What Does Full Coverage Car Insurance Cover

Full coverage car insurance is a comprehensive insurance policy that provides extensive protection for vehicle owners. Unlike basic liability coverage, which only covers damages caused to others in an accident, full coverage insurance offers a more comprehensive range of benefits. It aims to protect the policyholder's vehicle, as well as provide coverage for various situations that may arise on the road. In this article, we will delve into the specifics of full coverage car insurance, exploring what it covers, how it works, and why it is an essential consideration for vehicle owners.

Understanding Full Coverage Car Insurance

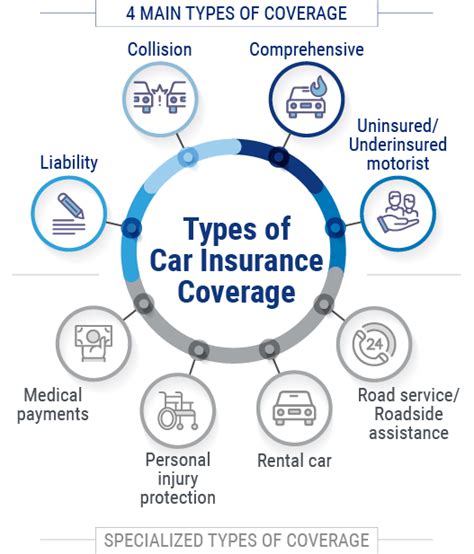

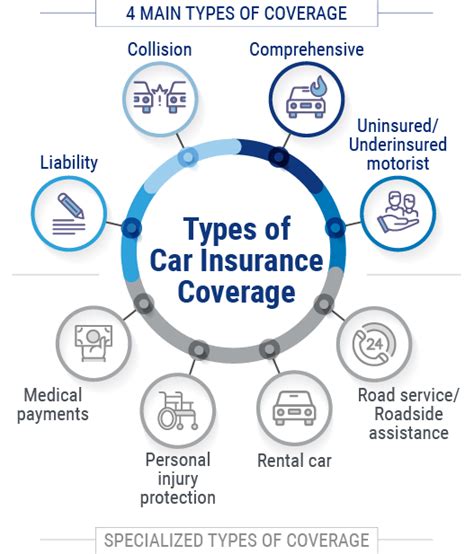

Full coverage car insurance is designed to offer a higher level of protection compared to standard liability insurance. While liability insurance primarily focuses on covering the costs of injuries and property damage caused to others, full coverage insurance goes a step further by providing additional coverage for the policyholder’s vehicle and other potential liabilities.

By opting for full coverage, vehicle owners gain peace of mind knowing that their vehicle is protected against a wide range of unforeseen events. These events can include accidents, natural disasters, theft, and even damage caused by vandalism or falling objects. Full coverage insurance typically consists of two main components: collision coverage and comprehensive coverage.

Collision Coverage

Collision coverage is a vital aspect of full coverage car insurance. It provides protection for the policyholder’s vehicle in the event of a collision with another vehicle, object, or even a single-vehicle accident. This coverage ensures that the costs of repairing or replacing the insured vehicle are covered, regardless of who is at fault.

In the unfortunate event of an accident, collision coverage steps in to cover the expenses associated with repairing the vehicle. Whether it's a minor fender bender or a more significant collision, collision coverage ensures that the policyholder is not left with a hefty repair bill. Additionally, if the vehicle is deemed a total loss, collision coverage will provide compensation for the vehicle's actual cash value.

| Key Benefits of Collision Coverage |

|---|

| Covers repairs or replacement of the insured vehicle after a collision |

| Protects against financial loss in case of a total loss accident |

| Provides peace of mind by ensuring financial protection in the event of an accident |

Comprehensive Coverage

Comprehensive coverage is the second crucial component of full coverage car insurance. While collision coverage addresses accidents, comprehensive coverage offers protection against a broader range of risks. It provides coverage for damages to the insured vehicle that are not specifically related to collisions.

