Compare Auto Insurance California

When it comes to auto insurance in California, there are numerous options available to residents. With a wide range of insurance providers offering diverse coverage plans, it can be challenging for drivers to navigate the complex landscape of policies and make informed decisions. This article aims to provide an in-depth comparison of auto insurance options in California, shedding light on the key factors that influence coverage and costs.

Understanding Auto Insurance in California

California is known for its strict auto insurance laws, aiming to protect drivers and ensure financial responsibility on the roads. The state requires all drivers to carry at least the minimum level of liability insurance, which includes bodily injury and property damage coverage. However, given the varying needs and preferences of drivers, understanding the nuances of auto insurance is crucial to make the right choice.

Minimum Requirements vs. Comprehensive Coverage

While the state mandates that drivers carry liability insurance, it is essential to note that this minimum coverage might not provide sufficient protection in case of accidents. Drivers in California have the option to enhance their coverage by adding additional policies such as collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage.

Collision coverage, for instance, protects against damage to your vehicle in case of an accident, regardless of fault. On the other hand, comprehensive coverage provides protection against damages caused by factors other than collisions, such as theft, vandalism, or natural disasters. Medical payments coverage, often referred to as MedPay, covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

Uninsured/underinsured motorist coverage is particularly important in California, as it protects you in case of an accident with a driver who lacks sufficient insurance. This coverage can provide financial support for medical bills, lost wages, and other damages.

Factors Influencing Auto Insurance Costs

The cost of auto insurance in California can vary significantly based on several factors. Understanding these factors can help drivers make more informed decisions and potentially save money on their insurance premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role in determining insurance costs. Additionally, the primary purpose of your vehicle (personal, commercial, or business use) can also impact your insurance rates.

- Driver Profile: Your driving history, age, gender, and credit score are key factors considered by insurance providers. Younger drivers and those with a history of accidents or traffic violations may face higher insurance premiums.

- Coverage and Deductibles: The level of coverage you choose and the associated deductibles directly impact your insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums.

- Location and Mileage: The area where you live and the average number of miles driven annually can affect your insurance rates. Urban areas with higher traffic density and theft rates often result in higher insurance costs.

- Discounts and Bundling: Many insurance providers offer discounts for safe driving, good student grades, or bundling multiple policies (such as auto and home insurance) with the same provider. Taking advantage of these discounts can help reduce your overall insurance costs.

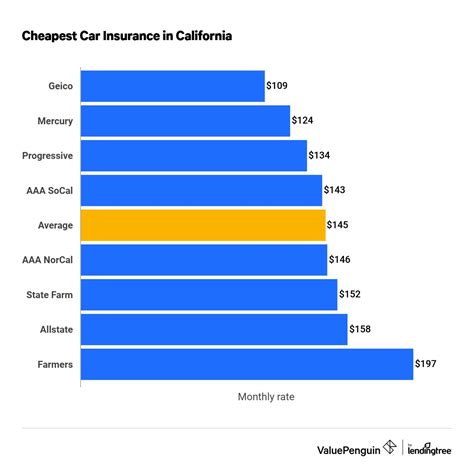

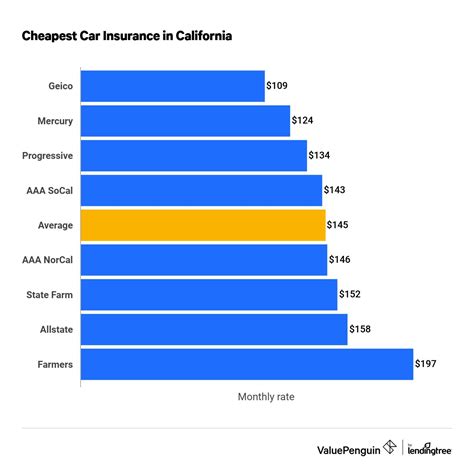

Top Auto Insurance Providers in California

California boasts a diverse range of auto insurance providers, each offering unique coverage plans and pricing structures. Here, we delve into some of the top providers and compare their offerings to help drivers make informed choices.

State Farm

State Farm is one of the leading auto insurance providers in California, known for its comprehensive coverage options and excellent customer service. The company offers a wide range of policies, including liability, collision, comprehensive, and medical payments coverage. State Farm also provides additional benefits such as rental car reimbursement and roadside assistance.

One of the key advantages of State Farm is its personalized approach to insurance. The company assigns each customer a dedicated agent who can provide tailored advice and assistance. This level of personalization can be particularly beneficial for drivers seeking guidance on coverage options and policy management.

