Health Insurance For Small Business Owner

As a small business owner, understanding and securing appropriate health insurance coverage for yourself and your employees is crucial. It not only impacts the financial health of your business but also the well-being and satisfaction of your workforce. This comprehensive guide aims to shed light on the key considerations, benefits, and strategies for choosing the right health insurance plan for your small business.

The Importance of Health Insurance for Small Businesses

In the dynamic landscape of small businesses, health insurance serves as a vital pillar, ensuring the stability and growth of your enterprise. It addresses a myriad of concerns, from mitigating financial risks associated with unexpected medical emergencies to fostering a productive and content workforce. Furthermore, it plays a pivotal role in attracting and retaining top talent, thereby contributing to the long-term success and sustainability of your business.

Let's delve into the intricacies of this subject, exploring the various facets that influence the selection of health insurance plans for small businesses. From understanding the diverse types of coverage to navigating the complex landscape of provider networks and benefit packages, we aim to equip you with the knowledge necessary to make informed decisions. Additionally, we will provide valuable insights into the strategies and considerations that can help optimize the value and affordability of your chosen health insurance plan.

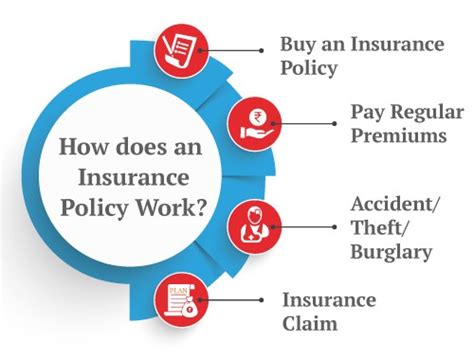

Understanding the Basics: Types of Health Insurance Plans

The health insurance landscape for small businesses is diverse, offering a range of plan types to cater to varying needs and preferences. These include:

- Health Maintenance Organizations (HMOs): HMOs are known for their cost-effectiveness, providing comprehensive coverage with a focus on preventive care. Members typically select a primary care physician (PCP) who coordinates their healthcare needs, referring them to specialists within the HMO network.

- Preferred Provider Organizations (PPOs): PPOs offer flexibility, allowing members to choose their healthcare providers from an extensive network. While they may incur higher costs compared to HMOs, PPOs provide more freedom in selecting specialists and healthcare facilities.

- Exclusive Provider Organizations (EPOs): EPOs strike a balance between HMOs and PPOs. Members are required to stay within the EPO network, but they have the freedom to choose their specialists without a referral from a primary care physician.

- Point-of-Service (POS) Plans: POS plans combine elements of both HMOs and PPOs. Members have the option to choose a primary care physician and stay within the network for lower out-of-pocket costs. However, they can also access out-of-network providers for a higher cost.

- High Deductible Health Plans (HDHPs): HDHPs are designed to be paired with Health Savings Accounts (HSAs). They typically have lower premiums but higher deductibles, making them an attractive option for those who prioritize saving for future healthcare expenses.

Each plan type has its unique advantages and considerations, and understanding these differences is crucial for selecting the most suitable health insurance option for your small business and its employees.

Navigating Provider Networks and Coverage Areas

When evaluating health insurance plans for your small business, it’s imperative to assess the provider networks and coverage areas they encompass. These factors directly influence the accessibility and convenience of healthcare services for your employees.

A robust provider network ensures that your employees have a wide range of healthcare options, including reputable hospitals, clinics, and specialists. It's essential to verify that the plan's network includes providers who are conveniently located and easily accessible for your workforce. Additionally, consider the plan's coverage area to ensure that it extends to regions where your employees reside or frequently travel for business purposes.

A comprehensive provider network not only enhances the availability of quality healthcare but also promotes cost-effectiveness. In-network providers typically offer more favorable rates, minimizing out-of-pocket expenses for your employees. This aspect is particularly crucial for small businesses aiming to provide competitive healthcare benefits while managing costs effectively.

Furthermore, assess the plan's coverage for specialized services, such as mental health or maternity care, to ensure that your employees' unique healthcare needs are adequately addressed. A well-structured provider network can be a powerful tool in promoting employee satisfaction, retention, and overall well-being.

Analyzing Benefits and Coverage: A Comprehensive Approach

Selecting the right health insurance plan for your small business involves a meticulous examination of the benefits and coverage it offers. This process goes beyond a simple comparison of premiums and deductibles; it requires a comprehensive understanding of the plan’s features and how they align with the diverse healthcare needs of your employees.

Begin by assessing the scope of coverage, which includes essential elements such as:

- Medical Services: Evaluate the plan's coverage for primary care, specialty care, and emergency services. Ensure that the plan provides adequate coverage for routine check-ups, preventive care, and necessary medical treatments.

