Marketplace Insurance Income Limits

In today's dynamic insurance landscape, understanding the intricacies of marketplace insurance income limits is crucial for individuals and families seeking affordable healthcare coverage. These income limits, also known as Modified Adjusted Gross Income (MAGI) thresholds, determine eligibility for premium tax credits and cost-sharing reductions, significantly impacting the affordability and accessibility of health insurance plans.

Navigating Income Limits: A Comprehensive Guide

The marketplace insurance income limits are a key component of the Affordable Care Act (ACA), shaping the healthcare landscape for millions of Americans. These limits, expressed as percentages of the Federal Poverty Level (FPL), dictate who qualifies for financial assistance and to what extent. Let’s delve into the specifics.

Understanding Modified Adjusted Gross Income (MAGI)

MAGI is a critical metric in determining income eligibility for marketplace insurance plans. It is a comprehensive calculation that considers various income sources, including:

- Taxable Income: Wages, salaries, tips, and other forms of taxable earnings.

- Tax-Exempt Income: Certain types of interest, social security benefits, and retirement plan distributions.

- Tax Credits and Deductions: These can reduce taxable income and impact MAGI calculations.

By factoring in these elements, MAGI provides a holistic view of an individual’s or household’s financial situation, ensuring a fair assessment for premium tax credit eligibility.

Income Eligibility: Breaking Down the Percentages

Marketplace insurance income limits are categorized into brackets, each corresponding to a specific percentage of the Federal Poverty Level (FPL). Here’s a breakdown of these brackets and their implications:

| Income Range | Percentage of FPL | Eligibility for Premium Tax Credits |

|---|---|---|

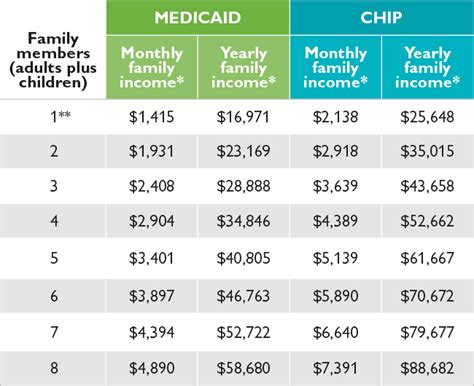

| Up to 138% | 138% | May qualify for Medicaid or the Children’s Health Insurance Program (CHIP) |

| 139% to 400% | 139% - 400% | Eligible for premium tax credits and cost-sharing reductions |

| 401% and above | 401% and up | Ineligible for premium tax credits |

It’s important to note that these percentages are subject to annual adjustments to account for inflation and changing economic conditions.

Calculating Your MAGI and Income Eligibility

Determining your MAGI and subsequent income eligibility involves a series of steps. Here’s a simplified breakdown:

- Gather Income Information: Collect data on all taxable and tax-exempt income sources for yourself and your family.

- Calculate Adjusted Gross Income (AGI): Start with your taxable income and subtract certain deductions and exclusions.

- Adjust AGI for MAGI: Add back specific tax-exempt items and credits to calculate MAGI.

- Compare MAGI to FPL: Use the FPL guidelines for your state and household size to determine your income bracket and eligibility.

Remember, these calculations can be complex, and it’s advisable to consult tax professionals or utilize reliable online tools and calculators for accuracy.

Premium Tax Credits: A Lifeline for Many

Premium tax credits are a cornerstone of marketplace insurance, providing vital financial assistance to those who qualify. These credits are designed to make healthcare coverage more affordable by reducing the monthly premium costs. The amount of the credit depends on your income and family size, with lower-income individuals and families receiving larger credits.

For example, let’s consider a hypothetical scenario where an individual with an annual income of 30,000 (150% FPL) purchases a marketplace insurance plan with a monthly premium of 400. If they qualify for a premium tax credit, the government may contribute a portion of that premium, say 250, leaving the individual responsible for only 150 per month.

