Quotes On Homeowners Insurance

Homeowners insurance is a crucial aspect of protecting one's home and assets. It provides financial coverage for various risks and liabilities associated with homeownership. In this comprehensive article, we delve into the world of homeowners insurance, exploring its importance, coverage options, and the quotes that homeowners receive. By understanding the factors influencing these quotes, homeowners can make informed decisions and secure the best protection for their valuable assets.

Understanding Homeowners Insurance Quotes

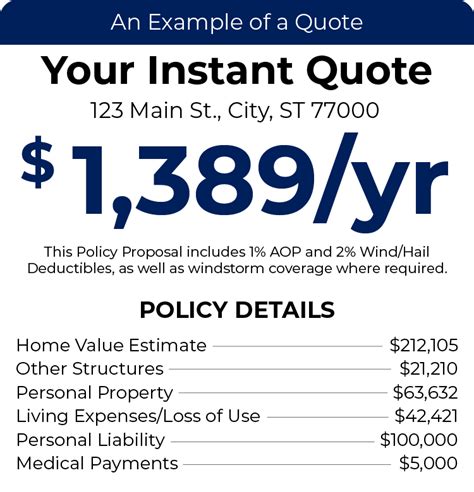

Homeowners insurance quotes are tailored estimates provided by insurance companies to assess the cost of insuring a specific home and its contents. These quotes consider numerous factors, including the location, size, construction materials, and potential risks associated with the property. Here, we break down the key elements that impact homeowners insurance quotes and provide valuable insights to help homeowners navigate this complex process.

Assessing Property Risk Factors

Insurance companies carefully evaluate the unique characteristics of each property to determine the level of risk involved. Some of the critical risk factors they consider include:

- Location: The geographical location of a home plays a significant role in insurance quotes. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, typically have higher insurance costs. Insurance companies assess the historical data and the potential risks associated with a specific region.

- Construction Materials: The materials used in constructing a home can impact its vulnerability to damage. For instance, homes built with flammable materials in wildfire-prone areas may face higher insurance premiums. Insurance providers consider the durability and fire resistance of construction materials when assessing quotes.

- Age of the Property: Older homes may require additional coverage due to potential wear and tear. Insurance companies assess the age of the property and the likelihood of older structures requiring more extensive repairs or replacements.

- Crime Rates: Areas with higher crime rates often experience increased insurance costs. Insurance providers analyze local crime statistics to evaluate the potential risks associated with theft, vandalism, or burglary.

| Risk Factor | Impact on Insurance Quotes |

|---|---|

| Natural Disaster Risk | Higher premiums in disaster-prone areas |

| Construction Materials | Flammable materials may result in higher costs |

| Age of Property | Older homes may require specialized coverage |

| Crime Rates | Increased premiums in high-crime areas |

Expert Tip: When comparing homeowners insurance quotes, it's essential to understand the specific risk factors influencing the rates. By assessing these factors and taking proactive measures to mitigate risks, homeowners can potentially lower their insurance costs.

Coverage Options and Customization

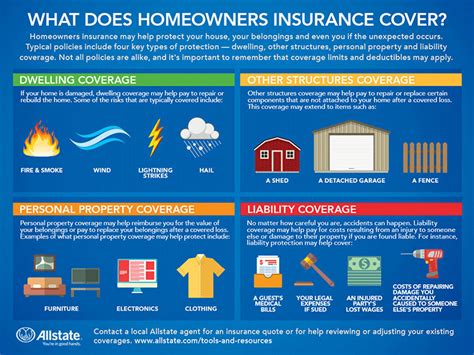

Homeowners insurance policies offer a range of coverage options, allowing homeowners to tailor their insurance plans to their specific needs. Here are some key coverage types to consider:

- Dwelling Coverage: This provides financial protection for the physical structure of the home, covering repairs or rebuilding costs in the event of damage or destruction.

- Personal Property Coverage: This covers the contents of the home, including furniture, electronics, and personal belongings. Homeowners can choose the level of coverage based on the value of their possessions.

- Liability Coverage: This protects homeowners from legal liabilities arising from accidents or injuries that occur on their property. It covers medical expenses and potential lawsuits, providing peace of mind.

- Additional Living Expenses: In the event of a covered loss that renders the home uninhabitable, this coverage reimburses homeowners for temporary living expenses, such as hotel stays or rental costs.

- Optional Endorsements: Homeowners can opt for additional endorsements to enhance their coverage. These may include coverage for specific items like jewelry, fine art, or high-value electronics.

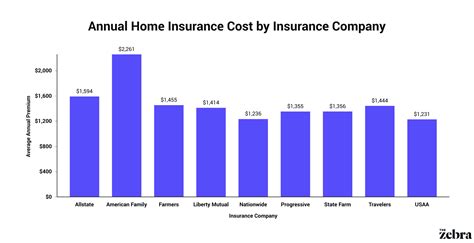

The Quote Comparison Process

Obtaining multiple quotes from different insurance providers is crucial to finding the best coverage at the most competitive price. Here’s a step-by-step guide to comparing homeowners insurance quotes:

- Research Insurance Companies: Start by researching reputable insurance companies that offer homeowners insurance policies. Look for companies with a solid financial rating and positive customer reviews.

- Request Quotes: Reach out to several insurance providers and request quotes. Provide accurate and detailed information about your home, including its location, size, construction materials, and any additional features.

- Analyze Coverage and Premiums: Carefully review each quote, comparing the coverage options and premiums offered. Ensure that the policies align with your specific needs and provide adequate protection.

- Consider Deductibles: Deductibles are the amount homeowners pay out of pocket before insurance coverage kicks in. Higher deductibles can lower premiums, but it’s essential to choose a deductible that you can afford in the event of a claim.

