Self Insured Plans

Self-insured plans represent a growing trend in healthcare management, offering unique opportunities and challenges for employers and employees alike. In this comprehensive article, we delve into the intricacies of self-insured plans, exploring their definition, benefits, risks, and potential future implications. By examining real-world examples and industry data, we aim to provide an in-depth analysis that will empower readers to make informed decisions regarding their healthcare coverage.

Understanding Self-Insured Plans: A Comprehensive Overview

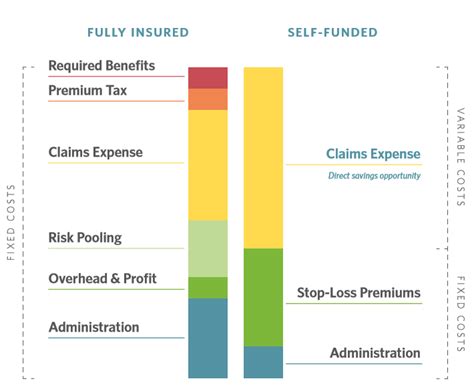

Self-insured plans, also known as self-funded or self-administered plans, are an alternative to traditional fully insured healthcare plans. Instead of paying a premium to an insurance company, which then assumes the financial risk, employers with self-insured plans take on the responsibility of covering their employees’ healthcare costs directly. This approach allows employers to have more control over their healthcare expenditures and can potentially lead to significant cost savings.

The concept of self-insured plans is not new, but its popularity has been steadily increasing over the years. A 2021 study by the Society for Human Resource Management (SHRM) found that approximately 32% of large organizations with more than 500 employees offered self-insured plans, a notable increase from previous years. This trend is driven by the desire for greater flexibility, cost control, and the ability to customize healthcare benefits to meet the unique needs of an organization's workforce.

Key Components of Self-Insured Plans

Self-insured plans operate on a few fundamental principles:

- Claim Administration: Employers typically partner with a third-party administrator (TPA) to manage the day-to-day operations of the plan. The TPA processes claims, handles billing, and provides other administrative services.

- Stop-Loss Insurance: To protect against catastrophic costs, employers often purchase stop-loss insurance. This insurance covers a portion of the plan’s expenses once the claims reach a predetermined threshold.

- Reserve Funds: Employers must establish a reserve fund to cover expected claims. This fund is typically funded through a combination of contributions from the employer and employee premiums.

- Network Negotiations: With self-insured plans, employers have the flexibility to negotiate directly with healthcare providers to establish preferred provider networks, potentially leading to cost savings.

Benefits of Self-Insured Plans

Self-insured plans offer a range of advantages that make them an attractive option for many employers:

Cost Savings

One of the primary motivations for adopting self-insured plans is the potential for significant cost savings. By assuming the financial risk, employers can avoid the administrative fees and profit margins typically associated with traditional insurance plans. Additionally, self-insured plans allow for greater flexibility in designing benefit packages, which can further reduce costs.

| Cost Comparison | Self-Insured Plan | Traditional Insurance |

|---|---|---|

| Administrative Fees | Lower | Higher |

| Profit Margins | None | Included |

| Flexibility in Benefit Design | High | Limited |

For example, a large technology company, TechPro Inc., transitioned to a self-insured plan and was able to negotiate significant discounts with healthcare providers, resulting in an average cost savings of 15% per employee compared to their previous fully insured plan.

Customized Benefits

Self-insured plans allow employers to tailor benefits to the specific needs of their workforce. This flexibility enables employers to offer unique perks, such as enhanced mental health coverage, wellness programs, or specialized services for a diverse employee base. By customizing benefits, employers can attract and retain top talent while promoting a culture of health and well-being.

Data Insights and Predictive Analytics

With self-insured plans, employers have access to detailed claims data, which can be analyzed to identify trends, predict future costs, and make informed decisions about benefit design. This data-driven approach empowers employers to make strategic choices, such as implementing preventive health initiatives or negotiating better rates with providers.

