Define Gap Insurance

In the world of automotive finance and insurance, Gap Insurance stands as a critical safeguard for vehicle owners, particularly in the context of auto loans and leases. It is a specialized insurance product designed to protect individuals from the financial pitfalls that can arise when a vehicle's market value declines below the outstanding balance on its loan or lease agreement.

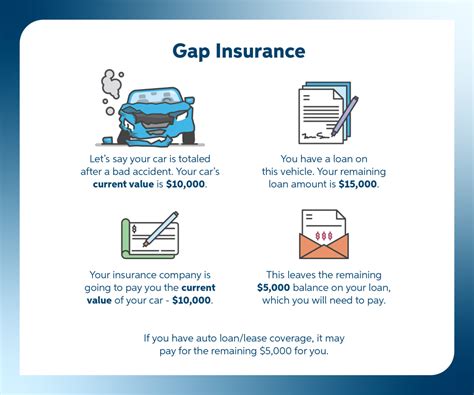

This type of insurance is especially relevant in scenarios where a vehicle is written off, stolen, or otherwise considered a total loss. In such situations, the insurance payout may not fully cover the outstanding loan or lease balance, leaving the owner with a significant financial gap. Gap Insurance steps in to bridge this gap, ensuring that the policyholder is not left with a substantial debt burden.

Understanding the Concept

Gap Insurance, short for Guaranteed Asset Protection Insurance, is a form of coverage that safeguards individuals against the financial loss that can occur when the value of their vehicle depreciates faster than the rate at which they are paying off their loan or lease. This depreciation can lead to a situation where the vehicle’s resale value is less than the remaining debt, a scenario often referred to as being “upside down” or “underwater” on a loan.

