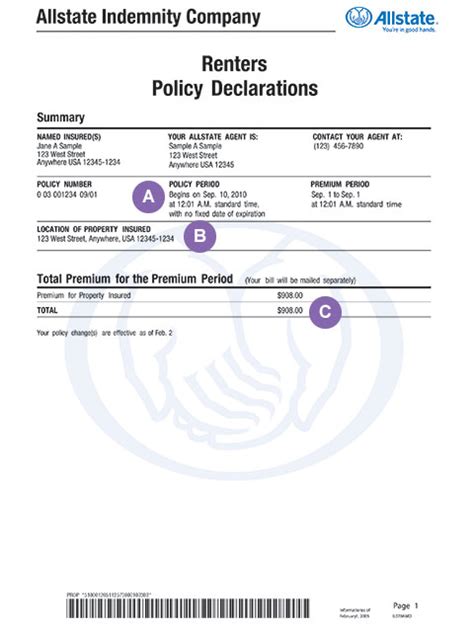

Allstate Insurance Renters

Protecting your rental property and your belongings is crucial, and Allstate Insurance understands the importance of providing comprehensive coverage tailored to renters' needs. With a focus on offering customizable policies and excellent customer service, Allstate has become a popular choice for renters seeking peace of mind. In this article, we will delve into the specifics of Allstate Insurance's Renters policy, exploring its features, benefits, and why it stands out in the insurance market.

Allstate Insurance Renters Policy: An In-Depth Overview

The Allstate Renters Insurance policy is designed to safeguard renters against various risks and potential losses. It provides financial protection for personal belongings, liability coverage, and additional benefits to ensure a well-rounded insurance experience. Here's a detailed breakdown of what this policy entails.

Personal Property Coverage

At the core of the Allstate Renters policy is personal property coverage. This aspect of the policy protects renters' belongings, such as furniture, electronics, clothing, and jewelry, against damage or loss due to covered perils. Covered perils typically include fire, lightning, vandalism, theft, and more. For instance, if a fire breaks out in your rental unit, Allstate will cover the cost of replacing your damaged possessions up to the policy limits.

Allstate offers two options for personal property coverage: Actual Cash Value (ACV) and Replacement Cost. ACV coverage takes into account depreciation, meaning the payout is based on the current value of your belongings. On the other hand, Replacement Cost coverage ensures you receive the full amount needed to replace your items without considering depreciation. This option provides more comprehensive protection, especially for high-value items.

| Coverage Type | Description |

|---|---|

| Actual Cash Value | Pays the current value of your belongings, considering depreciation. |

| Replacement Cost | Provides the full cost to replace your items without depreciation. |

Liability Protection

Allstate's Renters policy includes liability coverage, which is a vital aspect of any insurance plan. This coverage protects renters from financial liability if someone is injured on their rental property or if their belongings cause damage to others. It covers legal fees, medical expenses, and potential settlements up to the policy limits.

For example, if a guest slips and falls in your rental unit, sustaining injuries, Allstate's liability coverage would step in to handle the associated costs. This protection provides renters with peace of mind, knowing they are financially shielded from potential lawsuits or claims.

Additional Living Expenses

In the event of a covered loss that renders your rental unit uninhabitable, Allstate's Renters policy includes Additional Living Expenses (ALE) coverage. This benefit covers the extra costs you incur while temporarily relocating, such as hotel stays, meals, and other necessary expenses. ALE coverage ensures renters can maintain their standard of living during the repair or restoration process.

Let's say a severe storm damages your rental unit, forcing you to find temporary accommodation. Allstate's ALE coverage would reimburse you for the additional expenses incurred during this period, ensuring you don't have to shoulder the financial burden alone.

Personal Liability Umbrella

Allstate offers an optional Personal Liability Umbrella policy, which provides an extra layer of protection beyond the standard liability coverage. This umbrella policy increases the liability limits, offering higher coverage amounts to address more significant claims or lawsuits. It's an excellent option for renters who want enhanced financial protection against potential liability risks.

Personalized Coverage Options

One of the standout features of Allstate's Renters policy is its customization. Renters can tailor their coverage to align with their specific needs and budget. Allstate's agents work closely with policyholders to understand their circumstances and recommend appropriate coverage limits and endorsements.

