Lowest Car Insurance Rates

Finding the lowest car insurance rates is a top priority for many drivers, as it can significantly impact their monthly budget and overall financial planning. With numerous insurance providers and varying factors influencing rates, it's essential to understand the key aspects that determine insurance costs and the strategies to secure the best deals.

Understanding Car Insurance Rates

Car insurance rates are calculated based on a combination of factors, including the driver’s age, gender, driving history, vehicle type, and location. Insurance companies use these factors to assess the risk associated with insuring a particular driver, which directly influences the premium they charge.

Demographic Factors

Age and gender play a significant role in determining insurance rates. Generally, younger drivers, especially those under 25, tend to have higher premiums due to their lack of driving experience. Additionally, gender-based pricing is becoming less common, but some insurance companies may still consider gender as a factor, with young male drivers often facing higher rates.

Driving history is another crucial aspect. A clean driving record with no accidents or traffic violations can lead to lower insurance rates. Conversely, a history of accidents or claims can significantly increase premiums. Insurance companies view drivers with a history of accidents as higher risk, resulting in higher rates.

Vehicle and Location Considerations

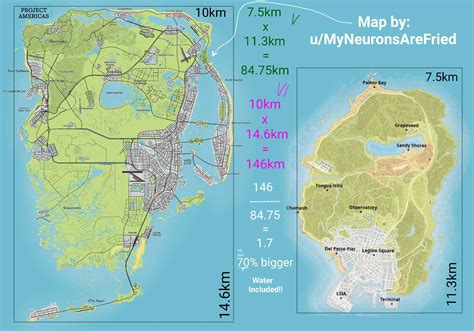

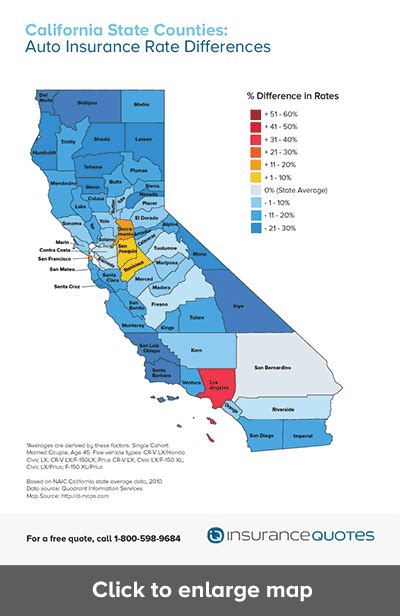

The type of vehicle you drive and where you live also impact your insurance rates. High-performance cars and luxury vehicles typically have higher insurance costs due to their value and the likelihood of higher repair costs. Additionally, the location where the vehicle is garaged can influence rates, as some areas may have a higher incidence of accidents or theft, leading to increased premiums.

| Demographic Factors | Impact on Rates |

|---|---|

| Age | Younger drivers often pay higher premiums. |

| Gender | Gender-based pricing is less common but may still influence rates. |

| Driving History | Clean records result in lower rates; accidents and violations increase premiums. |

Strategies to Secure the Lowest Rates

While insurance rates are largely determined by factors beyond your control, there are strategies you can employ to secure the lowest possible rates. These strategies involve a combination of careful research, understanding your options, and implementing certain practices to demonstrate your responsibility as a driver.

Shop Around and Compare

One of the most effective ways to find the lowest car insurance rates is to shop around and compare quotes from multiple insurance providers. Each company has its own rating system and considers different factors, so getting quotes from at least three to five providers can give you a good range of options. Online comparison tools can be especially useful for this, as they provide quick and easy access to multiple quotes.

When comparing quotes, pay attention to the coverage limits and deductibles. Ensure that you're comparing similar policies to get an accurate idea of the best value. Additionally, look beyond the initial premium and consider the overall cost of the policy, including any additional fees or discounts that may apply.

Understand Discounts and Savings

Insurance companies offer a variety of discounts to attract customers and reward responsible driving behavior. These discounts can significantly reduce your insurance premiums, so it’s essential to understand which ones you may be eligible for.

- Safe Driver Discounts: Many companies offer discounts for drivers with a clean driving record. If you've been accident-free and violation-free for a certain period, you may qualify for this discount.

- Multiple Policy Discounts: Insuring multiple vehicles or bundling your car insurance with other policies, such as home or life insurance, can often lead to significant savings.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may result in loyalty discounts, so it's worth checking if your current provider offers such incentives.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and may lead to lower premiums.

