Home Owner Insurance Calculator

Welcome to a comprehensive guide on understanding and calculating home insurance costs. In the world of homeownership, one of the most crucial aspects is ensuring adequate protection for your property and possessions. This article aims to delve into the intricacies of home insurance, providing you with the tools to make informed decisions and accurately estimate your insurance needs.

The Importance of Home Insurance

Home insurance is a vital financial safeguard for homeowners, offering protection against various risks and potential losses. From natural disasters to theft and accidental damages, having the right insurance coverage can provide peace of mind and financial security. However, navigating the world of home insurance policies and calculating the appropriate coverage can be a complex task. That’s where this guide comes in, offering a detailed breakdown of the key factors that influence your insurance costs.

Factors Influencing Home Insurance Premiums

The cost of home insurance is influenced by a multitude of factors, each playing a significant role in determining your premium. Understanding these factors is essential for accurately calculating your insurance needs and ensuring you have adequate coverage without overspending.

1. Property Value and Location

One of the primary factors that insurance providers consider is the value of your property. The higher the value of your home and its contents, the more expensive your insurance premium is likely to be. Additionally, the location of your property can also impact insurance costs. Areas prone to natural disasters, such as hurricanes, floods, or earthquakes, often carry higher insurance premiums due to the increased risk.

For instance, consider a coastal region frequently affected by hurricanes. Homes in this area would typically have higher insurance costs compared to those in inland regions with lower natural disaster risks.

| Region | Average Annual Premium |

|---|---|

| Coastal Region (Hurricane-Prone) | $2,500 |

| Inland Region (Lower Risk) | $1,800 |

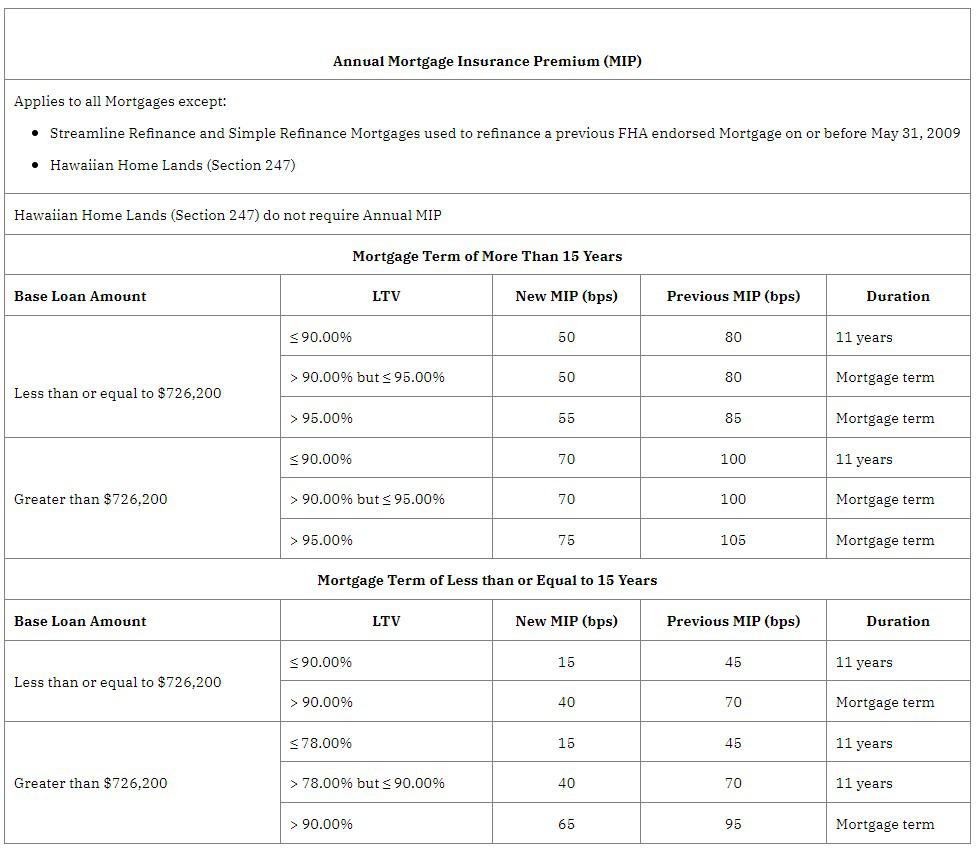

2. Coverage Types and Limits

Home insurance policies offer a range of coverage types, each with its own limits and premiums. Common coverage types include:

- Dwelling Coverage: Protects the structure of your home.

