Car Insurance Rate Quotes

When it comes to car insurance, one of the most important aspects for many drivers is the cost. Understanding how insurance companies calculate rates and the factors that influence them is crucial for making informed decisions about your coverage. This article aims to provide a comprehensive guide to car insurance rate quotes, exploring the key variables that impact costs and offering insights into how you can potentially secure the best deals.

Understanding Car Insurance Rates

Car insurance rates are determined through a complex process that takes into account numerous factors. Insurance companies use these factors to assess the risk associated with insuring a particular driver and vehicle. The higher the perceived risk, the higher the insurance premium is likely to be. Here’s an overview of the key components that influence car insurance rates:

Driver Factors

Insurance companies carefully examine the characteristics of the driver to assess their risk profile. This includes:

- Age and Gender: Younger drivers, especially males under the age of 25, are often considered higher-risk due to their lack of driving experience. As drivers age, their insurance rates generally decrease, with the lowest rates often seen in the 30-60 age range.

- Driving History: A clean driving record is a major factor in keeping insurance rates low. Traffic violations, accidents, and DUI convictions can significantly increase premiums. Insurance companies often use a three-year or five-year lookback period to assess a driver’s history.

- Credit Score: Surprisingly, your credit score can impact your insurance rates. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Drivers with lower credit scores may face higher premiums.

- Marital Status: Married drivers are often considered lower-risk, as they tend to have fewer accidents and claims. This factor can lead to slightly lower insurance rates for married individuals.

Vehicle Factors

The type of vehicle you drive and its specific characteristics can also influence insurance rates:

- Vehicle Type and Make: Sports cars and luxury vehicles often have higher insurance rates due to their higher repair costs and the likelihood of theft. SUVs and minivans, on the other hand, may offer lower rates due to their safety features and lower accident rates.

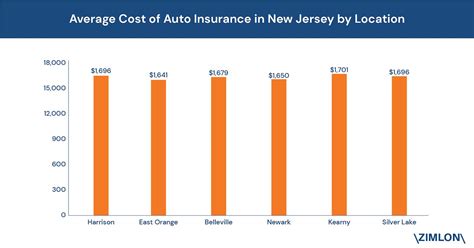

- Vehicle Usage: How and where you use your vehicle can impact rates. Commuting to work daily or frequently driving in urban areas with high accident rates can increase insurance costs. Conversely, low-mileage drivers or those living in rural areas may benefit from lower rates.

- Safety Features: Vehicles equipped with advanced safety features like lane departure warning, automatic emergency braking, and adaptive cruise control may qualify for insurance discounts. These features reduce the likelihood of accidents and subsequent claims.

Coverage and Deductibles

The type and amount of coverage you choose, as well as your deductible, play a significant role in determining your insurance rates:

- Coverage Types: Comprehensive and collision coverage protect against damages not related to accidents, such as theft, fire, or natural disasters. These coverages generally increase your insurance premium. Liability coverage, which is mandatory in most states, provides protection against claims from other drivers in the event of an accident you cause.

- Deductibles: A higher deductible means you’ll pay more out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lead to lower insurance premiums, but it’s important to choose a deductible you can afford.

Securing the Best Rate Quotes

With a better understanding of the factors that influence car insurance rates, you can take steps to potentially secure the best quotes. Here are some strategies to consider:

Shop Around and Compare

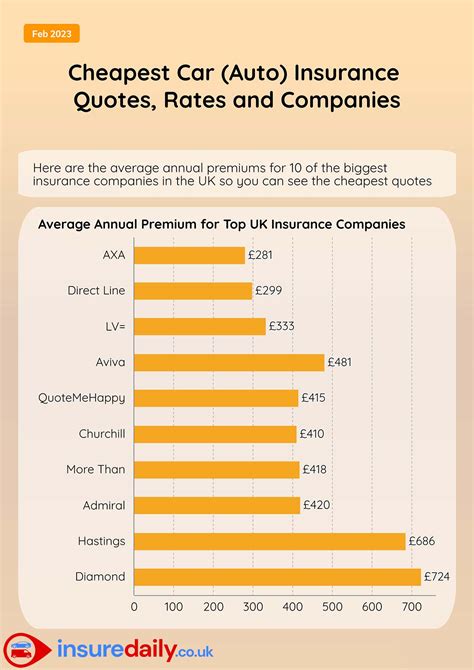

Insurance rates can vary significantly between companies, so it’s crucial to shop around and compare quotes. Use online tools and comparison websites to quickly gather quotes from multiple insurers. Remember, the cheapest quote might not always offer the best value, so be sure to carefully review the coverage details and exclusions.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same insurer. Many insurance companies offer multi-policy discounts, which can lead to significant savings.