Some common scenarios where comprehensive coverage comes into play include theft, vandalism, natural disasters, and damage caused by animals. For instance, if your vehicle is stolen or vandalized, comprehensive coverage will help cover the costs of repairing or replacing it. Similarly, if your vehicle is damaged by a falling tree during a storm, comprehensive coverage will provide the necessary financial assistance.

| Scenarios Covered by Comprehensive Coverage |

|---|

| Theft or attempted theft of the insured vehicle |

| Vandalism or malicious damage to the vehicle |

| Damage caused by natural disasters such as storms, floods, or earthquakes |

| Collisions with animals (e.g., deer) |

| Damage resulting from fire, explosions, or civil disturbances |

Additional Benefits of Full Coverage Car Insurance

Full coverage car insurance offers a wide range of benefits beyond collision and comprehensive coverage. These additional benefits enhance the overall protection and peace of mind provided by the policy. Here are some key advantages to consider:

Rental Car Coverage

In the event that your vehicle is damaged and requires repairs, full coverage insurance often includes rental car coverage. This benefit ensures that you have a temporary vehicle to use while your insured car is being repaired. Rental car coverage helps minimize the inconvenience and disruption caused by unexpected vehicle damage.

Uninsured/Underinsured Motorist Coverage

Full coverage insurance typically includes uninsured/underinsured motorist coverage. This coverage protects you in situations where you are involved in an accident with a driver who either has no insurance or insufficient insurance to cover the damages. It ensures that you are financially protected and can receive compensation for your injuries and property damage.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is another valuable addition to full coverage car insurance. This coverage provides financial assistance for medical expenses incurred as a result of an accident, regardless of fault. It covers not only the policyholder but also passengers in the insured vehicle. MedPay can help cover costs such as hospital visits, doctor’s fees, and even funeral expenses.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a vital component of full coverage insurance in certain states. PIP coverage provides comprehensive medical and disability benefits for the policyholder and their passengers, regardless of who is at fault in an accident. It covers a wide range of medical expenses, lost wages, and even essential services required during recovery.

Real-World Scenarios: When Full Coverage Makes a Difference

Full coverage car insurance demonstrates its value in a variety of real-world scenarios. Here are a few examples of situations where having full coverage can make a significant difference:

Imagine you're driving on a dark and rainy night when suddenly a deer runs into the road. Despite your best efforts, you collide with the animal. With full coverage insurance, you can rest assured that the damages to your vehicle will be covered, and you won't have to bear the financial burden alone.

Another scenario could involve severe weather conditions. If a storm causes a tree to fall on your parked car, resulting in significant damage, comprehensive coverage will come to your aid. It will cover the costs of repairing or replacing your vehicle, ensuring you're not left with unexpected expenses.

Choosing the Right Full Coverage Policy

When selecting a full coverage car insurance policy, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Policy Limits

Review the policy limits carefully. Ensure that the limits provided by the insurance company align with your financial needs and the value of your vehicle. Higher policy limits may result in a higher premium, but they offer greater protection in the event of extensive damage or a total loss.

Deductibles

Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Consider your financial situation and choose a deductible that you can comfortably afford. While higher deductibles may lower your premium, they also mean you’ll have to pay more upfront in the event of a claim.

Additional Coverage Options

Explore the additional coverage options available with full coverage insurance. Depending on your needs, you may want to consider adding endorsements or riders to your policy. These options can provide enhanced protection for specific situations, such as roadside assistance, gap coverage, or custom parts and equipment coverage.

Frequently Asked Questions

Does full coverage car insurance cover wear and tear?

+Full coverage insurance does not typically cover wear and tear or mechanical breakdowns. It is designed to provide protection against unforeseen events, such as accidents or natural disasters. Routine maintenance and repairs due to normal vehicle aging are generally not covered.

What is the difference between liability and full coverage insurance?

+Liability insurance provides coverage for damages caused to others in an accident, while full coverage insurance offers a more comprehensive range of benefits. Full coverage includes collision and comprehensive coverage, protecting the policyholder’s vehicle and providing additional benefits like rental car coverage and uninsured/underinsured motorist coverage.

Can I customize my full coverage insurance policy?

+Yes, you can often customize your full coverage insurance policy to meet your specific needs. Insurance companies offer various add-ons and endorsements that allow you to enhance your coverage. These may include options like rental car coverage, gap insurance, or coverage for custom parts and equipment.

Full coverage car insurance is a vital investment for vehicle owners, providing comprehensive protection against a wide range of unforeseen events. From collision coverage to comprehensive coverage, and additional benefits like rental car assistance and medical payments coverage, full coverage insurance offers peace of mind and financial security. By carefully selecting the right policy and understanding its benefits, vehicle owners can ensure they have the necessary protection to navigate the road with confidence.