Practice Safe Driving

One of the most straightforward ways to reduce your car insurance rates is to practice safe driving. Avoid accidents and traffic violations, as these can significantly increase your premiums. Additionally, maintain a good credit score, as many insurance companies use credit-based insurance scores to assess risk and determine rates.

If you're a young driver, consider taking a driver's education course or getting additional driving training. This can not only improve your driving skills but also potentially lead to insurance discounts.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an emerging trend that allows insurance companies to monitor your driving behavior and charge premiums based on your actual usage. This type of insurance can be beneficial for low-mileage drivers or those with a history of safe driving, as it provides a more personalized rate.

Opt for Higher Deductibles

Increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower premiums. However, this strategy should be approached with caution, as it means you’ll be responsible for a larger portion of any future claims. Ensure that you have the financial means to cover a higher deductible before opting for this strategy.

| Discount Type | Eligibility and Benefits |

|---|---|

| Safe Driver Discount | Requires a clean driving record; can lead to significant savings. |

| Multiple Policy Discount | Bundling insurance policies can result in reduced rates. |

| Loyalty Discount | Long-term customers may be rewarded with lower premiums. |

| Defensive Driving Course Discount | Completing a course can demonstrate commitment to safe driving. |

The Future of Car Insurance Rates

The car insurance industry is evolving, and several trends are shaping the future of insurance rates. One notable trend is the increasing use of technology, such as telematics and artificial intelligence, to more accurately assess risk and personalize insurance policies. This shift towards data-driven insurance is likely to continue, offering more precise rates based on individual driving behavior.

The Rise of Telematics

Telematics insurance, as mentioned earlier, is gaining traction. This technology uses sensors and GPS to track driving behavior, providing insurance companies with real-time data on driving habits. While it may not be suitable for everyone, it can benefit safe drivers by offering more accurate and potentially lower premiums.

Data-Driven Pricing

Insurance companies are increasingly using advanced analytics and machine learning to analyze vast amounts of data. This data-driven approach allows them to identify patterns and trends, helping to more accurately predict risk and set insurance rates. As a result, insurance rates are becoming more tailored to individual drivers, reflecting their specific risk profile.

Incorporating Autonomous Vehicles

The emergence of autonomous vehicles is set to revolutionize the insurance industry. While self-driving cars have the potential to significantly reduce accidents, the transition period as these vehicles integrate onto roads may lead to increased liability concerns. Insurance companies are already exploring how to adapt their policies and rates to accommodate this new technology.

Personalized Insurance

The future of car insurance rates is moving towards personalized policies. With the advent of new technologies and data analytics, insurance companies can offer coverage that is tailored to individual drivers’ needs and behaviors. This shift towards personalized insurance may lead to more affordable rates for those who demonstrate safe driving habits.

Conclusion

Securing the lowest car insurance rates requires a combination of research, understanding of discounts and savings, and practicing safe driving habits. By shopping around, comparing quotes, and implementing strategies to reduce risk, drivers can significantly lower their insurance premiums. As the car insurance industry continues to evolve, the use of technology and data-driven pricing will likely play an even more significant role in determining insurance rates, offering more personalized and accurate coverage.

How often should I review my car insurance rates?

+

It’s a good practice to review your insurance rates annually or whenever you experience a significant life change, such as a move, marriage, or purchasing a new vehicle. Regular reviews ensure you’re getting the best value and taking advantage of any available discounts.

Can my insurance rates change if I move to a different state or city?

+

Yes, insurance rates can vary significantly between states and even within different cities. Factors like population density, traffic congestion, and local laws can all impact insurance rates. If you’re planning a move, it’s wise to research insurance costs in your new location.

What is the best way to compare car insurance quotes online?

+

Use reputable insurance comparison websites that allow you to enter your details once and receive multiple quotes from different providers. Ensure you’re comparing similar coverage levels and deductibles to get an accurate comparison. Additionally, read reviews and check the financial stability of the insurance companies you’re considering.

Can I negotiate my car insurance rates with my provider?

+

While insurance rates are largely determined by risk assessment and regulatory factors, you can negotiate with your provider to some extent. Discuss your driving record, safe driving habits, and any changes in your personal circumstances that may affect your risk profile. Additionally, inquire about any available discounts you may not have previously been aware of.

Are there any government programs or initiatives that can help lower car insurance rates for certain individuals or groups?

+

Yes, some states and local governments offer programs or initiatives to assist individuals with low incomes or specific demographics (e.g., seniors, veterans) in obtaining more affordable car insurance. These programs may provide discounts, lower premiums, or even state-funded insurance options. Check with your state’s insurance department or local government agencies for more information.