Concealed Handgun Insurance

In the world of firearms, concealed carry has become an increasingly popular practice, with many individuals seeking the right to protect themselves and their loved ones. With this rising trend, the need for comprehensive insurance coverage specific to concealed handgun carriers has emerged. This article aims to delve into the world of Concealed Handgun Insurance, exploring its intricacies, benefits, and how it can provide peace of mind to responsible gun owners.

Understanding the Need for Concealed Handgun Insurance

The decision to carry a concealed handgun is a serious one, and it comes with a unique set of responsibilities and potential risks. While the primary purpose of carrying a firearm is self-defense, accidents can happen, and the consequences can be severe. This is where Concealed Handgun Insurance steps in, offering a tailored solution to address the specific concerns and liabilities associated with concealed carry.

Many standard insurance policies, such as homeowners or renters insurance, often exclude coverage for firearms-related incidents. This leaves gun owners exposed to significant financial risks, especially in situations where their firearm is involved in an accident or if they are faced with a lawsuit related to its use. Concealed Handgun Insurance fills this critical gap, providing dedicated coverage for concealed carry permit holders.

Key Benefits of Concealed Handgun Insurance

This specialized insurance offers a range of benefits tailored to the needs of concealed handgun carriers. Here are some of the key advantages:

- Liability Protection: One of the primary benefits is robust liability coverage. It protects policyholders from financial ruin in the event they are involved in an accident or incident where their firearm is discharged unintentionally. This coverage can provide a crucial safety net, covering legal fees, settlements, and other related expenses.

- Legal Defense: Concealed Handgun Insurance often includes legal defense coverage, ensuring policyholders have access to skilled legal representation if they face criminal or civil charges related to their firearm use. This provision can be invaluable, as legal proceedings can be complex and costly.

- Accidental Discharge Coverage: Accidents can occur, and this insurance covers the policyholder in such instances. It provides financial protection for any damage or injury caused by an accidental discharge of the firearm, ensuring the policyholder isn't left financially vulnerable.

- Replacement and Repair: In the event of theft, loss, or damage to the insured firearm, this insurance can provide coverage for repair or replacement, helping policyholders quickly get back on track with their concealed carry practices.

- Training and Education: Some policies offer discounts or incentives for gun safety courses, encouraging policyholders to stay up-to-date with the latest training and knowledge, which can be vital in preventing accidents and ensuring responsible firearm use.

Policy Details and Coverage Options

Concealed Handgun Insurance policies can vary significantly depending on the provider and the specific needs of the policyholder. Here’s a breakdown of some crucial policy details and coverage options:

Policy Limits

Policy limits refer to the maximum amount the insurance company will pay out in the event of a claim. These limits can vary widely, from basic coverage with lower limits to more comprehensive policies with higher limits to cater to various needs and risk profiles.

Covered Incidents

It’s essential to understand what incidents are covered under the policy. Most policies cover a range of situations, including accidental discharge, self-defense, and legal defense. However, some policies may exclude certain high-risk activities or situations, so it’s crucial to review the fine print to ensure the coverage aligns with your specific needs.

Exclusions and Limitations

All insurance policies come with certain exclusions and limitations. These can include specific activities, intentional acts, or situations where the policyholder is found to be under the influence of drugs or alcohol. Understanding these exclusions is vital to avoid any unexpected gaps in coverage.

Deductibles and Premiums

Like most insurance policies, Concealed Handgun Insurance comes with deductibles and premiums. Deductibles are the amount the policyholder pays out of pocket before the insurance coverage kicks in. Premiums, on the other hand, are the regular payments made to maintain the policy. These costs can vary based on the policy’s coverage limits, the policyholder’s location, and their risk profile.

Policy Add-ons

Some insurance providers offer additional coverage options or add-ons to tailor the policy to the policyholder’s specific needs. These add-ons can include coverage for non-firearm-related incidents, travel insurance, or even identity theft protection. These additions can enhance the overall value of the policy, providing a more comprehensive safety net.

Choosing the Right Provider and Policy

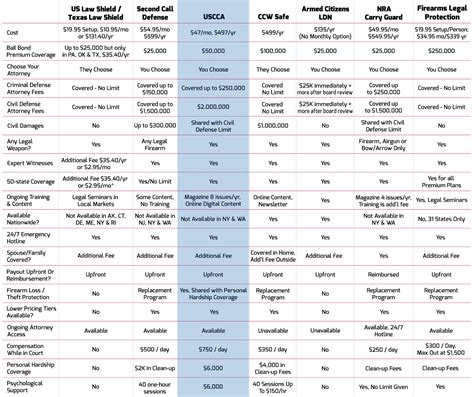

With the rising popularity of concealed carry, numerous insurance providers now offer specialized Concealed Handgun Insurance policies. However, not all policies are created equal, and it’s crucial to choose a provider and policy that align with your specific needs and circumstances.

Research and Compare

Take the time to research and compare different insurance providers and their policies. Look for providers with a solid reputation and a track record of providing reliable coverage and prompt claim processing. Consider factors such as policy limits, covered incidents, exclusions, and additional benefits to find a policy that offers the best value for your money.

Seek Expert Advice

Consulting with an insurance professional or a firearms expert can provide valuable insights and guidance. These experts can help you understand the nuances of different policies, ensuring you make an informed decision. They can also assist in identifying any potential gaps in coverage and suggest ways to mitigate risks effectively.

