Insurance Market Place

In the vast landscape of healthcare, the insurance marketplace plays a pivotal role, shaping the way individuals and businesses access essential medical services. With its complex web of policies, providers, and regulations, understanding the insurance marketplace is crucial for navigating the often-confusing world of healthcare coverage. This article aims to delve into the intricacies of this dynamic sector, offering a comprehensive guide for anyone seeking to grasp the fundamentals and future prospects of the insurance marketplace.

The Foundation: Understanding the Insurance Marketplace

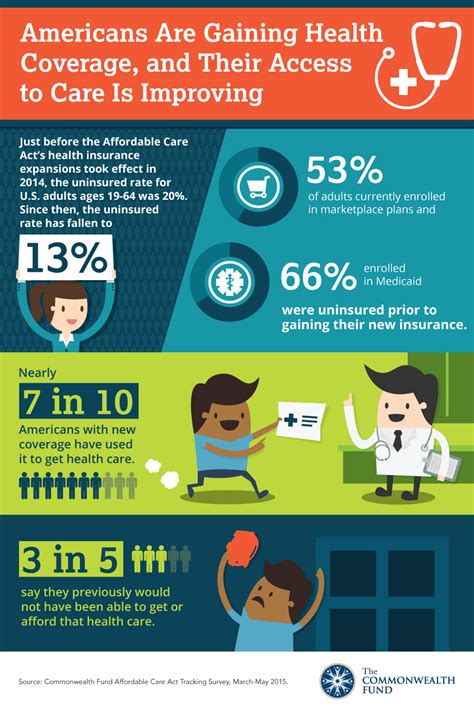

The insurance marketplace, at its core, serves as a platform where individuals and businesses can compare and purchase health insurance plans. This marketplace is a key component of the healthcare system, acting as a bridge between insurers and those in need of coverage. In the United States, the Affordable Care Act (ACA) established the Health Insurance Marketplace, commonly known as the Marketplace, which allows consumers to shop for and enroll in health insurance plans that meet specific criteria.

The Marketplace offers a range of benefits, including standardized plans that make it easier for consumers to compare options, subsidies for those who qualify based on income, and protection against discrimination based on pre-existing conditions. Additionally, the Marketplace often provides a simpler and more transparent process for purchasing insurance, especially for those who are new to the healthcare system or have limited experience with insurance.

Key Players in the Insurance Ecosystem

Several entities contribute to the functioning of the insurance marketplace. These include:

- Insurers: These are the companies that design and offer health insurance plans. They bear the financial risk associated with providing coverage and manage the network of healthcare providers.

- Healthcare Providers: Doctors, hospitals, and other medical professionals who deliver healthcare services to insured individuals. They play a crucial role in the marketplace as their participation determines the quality and availability of care.

- Government Regulators: Government bodies set the rules and guidelines for the insurance industry, ensuring fair practices and protecting consumer rights. In the U.S., the Department of Health and Human Services (HHS) plays a significant role in overseeing the Marketplace.

- Consumers: Individuals and families who purchase health insurance plans through the Marketplace. Their choices and behaviors significantly impact the marketplace's dynamics.

Navigating the Marketplace: A Step-by-Step Guide

Understanding the process of navigating the insurance marketplace is essential for making informed decisions about healthcare coverage. Here’s a simplified breakdown of the steps involved:

- Assess Your Needs: Start by evaluating your healthcare needs. Consider factors such as your current health status, any pre-existing conditions, and the healthcare services you anticipate needing in the coming year. This assessment will help you choose a plan that provides adequate coverage.

- Research Available Plans: Utilize the resources provided by the Marketplace to compare different insurance plans. Look at factors like premiums, deductibles, copayments, and the scope of coverage. Understand the network of healthcare providers associated with each plan to ensure your preferred doctors and facilities are included.

- Check Eligibility for Subsidies: Depending on your income, you may qualify for financial assistance, such as subsidies or tax credits, to reduce the cost of your insurance premiums. Use the Marketplace's tools to determine your eligibility and understand the potential savings.

- Enroll in a Plan: Once you've found a plan that meets your needs and budget, enroll during the open enrollment period. If you experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage, you may be eligible for a special enrollment period outside of the open enrollment window.

- Understand Your Coverage: Familiarize yourself with the details of your chosen plan, including what services are covered, any limitations or exclusions, and the steps you need to take to access care. This knowledge will help you make the most of your insurance and avoid unexpected costs.

Tips for a Smooth Enrollment Experience

- Gather all the necessary documents, such as proof of income and identification, before starting the enrollment process.

- Use the Marketplace’s online tools and resources, including calculators and comparison charts, to streamline your research and decision-making.

