Health Insurance Online Quote

In today's fast-paced world, health insurance is a necessity, and obtaining an online quote has become a convenient and efficient way to explore coverage options. With just a few clicks, individuals can gain access to a vast array of plans, allowing them to make informed decisions about their healthcare coverage. This comprehensive guide aims to delve into the process of acquiring health insurance online quotes, shedding light on the key factors to consider and the steps involved in securing the right coverage for your needs.

Understanding Health Insurance Quotes

Health insurance quotes are tailored estimates provided by insurance companies, detailing the costs and coverage specifics of their plans. These quotes are essential tools for consumers, offering a glimpse into the potential financial obligations and benefits associated with different health insurance options.

When seeking an online health insurance quote, you'll typically be required to provide personal and medical information. This data is used to assess your risk profile, which in turn determines the quote's accuracy and the coverage recommendations made by the insurance provider.

Here's a breakdown of the key elements typically included in a health insurance quote:

- Premium: This is the amount you'll pay regularly (usually monthly) to maintain your health insurance coverage. It's the most prominent cost associated with health insurance.

- Deductible: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, while lower deductibles typically come with higher premiums.

- Co-payments (Co-pays): Co-pays are fixed amounts you pay for specific services, like doctor visits or prescription medications. These are typically paid at the time of service.

- Coinsurance: Coinsurance is the percentage of costs you share with your insurance provider after you've met your deductible. For instance, if your coinsurance is 20%, you'll pay 20% of the approved cost for a covered service, while your insurance covers the remaining 80%.

- Out-of-Pocket Maximum: This is the most you'll pay in a year for deductibles, co-pays, and coinsurance. Once you reach this limit, your insurance typically covers 100% of covered services for the remainder of the year.

- Coverage Limits: These specify the maximum amounts your insurance will pay for certain services or within a given time frame.

- Network of Providers: Health insurance plans often have networks of preferred providers. Out-of-network care may cost more or be excluded from coverage.

- Covered Services: The quote should detail the specific services and treatments that are covered by the plan.

- Exclusions and Limitations: Be aware of what's not covered by the plan. These exclusions can vary widely between plans.

The Online Quote Process: Step-by-Step

The process of obtaining an online health insurance quote is designed to be user-friendly and straightforward. Here’s a step-by-step guide to help you navigate the process:

Step 1: Choose a Reputable Insurance Comparison Website

Start by selecting a reliable insurance comparison website or platform. These platforms aggregate quotes from multiple insurance providers, offering a comprehensive view of available plans. Some popular options include eHealth, HealthCare.gov, and HealthInsurance.org. Ensure the website is secure and reputable to protect your personal information.

Step 2: Enter Your Personal and Medical Information

On the chosen platform, you’ll be prompted to provide personal details such as your name, date of birth, and contact information. Additionally, you’ll need to disclose your medical history, including any pre-existing conditions, medications, and previous treatments. Accurate disclosure of this information is crucial for obtaining an accurate quote.

Step 3: Select Your Desired Coverage Options

The platform will present you with various coverage options, allowing you to choose the plan that best aligns with your needs. Consider factors like the scope of coverage, the network of providers, and the cost of premiums, deductibles, and other out-of-pocket expenses. You can often filter plans based on these criteria to narrow down your options.

Step 4: Review and Compare Quotes

Once you’ve provided the necessary information and selected your coverage preferences, the platform will generate quotes from multiple insurance providers. Take the time to carefully review and compare these quotes. Pay attention to the fine print, ensuring you understand the coverage details, exclusions, and any potential limitations.

Step 5: Apply for Your Chosen Plan

After reviewing the quotes, select the plan that best suits your needs and budget. The platform will guide you through the application process, which typically involves providing additional personal and financial information. Ensure you have all the necessary documents ready, such as proof of income and identification.

Step 6: Wait for Approval and Receive Your Policy

Once you’ve submitted your application, the insurance provider will review it. This process can take a few days to a few weeks, depending on the complexity of your application and the provider’s turnaround time. If your application is approved, you’ll receive your policy documents, outlining the terms and conditions of your coverage.

| Key Steps | Description |

|---|---|

| Choose a Platform | Select a reputable insurance comparison website for a comprehensive view of plans. |

| Provide Information | Accurately disclose personal and medical details for an accurate quote. |

| Select Coverage | Choose a plan that aligns with your needs and budget. |

| Compare Quotes | Carefully review and compare quotes, considering coverage, costs, and exclusions. |

| Apply for Plan | Complete the application process, providing necessary documents. |

| Wait for Approval | Allow time for the insurance provider to review and approve your application. |

Factors Influencing Health Insurance Quotes

Health insurance quotes are influenced by a multitude of factors, each playing a role in determining the cost and coverage of your plan. Understanding these factors can help you make more informed decisions when selecting a health insurance policy.

Age

Age is a significant factor in health insurance quotes. Generally, younger individuals tend to have lower premiums, as they are less likely to require extensive medical care. Conversely, older individuals may face higher premiums due to an increased risk of health issues.

Health Status

Your current and past health status significantly impact your insurance quote. Pre-existing conditions, chronic illnesses, and previous medical treatments can all affect the cost and availability of coverage. Some insurance providers may exclude certain conditions from coverage or offer plans with limited benefits for those conditions.