- Prescription Drugs: Consider the plan's formulary, which outlines the prescription drugs covered by the insurance. Verify that the plan includes medications commonly prescribed to your employees, particularly those with chronic conditions.

- Mental Health and Substance Abuse Services: Assess the plan's coverage for mental health counseling, therapy, and substance abuse treatment. These services are crucial for employee well-being and should be given due consideration.

- Maternity and Newborn Care: If your workforce includes individuals of reproductive age, evaluate the plan's coverage for maternity-related services, including prenatal care, delivery, and postpartum support.

- Dental and Vision Care: Understand the plan's coverage for dental and vision services, which are often separate from medical insurance. Assess whether the plan provides adequate coverage for routine dental check-ups, vision exams, and necessary procedures.

Beyond these core benefits, delve into the plan's additional perks and services that can enhance employee satisfaction and well-being. These may include:

- Wellness Programs: Assess whether the plan offers incentives or programs that encourage healthy lifestyles, such as gym memberships, smoking cessation programs, or weight management initiatives.

- Telehealth Services: With the rise of telemedicine, evaluate if the plan covers virtual doctor visits, which can provide convenient access to healthcare services, particularly for employees in remote locations.

- Chiropractic and Alternative Care: Consider the plan's coverage for chiropractic services, acupuncture, or other alternative therapies that may be preferred by some employees.

By conducting a thorough analysis of the benefits and coverage, you can make an informed decision that ensures your small business provides comprehensive and satisfying healthcare benefits to its valued employees.

Cost Considerations: Strategies for Affordability

When it comes to selecting health insurance for your small business, one of the key considerations is finding a plan that offers a balance between comprehensive coverage and affordability. Here are some strategies to help you navigate the cost landscape and make informed decisions:

Assess Employee Needs and Priorities

Understanding the healthcare needs and preferences of your employees is crucial. Conduct surveys or gather feedback to gauge the types of coverage they value most. This information will guide you in choosing a plan that aligns with their priorities, ensuring a higher level of satisfaction and potentially reducing unnecessary costs.

Evaluate Premium Structures

Premiums are a significant factor in the overall cost of health insurance. Evaluate the premium structures offered by different plans. Some plans may have higher premiums but lower deductibles, while others may have lower premiums but higher deductibles. Consider the financial situation of your business and employees, and opt for a structure that provides the best balance between affordability and coverage.

Explore Cost-Sharing Options

Cost-sharing arrangements, such as copayments, coinsurance, and deductibles, can impact the out-of-pocket expenses for your employees. Evaluate the cost-sharing options offered by different plans. Some plans may have higher cost-sharing for certain services, while others may provide more generous coverage. Assess the potential financial impact on your employees and choose a plan that strikes a reasonable balance.

Consider Network Providers and Coverage Areas

The network of providers and coverage areas included in a health insurance plan can significantly affect costs. Assess the network of healthcare providers associated with each plan. Ensure that the plan includes reputable and conveniently located providers, especially for specialized services. Additionally, consider the coverage areas to ensure that your employees have access to healthcare services where they live or frequently travel for work.

Utilize Tax Credits and Subsidies

Small businesses may be eligible for tax credits and subsidies to help offset the cost of providing health insurance to their employees. Research and understand the availability of these benefits in your region. Take advantage of any applicable credits or subsidies to reduce the financial burden on your business and make health insurance more affordable.

Negotiate with Insurance Providers

Don’t be afraid to negotiate with insurance providers. As a small business owner, you have the opportunity to leverage your understanding of the market and the needs of your employees to negotiate better rates and terms. Engage in open communication with insurance brokers or providers, expressing your expectations and budget constraints. They may be able to offer customized plans or discounts to meet your specific requirements.

Offer Employee Incentives and Wellness Programs

Implementing employee incentives and wellness programs can not only improve the overall health and satisfaction of your workforce but also potentially reduce healthcare costs. Encourage preventive care, healthy lifestyles, and regular check-ups by offering incentives such as gym memberships, wellness challenges, or discounts on healthy food options. These initiatives can lead to reduced healthcare utilization and lower insurance costs in the long run.

Strategies for Successful Implementation and Employee Engagement

Implementing a new health insurance plan for your small business is a significant undertaking, and ensuring a smooth transition and effective employee engagement is crucial for its success. Here are some strategies to guide you through this process:

Effective Communication

Clear and consistent communication is key. Provide comprehensive information to your employees about the new health insurance plan, including coverage details, cost implications, and any changes in provider networks or benefit structures. Ensure that your employees understand the value of the plan and how it meets their healthcare needs. Utilize various communication channels, such as emails, staff meetings, and informational sessions, to address any questions or concerns they may have.

