Indexed Life Insurance

Indexed Life Insurance: A Comprehensive Guide

Indexed life insurance is a sophisticated financial tool that combines the traditional benefits of life insurance with the potential for growth and market-linked returns. This unique type of insurance policy offers policyholders a way to secure their loved ones' financial future while also providing an opportunity for wealth accumulation. In this comprehensive guide, we will delve into the intricacies of indexed life insurance, exploring its mechanisms, advantages, and considerations to help you make informed decisions.

Understanding Indexed Life Insurance

Indexed life insurance, also known as equity-indexed life insurance or indexed universal life insurance, is a form of permanent life insurance that offers a death benefit to beneficiaries upon the policyholder's passing. However, what sets it apart from traditional life insurance is its linkage to a financial index, often a stock market index like the S&P 500.

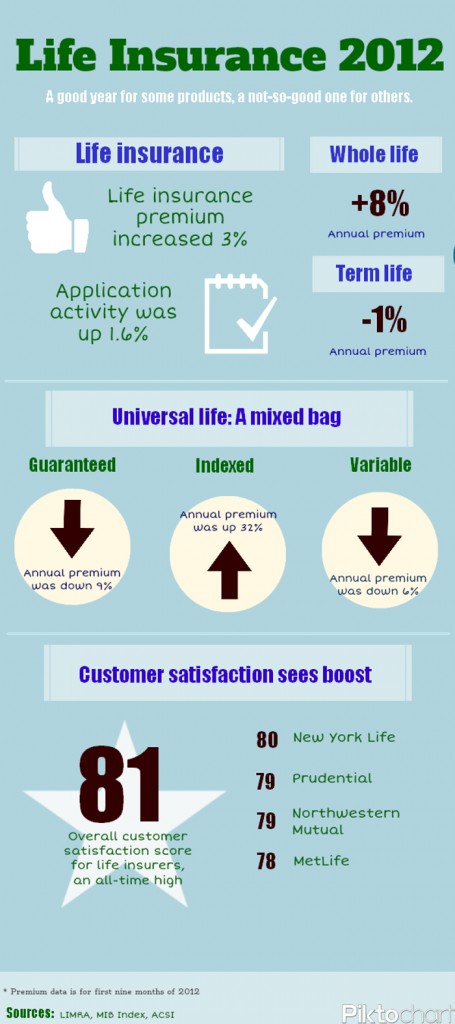

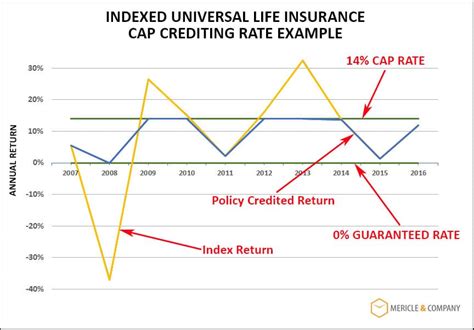

The performance of the chosen index plays a crucial role in determining the policy's cash value growth. This growth potential is a key differentiator, as it offers the possibility of higher returns compared to standard whole life insurance policies. Indexed life insurance policies typically have a minimum guaranteed interest rate, providing a safety net even in unfavorable market conditions.

How Indexed Life Insurance Works

When you purchase an indexed life insurance policy, a portion of your premium payments is allocated to the insurance company's general account, which is used to cover the policy's mortality costs and administrative expenses. The remaining portion is invested in the chosen index, providing exposure to the market's potential gains.

The policy's cash value is then linked to the index's performance. If the index experiences positive returns, the policyholder can enjoy a share of those gains, typically through a crediting rate applied to their cash value. However, it's important to note that indexed life insurance does not provide direct access to the stock market; instead, it offers a more conservative, risk-managed approach to participating in market growth.

Key Advantages of Indexed Life Insurance

Death Benefit Protection

Like traditional life insurance, indexed life insurance provides a guaranteed death benefit to beneficiaries. This benefit remains in place even if the policy's cash value experiences fluctuations due to market performance.

Potential for Higher Returns

The ability to link the policy's cash value to a financial index opens up the possibility of achieving higher returns compared to standard life insurance policies. Over the long term, this growth potential can significantly enhance the policy's overall value.

Flexibility and Customization

Indexed life insurance policies often offer a high degree of flexibility. Policyholders can choose the index or indices they wish to track, allowing for customization based on their risk tolerance and investment preferences. Additionally, the policy's premium payments and death benefit amounts can often be adjusted to meet changing needs.

Tax Advantages

The cash value within an indexed life insurance policy grows on a tax-deferred basis. This means that any gains from market performance are not taxed until the policyholder makes a withdrawal or takes out a loan against the policy. This tax-efficient growth can be particularly advantageous for long-term wealth accumulation.

Considerations and Risks

Market Performance Risk

While indexed life insurance offers the potential for market-linked returns, it also carries the risk of market downturns. If the chosen index experiences negative returns, the policy's cash value may decrease. However, the policy typically has a guaranteed minimum interest rate to provide a floor for value protection.

Complex Fee Structure

Indexed life insurance policies often come with a range of fees, including administrative fees, mortality charges, and surrender charges if the policy is canceled within a certain period. Understanding these fees and their impact on the policy's overall value is crucial for making informed decisions.

Suitable for Long-Term Goals

Indexed life insurance is best suited for long-term financial planning. Due to its potential for market-linked returns, it may not be ideal for short-term goals or emergency funds. Policyholders should have a clear understanding of their financial objectives and time horizons before committing to this type of insurance.