Smoking Status

Smoking is a known risk factor for various health issues, and as such, it can significantly influence your insurance quote. Smokers often face higher premiums and may be subject to smoking cessation programs or incentives to quit.

Location

The cost of healthcare varies across different regions and states. Consequently, your location can affect the price and availability of health insurance plans. Rural areas may have fewer healthcare options and higher costs, while urban areas may offer a wider range of plans and more competitive pricing.

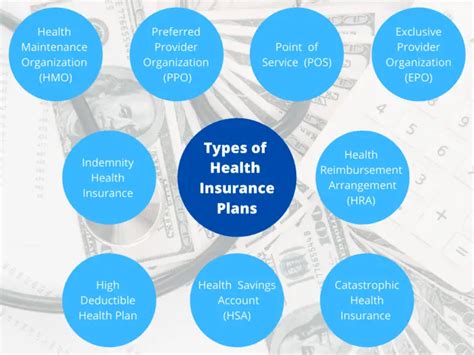

Plan Type and Coverage

The type of health insurance plan you choose and the level of coverage it provides are key factors in determining your quote. Plans with comprehensive coverage, lower deductibles, and a broad network of providers typically come with higher premiums. On the other hand, plans with limited coverage, higher deductibles, and a narrow provider network may offer more affordable premiums.

Family Size

If you’re seeking coverage for your entire family, the number of family members and their ages will impact your quote. Plans that cover more individuals may offer family discounts or have different premium structures based on the number of dependents.

Income Level

In some cases, your income level can influence your insurance quote, especially if you’re eligible for government-subsidized plans. Income-based subsidies can reduce the cost of premiums, making health insurance more affordable for those with lower incomes.

Pre-Existing Conditions

Pre-existing conditions, such as diabetes, heart disease, or cancer, can significantly impact your insurance quote. Some insurance providers may offer specific plans for individuals with pre-existing conditions, but these plans often come with higher premiums and limited coverage options.

Medications and Treatments

The medications you take and the treatments you require can also influence your insurance quote. Plans that cover a broader range of medications and treatments may have higher premiums, while those with more restrictive coverage may offer lower premiums.

Network of Providers

The network of healthcare providers associated with your insurance plan can affect your out-of-pocket costs. Plans with a broad network of providers may offer more flexibility and lower out-of-network costs, while plans with a narrow network may require you to pay more for out-of-network care.

Tips for Getting the Best Health Insurance Quote

Obtaining a health insurance quote is just the first step in securing the right coverage. To ensure you get the best value and coverage, consider the following tips:

- Shop Around: Compare quotes from multiple insurance providers to find the best deal. Online platforms make this process easier, but you can also reach out to individual providers for quotes.

- Understand Your Needs: Assess your healthcare needs and choose a plan that aligns with them. Consider your current and future medical requirements, including any pre-existing conditions or medications.

- Review Network of Providers: Ensure that your preferred doctors and hospitals are included in the plan's network to avoid unexpected out-of-network costs.

- Evaluate Cost vs. Coverage: Don't focus solely on the premium. Consider the overall cost, including deductibles, co-pays, and out-of-pocket maximums, as well as the coverage provided.

- Consider Subsidies: If you're eligible for government-subsidized plans, explore these options to reduce your premium costs.

- Review Exclusions and Limitations: Carefully read the fine print to understand what's not covered by the plan. This can help you avoid surprises and choose a plan that best suits your needs.

- Ask for Clarification: If you have questions or need further explanation about a plan's coverage or costs, don't hesitate to reach out to the insurance provider or a licensed insurance agent.

- Keep Records: Maintain a record of your quotes, applications, and policy documents for future reference and to facilitate any necessary changes or updates.

Can I get an online health insurance quote without providing my personal information?

+No, insurance companies require personal and medical information to provide an accurate quote. This information helps assess your risk profile and determine the appropriate coverage and costs.

Are online health insurance quotes binding?

+No, online quotes are estimates and are not binding. They provide a snapshot of the potential costs and coverage based on the information you've provided. The actual cost and coverage may vary once you apply and are approved for a plan.

Can I negotiate health insurance quotes?

+Health insurance quotes are typically based on standardized rates and regulations. While you may have some flexibility in choosing different coverage options or plans, the actual premium is often non-negotiable. However, it's worth exploring government-subsidized plans or employer-sponsored options, which can reduce your costs.

How often should I review and update my health insurance coverage?

+It's a good practice to review your health insurance coverage annually, especially during open enrollment periods. Life circumstances, health status, and plan offerings can change, so it's essential to ensure your coverage remains adequate and cost-effective.

What should I do if I have questions or need help understanding my health insurance quote?

+If you have questions or need clarification, reach out to the insurance provider or a licensed insurance agent. They can provide detailed explanations of the coverage, costs, and any exclusions or limitations.

In conclusion, obtaining an online health insurance quote is a vital step in securing the right coverage for your needs. By understanding the quote process, the factors that influence quotes, and the tips for getting the best value, you can make informed decisions about your healthcare coverage. Remember to carefully review and compare quotes, and don’t hesitate to seek professional guidance when needed.