How Much Will Renters Insurance Cost

Renters insurance is a vital yet often overlooked aspect of financial planning for tenants. It provides coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances. The cost of renters insurance can vary significantly based on several factors, making it essential for individuals to understand the variables that influence the premium. This comprehensive guide aims to delve into the intricacies of renters insurance costs, offering a detailed analysis to help readers make informed decisions.

Factors Influencing Renters Insurance Costs

Several key factors contribute to the variation in renters insurance premiums. Understanding these factors is crucial for renters to estimate their insurance costs accurately.

Coverage Amount and Deductibles

The coverage amount, which represents the value of personal belongings and liability coverage chosen by the renter, is a primary determinant of the insurance premium. Higher coverage amounts generally result in higher premiums. Additionally, the deductible, or the amount the renter agrees to pay out of pocket before the insurance coverage kicks in, also affects the cost. Opting for a higher deductible can lower the premium, while a lower deductible may increase it.

| Coverage Amount | Premium |

|---|---|

| $20,000 | $250 annually |

| $40,000 | $400 annually |

| $60,000 | $550 annually |

Location and Crime Rate

The location of the rental property plays a significant role in determining insurance costs. Areas with higher crime rates or a history of natural disasters often result in higher premiums. Insurance companies consider these factors as they assess the risk associated with insuring properties in specific locations.

| City | Average Annual Premium |

|---|---|

| New York City | $450 |

| Chicago | $320 |

| Los Angeles | $380 |

Type of Rental Property

The type of rental property can also impact insurance costs. For instance, a single-family home may have different insurance needs and costs compared to an apartment in a high-rise building. Factors such as the building’s age, construction type, and security features can influence the premium.

Renter’s Personal Information

Renter’s personal information, including age, credit score, and claim history, is considered by insurance companies. Younger renters or those with a history of claims may face higher premiums, as they are statistically more likely to make a claim. Similarly, a poor credit score can also lead to increased insurance costs.

Average Costs and Variations

The average cost of renters insurance in the United States is approximately $187 per year, according to the Insurance Information Institute. However, this average can vary significantly based on the factors mentioned above. It’s essential to note that renters insurance is relatively affordable, especially when considering the potential financial loss that could occur without adequate coverage.

State-by-State Variations

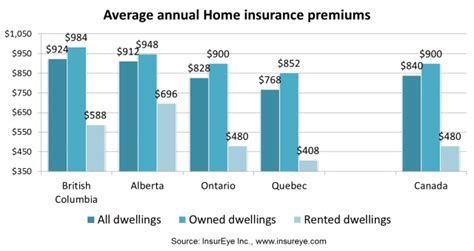

Renters insurance costs can vary significantly from state to state. This variation is due to differences in state regulations, the cost of living, and the average risk associated with various regions. For instance, states with a higher cost of living or a history of natural disasters may have higher average premiums.

| State | Average Annual Premium |

|---|---|

| California | $220 |

| Texas | $160 |

| Florida | $280 |

Additional Coverage and Endorsements

Renters may opt for additional coverage or endorsements to tailor their insurance policy to their specific needs. These can include coverage for high-value items like jewelry or electronics, identity theft protection, or rental car coverage. While these additions can increase the premium, they offer essential protection for valuable possessions.

Tips for Finding Affordable Renters Insurance

While renters insurance is generally affordable, there are strategies renters can employ to further reduce their premiums and ensure they are getting the best value for their money.

Shop Around and Compare Quotes

Renters should obtain quotes from multiple insurance companies to compare prices and coverage options. Online quote tools can be a convenient way to quickly gather multiple quotes and assess the market.

Bundle Policies

Bundling renters insurance with other policies, such as auto insurance, can often lead to significant savings. Many insurance companies offer discounts when customers combine multiple policies.

Choose a Higher Deductible

As mentioned earlier, selecting a higher deductible can reduce the premium. However, renters should carefully consider their financial situation and ensure they can afford the higher out-of-pocket expense in the event of a claim.

Understand Your Coverage Needs

Renters should carefully assess their coverage needs and choose a policy that provides adequate protection without unnecessary additions. Overinsuring can lead to higher premiums, so it’s essential to strike a balance between coverage and cost.

Future Outlook and Considerations

The renters insurance market is evolving, and several trends and considerations are shaping the future of this industry. Understanding these factors can help renters make more informed decisions about their insurance coverage.

Technological Advancements

The insurance industry is increasingly leveraging technology to streamline processes and enhance customer experience. This includes the use of digital tools for quote comparisons, policy management, and claims processing. Renters should stay updated on these technological advancements to take advantage of the convenience and cost-saving opportunities they offer.

Changing Risk Factors

The risk landscape for renters insurance is constantly evolving. Factors such as climate change, increasing crime rates in certain areas, and changing rental market dynamics can influence insurance costs. Renters should stay informed about these changes and their potential impact on insurance premiums.

Consumer Awareness and Education

As awareness about the importance of renters insurance grows, more tenants are expected to seek out coverage. This increased demand can lead to a more competitive market, potentially driving down premiums. Additionally, as renters become more educated about their insurance needs, they can make more informed decisions, ensuring they are adequately covered without unnecessary expenses.

Regulatory Changes

Regulatory changes at the state and federal levels can also impact renters insurance costs. For instance, changes in state laws regarding mandatory coverage or maximum deductible amounts can influence the insurance market. Renters should stay informed about these regulatory changes to understand their rights and obligations.

Conclusion

Renters insurance is an essential financial tool for tenants, providing peace of mind and protection against unforeseen circumstances. Understanding the factors that influence insurance costs and staying informed about market trends and considerations can help renters make informed decisions about their insurance coverage. By shopping around, understanding their coverage needs, and staying updated on industry developments, renters can find affordable, comprehensive insurance that meets their specific requirements.

Can renters insurance cover personal belongings outside the rental property, such as in a storage unit?

+Yes, many renters insurance policies offer coverage for personal belongings stored off-site, including in storage units. However, there may be limitations or additional costs associated with this coverage. It’s important to review your policy or consult with your insurance provider to understand the specific coverage and any applicable restrictions.

What is the typical liability coverage provided by renters insurance, and is it sufficient for most renters?

+The typical liability coverage for renters insurance is around $100,000, which is often sufficient for most renters. However, it’s essential to consider your specific situation and the potential risks you may face. If you frequently host guests or have valuable assets, you may want to consider increasing your liability coverage to ensure adequate protection.

Are there any discounts available for renters insurance, and how can I qualify for them?

+Yes, there are several discounts available for renters insurance, including bundling discounts, loyalty discounts, and safety discounts. To qualify for these discounts, you may need to meet certain criteria, such as having multiple policies with the same insurer, maintaining a good credit score, or installing safety devices like smoke detectors or security systems in your rental property.