Reliance General Insurance

Overview

Reliance General Insurance, a prominent player in the Indian insurance market, has established itself as a trusted provider of comprehensive insurance solutions. With a rich history spanning [number] years, the company has consistently evolved to meet the diverse needs of its customers. This article delves into the key aspects of Reliance General Insurance, exploring its offerings, growth, and impact on the insurance landscape.

The Evolution of Reliance General Insurance

Reliance General Insurance’s journey began in [founding year], with a vision to revolutionize the insurance sector in India. Over the years, the company has demonstrated its commitment to innovation and customer-centricity. Here’s a glimpse into its evolution:

- Founding Years: Established by visionary leaders, the company laid the foundation for a robust insurance business, focusing on general insurance products.

- Expansion and Growth: Rapid expansion characterized the early years, with the company quickly gaining recognition for its reliable services and innovative approaches.

- Product Diversification: Recognizing the diverse needs of customers, Reliance General Insurance expanded its portfolio, offering a wide range of insurance products, including [list of insurance products].

- Digital Transformation: Embracing technology, the company launched digital initiatives, enabling customers to access insurance services conveniently online.

- Partnerships and Collaborations: Strategic alliances with leading industry players further strengthened Reliance General Insurance’s position, enhancing its reach and expertise.

Insurance Products and Services

Reliance General Insurance offers a comprehensive suite of insurance products designed to cater to various aspects of life. Let’s explore some of its key offerings:

Auto Insurance

- Car Insurance: Comprehensive coverage for vehicles, including third-party liability, accident repairs, and add-on benefits like roadside assistance.

- Two-Wheeler Insurance: Tailored policies for bike owners, providing protection against accidents and theft, with options for personalized coverage.

Health Insurance

- Individual Health Plans: Customizable health insurance plans, offering coverage for medical expenses, hospitalization, and critical illnesses.

- Family Floater Plans: Cost-effective solutions for families, providing coverage for multiple members under a single policy.

- Senior Citizen Health Plans: Specialized plans designed to meet the unique healthcare needs of elderly individuals.

Home Insurance

- Homeowners’ Insurance: Protection for homeowners against fire, natural disasters, and other risks, with options for personalized coverage.

- Renters’ Insurance: Tailored policies for tenants, covering their belongings and providing liability protection.

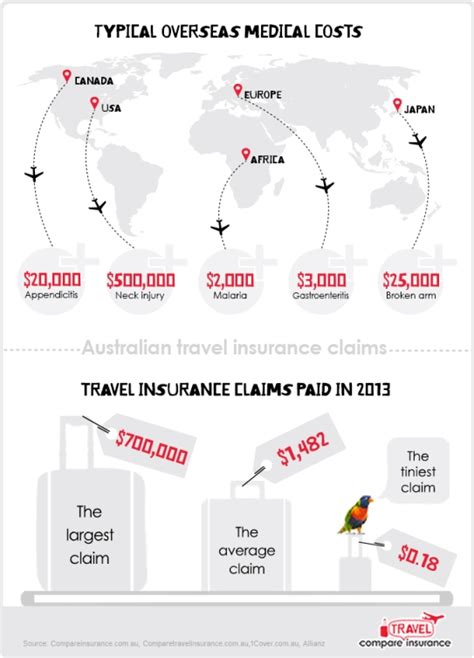

Travel Insurance

- Domestic Travel Insurance: Essential coverage for domestic trips, including medical emergencies, trip cancellations, and baggage loss.

- International Travel Insurance: Comprehensive plans for international travelers, offering global coverage and assistance during emergencies.

Commercial Insurance

- Business Insurance: Customized policies for small businesses, covering property, liability, and business interruption risks.

- Corporate Insurance: Tailored solutions for large corporations, providing comprehensive coverage for assets, employees, and liability risks.

Customer Experience and Digital Initiatives

Reliance General Insurance has prioritized enhancing the customer experience through various digital initiatives. Here’s an overview:

- Online Policy Purchase: Customers can conveniently purchase insurance policies online, simplifying the process and providing instant coverage.