Transition Support

Assist your employees during the transition period by offering support and guidance. Help them navigate the new insurance plan, understand their benefits, and locate in-network providers. Provide resources such as online tools, brochures, or personalized assistance to make the transition as seamless as possible. Ensure that your employees feel supported and empowered to make informed decisions about their healthcare.

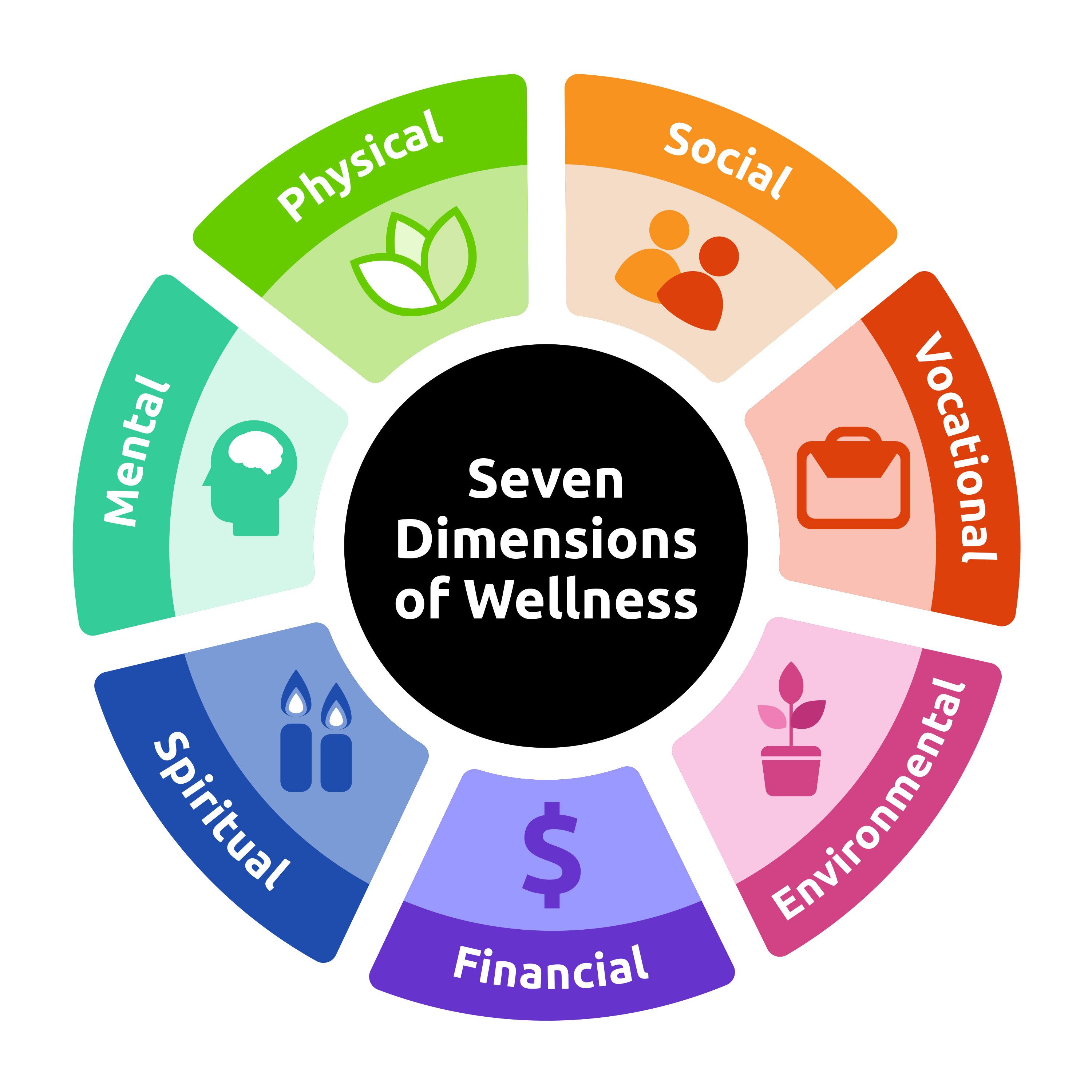

Educate on Preventive Care and Wellness

Emphasize the importance of preventive care and wellness in your new health insurance plan. Educate your employees about the benefits of regular check-ups, screenings, and healthy lifestyle choices. Promote a culture of wellness within your organization by organizing health-related events, providing resources for mental health support, or offering incentives for adopting healthy habits. By fostering a culture of proactive healthcare, you can improve employee well-being and potentially reduce healthcare costs in the long run.