For instance, if you have valuable art collections or high-end electronics, you can add personal article floaters to your policy, providing additional coverage for these items. Allstate's flexibility allows renters to create a policy that truly meets their unique requirements.

Benefits and Customer Experience

Allstate Insurance is known for its commitment to providing an exceptional customer experience. The company offers a range of benefits and services that enhance the overall insurance journey for renters.

Digital Tools and Convenience

Allstate understands the importance of convenience in today's fast-paced world. Their online platform and mobile app provide renters with easy access to their policy information, billing details, and claims management tools. Policyholders can make payments, view coverage details, and even file claims from the comfort of their homes.

Additionally, Allstate's Digital Locker feature allows renters to create a digital inventory of their belongings. This tool not only simplifies the claims process but also serves as a valuable resource for renters to keep track of their possessions.

Claims Handling and Customer Support

When it comes to claims, Allstate aims to make the process as seamless as possible. Their dedicated claims specialists work closely with policyholders to guide them through the steps, ensuring a prompt and efficient resolution. Allstate's claims team is available 24/7, providing renters with immediate assistance in the event of an emergency.

Moreover, Allstate's customer support extends beyond claims. Renters can reach out to their local Allstate agents or the customer service team for any policy-related queries or to make adjustments to their coverage. The company's focus on customer satisfaction is evident in its responsive and knowledgeable support system.

Discounts and Savings

Allstate offers a variety of discounts to make their Renters policy more affordable. Policyholders can take advantage of savings opportunities such as:

- Multi-Policy Discount: Renters who bundle their insurance policies with Allstate, such as auto and renters insurance, can enjoy significant discounts.

- Loyalty Discounts: Allstate rewards loyal customers with discounts for maintaining their policies over time.

- SafeTenant Discount: Renters who take extra precautions to secure their rental units, like installing smoke detectors and security systems, may be eligible for this discount.

- Early Signing Discount: Policyholders who renew their policies early can often receive discounts as a reward for their commitment.

Why Choose Allstate for Renters Insurance

Allstate Insurance stands out in the renters insurance market for several reasons. Here are some key factors that make Allstate an attractive choice for renters:

Comprehensive Coverage

Allstate's Renters policy offers a wide range of coverage options, ensuring renters can protect their belongings and themselves from various risks. From personal property coverage to liability protection and additional living expenses, Allstate provides a well-rounded insurance solution.

Customization and Flexibility

The ability to tailor the policy to individual needs is a significant advantage. Allstate's agents work with renters to create a personalized plan, ensuring they have the right coverage without paying for unnecessary add-ons.

Customer-Centric Approach

Allstate's focus on customer experience is evident in its digital tools, convenient online services, and responsive customer support. The company prioritizes making the insurance journey as smooth and stress-free as possible for renters.

Competitive Pricing

Allstate offers competitive rates for its Renters policy, making it an affordable option for those seeking comprehensive coverage. Additionally, the various discounts available further enhance the policy's value.

Reputation and Reliability

Allstate Insurance is a well-established and reputable insurance provider. With a strong track record of delivering reliable coverage and prompt claims handling, renters can trust Allstate to be there when they need it most.

Frequently Asked Questions

What is the average cost of Allstate Renters Insurance?

+

The cost of Allstate Renters Insurance can vary based on factors such as location, coverage limits, and personal circumstances. On average, renters can expect to pay around 15 to 30 per month for a basic policy. However, the final premium will depend on individual assessments.

Does Allstate Renters Insurance cover water damage from floods?

+

No, standard Allstate Renters Insurance policies typically exclude coverage for water damage caused by floods. However, renters can purchase separate flood insurance policies to protect against this specific risk.

Can I add roommates to my Allstate Renters policy?

+

Yes, Allstate allows renters to add their roommates as named insureds on the policy. This ensures that both parties are protected under the same coverage.

What is the claims process like with Allstate Renters Insurance?

+

Allstate has a straightforward claims process. Policyholders can file claims online, over the phone, or through their mobile app. Allstate’s claims specialists will guide renters through the steps and work towards a swift resolution.

Are there any discounts available for students with Allstate Renters Insurance?

+

Yes, Allstate offers a student discount for renters who are full-time students. This discount applies to those aged 17 to 24 who are enrolled in an accredited institution and have a GPA of 3.0 or higher.