Full Coverage Car Insurance

Full coverage car insurance is a comprehensive insurance policy that provides an extensive range of protections for vehicle owners. Unlike basic liability insurance, which only covers damages caused by the policyholder to others, full coverage insurance offers protection for the insured vehicle itself, as well as any damages or losses it may incur. This type of insurance is designed to offer peace of mind to drivers, knowing that their vehicle is protected from a wide array of potential risks and unexpected events.

In this in-depth article, we will delve into the world of full coverage car insurance, exploring its key components, benefits, and considerations. By the end, you'll have a comprehensive understanding of what full coverage entails and how it can provide the financial security and protection you need on the road.

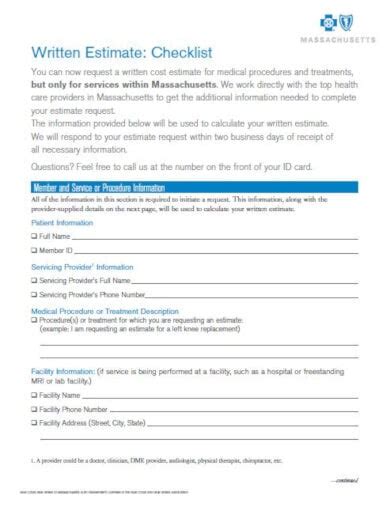

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term used to describe an insurance policy that goes beyond the minimum legal requirements for liability coverage. It combines multiple types of insurance coverages into one policy, providing a more comprehensive level of protection for your vehicle. Here’s a breakdown of the key components typically included in a full coverage policy:

Collision Coverage

Collision coverage is a fundamental aspect of full coverage insurance. It protects your vehicle in the event of a collision with another vehicle, object, or as a result of overturning. This coverage pays for the repairs or replacement of your vehicle, regardless of who is at fault. In cases where the damage is extensive and the repair costs exceed the vehicle’s actual cash value, collision coverage will provide compensation for the vehicle’s value.

Comprehensive Coverage

Comprehensive coverage, often paired with collision coverage, protects against damages caused by events other than collisions. This includes damage from natural disasters like hail, wind, or flood, as well as damage caused by theft, vandalism, or falling objects. Comprehensive coverage is an essential component of full coverage insurance, as it provides protection against a wide range of unforeseen events that can damage your vehicle.

Liability Coverage

Liability coverage is a critical aspect of any car insurance policy, including full coverage. It provides protection in the event that you cause an accident that results in bodily injury or property damage to others. This coverage pays for medical expenses, lost wages, and property damage claims of the injured party. In many states, liability coverage is mandatory, making it a crucial component of your insurance policy.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is an important feature of full coverage insurance. It provides protection in the event that you are involved in an accident with a driver who either does not have insurance or does not have sufficient insurance to cover the damages caused. This coverage can help cover medical expenses, lost wages, and other related costs if the at-fault driver is uninsured or underinsured.

Personal Injury Protection (PIP) or Medical Payments Coverage

Personal Injury Protection (PIP) or Medical Payments coverage is designed to cover the medical expenses of the policyholder and their passengers in the event of an accident, regardless of fault. This coverage can include hospital stays, doctor visits, rehabilitation, and even funeral expenses. It provides an essential layer of protection, ensuring that you and your passengers receive the medical care you need without worrying about immediate financial burdens.

Benefits of Full Coverage Car Insurance

Full coverage car insurance offers a range of benefits that can provide significant peace of mind and financial protection. Here are some key advantages to consider:

Comprehensive Protection

Full coverage insurance offers a comprehensive level of protection, covering a wide range of scenarios and potential risks. From collisions and natural disasters to theft and vandalism, you can rest assured that your vehicle is protected against numerous unforeseen events.

Peace of Mind

Knowing that your vehicle is fully insured can provide a significant sense of security and peace of mind. With full coverage, you don’t have to worry about unexpected costs associated with vehicle damage or repairs. Whether it’s a fender bender or a more severe accident, you’ll have the financial support you need to get your vehicle back on the road.

Financial Protection

Full coverage insurance protects you from potentially devastating financial losses. In the event of an accident, collision coverage ensures that your vehicle’s repairs or replacement costs are covered. Comprehensive coverage provides protection against damages caused by events beyond your control, ensuring that you aren’t left with unexpected expenses. Additionally, liability coverage protects you from financial liability in the event that you cause an accident, providing coverage for the injuries and property damage of others.

Legal Compliance

In many states, having a certain level of liability insurance is mandatory by law. Full coverage insurance typically includes liability coverage, ensuring that you meet the legal requirements and avoid potential legal penalties or consequences.

Considerations and Factors to Keep in Mind

While full coverage car insurance offers extensive protection, there are several considerations and factors to keep in mind when deciding if it’s the right choice for you:

Cost

Full coverage insurance tends to be more expensive than basic liability coverage. The cost of your insurance policy will depend on various factors, including your location, the make and model of your vehicle, your driving record, and your claims history. It’s important to weigh the cost against the level of protection you require and the potential risks associated with your driving habits and environment.

Vehicle Value

Full coverage insurance is particularly beneficial for newer or more valuable vehicles. If your vehicle is still under lease or loan, the lender may require full coverage insurance to protect their investment. Additionally, if your vehicle is still in good condition and holds a significant resale value, full coverage can provide the necessary protection to ensure you aren’t left with financial losses in the event of an accident.