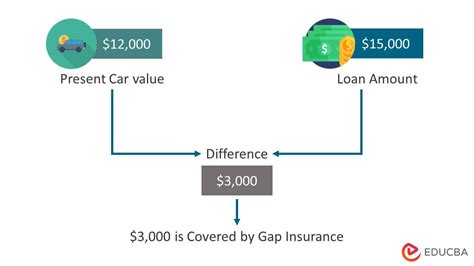

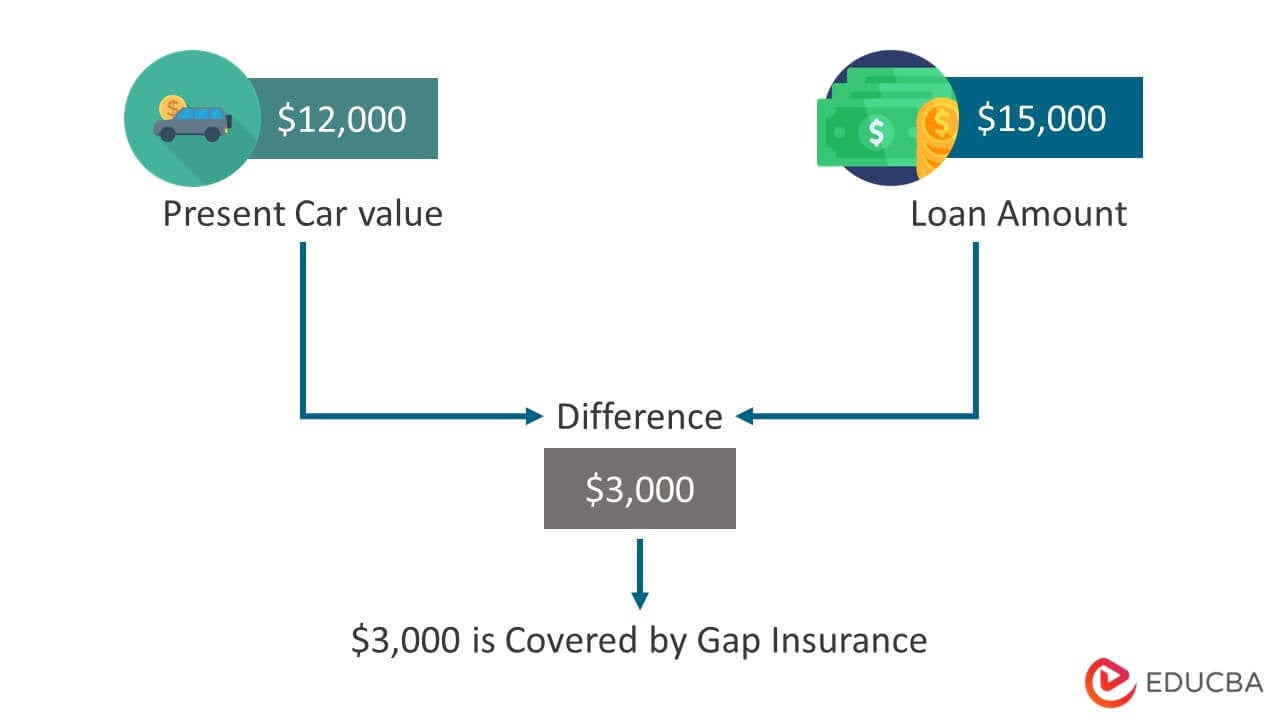

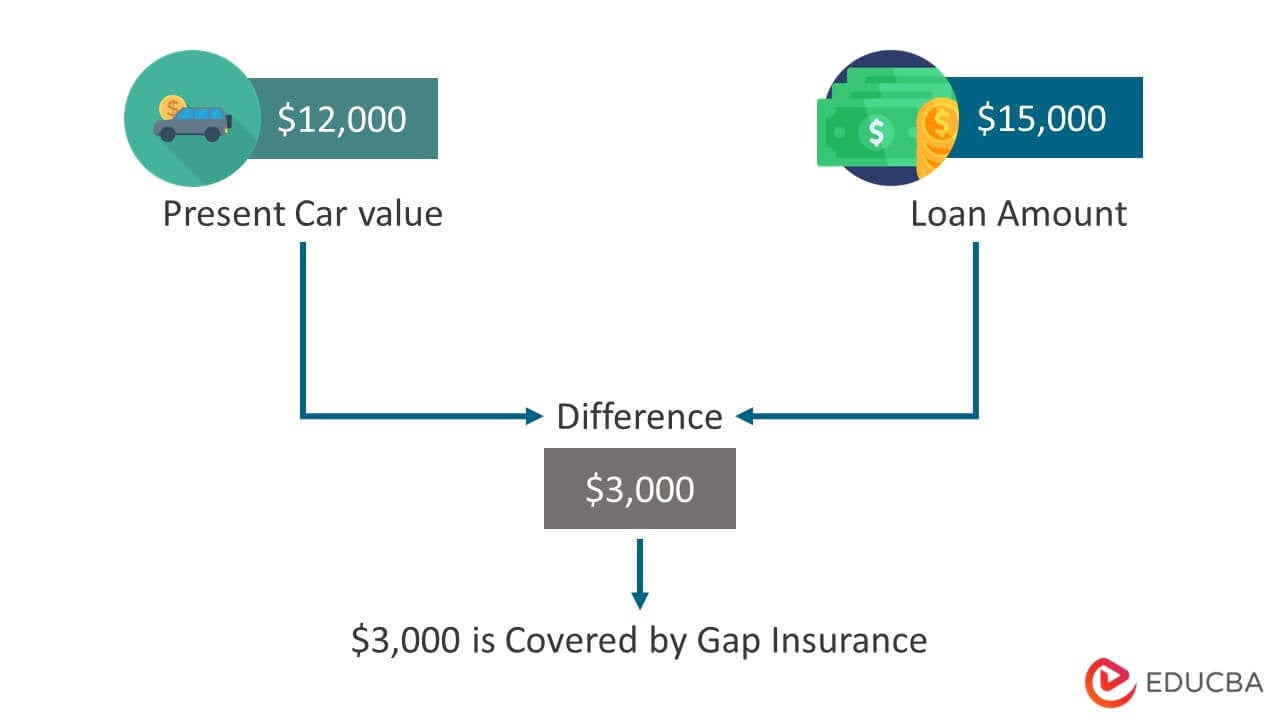

For instance, imagine purchasing a new car for $30,000 and taking out a loan for the full amount. Over time, the car's value drops due to factors like wear and tear, mileage, and market conditions. If, in a few years, the car's value has decreased to $20,000 but you still owe $25,000 on the loan, you would face a significant financial loss if the car were to be written off or stolen. This is where Gap Insurance comes into play, ensuring that the policyholder is not left liable for the remaining $5,000.

