Define Term Life Insurance

Term life insurance is a fundamental component of financial planning, offering a cost-effective solution for individuals and families to secure their future and protect their loved ones. In this comprehensive guide, we will delve into the intricacies of term life insurance, exploring its definition, key features, benefits, and how it can provide essential financial security during uncertain times.

Understanding Term Life Insurance

Term life insurance, often simply referred to as “term life,” is a type of insurance policy that provides coverage for a specified period, known as the policy term. Unlike permanent life insurance policies that offer lifelong coverage, term life insurance focuses on providing protection for a defined timeframe, typically ranging from 10 to 30 years.

The primary purpose of term life insurance is to offer financial support to beneficiaries in the event of the policyholder's untimely death during the policy term. This support can take the form of a lump-sum payment, also known as the death benefit, which is paid out to the designated beneficiaries, ensuring their financial stability and helping to cover various expenses, such as funeral costs, outstanding debts, and ongoing living expenses.

Key Features of Term Life Insurance

Term life insurance policies are renowned for their simplicity and affordability, making them an attractive option for many individuals and families. Here are some of the key features that set term life insurance apart:

- Fixed Coverage Period: Term life policies are designed to cover a specific period, typically chosen by the policyholder. This fixed term ensures that the policy remains in force only for the duration selected, after which it expires.

- Level Premiums: Policyholders can expect to pay a consistent premium throughout the policy term. This predictability makes it easier to budget and plan for the future.

- Death Benefit: The death benefit is the core benefit of term life insurance. It represents the amount that the beneficiaries will receive if the policyholder passes away during the policy term.

- Renewable or Convertible: Many term life policies offer the option to renew or convert the policy at the end of the term. Renewal allows the policyholder to extend the coverage period, while conversion enables them to switch to a permanent life insurance policy without undergoing a new medical examination.

- Flexible Policy Options: Term life insurance provides a range of policy options to cater to different needs and preferences. Policyholders can choose from various term lengths, benefit amounts, and even add optional riders to enhance their coverage.

Benefits of Term Life Insurance

Term life insurance offers a multitude of benefits that make it an essential tool for financial security. Some of the key advantages include:

- Affordability: Term life insurance is often the most cost-effective way to obtain a substantial death benefit. The fixed premiums and limited coverage period make it an attractive option for those on a budget.

- Financial Protection for Beneficiaries: The primary benefit of term life insurance is the peace of mind it provides by ensuring that your loved ones are financially secure in the event of your untimely death. The death benefit can help cover immediate and long-term expenses, ensuring a stable future for your family.

- Flexibility: With various term lengths and policy options, term life insurance allows policyholders to tailor their coverage to their specific needs and life stages. Whether you're starting a family, purchasing a home, or planning for retirement, term life insurance can adapt to your changing circumstances.

- Renewal and Conversion Options: The ability to renew or convert your policy provides an added layer of security. Renewal ensures continuous coverage, while conversion allows you to transition to a permanent life insurance policy, providing lifelong protection.

- Optional Riders: Term life insurance policies often offer additional riders that can enhance your coverage. These riders may include features like waiver of premium, accelerated death benefit, or disability income protection.

How Term Life Insurance Works

Understanding the mechanics of term life insurance is essential for making informed decisions about your financial future. Here’s a step-by-step breakdown of how term life insurance operates:

- Policy Application: The process begins with the policyholder completing an application, providing personal and health-related information. This information helps the insurance company assess the risk and determine the premium.

- Medical Examination: Depending on the policy and the insurance company, a medical examination may be required. This examination helps assess the policyholder's health and risk profile.

- Policy Approval: After reviewing the application and medical examination (if applicable), the insurance company will approve or decline the policy. If approved, the policyholder will receive the policy documents.

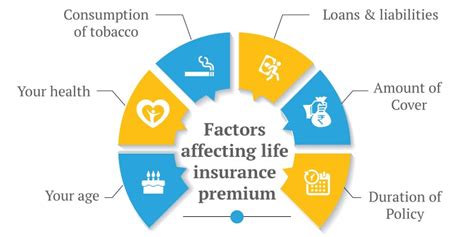

- Premium Payment: Policyholders are required to pay a premium, typically on a monthly, quarterly, or annual basis, to keep the policy active. The premium amount is determined by various factors, including the policyholder's age, health, and the chosen coverage amount.

- Coverage Period: The policy term begins, and the policyholder is covered for the specified period. During this time, the policyholder must continue paying the premiums to maintain coverage.

- Benefit Payment: In the unfortunate event of the policyholder's death during the policy term, the beneficiaries are entitled to receive the death benefit. The insurance company will require proof of death and may have specific procedures for claiming the benefit.

- Renewal or Conversion: As the policy term approaches its end, the policyholder has the option to renew the policy for an additional term or convert it to a permanent life insurance policy. Renewal typically requires the payment of a new premium, while conversion may have specific requirements and conditions.