Cost-Sharing Reductions: Enhancing Accessibility

In addition to premium tax credits, cost-sharing reductions are another crucial component of marketplace insurance. These reductions lower the out-of-pocket costs, such as deductibles, copayments, and coinsurance, for eligible individuals and families. By reducing these costs, healthcare becomes more accessible and affordable, especially for those with chronic conditions or frequent medical needs.

The Impact of Income Limits on Coverage Decisions

Understanding marketplace insurance income limits is not just about eligibility; it’s about making informed decisions regarding healthcare coverage. Here’s how income limits can influence your choices:

- Plan Selection: Income limits can guide you toward plans that offer the best value based on your financial situation. For instance, those with higher incomes might opt for plans with lower premiums but higher deductibles, while those with lower incomes may prioritize plans with lower out-of-pocket costs.

- Budgeting: Knowing your income eligibility can help you budget effectively for healthcare expenses, ensuring you choose a plan that aligns with your financial capabilities.

- Long-Term Planning: Income limits can influence career decisions and financial strategies. For example, freelancers or gig workers might consider their income variability when choosing healthcare plans.

Navigating Income Fluctuations and Life Changes

Income levels can fluctuate due to various life events, such as job changes, promotions, or family size adjustments. It’s important to understand how these changes impact your income eligibility and premium tax credits.

If your income increases, you may no longer qualify for premium tax credits or cost-sharing reductions. Conversely, a decrease in income could make you eligible for these benefits, even mid-year. Staying informed about these changes and their implications is crucial for managing your healthcare coverage effectively.

The Role of Professional Guidance

Given the complexity of income limits and eligibility criteria, seeking professional guidance can be invaluable. Tax professionals, insurance brokers, and healthcare navigators can provide personalized advice based on your unique circumstances. They can help you navigate the intricacies of the marketplace, ensuring you make the most informed decisions about your healthcare coverage.

Looking Ahead: Future Implications and Considerations

The landscape of marketplace insurance is continually evolving, and income limits are no exception. As healthcare policies and regulations adapt to changing societal needs, here are some key considerations for the future:

- Policy Changes: Keep an eye on potential policy shifts that could impact income limits and eligibility criteria. For instance, changes in the definition of MAGI or adjustments to FPL percentages could affect a significant number of individuals.

- Economic Fluctuations: Economic downturns or recessions can lead to income reductions for many, potentially increasing the number of individuals eligible for premium tax credits and cost-sharing reductions.

- Healthcare Reform: Ongoing discussions about healthcare reform could bring about significant changes to the marketplace, including adjustments to income limits and the structure of financial assistance.

Conclusion: Empowering Informed Decisions

Understanding marketplace insurance income limits is a critical step toward taking control of your healthcare journey. By grasping the intricacies of MAGI calculations, eligibility brackets, and the impact of income fluctuations, you can make informed choices about your healthcare coverage. Whether it’s selecting the right plan, budgeting effectively, or adapting to life changes, knowledge is power when it comes to navigating the marketplace.

As we continue to advocate for accessible and affordable healthcare, staying informed about these income limits and their implications remains essential. With the right information and guidance, individuals and families can make healthcare decisions that align with their financial realities and healthcare needs, ensuring a healthier and more secure future.

How often are income limits and FPL percentages adjusted?

+Income limits and FPL percentages are typically adjusted annually to account for inflation and changes in the cost of living. These adjustments ensure that the income brackets remain relevant and that individuals’ financial situations are accurately reflected.

Can I qualify for premium tax credits if my income fluctuates throughout the year?

+Yes, income fluctuations can impact your eligibility for premium tax credits. If your income decreases during the year, you may become eligible for these credits, even if you weren’t eligible at the beginning of the year. It’s important to monitor your income and adjust your healthcare plan accordingly.

What happens if I earn more than the income limit for premium tax credits?

+If your income exceeds the income limit for premium tax credits, you will not be eligible for these credits. However, you may still be able to purchase a marketplace insurance plan without financial assistance. It’s essential to carefully consider your budget and the cost of the plan to ensure it aligns with your financial capabilities.