Geico

Geico is another prominent player in the California auto insurance market, renowned for its competitive pricing and digital-first approach. The company offers a user-friendly online platform, allowing customers to easily compare quotes, manage policies, and file claims.

Geico provides a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The company also offers additional benefits such as accident forgiveness, which can prevent your insurance rates from increasing after a single at-fault accident. Geico’s digital platform further enhances the convenience of managing your insurance needs.

Progressive

Progressive is a well-established auto insurance provider known for its innovative products and customer-centric approach. The company offers a wide range of coverage options, including liability, collision, comprehensive, and medical payments coverage. Progressive also provides specialized policies for high-risk drivers and those with unique vehicle needs.

One of Progressive’s standout features is its Name Your Price® tool, which allows customers to choose their desired coverage and price range. This tool provides a customized quote based on the customer’s preferences, offering a unique level of control over insurance costs. Progressive also offers additional benefits such as usage-based insurance (snapshot®), which rewards safe driving habits with potential discounts.

Esurance

Esurance is a digital-focused auto insurance provider, offering a seamless online experience for California drivers. The company provides a user-friendly platform where customers can easily compare quotes, manage policies, and file claims from the comfort of their homes.

Esurance offers a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The company also provides additional benefits such as rental car coverage and roadside assistance. Esurance’s digital platform is designed to streamline the insurance process, making it a convenient choice for tech-savvy drivers.

Allstate

Allstate is a well-known auto insurance provider with a strong presence in California. The company offers a comprehensive range of coverage options, including liability, collision, comprehensive, and medical payments coverage. Allstate also provides specialized policies for high-risk drivers and those with unique vehicle needs.

One of Allstate’s standout features is its Drivewise® program, which utilizes telematics technology to track driving habits and reward safe driving with potential discounts. Allstate also offers additional benefits such as accident forgiveness and safe driving bonuses. With a focus on customer satisfaction, Allstate provides personalized support and guidance to its policyholders.

Comparative Analysis: Key Considerations

When comparing auto insurance providers in California, there are several key considerations to keep in mind. These factors can help drivers make informed decisions and find the best coverage options for their needs.

Coverage Options and Customization

Each driver’s insurance needs are unique, and the ability to customize coverage options is essential. Look for providers that offer a wide range of coverage options, including liability, collision, comprehensive, and specialized policies. The ability to tailor your coverage based on your specific needs is crucial to ensure adequate protection.

Pricing and Discounts

Insurance premiums can vary significantly between providers, so it is important to compare pricing structures. Look for providers that offer competitive rates and provide discounts for safe driving, good student grades, or bundling multiple policies. Additionally, consider the overall value of the coverage provided, rather than solely focusing on the lowest price.

Customer Service and Claims Handling

In the event of an accident or claim, efficient and responsive customer service is crucial. Look for providers with a strong track record of excellent customer service and a streamlined claims handling process. Consider factors such as the availability of dedicated agents, online resources, and the ease of filing and managing claims.

Digital Tools and Convenience

In today’s digital age, many drivers prefer the convenience of managing their insurance needs online. Look for providers that offer user-friendly digital platforms, allowing easy access to quotes, policy management, and claims filing. Additionally, consider providers that offer mobile apps for added convenience.

Conclusion

Navigating the auto insurance landscape in California can be complex, but with the right knowledge and tools, drivers can make informed decisions. By understanding the key factors that influence coverage and costs, comparing top providers, and considering key considerations, drivers can find the best auto insurance options that meet their unique needs. Remember to carefully evaluate coverage options, pricing, customer service, and digital convenience when making your choice.

How much does auto insurance cost in California on average?

+The average cost of auto insurance in California can vary depending on factors such as location, driving history, and coverage options. As of 2023, the average annual premium for minimum liability coverage in California is around 700 to 800. However, comprehensive coverage with higher limits can cost significantly more, ranging from 1,500 to 2,000 or more per year.

Are there any discounts available for auto insurance in California?

+Yes, many auto insurance providers in California offer a range of discounts to help customers save on their premiums. Common discounts include safe driver discounts, good student discounts, bundling discounts (combining auto and home insurance), and loyalty discounts for long-term customers. It is worth exploring these options with your insurance provider to maximize your savings.

What factors can increase my auto insurance rates in California?

+Several factors can impact your auto insurance rates in California. These include your driving record (accidents, traffic violations), the make and model of your vehicle, the area where you live, and your credit score. Additionally, factors such as age, gender, and marital status can also influence your insurance rates. It is important to maintain a clean driving record and explore ways to improve your credit score to potentially lower your insurance costs.