- Digital Claims Process: A streamlined digital claims process ensures efficient and transparent claim settlements, reducing processing times.

- Mobile App: The Reliance General Insurance mobile app offers policyholders easy access to their policies, allowing them to manage their insurance portfolio on the go.

- Customer Support: A dedicated customer support team provides prompt assistance, addressing inquiries and resolving issues promptly.

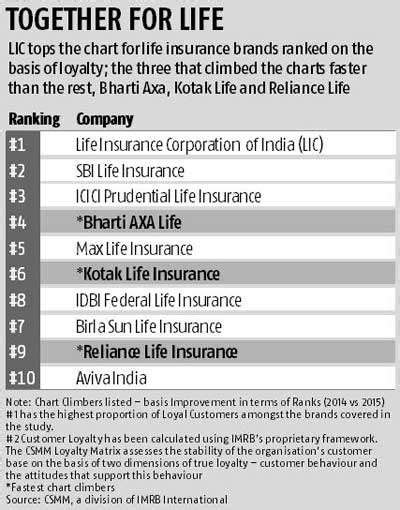

Industry Recognition and Awards

The company’s commitment to excellence has been recognized by various industry bodies and organizations. Some notable accolades include:

- [Award Name]: Awarded by [organization] for its outstanding contribution to the insurance sector, recognizing its innovative approaches and customer-centric services.

- [Award Name]: Recognized as the “Best General Insurance Company” by [industry publication], highlighting its strong financial performance and customer satisfaction.

- [Award Name]: Honored with the [award description] award, acknowledging its efforts in promoting financial inclusion and empowering customers.

Future Outlook and Innovations

Reliance General Insurance continues to stay ahead of the curve, focusing on future-ready innovations. Here’s a glimpse into its future initiatives:

- Digital Transformation: Further enhancing its digital capabilities, the company aims to leverage technology for improved customer engagement and streamlined processes.

- AI and Data Analytics: Integrating artificial intelligence and data analytics, Reliance General Insurance seeks to offer personalized insurance solutions and enhance risk assessment.

- Sustainability Initiatives: Committed to sustainability, the company plans to incorporate eco-friendly practices and support green initiatives, aligning with global sustainability goals.

- International Expansion: With a vision to expand globally, Reliance General Insurance is exploring opportunities to offer its insurance expertise and services in new markets.

Conclusion

Reliance General Insurance stands as a testament to the company’s dedication to protecting individuals, families, and businesses. With its comprehensive insurance offerings, customer-centric approach, and future-oriented innovations, the company is well-positioned to continue its growth trajectory. As it navigates the evolving insurance landscape, Reliance General Insurance remains committed to delivering exceptional value and peace of mind to its customers.

FAQ

How can I purchase Reliance General Insurance policies online?

+

To purchase Reliance General Insurance policies online, you can visit their official website and navigate to the ‘Buy Policy’ section. Select the type of insurance you require, fill in the necessary details, and follow the guided steps to complete the purchase.

What are the benefits of opting for digital insurance policies?

+

Digital insurance policies offer several benefits, including convenience, instant coverage, and the ability to manage policies online. Additionally, digital platforms often provide a more transparent and efficient claims process, enhancing the overall customer experience.

Does Reliance General Insurance offer insurance for specific industries or professions?

+

Yes, Reliance General Insurance offers specialized insurance solutions tailored to specific industries and professions. These policies are designed to address the unique risks and requirements of businesses in sectors such as healthcare, construction, and more.

How does Reliance General Insurance ensure customer satisfaction and support?

+

Reliance General Insurance prioritizes customer satisfaction through various initiatives. This includes a dedicated customer support team, easy-to-access online resources, and a commitment to transparent communication. The company also regularly seeks customer feedback to improve its services.

What are the future plans of Reliance General Insurance in terms of international expansion?

+

Reliance General Insurance is actively exploring opportunities to expand its presence globally. The company aims to leverage its expertise and innovative approaches to cater to insurance needs in new markets, offering its comprehensive range of insurance solutions to a wider audience.