Encourage Feedback and Collaboration

Create an open and collaborative environment where employees feel comfortable providing feedback on the new health insurance plan. Encourage them to share their experiences, concerns, and suggestions for improvement. This feedback loop can help you identify areas where the plan may need adjustments or where additional support is required. Demonstrate your commitment to their well-being by actively listening to their input and implementing feasible changes based on their feedback.

Partner with Healthcare Providers

Establish strong partnerships with healthcare providers in your network. Collaborate with them to ensure that your employees receive the best possible care. Work together to develop strategies that improve access to healthcare services, enhance patient experiences, and optimize the overall healthcare delivery process. By fostering positive relationships with healthcare providers, you can contribute to a more efficient and effective healthcare system for your employees.

Regular Review and Adaptation

Health insurance plans and healthcare needs can evolve over time. Regularly review the performance and effectiveness of your chosen plan. Stay informed about changes in the healthcare landscape, new coverage options, and potential cost-saving measures. Adapt your plan as necessary to ensure it continues to meet the needs of your employees and remains competitive in the market. By staying proactive and responsive, you can maintain a robust and beneficial health insurance offering for your small business.

Future Trends and Innovations in Health Insurance for Small Businesses

The landscape of health insurance for small businesses is continually evolving, driven by technological advancements, changing consumer preferences, and policy shifts. Here are some key trends and innovations that are shaping the future of health insurance for small businesses:

Telehealth and Virtual Care

Telehealth and virtual care services have gained significant traction, especially in the wake of the COVID-19 pandemic. These services offer convenient and accessible healthcare options, allowing patients to consult with healthcare providers remotely. Small businesses can leverage telehealth platforms to provide employees with easy access to medical advice, reducing the need for in-person visits and potentially lowering healthcare costs.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while reducing costs. These models incentivize healthcare providers to prioritize patient outcomes and overall well-being. By adopting value-based care, small businesses can encourage preventive care, improve chronic disease management, and reduce unnecessary healthcare expenditures.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are gaining popularity. These plans empower individuals to take control of their healthcare spending and decision-making. Small businesses can offer these plans as an option, allowing employees to contribute pre-tax dollars and have more flexibility in managing their healthcare expenses.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the healthcare industry. These technologies enable more accurate risk assessments, personalized treatment plans, and efficient claim processing. Small businesses can leverage AI-powered tools to enhance their health insurance offerings, improve employee engagement, and optimize healthcare outcomes.

Wellness and Lifestyle Programs

Wellness and lifestyle programs are becoming increasingly important in the health insurance landscape. These programs focus on promoting healthy behaviors, preventing chronic diseases, and improving overall employee well-being. Small businesses can implement wellness initiatives, such as fitness challenges, nutritional programs, or mental health support, to enhance employee satisfaction and reduce healthcare costs associated with preventable conditions.

Digital Health Platforms

Digital health platforms are revolutionizing the way healthcare services are delivered and accessed. These platforms integrate various healthcare services, including telemedicine, electronic health records, and personalized health tracking. Small businesses can leverage digital health platforms to provide employees with a seamless and integrated healthcare experience, improving convenience and engagement.

Preventive Care Initiatives

Preventive care initiatives, such as immunizations, screenings, and health coaching, are gaining prominence in health insurance plans. These initiatives aim to identify and address health issues early on, reducing the need for costly treatments later. Small businesses can prioritize preventive care by offering incentives, educational resources, and access to preventive services, ultimately contributing to a healthier and more productive workforce.

Conclusion: Empowering Your Small Business with the Right Health Insurance

Navigating the complex world of health insurance as a small business owner can be daunting, but with the right knowledge and strategies, you can make informed decisions that benefit both your business and your employees. By understanding the various plan types, evaluating provider networks and coverage areas, analyzing benefits and coverage, and considering cost-saving strategies, you can select a health insurance plan that provides comprehensive and affordable healthcare for your workforce.

Implementing the right health insurance plan not only protects your employees' well-being but also contributes to a positive and productive work environment. Through effective communication, transition support, and employee engagement, you can ensure a smooth adoption of the new plan and foster a culture of wellness within your organization. Additionally, staying updated on future trends and innovations in health insurance will allow you to adapt and stay competitive in the ever-evolving healthcare landscape.

As a small business owner, you play a vital role in the well-being and satisfaction of your employees. By prioritizing health insurance and making it a cornerstone of your business strategy, you empower your workforce to thrive and contribute to the long-term success of your enterprise.

What is the average cost of health insurance for small businesses?

+The average cost of health insurance for small businesses varies based on factors such as the size of the business, location, and the chosen plan type. According to recent data, the average annual premium for small group health insurance plans ranges from 6,000 to 12,000 per employee, with an average monthly premium of approximately 500 to 1,000.