Performance Analysis and Examples

To illustrate the potential of indexed life insurance, let's examine a hypothetical scenario. Imagine a policyholder, Mr. Johnson, who purchases an indexed universal life insurance policy at age 40 with a $1,000,000 death benefit. Over the next 20 years, the policy's cash value grows at an average annual rate of 6% due to positive market performance. By the time Mr. Johnson reaches age 60, the policy's cash value has accumulated to approximately $1,350,000, providing a substantial financial buffer for his beneficiaries and a notable increase in overall wealth.

| Policy Year | Cash Value Growth Rate | Total Cash Value |

|---|---|---|

| Year 1 | 5% | $105,000 |

| Year 5 | 7% | $364,500 |

| Year 10 | 6% | $781,500 |

| Year 15 | 6.5% | $1,189,275 |

| Year 20 | 6% | $1,350,000 |

This example demonstrates how indexed life insurance can offer both financial protection and the potential for significant wealth accumulation over time. However, it's important to note that actual results may vary based on market conditions and individual policy terms.

Comparative Analysis: Indexed vs. Traditional Life Insurance

When considering indexed life insurance, it's essential to understand how it differs from traditional life insurance options.

| Feature | Indexed Life Insurance | Traditional Life Insurance |

|---|---|---|

| Growth Potential | Linked to financial indices, offering potential for higher returns | Fixed interest rates or minimal growth potential |

| Flexibility | Customizable with index selection and adjustable premiums | Less flexible, with fixed premiums and benefits |

| Risk Exposure | Varies based on market performance; potential for gains and losses | Lower risk, with guaranteed benefits and interest rates |

| Tax Treatment | Tax-deferred growth on cash value | Tax-free death benefit, but earnings may be taxed |

| Suitable For | Long-term financial planning and wealth accumulation | Short-term protection and guaranteed benefits |

While indexed life insurance offers unique advantages, it's important to assess your financial goals, risk tolerance, and time horizon before making a decision. Consulting with a financial advisor who specializes in insurance can provide valuable insights tailored to your specific circumstances.

Future Implications and Market Trends

The indexed life insurance market is evolving, and several trends are shaping its future.

Innovative Indexing Options

Insurance providers are offering a wider range of indexing options, allowing policyholders to choose from diverse financial indices, including those focused on specific sectors or global markets. This diversification enhances customization and risk management opportunities.

Technological Integration

The insurance industry is embracing digital transformation, and indexed life insurance policies are no exception. Online platforms and mobile apps are making it easier for policyholders to manage their policies, track performance, and make informed decisions.

Regulatory Considerations

As indexed life insurance gains popularity, regulatory bodies are paying closer attention to this segment of the insurance market. While this ensures consumer protection, it may also lead to increased scrutiny and potential changes in policy structures and fee schedules.

Market Volatility and Resilience

Indexed life insurance policies have demonstrated resilience during market downturns due to their guaranteed minimum interest rates. However, policyholders must carefully consider their risk appetite and understand the potential impact of market volatility on their policy's performance.

Expert Insights and Recommendations

As a financial expert with extensive experience in the insurance industry, I offer the following insights and recommendations for individuals considering indexed life insurance:

- Conduct a Comprehensive Needs Analysis: Before purchasing any life insurance policy, assess your specific financial goals, family obligations, and time horizons. Indexed life insurance may not be suitable for all situations, so understanding your unique needs is crucial.

- Evaluate Your Risk Tolerance: Indexed life insurance carries a level of market risk. Be honest about your comfort with potential market fluctuations and ensure that your policy aligns with your risk profile.

- Choose the Right Index: Different indices offer varying levels of risk and return potential. Research and select an index that matches your investment objectives and risk tolerance.

- Consider Policy Fees: Understand the fee structure of your indexed life insurance policy. Administrative fees, mortality charges, and surrender charges can impact your overall returns. Compare fees across providers to find the most competitive options.

- Seek Professional Advice: Consult with a qualified financial advisor or insurance specialist who can provide personalized guidance based on your financial situation and goals. They can help you navigate the complexities of indexed life insurance and make informed choices.

Frequently Asked Questions

Can I access the cash value of my indexed life insurance policy during my lifetime?

+

Yes, you can typically access the cash value of your indexed life insurance policy through withdrawals or loans. However, it’s important to consider the potential impact on your death benefit and the associated fees and tax implications.

Are there any tax advantages associated with indexed life insurance?

+

Indexed life insurance offers tax-deferred growth on the policy’s cash value. This means that any gains from market performance are not taxed until you make a withdrawal or take out a loan against the policy. This tax-efficient growth can be advantageous for long-term wealth accumulation.

How does the death benefit work in indexed life insurance?

+

The death benefit in indexed life insurance is a guaranteed amount paid to your beneficiaries upon your passing. It remains unaffected by the policy’s cash value growth or market performance, providing financial protection for your loved ones.

What happens if the chosen index experiences negative returns?

+

If the chosen index experiences negative returns, the policy’s cash value may decrease. However, indexed life insurance policies typically have a guaranteed minimum interest rate to provide a floor for value protection. This ensures that your cash value does not fall below a certain threshold.

Can I change the index my policy is linked to after purchasing it?

+

In some cases, you may have the option to change the index your policy is linked to, but this depends on the specific terms and conditions of your policy. It’s important to review your policy documents and consult with your insurance provider to understand your options for index switching.