What Is Liability Car Insurance Coverage

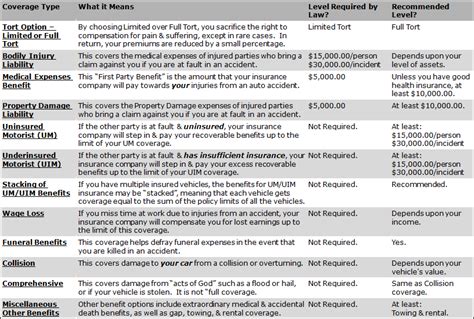

Liability car insurance coverage is an essential component of any vehicle insurance policy, designed to protect policyholders from financial ruin in the event of an at-fault accident. This type of insurance is mandated by law in most states and plays a critical role in maintaining the financial stability of drivers and ensuring they can fulfill their legal obligations after causing harm or property damage to others.

Understanding Liability Insurance

Liability insurance is a cornerstone of auto insurance, covering the costs that arise when a policyholder is found legally responsible for an accident. This coverage extends to a range of expenses, including medical bills, property damage, and legal fees. By providing this financial protection, liability insurance helps drivers meet their legal obligations and prevent devastating financial consequences.

Bodily Injury Liability

Bodily injury liability is a critical aspect of liability insurance, covering medical expenses and lost wages for individuals injured in an accident caused by the policyholder. This coverage is essential for ensuring that victims receive the necessary medical care and compensation for their injuries, and it also protects the policyholder from being personally sued for these costs.

| Coverage | Description |

|---|---|

| Bodily Injury Per Person | Maximum coverage per injured person. |

| Bodily Injury Per Accident | Maximum coverage for all injured persons in one accident. |

Property Damage Liability

Property damage liability covers the cost of repairing or replacing property damaged in an accident for which the policyholder is at fault. This coverage includes damage to vehicles, buildings, fences, and other structures. By providing this financial protection, property damage liability ensures that the policyholder can fulfill their legal obligation to restore damaged property.

| Coverage | Description |

|---|---|

| Property Damage Liability Limit | Maximum amount covered for property damage in an accident. |

Legal Defense and Settlement Costs

Liability insurance also covers the costs associated with legal defense and settlements if an accident victim decides to sue the policyholder. This includes attorney fees, court costs, and any settlement or judgment amounts. By providing this coverage, liability insurance ensures that policyholders have the resources to defend themselves in court and resolve claims fairly.

Why Liability Car Insurance Is Important

Liability car insurance is crucial for several reasons. Firstly, it is often mandatory by law, and driving without it can result in severe penalties, including fines, license suspension, and even jail time. Secondly, it provides essential financial protection, ensuring that policyholders can meet their legal obligations and avoid devastating financial consequences after an at-fault accident.

Legal and Financial Protection

When an accident occurs, liability insurance steps in to cover the costs, preventing the policyholder from being personally liable for these expenses. This protection is particularly important given the potential for significant financial losses, especially in cases of severe injuries or extensive property damage. Without liability insurance, a single accident could lead to bankruptcy or severe financial strain.

Compliance with State Laws

Most states in the U.S. require drivers to carry minimum levels of liability insurance. These laws are designed to ensure that drivers can cover the costs of accidents they cause, protecting both the victims and the public at large. Failure to comply with these laws can result in severe penalties and even criminal charges.

Protection for Victims

Liability insurance not only protects policyholders but also provides crucial financial support to accident victims. By ensuring that victims receive compensation for their injuries and property damage, liability insurance promotes fairness and justice in the aftermath of an accident. This coverage helps victims access the medical care and resources they need to recover.

Choosing the Right Liability Limits

When selecting liability insurance, choosing the right coverage limits is crucial. While state laws typically set minimum requirements, these limits may not be sufficient to cover all potential claims. It’s essential to consider your specific needs and circumstances, including your financial situation, the value of your assets, and the potential risks you face on the road.

Assessing Your Risk Profile

Your risk profile plays a significant role in determining the appropriate liability limits. Factors such as your driving record, the type of vehicle you drive, and the areas you frequently drive in can influence your risk level. For example, if you frequently drive in high-risk areas or have a history of accidents, you may need higher liability limits to protect your assets.

Considering Your Assets

Your assets, including your home, savings, investments, and other valuables, are at risk if you’re involved in an at-fault accident with insufficient liability coverage. In such cases, the victim could sue you personally to recover damages beyond your insurance limits. To protect your assets, it’s crucial to choose liability limits that provide adequate coverage for potential claims.

Understanding State Minimums

While state minimum liability limits provide a starting point, they may not offer sufficient protection. These minimums are typically set to cover basic expenses but may fall short in cases of severe injuries or extensive property damage. It’s essential to review your state’s minimum requirements and consider whether higher limits are necessary to protect your financial well-being.

Liability Insurance and Personal Injury Protection

While liability insurance covers the costs associated with accidents caused by the policyholder, it does not provide coverage for the policyholder’s own injuries or property damage. This is where Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage comes into play, offering crucial financial protection for policyholders and their passengers.

Personal Injury Protection (PIP)

Personal Injury Protection is a type of coverage that provides financial support for medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault. This coverage is particularly valuable in no-fault states, where accidents are typically handled without determining fault. PIP ensures that policyholders and their passengers receive the necessary medical care and financial support after an accident.

Medical Payments (MedPay) Coverage

Medical Payments coverage is similar to PIP but typically has lower limits and a narrower scope. It covers medical expenses for the policyholder and their passengers, regardless of fault, but may not cover other costs such as lost wages or funeral expenses. MedPay is a valuable addition to liability insurance, providing additional financial protection for medical-related expenses after an accident.

Conclusion: The Importance of Liability Insurance

Liability car insurance is a vital component of any auto insurance policy, providing essential financial protection for policyholders and ensuring they can meet their legal obligations after an at-fault accident. By understanding the different aspects of liability insurance, including bodily injury, property damage, and legal defense coverage, drivers can make informed decisions about their coverage limits and ensure they have the protection they need. Additionally, considering the value of Personal Injury Protection or Medical Payments coverage can further enhance the financial security of policyholders and their passengers.

What is the difference between liability insurance and comprehensive coverage?

+Liability insurance covers the costs associated with accidents caused by the policyholder, while comprehensive coverage protects against non-accident-related damages, such as theft, vandalism, and natural disasters. Comprehensive coverage is optional, while liability insurance is often mandatory.

Are liability limits the same in all states?

+No, liability limits vary by state. Each state sets its own minimum requirements for liability insurance, and these limits can differ significantly. It’s important to review your state’s specific requirements and consider whether higher limits are necessary to adequately protect your financial interests.

What happens if I cause an accident with insufficient liability coverage?

+If you cause an accident and your liability coverage limits are insufficient to cover the damages, the victim may sue you personally for the remaining amount. This could result in significant financial losses, including the seizure of your assets to cover the outstanding claims. Choosing adequate liability limits is crucial to avoid such situations.