Obamacare Health Insurance Marketplace

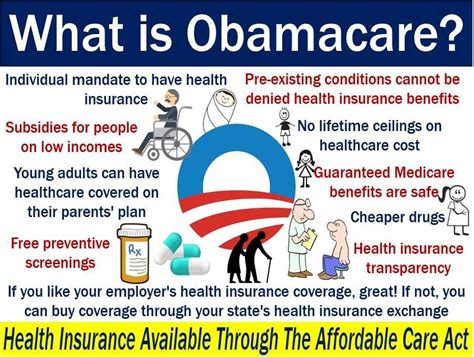

The Affordable Care Act (ACA), commonly known as Obamacare, has transformed the healthcare landscape in the United States, offering millions of Americans access to affordable health insurance. One of the key components of the ACA is the creation of the Health Insurance Marketplace, a platform that allows individuals and small businesses to compare and purchase health insurance plans. In this comprehensive article, we will delve into the intricacies of the Obamacare Health Insurance Marketplace, exploring its purpose, benefits, and impact on healthcare coverage.

The Birth of the Health Insurance Marketplace

The Health Insurance Marketplace, established under the ACA, serves as a centralized platform where individuals and families can shop for and enroll in qualified health plans. This marketplace aims to provide a transparent and competitive environment, empowering consumers to make informed choices about their healthcare coverage. The idea behind the marketplace is to increase competition among insurance providers, drive down costs, and ensure that individuals have access to a range of affordable options.

The marketplace operates on a state-by-state basis, with some states running their own marketplaces, while others utilize the federal marketplace, HealthCare.gov. This decentralized approach allows for customization and adaptation to the unique healthcare needs of each state's population.

Navigating the Marketplace: A Step-by-Step Guide

Understanding how to navigate the Health Insurance Marketplace is crucial for individuals seeking affordable healthcare coverage. Here’s a step-by-step guide to help you through the process:

Step 1: Eligibility and Open Enrollment

Before diving into the marketplace, it’s essential to determine your eligibility. The ACA mandates that individuals and families with incomes below a certain threshold qualify for subsidies to help cover the cost of their health insurance premiums. These subsidies, known as premium tax credits, can significantly reduce the financial burden of healthcare coverage.

The open enrollment period is a crucial time to enroll in a health plan. During this period, typically lasting a few months, individuals can sign up for new coverage or make changes to their existing plans. Missing the open enrollment deadline may result in limited options for coverage unless you qualify for a special enrollment period due to specific life events, such as marriage, birth, or loss of other coverage.

Step 2: Exploring Plan Options

Once you’ve determined your eligibility and the open enrollment period is underway, it’s time to explore the available health insurance plans. The marketplace offers a variety of plan types, including Bronze, Silver, Gold, and Platinum, each with different levels of coverage and cost-sharing. It’s crucial to assess your healthcare needs and financial situation to choose a plan that aligns with your requirements.

Key factors to consider when comparing plans include:

- Premium Costs: The amount you pay monthly for your health insurance.

- Deductibles: The out-of-pocket expenses you must pay before your insurance coverage kicks in.

- Co-pays and Co-insurance: The share of costs you pay for medical services.

- Out-of-Pocket Maximums: The maximum amount you'll pay out of pocket in a year for covered services.

- Network of Providers: Ensure that your preferred doctors and hospitals are in-network to avoid higher costs.

Step 3: Applying and Enrolling

Once you've found the right plan, the next step is to apply and enroll. The application process typically involves providing personal and household information, such as income, family size, and citizenship status. It's important to be accurate and honest in your application to avoid potential issues with your coverage.

After submitting your application, you'll receive a confirmation of enrollment, and your chosen health insurance plan will become effective on the first day of the following month. Remember to keep important documents, such as your policy details and contact information for your insurance provider, easily accessible.

The Benefits of the Health Insurance Marketplace

The Health Insurance Marketplace offers numerous advantages to individuals and families seeking healthcare coverage. Here are some key benefits:

1. Increased Transparency and Choice

The marketplace provides a transparent platform where consumers can easily compare different health insurance plans. This level of transparency empowers individuals to make informed decisions based on their specific needs and budgets. The ability to choose from multiple plans encourages competition among insurance providers, leading to improved quality and better pricing.

2. Subsidies and Financial Assistance

One of the most significant advantages of the marketplace is the availability of subsidies and financial assistance. The ACA offers premium tax credits to eligible individuals and families, reducing the cost of their monthly premiums. Additionally, those with lower incomes may qualify for cost-sharing reductions, which lower their out-of-pocket expenses for covered services.