- Personal Property Coverage: Covers the contents of your home.

- Liability Coverage: Provides protection against lawsuits and medical expenses for injuries that occur on your property.

- Additional Living Expenses: Covers the cost of temporary housing if your home becomes uninhabitable due to a covered event.

The level of coverage you choose, as well as the limits you set for each coverage type, will directly impact your insurance premium. Higher coverage limits typically result in higher premiums, so it’s essential to strike a balance between adequate protection and affordability.

3. Deductibles and Discounts

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, as you’re assuming more financial responsibility in the event of a claim. However, it’s crucial to choose a deductible that you’re comfortable paying should the need arise.

Additionally, insurance providers often offer discounts to policyholders who take certain safety precautions or meet specific criteria. These discounts can significantly reduce your insurance premiums. Common discounts include:

- Multi-Policy Discount: Bundling your home and auto insurance policies with the same provider can result in savings.

- Safety Features Discount: Installing security systems, smoke detectors, or fire sprinklers may qualify you for a discount.

- Loyalty Discount: Staying with the same insurance provider for an extended period may result in reduced premiums.

4. Claim History and Credit Score

Your insurance claim history is another factor that insurance providers consider when calculating your premium. A history of frequent claims may lead to higher premiums or even policy non-renewal. It’s essential to carefully assess your claim history and understand its impact on your insurance costs.

Furthermore, your credit score can also play a role in determining your insurance premium. Many insurance providers use credit-based insurance scores to assess the risk associated with insuring you. A higher credit score may result in a lower premium, as it indicates a lower risk of financial loss for the insurance company.

Calculating Your Home Insurance Needs

Now that we’ve explored the key factors influencing home insurance premiums, let’s delve into the process of calculating your insurance needs. This will involve a detailed assessment of your property, its value, and your desired coverage limits.

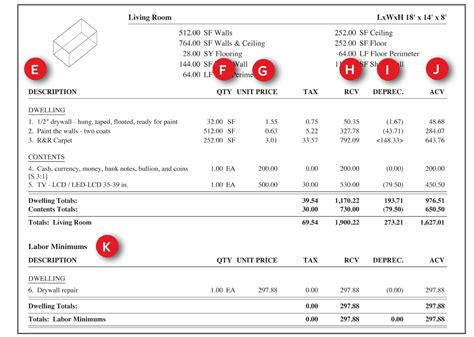

1. Property Assessment

Start by thoroughly assessing your property, including the structure, any additions or renovations, and the value of your personal belongings. Consider the replacement cost of these items, rather than their current market value, as this will ensure you have adequate coverage in the event of a loss.

For instance, if you have a valuable antique furniture collection, you’ll want to ensure your insurance policy covers the cost of replacing or repairing these items should they be damaged or stolen.

2. Coverage Selection

Next, carefully select the coverage types and limits that align with your needs and budget. Consider the following:

- Dwelling Coverage: Ensure you have sufficient coverage to rebuild your home in the event of a total loss. This should include the cost of materials and labor.

- Personal Property Coverage: Assess the value of your belongings and choose a coverage limit that adequately protects them. Remember to account for high-value items.

- Liability Coverage: Consider the potential risks associated with your property and choose a liability limit that provides sufficient protection.

- Additional Living Expenses: Estimate the cost of temporary housing and other expenses you may incur if your home becomes uninhabitable. Ensure your coverage limit is adequate for these costs.