Risks and Considerations

While self-insured plans offer numerous benefits, they also come with certain risks and challenges that employers should carefully consider:

Financial Risk

Taking on the financial risk of healthcare costs is a significant responsibility for employers. Unexpected high claims or catastrophic events can strain an employer’s finances, especially if adequate stop-loss insurance is not in place.

Administrative Burden

Self-insured plans require dedicated administrative resources. Employers must manage relationships with TPAs, negotiate with healthcare providers, and ensure compliance with complex healthcare regulations. This can be a substantial burden for smaller organizations or those with limited HR support.

Employee Communication and Education

Transitioning to a self-insured plan requires effective communication with employees. Educating employees about the plan’s benefits, costs, and coverage is crucial to ensure they understand their healthcare options and feel supported.

Performance Analysis: Real-World Examples

To better understand the impact of self-insured plans, let’s examine two case studies:

Case Study 1: Healthcare Innovations, Inc.

Healthcare Innovations, a mid-sized healthcare technology firm, implemented a self-insured plan in 2018. By leveraging their data analytics capabilities, they were able to negotiate discounted rates with local healthcare providers. As a result, they achieved an average cost savings of 20% for their employees over a two-year period. Additionally, they introduced a wellness program, incentivizing employees to adopt healthier lifestyles, which further reduced healthcare costs.

Case Study 2: GreenTech Solutions

GreenTech Solutions, a renewable energy startup, opted for a self-insured plan to offer comprehensive healthcare benefits to their growing workforce. However, they faced challenges in their first year due to an unexpected surge in high-cost claims. Without sufficient stop-loss insurance, they struggled to cover these expenses, leading to financial strain. Learning from this experience, they adjusted their reserve funds and stop-loss coverage, ensuring better financial protection in the future.

Future Implications and Trends

The future of self-insured plans looks promising, with several emerging trends shaping the landscape:

- Digital Health Solutions: The integration of digital health technologies, such as telehealth and remote monitoring, is expected to play a significant role in self-insured plans. These solutions can enhance employee access to care, improve health outcomes, and potentially reduce costs.

- Employee-Centric Benefits: As employers aim to attract and retain talent, we can expect to see a continued focus on employee-centric benefit designs. Self-insured plans will likely offer more personalized and tailored benefits, addressing the unique needs of diverse workforces.

- Data-Driven Decision Making: The ability to analyze large datasets will become increasingly important. Employers will rely on advanced analytics to make informed decisions about benefit design, network negotiations, and cost-saving initiatives.

Regulatory Considerations

The regulatory environment surrounding self-insured plans is evolving. Employers must stay informed about changing healthcare laws and regulations, such as the Affordable Care Act (ACA) and state-specific mandates, to ensure compliance and avoid potential penalties.

Conclusion

Self-insured plans present a compelling opportunity for employers to take control of their healthcare costs and customize benefits to meet the needs of their workforce. While the benefits are significant, so are the risks and responsibilities. By carefully considering the advantages, challenges, and future trends, employers can make informed decisions about whether a self-insured plan is the right choice for their organization.

How do self-insured plans differ from fully insured plans?

+Self-insured plans differ from fully insured plans in that employers assume the financial risk of healthcare costs directly, while fully insured plans transfer this risk to an insurance company through premium payments. Self-insured plans offer more flexibility and potential cost savings but require careful administration and financial management.

What are the key advantages of self-insured plans for employers?

+Self-insured plans provide employers with greater control over healthcare costs, allowing for potential cost savings. They also offer flexibility in designing benefit packages and access to detailed claims data for strategic decision-making. Additionally, self-insured plans can be customized to meet the unique needs of the workforce.

Are self-insured plans suitable for small businesses?

+Self-insured plans can be beneficial for small businesses, but they require careful consideration. Small businesses may face challenges with limited administrative resources and financial exposure. However, with proper planning, risk management strategies, and the support of a reputable TPA, self-insured plans can be a viable option for small businesses.