These financial incentives make healthcare coverage more accessible and affordable for millions of Americans, ensuring that cost is not a barrier to receiving essential medical care.

3. Protection for Pre-Existing Conditions

A groundbreaking aspect of the ACA is the protection it provides for individuals with pre-existing conditions. Prior to the ACA, insurance companies could deny coverage or charge higher premiums to those with pre-existing health issues. The marketplace ensures that everyone, regardless of their health status, has access to affordable and comprehensive healthcare coverage.

4. Essential Health Benefits

The ACA mandates that all qualified health plans offered through the marketplace must cover a set of essential health benefits. These benefits include services such as ambulatory patient services, emergency care, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. By ensuring that these essential services are covered, the marketplace provides comprehensive and reliable healthcare coverage.

Impact and Success Stories

Since its implementation, the Health Insurance Marketplace has had a profound impact on the lives of millions of Americans. Here are some real-life success stories that highlight the positive outcomes of the marketplace:

1. Sarah’s Story: A Life-Saving Coverage

Sarah, a single mother of two, struggled to find affordable health insurance due to her low income. Through the Health Insurance Marketplace, she discovered a plan that fit her budget and provided the coverage she needed. Shortly after enrolling, Sarah was diagnosed with a serious medical condition. Thanks to her new insurance coverage, she was able to receive the necessary treatments and medications, ensuring her and her children’s well-being.

2. John’s Story: Peace of Mind for Small Business Owners

John, a small business owner, wanted to provide health insurance benefits to his employees but faced challenges due to rising costs. The Health Insurance Marketplace offered him a solution. By enrolling his business in a group plan, John was able to offer comprehensive coverage to his employees at a competitive rate. This not only improved the overall health and morale of his team but also attracted and retained talented individuals.

3. Maria’s Story: Navigating Complex Medical Needs

Maria, a young professional with a complex medical condition, required specialized care and medications. Through the marketplace, she found a plan that covered her specific needs, including access to a network of specialists. With her new insurance coverage, Maria could focus on her health and well-being without worrying about the financial burden of her medical expenses.

The Future of Healthcare Coverage

The Health Insurance Marketplace has paved the way for a more inclusive and accessible healthcare system in the United States. As the ACA continues to evolve and improve, the marketplace is expected to play a vital role in ensuring that all Americans have access to affordable and comprehensive healthcare coverage. Here are some potential future developments:

1. Expansion of Coverage Options

Efforts are underway to expand the range of health insurance plans available through the marketplace. This includes exploring partnerships with private insurance providers to offer more customized and innovative coverage options, catering to the diverse needs of consumers.

2. Enhanced Consumer Education

Recognizing the importance of informed decision-making, there is a growing focus on consumer education. Initiatives to simplify and improve the enrollment process, as well as provide comprehensive resources and tools, will empower individuals to choose the right health plans for their specific circumstances.

3. Technological Advancements

The Health Insurance Marketplace is expected to leverage technology to enhance the user experience. This may include the development of user-friendly mobile applications, improved data security measures, and the integration of artificial intelligence to streamline the enrollment and claims processes.

4. Collaboration with Healthcare Providers

To further improve the efficiency and effectiveness of healthcare coverage, collaboration between the marketplace, insurance providers, and healthcare facilities is being explored. This collaboration aims to streamline administrative processes, reduce costs, and enhance the overall patient experience.

| Metric | Value |

|---|---|

| Number of Enrollees (2022) | 12.7 million |

| Average Premium Tax Credit | $574/month |

| States Running Their Own Marketplaces | 15 |

Can I enroll in the Health Insurance Marketplace outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you qualify for a special enrollment period. Qualifying life events, such as losing other coverage, getting married, or having a baby, can trigger a special enrollment period, allowing you to enroll in a new health plan.

How do I know if I’m eligible for subsidies through the marketplace?

+Eligibility for subsidies is determined based on your household income. Generally, individuals and families with incomes below 400% of the federal poverty level qualify for premium tax credits. You can use the marketplace’s online tools or consult with a healthcare navigator to assess your eligibility.

Can I switch health plans during the year if my needs change?

+Yes, you can switch health plans during the year if your circumstances change. This could include a change in income, family size, or other qualifying events. However, it’s important to note that you may need to provide documentation to support your change in circumstances.

What happens if I miss the open enrollment deadline and don’t qualify for a special enrollment period?

+If you miss the open enrollment deadline and don’t qualify for a special enrollment period, you may have to wait until the next open enrollment period to enroll in a new health plan. In the meantime, you can explore short-term health insurance plans or other coverage options to ensure you have some level of protection.