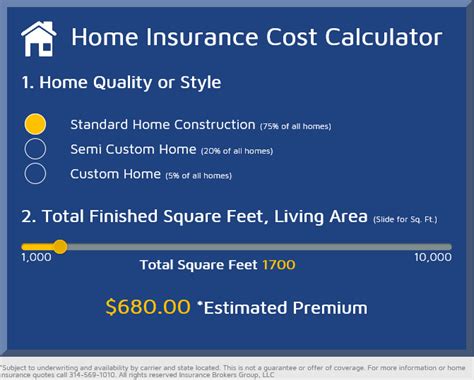

3. Premium Calculation

Once you’ve determined your coverage needs, you can begin calculating your insurance premium. This will involve considering the factors we discussed earlier, such as property value, location, coverage types and limits, deductibles, and any applicable discounts.

Insurance providers often use complex algorithms to calculate premiums, taking into account these various factors and their impact on risk. While it’s challenging to provide an exact formula, understanding the key drivers of insurance costs will help you estimate your premium and make informed decisions.

Comparing Insurance Providers and Quotes

With a solid understanding of your insurance needs and the factors that influence premiums, you can now begin the process of comparing insurance providers and obtaining quotes. This step is crucial to ensuring you find the best coverage at the most competitive price.

1. Research Insurance Providers

Start by researching reputable insurance providers in your area. Consider factors such as their financial stability, customer service reputation, and the range of coverage options they offer. Online reviews and ratings can provide valuable insights into the experiences of other policyholders.

2. Obtain Quotes

Reach out to several insurance providers and request quotes based on the coverage limits and deductibles you’ve determined. Ensure you provide consistent information to each provider to ensure an accurate comparison.

When reviewing quotes, pay close attention to the coverage details and any exclusions or limitations. Make sure the policies align with your needs and expectations.

3. Compare and Negotiate

Once you’ve gathered multiple quotes, it’s time to compare and analyze the offerings. Consider not just the premium amounts but also the coverage limits, deductibles, and any additional benefits or discounts included in the policy.

If you find a policy that meets your needs at a competitive price, you may choose to proceed with that provider. However, it’s always worth exploring the possibility of negotiating your premium. Many insurance providers are open to discussing discounts or adjustments, especially if you have a strong claim history or are a long-time customer.

Future Implications and Tips

As you navigate the world of home insurance, it’s essential to stay informed and proactive. Regularly review your insurance needs and coverage limits to ensure they remain adequate as your circumstances change. Here are some additional tips to consider:

- Regular Policy Reviews: Schedule annual reviews of your insurance policy to ensure it aligns with your current needs and any changes in your property or personal belongings.

- Maintain a Clean Claim History: Avoid making small claims whenever possible, as this can impact your insurance premiums and renewal options. Only make claims for significant losses.

- Bundle Policies: Consider bundling your home and auto insurance policies with the same provider to take advantage of multi-policy discounts.

- Safety Precautions: Implement safety measures such as security systems, smoke detectors, and fire sprinklers. These can not only protect your home but also qualify you for insurance discounts.

- Understand Exclusions: Familiarize yourself with the exclusions and limitations of your policy to avoid any surprises in the event of a claim. Ensure you understand what events and damages are not covered.

How often should I review my home insurance policy?

+It's recommended to review your home insurance policy annually to ensure it remains up-to-date with your changing needs and circumstances. Regular reviews can help you identify any gaps in coverage or opportunities to adjust your policy to better protect your home and belongings.

What should I do if I have a claim?

+In the event of a claim, contact your insurance provider as soon as possible. Provide detailed information about the incident and any damages incurred. Be prepared to cooperate with the claims process, which may involve inspections and documentation.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers during your policy term, although it's generally recommended to wait until your policy renewal date to avoid potential penalties or additional fees. Compare quotes and coverage options to find a better fit for your needs.

How can I reduce my home insurance premiums?

+There are several ways to reduce your home insurance premiums, including increasing your deductible, bundling policies with the same provider, maintaining a clean claim history, and implementing safety measures like security systems. Additionally, regularly reviewing and adjusting your coverage limits can help ensure you're not overpaying for unnecessary coverage.

Understanding and calculating your home insurance needs is a crucial aspect of responsible homeownership. By carefully assessing your property, selecting the right coverage, and comparing insurance providers, you can ensure you have the protection you need at a competitive price. Stay informed, review your policy regularly, and take advantage of safety measures and discounts to make the most of your home insurance coverage.