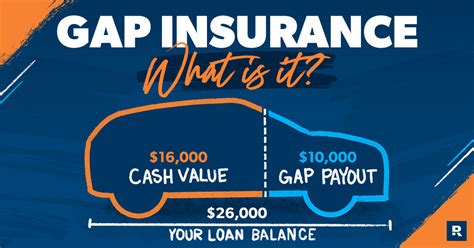

How Gap Insurance Works

Gap Insurance policies typically cover the difference between the value of the vehicle and the amount owed on the loan or lease. This difference, known as the “gap,” can occur due to various factors, including normal vehicle depreciation, excess mileage charges, or the application of deductible amounts. By purchasing Gap Insurance, policyholders can ensure that they are not left financially exposed in the event of a total loss.

When a claim is made, the insurance company pays out the gap amount, either directly to the policyholder or to the finance company, ensuring that the outstanding debt is settled in full. This not only protects the individual from unexpected financial burdens but also ensures that they are not left with a vehicle that is worth less than what they owe.

Key Features and Benefits

- Financial Protection: Gap Insurance provides a safety net, ensuring that policyholders are not left with a substantial debt if their vehicle is written off or stolen.

- Peace of Mind: By eliminating the risk of negative equity, Gap Insurance offers peace of mind, allowing individuals to focus on their driving experience without financial worries.

- Wide Coverage: Gap Insurance covers a range of situations, including total loss, theft, or damage beyond repair, providing comprehensive protection.

- Affordable Premiums: Despite its extensive coverage, Gap Insurance is often affordable, with premiums typically lower than other insurance types.

- Ease of Purchase: Many dealerships offer Gap Insurance at the time of vehicle purchase, making it convenient for buyers to secure this crucial coverage.

Considerations and Limitations

While Gap Insurance offers valuable protection, it is important to understand its limitations and potential exclusions. For instance, Gap Insurance may not cover all types of vehicles or situations, and policyholders should carefully review the terms and conditions to ensure they understand the coverage extent.

Additionally, some policies may have specific requirements or conditions that must be met for a claim to be valid. For example, regular vehicle maintenance, adherence to mileage limits (if applicable), and prompt reporting of any incidents are often essential for a successful claim.

Real-World Examples

Let’s consider a real-life scenario. Mr. Johnson recently purchased a new SUV for 45,000 and financed the entire amount. After two years of ownership, the SUV's value has depreciated to 35,000, but Mr. Johnson still owes 40,000 on his loan. If the SUV were to be totaled in an accident, Mr. Johnson would face a financial loss of 5,000. However, with Gap Insurance, the insurance company would cover this gap, ensuring Mr. Johnson does not incur any additional debt.

| Scenario | Vehicle Value | Loan/Lease Balance | Gap Amount |

|---|---|---|---|

| New Car Purchase | $30,000 | $30,000 | $0 |

| 2 Years Later | $20,000 | $25,000 | $5,000 |

Future Implications and Industry Trends

As the automotive industry continues to evolve, with a focus on electric vehicles (EVs) and autonomous driving, the role of Gap Insurance may also shift. The unique depreciation patterns and resale values of EVs, coupled with the potential impact of autonomous driving on insurance claims, could influence the design and coverage of Gap Insurance policies.

Additionally, with the rise of subscription-based vehicle models and other alternative ownership structures, the traditional loan-based Gap Insurance may need to adapt to cater to these changing consumer preferences. This could involve developing new policies or expanding the scope of existing ones to provide comprehensive protection for a wider range of vehicle ownership scenarios.

Frequently Asked Questions

Is Gap Insurance mandatory for all vehicle owners?

+Gap Insurance is not mandatory, but it is highly recommended, especially for those who finance their vehicles. It provides an additional layer of protection, ensuring that vehicle owners are not left with a significant debt if their car is written off or stolen.

How much does Gap Insurance typically cost?

+The cost of Gap Insurance can vary depending on several factors, including the value of the vehicle, the loan or lease amount, and the provider. However, it is often affordable, with premiums typically ranging from a few hundred to a few thousand dollars for the entire coverage period.

Can Gap Insurance be purchased at any time, or is there a specific window for purchase?

+Gap Insurance is typically available at the time of vehicle purchase or lease. However, in some cases, it can be purchased at a later date, depending on the provider and the policy terms. It is advisable to check with your insurance provider or dealer to understand the specific window for purchase.

Does Gap Insurance cover all types of vehicles, or are there any restrictions?

+Gap Insurance coverage can vary based on the provider and the policy terms. While it is commonly available for cars, trucks, and SUVs, there may be restrictions or additional requirements for certain types of vehicles, such as motorcycles, recreational vehicles, or commercial fleet vehicles. It’s important to review the policy details to understand the specific coverage.