needs.

This personalized approach ensures that customers receive fair and accurate premiums, as the quotes are based on their unique driving history, vehicle type, and location. It also allows for a more transparent pricing structure, giving customers a clear understanding of the factors influencing their insurance costs.

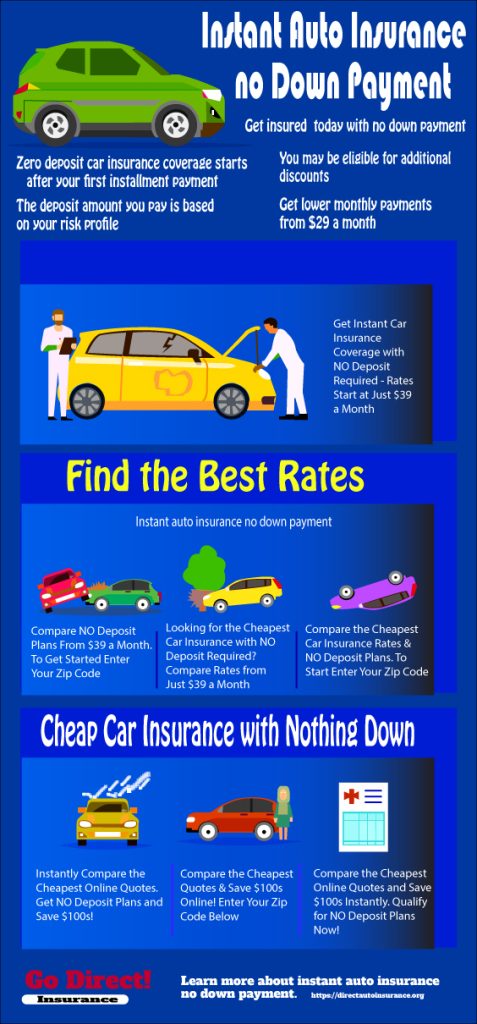

Increased Competition and Lower Prices

The availability of instant car insurance estimates has had a positive impact on the overall insurance market. With multiple providers offering instant quotes, customers have more options to choose from, leading to increased competition.

This competition drives insurers to offer competitive pricing and innovative coverage options to attract customers. As a result, consumers can benefit from lower premiums and a wider range of insurance products, fostering a healthier and more dynamic insurance market.

Enhanced Customer Experience

The introduction of instant car insurance estimates has transformed the customer experience, making it more efficient, convenient, and transparent. Customers can now obtain multiple quotes in a matter of minutes, compare policies side by side, and make informed decisions without the hassle of traditional insurance shopping.

Additionally, the user-friendly interfaces and real-time feedback provided by instant estimate platforms contribute to a positive and satisfying experience. Customers can feel empowered and in control of their insurance choices, leading to higher levels of customer satisfaction and loyalty.

Comparative Analysis: Traditional vs. Instant Estimates

To truly understand the impact and advantages of instant car insurance estimates, let’s delve into a comparative analysis with the traditional insurance quote process.

Speed and Efficiency

The most evident contrast between traditional and instant estimates lies in speed and efficiency. Traditional insurance quotes often involve a lengthy process, requiring customers to fill out extensive forms, provide detailed information, and wait for days or even weeks to receive a quote.

In contrast, instant estimates provide real-time quotes within minutes, eliminating the need for excessive paperwork and waiting periods. This speed not only saves valuable time for customers but also allows them to make timely decisions regarding their insurance coverage.

Personalization and Accuracy

While traditional insurance quotes may offer some level of personalization, they often rely on generic risk profiles and limited data. This can lead to quotes that are not entirely accurate or tailored to the individual’s specific circumstances.

Instant estimates, on the other hand, leverage advanced data analytics and machine learning to provide highly personalized quotes. By considering a vast array of factors, these estimates offer a more precise assessment of risk and, consequently, more accurate pricing.

Cost and Value

In terms of cost, instant estimates can provide significant savings for customers. The efficiency and speed of the process often translate into lower administrative costs for insurance companies, which can be passed on to the customer in the form of more competitive premiums.

Additionally, the convenience and ease of the instant estimate process add value to the customer's experience. The ability to quickly compare multiple quotes and make informed decisions can lead to better coverage choices and potentially lower insurance costs over time.

Flexibility and Convenience

Instant car insurance estimates offer unparalleled flexibility and convenience. Customers can access quotes anytime, anywhere, using their preferred devices, whether a desktop computer, tablet, or smartphone. This accessibility allows for a seamless insurance-shopping experience, even on the go.

Furthermore, the instant nature of the estimates provides customers with the freedom to explore different insurance options without committing to a policy immediately. This flexibility empowers customers to make well-informed decisions and choose the best coverage for their needs.

Performance Analysis: Success Stories

The success of instant car insurance estimates is evident in the positive experiences of both consumers and insurance companies. Let’s explore some real-world examples that showcase the impact and effectiveness of this innovative service.