- If you have complex healthcare needs or are unsure about the best plan for your situation, consider seeking guidance from a healthcare professional or insurance expert.

The Impact of the Insurance Marketplace: A Real-World Perspective

The insurance marketplace has had a profound impact on the healthcare landscape, especially for individuals and families who previously struggled to access affordable coverage. For instance, consider the story of Sarah, a single mother living in a rural area. Before the implementation of the Marketplace, Sarah faced significant challenges in finding an insurance plan that suited her budget and provided adequate coverage for her and her children.

However, with the introduction of the Marketplace, Sarah was able to compare various plans and discover a cost-effective option that covered her family's needs. The Marketplace's tools and resources, such as income-based premium calculators and clear plan comparisons, empowered Sarah to make an informed decision, leading to improved healthcare access for her family.

Data-Driven Insights

The following table presents a snapshot of the insurance marketplace’s growth and impact:

| Metric | Value |

|---|---|

| Number of Enrollees (2022) | 14.6 million |

| Percentage of Uninsured Reduced (2013-2020) | 50% |

| Average Premium Reduction (2022) | 4.5% |

| States with Expanded Medicaid Coverage | 38 (as of 2023) |

The Future of the Insurance Marketplace: Trends and Innovations

As technology continues to advance and healthcare needs evolve, the insurance marketplace is poised for significant changes and improvements. Here are some key trends and innovations that are shaping the future of this industry:

1. Digital Transformation

The insurance marketplace is undergoing a digital revolution, with insurers and brokers leveraging technology to enhance the customer experience. Online portals and mobile apps now allow consumers to compare plans, enroll, and manage their policies more conveniently. Additionally, insurers are using data analytics to personalize offerings and improve risk assessment, leading to more efficient and effective coverage.

2. Focus on Preventive Care

There’s a growing emphasis on preventive healthcare measures within the insurance marketplace. Insurers are incentivizing policyholders to adopt healthier lifestyles and engage in regular preventive care, such as annual check-ups and screenings. This shift not only improves overall health outcomes but also reduces the cost burden for insurers and consumers alike.

3. Telemedicine Integration

The rise of telemedicine services has been a game-changer for the insurance marketplace. Insurers are increasingly incorporating telemedicine into their plans, offering policyholders the convenience of remote medical consultations and diagnostics. This integration not only improves access to healthcare, especially in remote areas, but also reduces costs by minimizing the need for in-person visits.

4. Personalized Coverage Options

The insurance marketplace is moving towards more tailored and personalized coverage options. Insurers are using data-driven approaches to offer plans that align with individual health needs and preferences. This could mean plans with specific benefits for chronic conditions or plans that cater to certain lifestyles, such as those focused on mental health or wellness.

5. Collaboration and Partnerships

Insurers are recognizing the value of collaboration and partnerships to enhance their offerings. They’re working with healthcare providers, technology companies, and other stakeholders to develop innovative solutions. For instance, partnerships with wearable technology companies can lead to incentives for policyholders who adopt healthy behaviors, tracked through these devices.

6. Regulatory Changes and Expansion

The insurance marketplace is influenced by regulatory changes, and the future may see further expansion and refinement of these regulations. This could include updates to the ACA or the introduction of new legislation that impacts the marketplace, potentially broadening access to coverage and improving consumer protections.

Conclusion: A Transformative Force in Healthcare

The insurance marketplace has emerged as a transformative force in the healthcare landscape, empowering individuals and families to take control of their healthcare coverage. Through its standardized plans, consumer-friendly tools, and focus on accessibility, the Marketplace has played a pivotal role in reducing the number of uninsured individuals and improving healthcare outcomes. As the industry continues to evolve, driven by technological advancements and a shifting healthcare landscape, the insurance marketplace is poised to become even more efficient, innovative, and tailored to the diverse needs of consumers.

FAQ

How do I know if I qualify for subsidies on the Marketplace?

+

Eligibility for subsidies is typically based on your household income. You can use the Marketplace’s income calculator to determine if you qualify. Generally, individuals and families with incomes up to 400% of the federal poverty level may be eligible for some form of financial assistance.

What happens if I miss the open enrollment period?

+

If you miss the open enrollment period, you may still be able to enroll in a plan if you experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage. These events allow for a special enrollment period outside of the open enrollment window.

Can I change my insurance plan during the year?

+

In general, you’re locked into your chosen plan for a year unless you experience a qualifying life event. However, some states and insurers offer special enrollment periods for specific reasons, such as a move to a different coverage area or a change in income that affects your subsidy eligibility.

What’s the difference between an HMO and a PPO plan?

+

HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician (PCP) and obtain referrals for specialist care. They often have lower premiums but may have a more limited network of providers. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to see any provider within the network without a referral, but they generally have higher premiums.