Consider Your Needs

Every gun owner’s situation is unique, and it’s essential to choose a policy that suits your specific needs. Consider factors such as your risk profile, the value of your firearm, and your anticipated usage. If you frequently travel with your firearm, for instance, you may want to prioritize policies that offer travel coverage. Similarly, if you have a high-value firearm, ensuring it’s adequately covered should be a priority.

Read the Fine Print

Before finalizing your policy, carefully review the terms and conditions, including any exclusions and limitations. Ensure you understand the policy inside and out to avoid any surprises later. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

Real-Life Case Studies: The Impact of Concealed Handgun Insurance

To illustrate the importance and benefits of Concealed Handgun Insurance, let’s explore a couple of real-life case studies:

Case Study 1: Accidental Discharge

John, a responsible gun owner and concealed carry permit holder, was cleaning his handgun at home when it accidentally discharged, causing property damage and minor injuries to a family member. Without Concealed Handgun Insurance, John would have been liable for the repair costs and any medical expenses, which could have amounted to thousands of dollars. However, with his insurance coverage, John’s policy covered the repair and medical expenses, ensuring he wasn’t financially burdened by the accident.

Case Study 2: Self-Defense and Legal Proceedings

Emily, a concealed carry permit holder, was involved in a self-defense situation where she discharged her firearm to protect herself from an assailant. Unfortunately, the incident resulted in the assailant’s injury, leading to a civil lawsuit. Without insurance, Emily would have faced significant legal fees and potential financial ruin. However, with her Concealed Handgun Insurance policy, she had access to legal defense coverage, which provided her with skilled legal representation throughout the proceedings. This coverage not only protected her financially but also ensured she had the support she needed to navigate the complex legal system.

The Future of Concealed Handgun Insurance

As the demand for concealed carry continues to grow, the market for Concealed Handgun Insurance is also expanding. Insurance providers are recognizing the need for specialized coverage and are developing innovative solutions to meet the unique requirements of concealed handgun carriers. This includes offering more comprehensive policies, improved coverage limits, and additional benefits to address the evolving needs of policyholders.

Furthermore, with the increasing focus on gun safety and responsible firearm ownership, Concealed Handgun Insurance can play a vital role in promoting safe practices and reducing the potential risks associated with concealed carry. By providing financial protection and access to legal defense, this insurance can encourage gun owners to seek proper training, stay informed about firearm laws, and adopt responsible behaviors, ultimately contributing to a safer community.

Potential Developments

- Expanded Coverage: As the industry evolves, we can expect to see an expansion of coverage options. This may include increased policy limits, broader coverage for a wider range of incidents, and even coverage for non-firearm-related incidents that could impact a concealed carry permit holder.

- Integration with Firearms Technology: With the advancement of firearms technology, we may see insurance policies integrating with smart gun systems or biometric identification. This could lead to innovative coverage options, such as discounted premiums for policyholders who adopt these advanced safety measures.

- Community Engagement: Some insurance providers may explore initiatives to engage with the concealed carry community, offering educational resources, safety workshops, or even discounts for policyholders who actively participate in community safety programs.

Conclusion: The Value of Concealed Handgun Insurance

Concealed Handgun Insurance is an essential component of responsible firearm ownership and concealed carry. It provides a vital layer of protection, ensuring that gun owners can practice their rights with confidence, knowing they are financially protected in the event of an accident or incident. With the right policy, gun owners can focus on their safety and the safety of those around them, without the worry of potential financial ruin.

As the world of firearms continues to evolve, Concealed Handgun Insurance will play an increasingly important role in promoting responsible gun ownership and providing peace of mind to concealed carry permit holders. By understanding the benefits, policy details, and future prospects of this specialized insurance, gun owners can make informed decisions to protect themselves and their loved ones.

What is the average cost of Concealed Handgun Insurance?

+The cost of Concealed Handgun Insurance can vary significantly depending on the provider, policy limits, and the policyholder’s risk profile. On average, premiums can range from 150 to 500 annually, with higher limits and additional coverage options increasing the cost.

Does Concealed Handgun Insurance cover theft of my firearm?

+Yes, most Concealed Handgun Insurance policies include coverage for theft of the insured firearm. This coverage typically provides financial protection for the replacement or repair of the firearm, ensuring the policyholder isn’t left without their primary means of self-defense.

Are there any discounts available for Concealed Handgun Insurance?

+Yes, many insurance providers offer discounts for Concealed Handgun Insurance. These discounts can be based on factors such as the policyholder’s age, the number of years they’ve held a concealed carry permit, or their participation in gun safety courses. It’s always worth inquiring about potential discounts when shopping for insurance.

Can I bundle my Concealed Handgun Insurance with other policies?

+Yes, some insurance providers offer the option to bundle Concealed Handgun Insurance with other policies, such as homeowners or renters insurance. Bundling can often result in significant savings and streamlined coverage for your various insurance needs.

What should I do if I need to file a claim under my Concealed Handgun Insurance policy?

+If you need to file a claim, it’s essential to follow the procedures outlined in your policy. This typically involves contacting your insurance provider as soon as possible, providing all relevant details, and cooperating with their investigation process. It’s crucial to act promptly to ensure your claim is processed efficiently.