Performance Analysis and Case Studies

To illustrate the impact and effectiveness of term life insurance, let’s examine some real-life case studies and analyze the performance of term life policies in different scenarios:

Case Study 1: Young Family Protection

John and Emily, a young couple with two children, purchase a 20-year term life insurance policy with a $1 million death benefit. John, the primary breadwinner, passes away unexpectedly in a tragic accident when their children are still young. The death benefit provides the family with financial stability, covering funeral expenses, paying off their mortgage, and funding their children’s education.

Case Study 2: Business Protection

Sarah, a successful entrepreneur, purchases a 10-year term life insurance policy with a $500,000 death benefit to protect her business. Unfortunately, Sarah suffers a severe illness and passes away during the policy term. The death benefit is used to buy out her business partners, ensuring the company’s continuity and protecting the financial interests of her loved ones.

Case Study 3: Debt Repayment

Michael, a single father with substantial student loan debt, secures a 30-year term life insurance policy with a $250,000 death benefit. Tragically, Michael is involved in a car accident and passes away, leaving his daughter alone. The death benefit is utilized to repay his outstanding loans, providing his daughter with financial freedom and a secure future.

| Case Study | Policy Term | Death Benefit | Beneficiary Impact |

|---|---|---|---|

| Young Family Protection | 20 years | $1 million | Covered funeral costs, paid off mortgage, funded education |

| Business Protection | 10 years | $500,000 | Bought out business partners, ensured company continuity |

| Debt Repayment | 30 years | $250,000 | Repaid student loans, provided financial freedom |

Evidence-Based Future Implications

Term life insurance continues to evolve and adapt to the changing needs of individuals and families. Here are some future implications and trends to consider:

- Increasing Awareness: As financial literacy grows, more individuals are recognizing the importance of term life insurance. The future is likely to see a continued rise in awareness and adoption of term life policies.

- Digital Transformation: The insurance industry is embracing digital technologies, making it easier for policyholders to manage their policies online. Expect further innovations in online applications, policy management, and claim processes.

- Personalized Coverage: With advancements in data analytics, insurance companies can offer more personalized term life insurance policies. This may include dynamic coverage amounts and flexible payment options based on individual needs and risk profiles.

- Enhanced Riders: Insurance providers are likely to introduce new and improved riders to term life insurance policies. These riders may offer additional benefits, such as critical illness coverage or long-term care protection, providing comprehensive financial security.

- Global Expansion: Term life insurance is gaining traction globally, and its reach is expected to expand further. As more countries recognize the importance of financial protection, term life insurance will become a standard component of financial planning worldwide.

Frequently Asked Questions

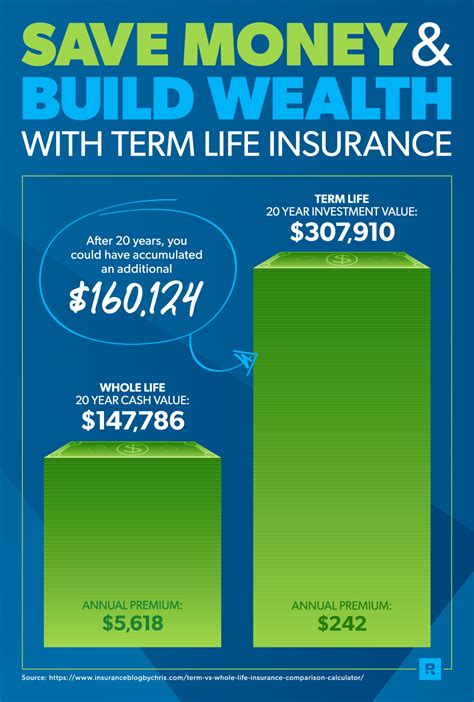

What is the difference between term life insurance and whole life insurance?

+

Term life insurance provides coverage for a specific term, typically 10-30 years, and offers a fixed death benefit. Whole life insurance, on the other hand, provides lifelong coverage and accumulates cash value over time, which can be borrowed against or withdrawn.

Is term life insurance renewable?

+

Yes, many term life insurance policies offer the option to renew the coverage for an additional term. Renewal typically involves paying a new premium based on the policyholder’s age and health at the time of renewal.

Can I convert my term life insurance policy to a permanent policy?

+

Yes, many term life policies allow policyholders to convert their coverage to a permanent life insurance policy without undergoing a new medical examination. Conversion typically has specific requirements and deadlines, so it’s important to review your policy details.

How much does term life insurance cost?

+

The cost of term life insurance varies based on factors such as the policyholder’s age, health, coverage amount, and policy term. Generally, term life insurance is more affordable than permanent life insurance, making it an accessible option for many individuals.

What happens if I miss a premium payment for my term life insurance policy?

+

Missing a premium payment can result in the policy lapsing or being canceled. It’s important to stay current with your premium payments to maintain continuous coverage. Some policies may offer a grace period for late payments.