Choose a Higher Deductible

As mentioned earlier, opting for a higher deductible can lower your insurance premiums. However, it’s essential to choose a deductible that aligns with your financial situation and ability to pay out of pocket in the event of a claim. A higher deductible is not advisable if you can’t afford to cover the costs.

Explore Discounts

Insurance companies offer various discounts to attract customers and reward safe driving. Some common discounts include:

- Safe Driver Discount: Insurers often provide discounts to drivers with clean driving records, free of accidents and violations.

- Multi-Car Discount: If you insure more than one vehicle with the same insurer, you may be eligible for a discount.

- Good Student Discount: Many insurers offer discounts to students who maintain a certain GPA or honor roll status.

- Safety Features Discount: Vehicles equipped with advanced safety features may qualify for discounts.

- Payment Method Discount: Some insurers offer discounts for setting up automatic payments or paying the full annual premium upfront.

Improve Your Driving Record

A clean driving record is a significant factor in determining insurance rates. To improve your record and potentially lower your premiums, consider taking defensive driving courses, which may result in reduced points on your license. Additionally, avoid traffic violations and practice safe driving habits to reduce the likelihood of accidents.

The Future of Car Insurance Rates

The car insurance industry is evolving, and new technologies and trends are shaping the way rates are calculated. Here’s a glimpse into the future of car insurance rates:

Usage-Based Insurance (UBI)

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining traction. With UBI, insurance rates are based on real-time data collected from your vehicle, such as mileage, driving behavior, and location. This data is used to assess your risk profile more accurately and potentially offer personalized insurance rates.

Telematics and Connected Cars

The integration of telematics and connected car technologies allows insurers to gather more detailed data about drivers’ habits. These technologies can track driving behavior, including acceleration, braking, cornering, and even distraction indicators like phone usage while driving. By analyzing this data, insurers can offer more precise risk assessments and potentially adjust rates accordingly.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are being employed by insurance companies to analyze vast amounts of data and identify patterns that traditional methods might miss. These technologies can help insurers more accurately predict risks and adjust rates based on emerging trends and behaviors.

Autonomous Vehicles

The rise of autonomous vehicles is expected to revolutionize the car insurance industry. As self-driving cars become more prevalent, the focus of insurance may shift from individual drivers to the vehicles themselves. Insurance rates could be based on the safety features and performance of autonomous vehicles, rather than the driving records of individuals.

Conclusion

Understanding the factors that influence car insurance rates is the first step towards securing the best quotes. By being a responsible driver, maintaining a clean driving record, and exploring the various discounts and coverage options available, you can potentially reduce your insurance costs. Additionally, staying informed about the latest trends and technologies in the insurance industry can help you navigate the evolving landscape of car insurance rates.

How often should I review my car insurance rates?

+It’s a good idea to review your car insurance rates annually or whenever you experience a significant life event, such as getting married, buying a new car, or moving to a new location. Insurance rates can change based on various factors, so regular reviews can help you ensure you’re getting the best value.

Can I negotiate my car insurance rates?

+While car insurance rates are primarily determined by algorithms and risk assessments, you can still negotiate with your insurance provider. Explain your situation, provide any relevant documentation, and ask for a review of your policy. Insurers may be willing to offer discounts or adjust rates based on your specific circumstances.

What are some common mistakes to avoid when choosing car insurance?

+Common mistakes include not comparing quotes from multiple insurers, choosing the cheapest quote without reviewing coverage details, and neglecting to explore available discounts. It’s important to carefully review the policy terms, understand the coverage limits, and ensure you’re getting the right balance of coverage and cost.