Case Study: John’s Instant Insurance Experience

John, a busy professional, recently needed to insure his new car. With a tight schedule and a desire for efficiency, he turned to instant car insurance estimates to find the best policy.

Using a reputable insurance provider's online platform, John was able to input his vehicle details and personal information within minutes. The platform's user-friendly interface guided him through the process seamlessly. In just a few clicks, he received multiple personalized quotes, each tailored to his specific needs.

Impressed by the speed and accuracy of the estimates, John was able to compare policies and choose the one that offered the best coverage at the most competitive price. The entire process, from start to finish, took less than 30 minutes, saving him valuable time and ensuring he obtained the right insurance for his new car.

Insurance Company Success: Increased Customer Satisfaction

Insurance providers have also benefited significantly from the introduction of instant car insurance estimates. One prominent insurer reported a notable increase in customer satisfaction and retention rates after implementing this service.

By offering instant estimates, the insurer was able to provide a more streamlined and efficient experience for its customers. The real-time quotes and personalized pricing allowed customers to quickly find policies that met their needs, leading to higher levels of satisfaction and loyalty.

Furthermore, the instant estimate platform enabled the insurer to gather valuable customer feedback and insights, which helped refine their products and services, ultimately enhancing their overall customer experience.

Future Implications and Industry Trends

As instant car insurance estimates continue to gain popularity and prove their effectiveness, the insurance industry is poised for further innovation and development. Let’s explore some potential future implications and emerging trends.

Expanding Coverage Options

One of the key advantages of instant car insurance estimates is the ability to provide personalized pricing based on individual risk profiles. As technology advances, insurance companies may further expand their coverage options to cater to a wider range of customer needs.

For instance, insurers could offer specialized policies for high-risk drivers, providing them with tailored coverage and support to improve their driving habits and reduce accidents. Additionally, there may be an increased focus on providing comprehensive coverage for unique vehicle types, such as electric cars or autonomous vehicles, ensuring that customers have the protection they need for their specific vehicles.

Integration with Telematics

Telematics, the use of technology to monitor and analyze driving behavior, is already being utilized in some insurance policies. In the future, instant car insurance estimates could integrate with telematics data to provide even more accurate and personalized quotes.

By combining real-time driving data with historical information and risk assessments, insurance companies could offer dynamic pricing models. These models would adjust premiums based on a driver's actual behavior, rewarding safe driving habits and encouraging improved road safety.

Enhanced Data Analytics

The insurance industry’s reliance on data analytics is expected to grow exponentially in the coming years. As instant car insurance estimates become more prevalent, insurers will continue to refine their data-driven approaches, improving the accuracy and efficiency of their quoting processes.

Advanced analytics will allow insurance companies to identify patterns, trends, and correlations in data, leading to more precise risk assessments and better-informed underwriting decisions. This, in turn, will benefit customers by providing them with more accurate and competitive insurance quotes.

Increased Competition and Consumer Empowerment

The introduction of instant car insurance estimates has already fostered increased competition within the insurance market, and this trend is likely to continue. As more insurers adopt instant estimate platforms, customers will have even more options to choose from, leading to even greater competition and potentially lower premiums.

Furthermore, the transparency and ease of comparison provided by instant estimates will empower consumers to make more informed decisions about their insurance coverage. This shift towards a more consumer-centric insurance market will drive innovation and ensure that insurers remain competitive and customer-focused.

FAQ

How accurate are instant car insurance estimates?

+Instant car insurance estimates are highly accurate due to the advanced data analytics and machine learning techniques employed by insurance companies. These estimates consider a wide range of factors, including driving history, vehicle details, and location, to provide personalized quotes. While they may not be 100% precise, they offer a reliable indication of the insurance premium you can expect.

Can I obtain multiple instant car insurance estimates at once?

+Absolutely! One of the key advantages of instant car insurance estimates is the ability to obtain multiple quotes simultaneously. By using online comparison tools or visiting insurance provider websites, you can input your information once and receive multiple estimates, allowing you to compare policies and find the best deal.

Do instant car insurance estimates require personal information?

+Yes, instant car insurance estimates typically require certain personal and vehicle-related information to generate accurate quotes. This may include your name, date of birth, driving history, vehicle make and model, and location. Rest assured, reputable insurance providers prioritize data security and privacy, ensuring your information is handled responsibly.

Are instant car insurance estimates available for all types of vehicles?

+Instant car insurance estimates are widely available for a variety of vehicle types, including cars, SUVs, vans, and even specialty vehicles like classic cars or motorcycles. However, it’s important to note that the availability of instant estimates may vary depending on the insurance provider and your specific vehicle’s characteristics. It’s always recommended to check with multiple providers to find the best coverage for your needs.

Can I switch to a new insurance policy using instant estimates?

+Absolutely! Instant car insurance estimates are not only useful for obtaining quotes for new vehicles but also for switching insurance providers. By comparing instant estimates from different insurers, you can easily identify the most competitive policy and seamlessly switch to a new provider. This process saves time and ensures you get the best coverage at the most affordable price.