Deductibles

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. With full coverage insurance, you typically have the option to choose your deductible amount. A higher deductible can result in lower premiums, but it also means you’ll have to pay more out of pocket in the event of a claim. Consider your financial situation and risk tolerance when choosing your deductible.

Additional Coverages

Full coverage insurance policies may also offer optional additional coverages, such as rental car reimbursement, gap insurance, or roadside assistance. These coverages can provide added protection and convenience in specific situations. It’s important to review these options and assess whether they are necessary for your individual needs.

Comparing Full Coverage with Other Insurance Options

When considering full coverage car insurance, it’s essential to understand how it differs from other insurance options and to choose the right coverage for your needs. Here’s a brief comparison with other common insurance options:

Full Coverage vs. Liability-Only Insurance

Liability-only insurance provides coverage only for damages you cause to others. It does not cover any damages to your own vehicle, regardless of the cause. Full coverage insurance, on the other hand, provides protection for both your vehicle and others in the event of an accident, as well as protection against a wide range of other potential risks. Full coverage offers a more comprehensive level of protection, making it a better choice for those who want peace of mind and financial security.

Full Coverage vs. High-Deductible Insurance

High-deductible insurance policies have lower premiums but require you to pay a higher amount out of pocket before your insurance coverage kicks in. While this can be a cost-effective option for those who rarely make claims, it may not provide the same level of financial protection as full coverage insurance. Full coverage insurance ensures that you have comprehensive protection and reduces the financial burden in the event of an accident or other covered event.

Performance Analysis and Real-World Examples

To illustrate the benefits and importance of full coverage car insurance, let’s consider a real-world example. Imagine a driver named Sarah, who lives in a region prone to severe weather and has a history of occasional accidents. Sarah opts for full coverage insurance, including collision, comprehensive, and liability coverage, with a moderate deductible.

One day, while driving during a heavy rainstorm, Sarah's vehicle is struck by a fallen tree branch, causing significant damage to the roof and windshield. Thanks to her comprehensive coverage, the repairs are covered by her insurance policy, and she only needs to pay the deductible. Additionally, a few months later, Sarah is involved in a minor fender bender with another vehicle. Her collision coverage kicks in, paying for the repairs to her vehicle, and her liability coverage takes care of the other driver's property damage claims.

In this scenario, Sarah's full coverage insurance policy provides her with the necessary protection and financial support to navigate these unexpected events. Without full coverage, she would have faced substantial out-of-pocket expenses and potential financial hardship.

Evidence-Based Future Implications

Full coverage car insurance continues to evolve to meet the changing needs and risks associated with modern driving. As technology advances and autonomous vehicles become more prevalent, insurance policies may need to adapt to cover new risks and liabilities. Additionally, with the increasing prevalence of natural disasters and severe weather events, comprehensive coverage will likely become even more crucial in protecting vehicles from these unforeseen hazards.

Furthermore, as more drivers embrace shared mobility options like ride-sharing and car-sharing services, insurance policies may need to adapt to cover these new modes of transportation. Full coverage insurance may play a vital role in ensuring that drivers and passengers are protected, regardless of how they choose to travel.

Conclusion

Full coverage car insurance is a comprehensive and robust insurance solution that provides extensive protection for vehicle owners. By combining collision, comprehensive, liability, and other essential coverages, full coverage insurance offers peace of mind and financial security in a wide range of situations. While it may come at a higher cost, the benefits it provides can be invaluable, especially in the event of an accident or unexpected damage to your vehicle.

As you consider your insurance options, it's essential to assess your individual needs, driving habits, and potential risks. Full coverage insurance may be the ideal choice for those seeking the highest level of protection and financial security on the road. Remember to carefully review your policy, understand the coverages and deductibles, and ensure that you have the right level of protection for your specific circumstances.

What is the difference between full coverage and liability-only car insurance?

+Full coverage car insurance includes liability coverage as well as additional coverages such as collision and comprehensive. Liability-only insurance provides coverage only for damages you cause to others, excluding any protection for your own vehicle.

Is full coverage car insurance necessary for all drivers?

+Full coverage insurance is not mandatory for all drivers. However, it is recommended for those who want comprehensive protection and financial security. It is particularly beneficial for drivers with newer or more valuable vehicles, or those who live in areas with higher risks of accidents or natural disasters.

How much does full coverage car insurance cost?

+The cost of full coverage car insurance varies depending on several factors, including your location, the make and model of your vehicle, your driving record, and your claims history. It’s best to obtain quotes from multiple insurance providers to compare rates and find the best coverage for your needs.

Can I customize my full coverage car insurance policy?

+Yes, you can often customize your full coverage insurance policy by choosing the specific coverages you want and selecting your deductible amount. Additionally, many insurance providers offer optional additional coverages, such as rental car reimbursement or gap insurance, which can be added to your policy.

What should I do if I’m unsure about the level of coverage I need?

+If you’re unsure about the level of coverage you need, it’s recommended to consult with an insurance agent or broker. They can assess your individual circumstances, driving habits, and potential risks to help you choose the right coverage and ensure you have adequate protection.