- Evaluate Additional Benefits: Look beyond the premiums and assess the additional benefits and services provided by each insurance company. Some companies offer perks like 24⁄7 customer support, claims assistance, or discounts for bundling policies.

- Read Policy Documents: Take the time to read the policy documents thoroughly. Understand the exclusions, limitations, and any fine print that may impact your coverage. This ensures that you fully comprehend the scope of the insurance plan.

- Seek Professional Advice: If you have specific concerns or complex insurance needs, consider consulting an insurance broker or agent. They can provide personalized advice and help you navigate the quote comparison process.

Industry Insight: It's crucial to strike a balance between comprehensive coverage and affordable premiums. Working with an experienced insurance professional can help homeowners tailor their insurance plans to their unique circumstances, ensuring adequate protection without unnecessary expenses.

The Impact of Claims History

A homeowner’s claims history plays a significant role in determining insurance quotes. Insurance companies carefully evaluate past claims to assess the potential risk associated with a specific property. Here’s how claims history can impact homeowners insurance quotes:

The Role of Claims in Insurance Assessments

Insurance companies use claims data to calculate the likelihood of future claims and adjust premiums accordingly. They analyze factors such as the frequency and severity of past claims, the types of losses, and the overall claims history of the homeowner. This information helps insurance providers determine the level of risk associated with insuring a particular home.

| Claims History Impact | Effect on Insurance Quotes |

|---|---|

| Multiple Claims | May result in higher premiums or non-renewal |

| Severity of Claims | Large, frequent claims may lead to increased costs |

| Type of Claims | Certain claims, like theft or water damage, may impact rates |

| Claims-Free Record | Can lead to discounts or lower premiums |

Strategies for Managing Claims History

Homeowners can take proactive steps to manage their claims history and potentially reduce the impact on insurance quotes. Here are some strategies to consider:

- Preventative Measures: Implement safety measures to minimize the risk of accidents or damage. Regular maintenance, smoke detectors, and security systems can help reduce the likelihood of claims.

- Documenting and Reporting Claims: When a claim occurs, ensure that it is accurately documented and reported to your insurance company. Provide all necessary information and cooperate fully with the claims process.

- Consider Alternative Dispute Resolution: In some cases, resolving claims through alternative dispute resolution methods, such as mediation or arbitration, can help mitigate the impact on your insurance record.

- Bundling Policies: Combining homeowners insurance with other policies, such as auto insurance, can lead to discounts and potentially offset the impact of claims history.

The Future of Homeowners Insurance

The homeowners insurance industry is continuously evolving, adapting to new technologies and changing market dynamics. Here, we explore some of the emerging trends and advancements that are shaping the future of homeowners insurance.

Technology-Driven Innovations

Technology is revolutionizing the homeowners insurance landscape, offering new opportunities for efficiency and personalized coverage. Some key technological advancements include:

- Telematics and IoT Devices: Insurance companies are utilizing telematics and Internet of Things (IoT) devices to gather real-time data about homes. These devices can monitor factors like temperature, humidity, water usage, and even detect potential risks, allowing for more accurate risk assessments.

- AI and Machine Learning: Artificial intelligence and machine learning algorithms are being employed to analyze vast amounts of data, identify patterns, and make more precise predictions about insurance risks. This technology enhances the accuracy of insurance quotes and claims assessments.

- Blockchain Technology: Blockchain is being explored as a secure and transparent way to store and share insurance data. It can streamline the claims process, reduce fraud, and enhance the overall efficiency of homeowners insurance operations.

Sustainable and Resilient Housing

The increasing focus on sustainability and resilience in home construction is influencing homeowners insurance. Insurance companies are recognizing the benefits of energy-efficient and resilient homes, which are less vulnerable to certain risks. Here’s how sustainable and resilient housing is impacting insurance:

- Discounts for Green Homes: Insurance providers are offering discounts to homeowners who adopt energy-efficient and eco-friendly practices. These homes are often better equipped to withstand natural disasters and have lower environmental impacts.

- Resilience Incentives: Some insurance companies are providing incentives for homeowners who invest in resilience measures, such as hurricane shutters, reinforced roofs, or seismic retrofits. These improvements enhance the structural integrity of homes and reduce the risk of damage.

- Resilience Ratings: Insurance companies are developing resilience rating systems to assess the resilience of homes. These ratings consider factors like construction materials, foundation strength, and the overall ability of a home to withstand extreme weather events.

Conclusion

Understanding homeowners insurance quotes is essential for making informed decisions about protecting one’s home and assets. By assessing property risk factors, customizing coverage options, and comparing quotes, homeowners can secure the best insurance plan for their needs. Additionally, managing claims history and embracing technological innovations can further enhance the homeowners insurance experience.

As the industry continues to evolve, homeowners can expect more personalized and sustainable insurance solutions. By staying informed and proactive, homeowners can navigate the complexities of homeowners insurance with confidence, ensuring their valuable assets are adequately protected.

How often should I review my homeowners insurance policy?

+It is recommended to review your homeowners insurance policy annually or whenever significant changes occur in your life or property. This ensures that your coverage remains up-to-date and adequately protects your assets.

Can I negotiate homeowners insurance quotes?

+While homeowners insurance quotes are typically non-negotiable, you can still shop around and compare multiple quotes to find the best coverage at a competitive price. Additionally, you may be able to negotiate discounts or special rates by bundling policies or taking advantage of loyalty programs.

What should I do if I receive a high insurance quote?

+If you receive a high insurance quote, it’s essential to understand the reasons behind it. Review the quote carefully and assess the coverage options and risk factors considered. Consider taking steps to mitigate risks, such as installing security systems or making home improvements. You can also seek advice from an insurance professional to explore alternative options and potentially lower your premiums.